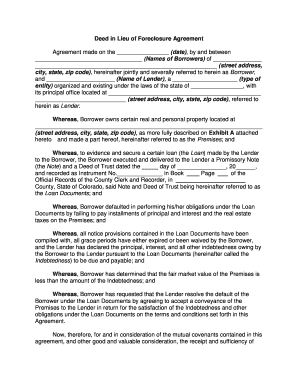

Deed in Lieu of Foreclosure Agreement

Agreement made on the ________________ (date) , by and between

_________________________________ (Names of Borrowers) of _______________

________________________________________________________ (street address,

city, state, zip code) , hereinafter jointly and severally referred to herein as Borrower ,

and _____________________ (Name of Lender) , a ____________________ (type of

entity) organized and existing under the laws of the state of ___________ _____, with

its principal office located at _______________________________________________

____________________________ (street address, city, state, zip code) , referred to

herein as Lender .

Whereas , Borrower owns certain real and personal property locat ed at

______________________________________________________________________

(street address, city, state, zip code) , as more fully described on Exhibit A attached

hereto and made a part hereof, hereinafter referred to as the Premises ; and

Whereas , to ev idence and secure a certain loan (the Loan ) made by the Lender

to the Borrower, the Borrower executed and delivered to the Lender a Promissory Note

(the Note ) and a Deed of Trust dated the _____ day of _______________, 20______,

and recorded as Instrument No.______________ in Book __ Page of the

Official Records of the County Clerk and Recorder, in

County, State of Colorado , said Note and Deed of Trust being hereinafter referred to as

the Loan Documents ; and

Whereas , Borrower defaulted in performi ng his/her obligations under the Loan

Documents by failing to pay installments of principal and interest and the real estate

taxes on the Premises; and

Whereas , all notice provisions contained in the Loan Documents have been

compiled with, all grace periods have either expired or been waived by the Borrower,

and the Lender has declared the principal, interest, and all other indebtedness owing by

the Borrower to the Lender pursuant to the Loan Documents (hereinafter called the

Indebtedness ) to be due and payable; and

Whereas , Borrower has determined that the fair market value of the Premises is

less than the amount of the Indebtedness; and

Whereas , Borrower has requested that the Lender resolve the default of the

Borrower under the Loan Documents by agreeing to accept a conveyance of the

Premises to the Lender in return for the satisfaction of the Indebtedness and other

obligations under the Loan Documents on the terms and conditions set forth in this

Agreement.

Now, therefore, for and in consideration of the mutual covenants contained in this

agreement, and other good and valuable consideration, the receipt and sufficiency of

which is hereby acknowledged, the pa rties agree as follows:

Section 1. Conveyances to the Lender. On the Closing Date (as hereafter defined),

the Borrower shall convey or cause to be conveyed to the Lender absolutely and free of

any right of redemption or other right or interest of the Bo rrower, or anyone claiming by

or through the Borrower, the following real and personal property: (a) all of the land

situated at _____________________________________________________________

_________________ (street address, city, state, zip code) , descri bed in Exhibit A

attached, together with all buildings, fixtures, and other improvements now or hereafter

located thereon and all appurtenances thereunto belonging; and (b) all tangible and

intangible personal property which is owned by the Borrower, or an y person claiming by

or through the Borrower located or in or used in connection with the ownership,

financing, operation, and maintenance of the Premises, which is owned by the Borrower,

or any person claiming by or through the Borrower acquired for insta llation or use in

connection therewith, wherever located.

Section 2. Consideration.

A. Subject to the satisfaction by the Borrower of the conditions herein contained, the

Lender shall accept the conveyance of the Premises to the Lender in full, final, and

complete settlement, accord, and satisfaction of the Indebtedness and the other

obligations of the Borrower owing under the Loan Documents.

B. Provided that the Borrower perform their respective obligations under this

Agreement, the Lender agrees to pay the sum of ____________ Dollars

($____________) to the Borrower in two (2) installments. The first installment in the

amount of ____________ Dollars ($____________) to be paid on the Closing Date and

the balance of ____________ Dollars ($____________) to b e paid on the later of: (i) the

satisfaction of all obligations owing by the Borrower to the Lender under the terms of

this Agreement; or (ii) that date which is ninety -one (91) calendar days after the Closing

Date.

C. The Borrower represents that the Indebtedness is no less than ____________

Dollars ($____________) in principal and accrued but unpaid interest and attorneys'

fees owing by the Borrower to the Lender.

D. The Borrower represents that it has made an indepen dent determination of the

fair market value of the Premises and as a result thereof, it has concluded that: (i) the

amount of the Indebtedness substantially exceeds the fair market value of the

Premises; (ii) the Premises is unable to generate sufficient i ncome to repay the

Indebtedness in accordance with the terms of the Loan Documents; and (iii) the

consideration to be received by the Borrower pursuant to the terms of this Agreement

represents the payment by the Lender of full, fair, and adequate consider ation for the

Premises.

Section 3. Closing Date

A. The Closing shall occur on or before 5:00 p.m. on __________________ (date) ,

(the Closing Date) at the offices of

___________________________________________________________ (location) .

B. If, for any r eason except the Lender's breach of this Agreement, the conditions

precedent to closing required to be performed by the Borrower under this Agreement

have not been performed and the transactions consummated on or before the Closing

Date, the Lender, at the Lender's sole option, may by written notice to the Borrower: (i)

extend the Closing Date to a date provided in such written notice; or (ii) terminate all of

the obligations of the Lender under this Agreement and proceed to exercise or renew

the exercise o f all of the rights and remedies held by the Lender under the Loan

Documents and applicable law.

Section 4. Closing Documents. On the Closing Date, the Borrower will deliver or

cause to be delivered to the Lender the following items which will be duly exe cuted and

acknowledged:

A. A Quitclaim Deed in the form of Exhibit B attached hereto and made a part

hereof conveying to the Lender good and marketable fee simple title to the Premises

subject only to title exceptions described on Exhibit C attached heret o and made a part

hereof ;

B. A Bill of Sale in substantially the form of Exhibit D attached hereto and made a

part hereof conveying to the Lender marketable title to the personal property therein

described, free and clear of all liens and encumbrances;

C. A Consent Judgment duly executed and acknowledged by the Borrower and

such further documents as the Lender might reasonably request to facilitate the

foreclosure of the liens and security interests created by the Loan Documents, and

D. Such other convey ance documents as might be reasonably requested by the

Lender to transfer absolute ownership of all of the property interests comprising the

Project to the Lender.

Section 5. Exchange of Releases

A. Effective on the Closing Date and only if the transacti ons contemplated by this

Agreement are consummated, the Borrower shall release, acquit, and forever discharge

the Lender and the Lender's subsidiaries, affiliates, officers, directors, agents, and

employees (hereafter collectively called the Lender and its Affiliates) from any and all

claims, demands, debts, actions, causes of action, suits, contracts, agreements,

obligations, accounts, defenses, offsets against the Indebtedness, and liabilities of any

kind or character whatsoever, known or unknown, suspect ed or unsuspected, in

contract or in tort, at law or in equity, including without implied limitation such claims and

defenses as fraud, mistake, duress, and usury, which the Borrower ever had, now has,

or might hereafter have against the Lender and its Aff iliates, jointly or severally, for or by

reason of any matter, cause, or thing whatsoever occurring prior to the Closing Date,

which relates to in whole or in part, directly or indirectly: (i) the Loan; (ii) the Loan

Documents; (iii) the Premises; (iv) the Indebtedness; or (v) the conveyance of the

Premises by the Borrower to the Lender.

B. The Borrower shall not commence, join in, prosecute, or participate in any suit or

other proceeding in a position which is adverse to any of the Lender and its Affiliat es

arising directly or indirectly from any of the foregoing matters.

C. Effective on the Closing Date and only if the transactions contemplated by this

Agreement are consummated, the Lender shall release, acquit, and forever discharge

the Borrower from an y and all claims, demands, debts, actions, causes of action, suits,

contracts, agreements, obligations, accounts, defenses, and liabilities of any kind or

character whatsoever, known or unknown, suspected or unsuspected, in contract or in

tort, at law or i n equity, which the Lender ever had, now has, or might hereafter have

against the Borrower for or by reason of any matter, cause, or thing whatsoever

occurring prior to the Closing Date which relates to, in whole or in part, directly or

indirectly: (i) the Loan; (ii) the Loan Documents; or (iii) any agreement of the Borrower

relating to the Premises or the Indebtedness. Notwithstanding anything contained

herein to the contrary, the obligations of the Borrower to perform the terms of this

Agreement and the d ocuments delivered pursuant to this Agreement shall survive the

Closing Date.

Section 6. Termination of Lender's Releases. The release provided to the Borrower

in Section 5.C of this Agreement will be voided ab initio and will be of no force or effect

and the Borrower will be obligated to repay to the Lender the Indebtedness and any

sums paid by the Lender to the Borrower pursuant to Section 11 of this Agreement in

the event any one or more of the following occurs:

(a ) The Borrower or any person claiming by or through the Borrower

commence, joins in, assists, cooperates in, or participates as an adverse party or

as an adverse witness (subject to compulsory legal process which requires

testimony) in any suit or other pr oceeding against Lender and its Affiliates

relating to the Loan, the Loan Documents, the Indebtedness, or the Premises; or

(b) The deed or any other document evidencing a conveyance of the

Premises to the Lender is ever rendered void or is rescinded by o peration of law,

or by order of any state or federal court of competent jurisdiction, by reason of an

order arising out of any claim or proceeding initiated or commenced in favor of,

against, on behalf of, or in concert with, directly or indirectly, the Bo rrower, or any

person claiming by or through the Borrower or any of his/her respective agents,

employees, representatives, successors, or assigns; or

(c) The Borrower or any person claiming by or through the Borrower denies

the Lender, or the Lender's re presentatives, the right to inspect the Premises, or

to inspect, audit, and transcribe the books, records, contracts, and insurance

policies maintained by the Borrower or any person claiming by or through the

Borrower in connection with the construction, o peration, or maintenance of the

Premises; or

(d) The release of the Lender and its Affiliates in Section 5.A of this

Agreement is ever rendered void, is rescinded, or is adjudicated unenforceable

by operation of law or by order of any state or federal co urt of competent

jurisdiction, by reason of an order arising out of any claim or proceeding initiated

or commenced in favor of, against, on behalf of, or in concert with, directly or

indirectly, the Borrower or any person claiming or by through the Borrowe r or any

of his/her respective agents, employees, representatives, successors, or assigns.

Section 7. Corporate Authority. Each party to this Agreement represents and

warrants to the other that: (a) all necessary corporate action on the part of each party to

be taken in connection with the execution, delivery, and performance of this Agreement

has been duly and effectively taken; and (b) the execution, delivery, and performance

by each party of this Agreement does not constitute a violation or breach of su ch party's

articles of incorporation, bylaws, or any other agreement or law by which such party is

bound.

Section 8. Deliveries by the Borrower. The Borrower shall deliver or cause the

following items relating to the Premises to be delivered to the Lender within five (5)

business days after each written request therefore (to the extent that any of such items

are in the possession or direct or indirect control of the Borrower: (a) any personal

property comprising the Premises that is owned or leased by the Borrower or by a

person claiming by or through the Borrower; (b) any insurance policies; (c) any

warranties, guarantees, and assurances given by third parties with respect to any part

of the Premises; (d) any certificates of occupancy, licenses, and other governmental

permits; (e) any drawings, engineering reports, maps, plans, and specifications and

other similar matters; (f) any agreements, employment agreements, purchase orders,

maintenance agreements, franchise agreements, union contracts, or other simi lar

agreements; (g) any tax assessments, notices, and statements; (h) income and

expense statements covering the operation of the Premises for the calendar year

20____; (i) all books and records pertaining to the Premises; (j) any keys necessary to

obtain full access to the Premises; (k) all cash located on the Premises; ( l) evidence

satisfactory to the Lender that the coverage afforded by ______________________

(name of the Title Insurer) , the Title Insurer, continues in effect and that the coverage

afforded the Lender thereby will not be prejudiced by the actions contemplated by this

Agreement; and (m) all instruments required by the Title Insurer as a condition

precedent to the issuance of a policy of owner's title insurance to the Lender, including,

without implied limitation, an Estoppel Affidavit in substantially the form of Exhibit E

attached as a part hereof.

Section 9. Representations and Warranties. The Borrower hereby represents and

warrants to the Lender that to the best knowledge of the Borrower after due inquiry and

investigation:

(a) Attached hereto as Exhibit F and made a part hereof is a true, complete,

and correct listing of all employment agreements, commitments, rental

agreements, equipment leases, guarantees, leases, contracts, undertakings, and

arrangements entered into by the Borrower or anyone on the Borrower's behalf,

whether written and oral, relating to the Premises;

(b) The Borrower has delivered to the Lender copies of all documents relating

to such matters to the extent that any of such items are in the possession or

direct or indirect control of the Borrower;

(c) Attached hereto as Exhibit G and made a part hereof is a true and correct

listing of all claims against the Premises and all other payables owing in

connection with the Premises, including, without implied limitation, all trade

payables, real and personal property taxes, employee wages (including accrued

vacation and fringe benefits, if any), utilit y charges, insurance premiums, lease

payments, and license, franchise, and royalty payments (hereafter collectively

called the payables) as of the dates therein stated. It is specifically understood

that the Lender has not agreed and will not agree to assu me or incur any liability

or responsibility with respect to the payables or any other obligation of the

Borrower.

(d) The Borrower is represented by legal counsel of his/her choice, are fully

aware of the terms contained in this Agreement, and have volun tarily and without

coercion or duress of any kind entered into this Agreement and the documents

executed in connection with this Agreement;

(e) The Borrower is now and on the Closing Date will have a net worth no less

than $____________;

(f) The transfer of the Premises to the Lender will not render the Borrower

insolvent;

(g) The Borrower has made adequate provision for the payment of all

creditors of the Borrower other than the Lender; and

(h) Borrower has not entered into this transacti on to provide preferential

treatment to the Lender or any other creditor of the Borrower in anticipation of

seeking relief under the Bankruptcy Code.

The continued validity in all respects of all representations and warranties made

in this Agreement and a ll other documents delivered by the Borrower in connection with

this Agreement will be a condition precedent to the Lender's obligations created by this

Agreement. If any of such representations and warranties are not correct at the time

such representatio n and warranty was made or as of the Closing Date, or if the

Borrower fails to perform any action required of any such party by the terms of this

Agreement, on written notice from the Lender to the Borrower on or prior to the Closing

Date, the obligations of the Lender created by this Agreement will become null and void.

All representations and warranties contained in this Agreement and in all documents

delivered by the Borrower in connection with this Agreement will be deemed remade as

of the Closing Date and will survive the Closing Date.

Section 10. No Third Party Beneficiaries . The Borrower acknowledges and agrees

that the acceptance by the Lender of ownership of the Premises pursuant to the terms

of this Agreement and the assignment to the Lender of va rious contracts and

agreements pertaining to the Premises will not create any obligation on the part of the

Lender to third parties which might have claims of any kind whatsoever against the

Borrower. No person not a party to this Agreement will be a third -party beneficiary or

acquire any rights hereunder.

Section 11. Absolute Conveyance . The Borrower acknowledges and agree that: (a)

the conveyance of the Premises to the Lender pursuant to the terms of this Agreement

is an absolute conveyance of all of the Borrower's right, title, and interest in and to the

Premises in fact as well as in the form and the deed, bill of sale, and other conveyance

documents are not intended to be a mortgage, trust conveyance, deed of trust, or

security interest of any kind; (b ) the consideration for such conveyance is exactly as

recited in this Agreement; and (c) after the Closing Date the Borrower will have no

further interest (including rights of redemption) or claims in, to, or against the Premises

or to the proceeds or prof its that might be derived therefrom.

Section 12. No Merger. The parties acknowledge and agree that notwithstanding the

release contemplated by this Agreement, all of the Loan Documents will remain in full

force and effect after the transactions contemplat ed by this Agreement have been

consummated. The parties further acknowledge and agree that the interest of the

Lender in the Premises created by all of the conveyances provided for herein will not

merge with the interest of the Lender in the Premises under the Loan Documents. It is

the express intention of each of the parties (and all of the conveyances provided for

herein will so recite) that such interests of the Lender in the Premises will not merge, but

be and remain at all times separate and distinct, notwithstanding any union of said

interest in the Lender at any time by purchase, termination, or otherwise and that the

liens held by the Lender against the Premises created by certain of the Loan

Documents will remain at all times valid and continuous li ens against the Premises.

Section 13. Indemnification. The Borrower agrees to hold the Lender harmless from

and against any and all liabilities, claims, demands, losses, damages, costs and

expenses (including, without limitation, reasonable attorneys' fee s and litigation

expenses), actions, or causes of action, arising out of or relating to any breach of any

covenant or agreement or the incorrectness or inaccuracy of any representation

Agreement or any document delivered to the Lender by the Borrower pursu ant to the

terms of this Agreement.

Section 14. Time. It is further agreed that time is of the essence of this Agreement and

each provision of this Agreement.

Section 15. Notices. Any notice, payment, demand, or communication required or

permitted to be given by any provision of this Agreement will be deemed to have been

given when delivered personally to the party designated to receive such notice or, on

the third (3rd) business day after the same is sent by certified mail, postage and

charges prepaid, d irected to the following addresses or to such other or additional

addresses as any party might designate by written notice to the other parties:

To the Lender: _____________________________________________

With a copy to: __________________________________ ___________

To the Borrower: _____________________________________________

With a copy to: _____________________________________________

Section 16. Brokerage . The parties represent and warrant each to the other that the

transactions hereby contemplated are made without liability for any finder's, realtor's,

broker's, agent's, or other similar commission. The parties mutually agree to indemnify

and hold each othe r harmless from claims or commissions asserted by any party as a

result of dealings claimed to give rise to such commissions.

Section 17. Entire Agreement. This Agreement (including the Exhibits attached as a

part hereof) constitutes the entire and final agreement among the parties and there are

no agreements, understandings, warranties, or representations among the parties

except as set forth herein.

Section 18. Binding Effect . This Agreement will inure to the benefit of and bind the

respective heirs, pe rsonal representatives, successors, and permitted assigns of the

parties hereto.

Section 19. Relationship . The relationship between the Borrower and the Lender is

that of debtor and creditor. Nothing contained in this Agreement will be deemed to

create a partnership or joint venture between the Lender and the Borrower or between

the Lender and any other party, or to cause the Lender to be liable or responsible in any

way for the actions, liabilities, debts, or obligations of the Borrower or any other party .

Section 20. Severability. If any clause or provision of this Agreement is determined to

be illegal, invalid, or unenforceable under any present or future law by the final

judgment of a court of competent jurisdiction, the remainder of this Agreement wil l not

be affected thereby. It is the intention of the parties that if any such provision is held to

be illegal, invalid, or unenforceable, there will be added in lieu thereof a provision as

similar in terms to such provision as is possible and be legal, va lid, and enforceable.

Section 21. Headings. Paragraph or other headings contained in this Agreement are

for reference purposes only and are not intended to affect in any way the meaning of

interpretation of this Agreement.

Section 22. Counterpart Executi on. This Agreement may be executed in counterparts,

each of which will be deemed an original document, but all of which will constitute a

single document. This document will not be binding on or constitute evidence of a

contract between the parties until s uch time as a counterpart of this document has been

executed by each party and a copy thereof delivered to each other party to this

Agreement.

Section 23. Governing Law. This Agreement will be interpreted and construed under

the laws of the State of Color ado. All claims, disputes, and other matters in question

arising out of or relating to this Agreement, or the breach thereof, will be decided by

proceedings instituted and litigated in a court of competent jurisdiction sitting in

Colorado.

Section 24. Coo peration. Prior to and at all times following the Closing Date, the

Borrower and the Lender agree to execute and deliver, or to cause to be executed and

delivered, such documents and to do, or cause to be done, such other acts and things

as might reasonabl y be requested by the Title Insurer or any party to this Agreement to

assure that the benefits of this Agreement are realized by the parties. The Borrower

specifically agrees to assist the Lender in the disposition of any claims asserted against

or on beha lf of the Premises or the Lender in connection with the Premises which arose

prior to the Closing Date.

Section 25. Amendment . Neither this Agreement nor any of the provisions hereof can

be changed, waived, discharged, or terminated, except by an instrume nt in writing

signed by the party against whom enforcement of the change, waiver, discharge, or

termination is sought.

EXECUTED on the dates hereafter specified, effective as of the date first above written.

__________________________________

(Printed N ame of Borrower)

__________________________________

(Signature of Borrower)

___________________________________

(Printed Name of Borrower)

___________________________________

(Signature of Borrower)

State of Colorado

ss.

County of ___________________

The foregoing instrument was acknowledged before me this ________________ (date)

by ______________________________________ (Names of each Borrower) .

Witness my hand and official seal.

________________________________

(Print ed Name of Notary)

________________________________

(Signature of Notary)

My Commission Expires:

_______________________