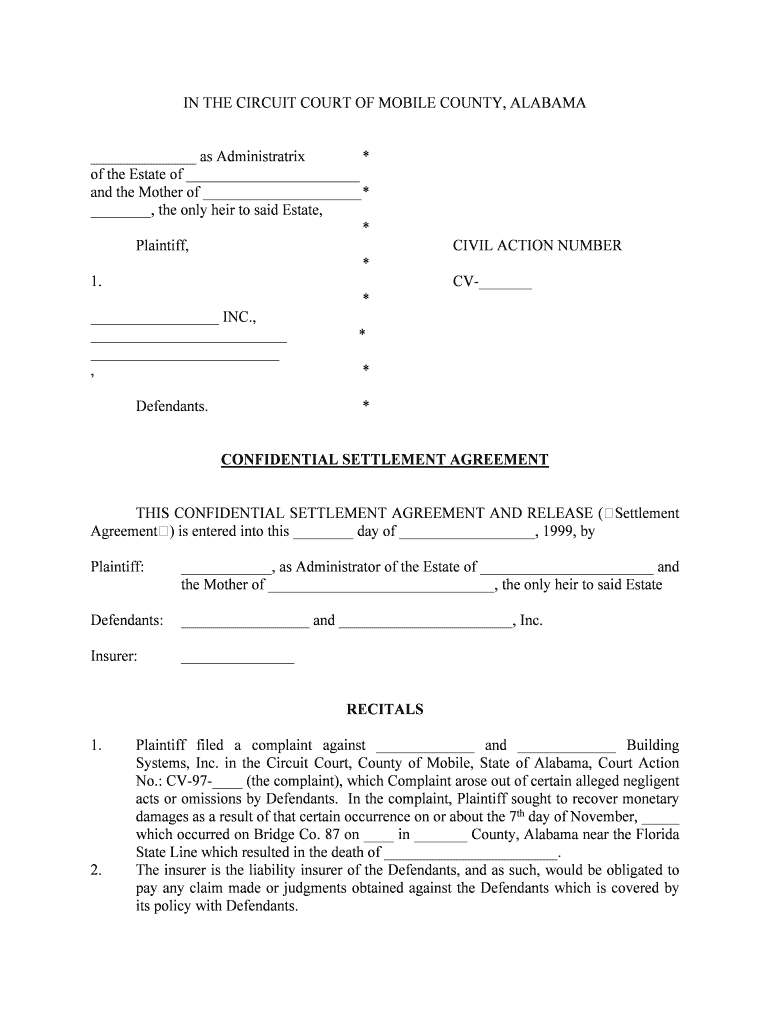

IN THE CIRCUIT COURT OF MOBILE COUNTY, ALABAMA ______________ as Administratrix *of the Estate of _______________________ and the Mother of _____________________ *________, the only heir to said Estate,*Plaintiff, CIVIL ACTION NUMBER*1. CV-_______*_________________ INC.,__________________________ *_________________________, *Defendants.* CONFIDENTIAL SETTLEMENT AGREEMENT THIS CONFIDENTIAL SETTLEMENT AGREEMENT AND RELEASE (Settlement

Agreement) is entered into this ________ day of __________________, 1999, byPlaintiff: ____________, as Administrator of the Estate of _______________________ and

the Mother of ______________________________, the only heir to said EstateDefendants:_________________ and _______________________, Inc.Insurer:_______________ RECITALS 1.Plaintiff filed a complaint against _____________ and _____________ Building

Systems, Inc. in the Circuit Court, County of Mobile, State of Alabama, Court Action

No.: CV-97-____ (the complaint), which Complaint arose out of certain alleged negligent

acts or omissions by Defendants. In the complaint, Plaintiff sought to recover monetary

damages as a result of that certain occurrence on or about the 7th

day of November, _____

which occurred on Bridge Co. 87 on ____ in _______ County, Alabama near the Florida

State Line which resulted in the death of _______________________.2. The insurer is the liability insurer of the Defendants, and as such, would be obligated to

pay any claim made or judgments obtained against the Defendants which is covered by

its policy with Defendants.

2 3.The parties desire to enter into this Settlement Agreement in order to provide for certain

payments in full settlement and discharge of all claims which are, or might have been, the

subject matter of the Complaint, upon the terms and conditions set forth below. AGREEMENT The parties agree as follows:1. Release and DischargeIn consideration of payments set forth in Section 2, Plaintiff hereby completely releases,

and forever discharges Defendants and Insurer from any and all past, present or future claims,

demands, obligations, actions, causes of action, wrongful death claims, rights, damages, costs,

losses of service, expenses and compensation of any nature whatsoever, whether based on tort,

contract or other theory of recovery, which the Plaintiff now has, or which may hereafter accrue

or otherwise be acquired, on account of, or may in any way grow out of, or which are the subject

of the Complaint (and all related pleadings), including, without limitation, any and all or

unknown claims for bodily and personal injuries to Plaintiff s decedent,

_______________________, or any future claims of Plaintiff s representatives or heirs, which

have resulted or may result from the alleged acts or omissions of the Defendants.This release and discharge shall also apply to Defendants and Insurer s past, present

and future officers, directors, stockholders, attorneys, agents, servants, representatives,

employees, subsidiaries, affiliates, partners, predecessors and successors in interest, and assigns

and all other persons, firms or corporations with whom any of the former have been, are now, or

may hereafter be affiliated.This release, on the part of the Plaintiff, shall be a fully binding and complete settlement

between the Plaintiff, the Defendants, and the Insurer, their heirs, assigns and successors.The Plaintiff acknowledges and agrees that the release and discharge set forth above is a

general release. Plaintiff expressly waives and assumes the risk of any and all claims for

damages, which exist as of this date, but of which the Plaintiff does not know or suspect to exist,

whether through ignorance, oversight, error, negligence or otherwise, and which, is known,

would materially affect Plaintiff s decision to enter into this Settlement Agreement. The

Plaintiff further agrees that Plaintiff has accepted payment of the sums specified herein as a

complete compromise of matters involving disputed issues of law and fact. Plaintiff assumes the

risk that the facts or law may be other than Plaintiff believes. It is understood and agreed to by

the parties that this settlement is a compromise of a doubtful and disputed claim, and the

payments are not to be construed as an admission of liability on the part of the Defendants, by

whom liability is expressly denied.3.Payments

3 In consideration of the release set forth above, the Insurer, on behalf of the Defendants,

agrees to pay to the individual(s) named below (the Payee(s)) the sums outlined in this Section 2

below:1 Within ten (10) days after the signing of this Settlement Agreement and Release,

the Plaintiff (and her attorney) will be paid by the Defendants

___________________________________________________ ($__________).2SUMMARY OF FUTURE BENEFITSPeriodic Payments Payable to the conservator of

______________________________:$___ payable monthly, guaranteed 12 years, 1 month, to begin 1-10-2000 (last

guaranteed payment is 1-10-2012)Note: Beginning 1-10-2004 all payments will be made directly to

______________________________.$______ payable annually, guaranteed 4 years, to begin 9-1-2004$______ payable on 1-10-2011$______ payable on 1-10-2016$_______ payable on 1-10-2021All sums set forth herein constitute damages on account of personal injuries or sickness,

within the meaning of 104(a)(2) of the Internal Revenue code of 1986, as amended.3. Plaintiff s Rights to PaymentsPlaintiff acknowledges that the Periodic Payments cannot be accelerated, deferred,

increased or decreased by the Plaintiff or any Payee; nor shall the Plaintiff or any Payee have the

power to sell, mortgage, encumber, or anticipate the Periodic Payments, or any part thereof, by

assignment or otherwise. 4.Plaintiff s BeneficiaryAny payments to be made after the death of any Payee pursuant to the terms of this

Settlement Agreement shall be made to such person or entity as shall be designated in writing by

said Payee to the Insurer or the Insurer s Assignee. If no such person or entity is so designated

by Payee, or if the person designated is not living at the time of the Payee s death, such

4 payment shall be made to the Estate of the Payee. No such designation, nor any revocation

thereof, shall be effective unless it is in writing and delivered to the Insurer or the Insurer s

Assignee. The designation must be in a form acceptable to the Insurer or the Insurer s Assignee

before such payments are made.5.Consent to Qualified AssignmentPlaintiff acknowledges and agrees that the Defendant and/or the Insurer may make a

qualified assignment, within the meaning of 130(c) of the Internal Revenue Code of 1986, as

amended, of the Defendants and/or the Insurer s liability to make the Periodic Payments set

forth in Section 2b to_________________________ (the Assignees). The Assignee s

obligation for payment of the Periodic Payments shall be no greater than that of the Defendants

and/or the Insurer (whether by judgment or agreement) immediately preceding the assignment of

the Periodic Payments obligation.Any such assignment, if made, shall be accepted by the Plaintiff without right of rejection

and shall completely release and discharge the Defendants and the Insurer from the Periodic

Payments obligation assigned to the Assignee. The Plaintiff recognizes that, in the event of such

an assignment, the Assignee shall be the sole obligor with respect to the Periodic Payments

obligation, and that all of the other releases with respect to the periodic Payments obligation that

pertain to the liability of the Defendants and the Insurer shall thereupon become final,

irrevocable and absolute.To ensure the future payment obligations of the Assignee, ___________________

Company will issue a Statement of Irrevocable Guarantee, a copy of which is attached hereto as

Exhibit A.6.Right to Purchase an AnnuityThe Defendants and/or the Insurer, itself or through its Assignee, reserve the right to fund

the liability to make the Periodic Payments through the purchase of an annuity policy from

____________________Company (the Annuity Issuer). The Defendants, the Insurer or the

Assignee shall be the sole owner of the annuity policy and shall have all rights of ownership.

The Defendants, the Insurer or the Assignee may have____________________ Company mail

payments directly to the Payee(s). The Plaintiff shall be responsible for maintaining a current

mailing address for Payee(s) with____________________ Company7.Discharge of ObligationThe obligation of the Defendants, the Insurer and/or Assignee to make each Periodic

Payment shall be discharged upon the mailing of valid check in the amount of such payment to

the designated address of the Payee(s) named in Section 2b of the Settlement Agreement.

5 8.Attorney FeesEach party hereto shall bear all attorney s fees and costs arising from the actions of its

own counsel in connection with the Complaint, the Settlement Agreement, and the matters and

documents referred to herein, the filing of a Dismissal of the Complaint, and all related matters.9.Delivery of Dismissal with PrejudiceConcurrently with the execution of this Settlement Agreement, counsel for the Plaintiff

shall deliver to counsel for the Defendants or counsel for the Insurer an executed Dismissal with

Prejudice of the Complaint. Plaintiff hereby authorizes counsel for the Defendants and/or

counsel for the Insurer to file said Dismissal with the Court and enter it as a matter of record.10.Representation of Comprehension of DocumentsIn entering into this Settlement Agreement, the Plaintiff represents that Plaintiff has

relied upon the advise of Plaintiff s attorneys who are the attorneys of Plaintiff s own choice,

concerning legal and income tax consequences of this Settlement Agreement; that the terms of

this Settlement Agreement have been completely read and explained to Plaintiff by Plaintiff s

attorneys; and that the terms of this Settlement Agreement are fully understood and voluntarily

accepted by Plaintiff.11.Warranty of Capacity to Execute AgreementPlaintiff represents and warrants that no other person or entity has, or has had, any

interest in the claims, demands, obligations or causes of actions referred to in this Settlement

Agreement, except as otherwise set forth herein; and that Plaintiff has the sole right and

exclusive authority to execute this Settlement Agreement and receive the sum specified in it; and

that Plaintiff has not sold, assigned, transferred, conveyed or otherwise disposed of any claims,

demands, obligations, or causes of action referred to in this Settlement Agreement.12.ConfidentialityThe parties agree that neither they nor their attorneys nor representatives shall reveal to

anyone, other than as may be mutually agreed to in writing, any of the terms of this Settlement

Agreement or any of the amounts, numbers or terms and conditions of any sums payable to the

Payee(s) hereunder.13. Governing LawThis Settlement Agreement shall be construed and interpreted in accordance with the

laws of the State of Alabama.14. Additional Documents

6 All parties agree to cooperate fully and execute any and all supplementary documents and

to take all additional actions which may be necessary or appropriate to give full force and effect

to the basic terms and intent of this Settlement Agreement.15. Entire Agreement and Successors in InterestThis Settlement Agreement contains the entire agreement between the Plaintiff, the

Defendants, and the Insurer with regard to the matters set forth herein and shall be binding upon

and inure to the benefit of the executors, administrators, personal representatives, heirs,

successors and assigns of each.16.EffectivenessThis Settlement Agreement shall become effective following execution by all parties.IN WITNESS WHEREOF, the parties hereto have duly executed this Settlement

Agreement in multiple originals.Date:___________________ ____________________________________Plaintiff, _____________, as Administratrix ofThe Estate of _______________________ and theMother of ______________________________, the only heir to said EstateSUBSCRIBED TO AND SWORN TOBEFORE ME THIS ________ DAYOF ___________, 1999.____________________________NOTARY PUBLICMy commission expires:________APPROVED AS TO FORM AND CONTENT:Date:___________________ ______________________________

7 Attorney for PlaintiffDate:_________________________________________________InsurerBY:___________________________Title:___________________________

EXHIBIT A THE TRAVELERS INSURANCE COMPANY STATEMENT OF IRREVOCABLE GUARANTEE Claimant: ____________________________________________________________________Date of Structured Settlement Agreement: __________________________________________Date of Qualified Assignment: ___________________________________________________The Travelers Insurance Company (TIC ), an insurance company domiciled in the State of

Connecticut, hereby states and represents as follows:WHEREAS, The Travelers Life and Annuity Company (TLAC ) is an insurance company

domiciled in the State of Connecticut and a wholly owned subsidiary of TIC, which acts as an

assignment company with respect to Qualified Assignments as provided in Section 130(c) of the

Internal Revenue Code;WHEREAS, TLAC has accepted a Qualified Assignment with respect to the above-referenced

Claimant;WHEREAS, as a condition to accept TLAC s assumption of liabilities and rely on TLAC for

payment of the obligation under the Structured Settlement, the above-referenced Claimant has

requested that TIC guarantee the payment obligations of TLAC under the Qualified Assignment;

andWHEREAS, TIC guarantees the Qualified Assignment obligations assumed by TLAC with

regard to the above-referenced Claimant.NOW, THEREFORE, TIC states that if TLAC shall fail to make any payment as assumed by it

under said Qualified Assignment, then TIC, by virtue of said guarantee, shall make such

payment as and when due. Said guarantee is irrevocable as to the above-referenced Claimant. This Statement of Irrevocable Guarantee is dated the ______ day of _____________, 1999.THE TRAVELERS INSURANCE COMPANYBy:__________________________________Its