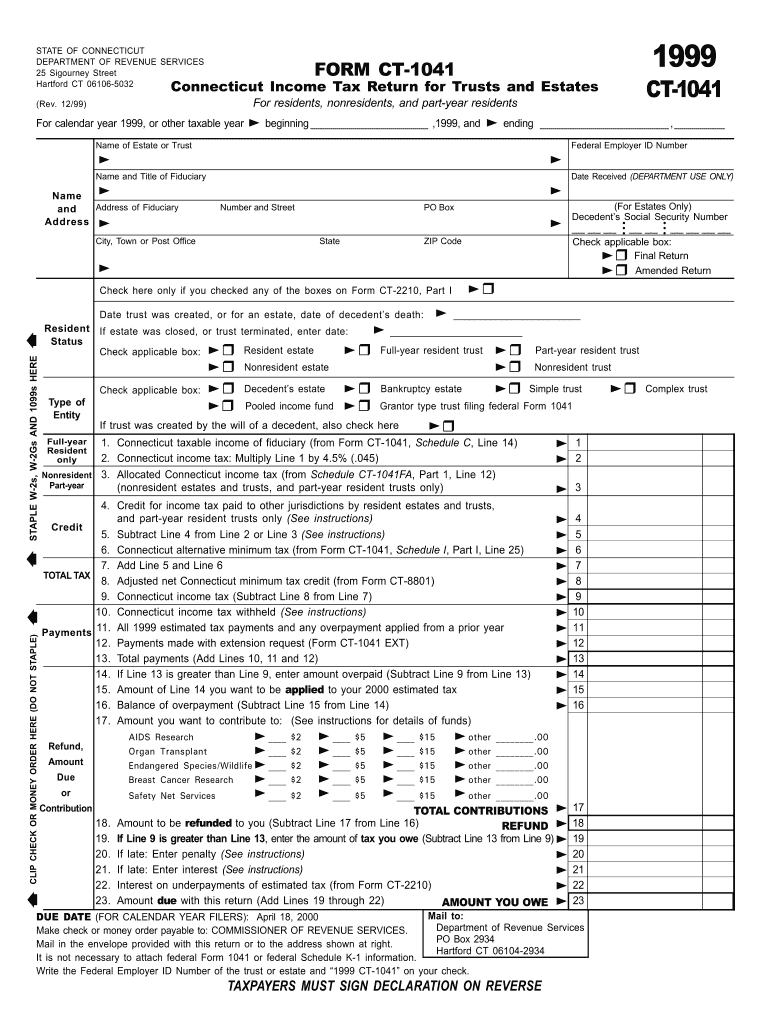

Fill and Sign the Ct 1041 1999 Connecticut Income Tax Return for Trusts and Estates Form

Practical advice on finalizing your ‘Ct 1041 1999 Connecticut Income Tax Return For Trusts And Estates’ online

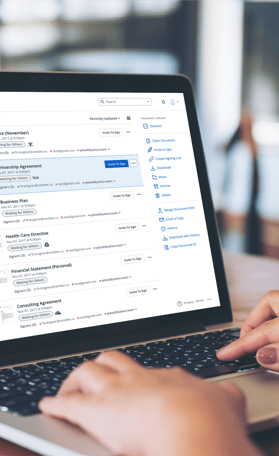

Are you fed up with the inconvenience of dealing with documents? Your search ends with airSlate SignNow, the premier electronic signature platform for individuals and businesses. Bid farewell to the monotonous tasks of printing and scanning papers. With airSlate SignNow, you can effortlessly finalize and sign documents online. Leverage the robust capabilities embedded within this user-friendly and cost-effective platform and transform your method of document management. Whether you need to sign forms or collect electronic signatures, airSlate SignNow manages everything efficiently, requiring only a few clicks.

Follow these detailed instructions:

- Log into your account or sign up for a complimentary trial of our service.

- Click +Create to upload a file from your device, cloud, or our template collection.

- Open your ‘Ct 1041 1999 Connecticut Income Tax Return For Trusts And Estates’ in the editor.

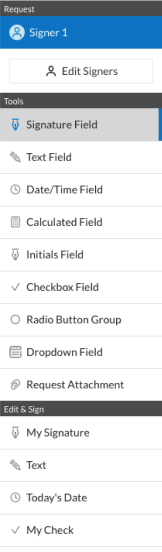

- Click Me (Fill Out Now) to complete the document on your end.

- Add and assign fillable fields for other individuals (if necessary).

- Proceed with the Send Invite options to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to work with your colleagues on your Ct 1041 1999 Connecticut Income Tax Return For Trusts And Estates or send it for notarization—our solution provides everything necessary to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is the CT 1041, Connecticut Income Tax Return For Trusts And Estates?

The CT 1041, Connecticut Income Tax Return For Trusts And Estates, is a tax form that fiduciaries must file to report the income of trusts and estates in Connecticut. This form is crucial for ensuring compliance with state tax laws and accurately calculating tax liabilities for these entities.

-

How can airSlate SignNow assist with filing the CT 1041, Connecticut Income Tax Return For Trusts And Estates?

airSlate SignNow streamlines the process of preparing and submitting the CT 1041, Connecticut Income Tax Return For Trusts And Estates, by allowing users to eSign and send documents securely. Our platform simplifies document management, making it easier for fiduciaries to handle tax returns efficiently.

-

What are the benefits of using airSlate SignNow for the CT 1041, Connecticut Income Tax Return For Trusts And Estates?

Using airSlate SignNow for the CT 1041, Connecticut Income Tax Return For Trusts And Estates, offers numerous benefits, including enhanced security, ease of use, and cost-effectiveness. Our solution ensures your sensitive tax documents are securely transmitted, and our intuitive interface makes document signing a breeze.

-

Is there a cost associated with using airSlate SignNow for filing the CT 1041, Connecticut Income Tax Return For Trusts And Estates?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs when filing the CT 1041, Connecticut Income Tax Return For Trusts And Estates. Our plans are designed to be affordable, providing excellent value for businesses managing trust and estate tax returns.

-

What features does airSlate SignNow offer for managing the CT 1041, Connecticut Income Tax Return For Trusts And Estates?

airSlate SignNow provides features like document templates, eSignature capabilities, and secure cloud storage, all tailored for managing the CT 1041, Connecticut Income Tax Return For Trusts And Estates. These features help simplify the filing process and improve overall efficiency.

-

Can I integrate airSlate SignNow with other software for filing the CT 1041, Connecticut Income Tax Return For Trusts And Estates?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax software, making it easier for users to manage the CT 1041, Connecticut Income Tax Return For Trusts And Estates. This integration ensures a smooth workflow, reducing manual entry and errors.

-

How does airSlate SignNow ensure the security of my CT 1041, Connecticut Income Tax Return For Trusts And Estates documents?

airSlate SignNow prioritizes the security of your documents, including the CT 1041, Connecticut Income Tax Return For Trusts And Estates, by employing advanced encryption and secure cloud storage solutions. This ensures that your sensitive tax information remains safe and confidential throughout the entire process.

Related searches to ct 1041 1999 connecticut income tax return for trusts and estates form

Find out other ct 1041 1999 connecticut income tax return for trusts and estates form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles