Fill and Sign the Donation or Gift to Charity of Personal Property Form

Useful suggestions for preparing your ‘Donation Or Gift To Charity Of Personal Property’ online

Are you fed up with the inconvenience of managing documents? Look no further than airSlate SignNow, the leading eSignature platform for individuals and businesses. Bid farewell to the tedious process of printing and scanning files. With airSlate SignNow, you can easily complete and sign documents online. Utilize the powerful features integrated into this intuitive and affordable platform and transform your method of document organization. Whether you need to authorize forms or collect signatures, airSlate SignNow manages it all effortlessly, needing only a few clicks.

Follow this step-by-step guide:

- Access your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘Donation Or Gift To Charity Of Personal Property’ in the editor.

- Click Me (Fill Out Now) to finish the document on your side.

- Add and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t stress if you need to work with others on your Donation Or Gift To Charity Of Personal Property or send it for notarization—our solution offers everything you need to perform such tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

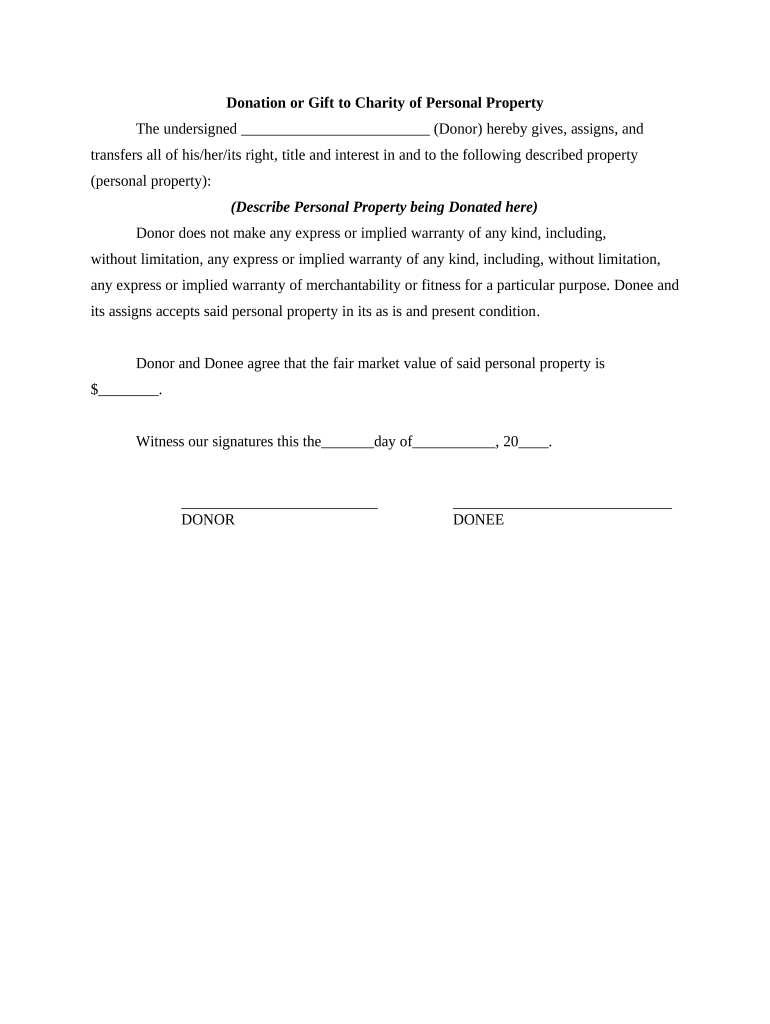

What is a Donation Or Gift To Charity Of Personal Property?

A Donation Or Gift To Charity Of Personal Property refers to the act of giving tangible items, such as vehicles, art, or real estate, to a charitable organization. This type of donation can provide tax benefits and support causes that are important to you. It’s an impactful way to contribute to society while potentially receiving a tax deduction for your generosity.

-

How can airSlate SignNow help with the Donation Or Gift To Charity Of Personal Property process?

airSlate SignNow simplifies the process of creating and signing documents related to a Donation Or Gift To Charity Of Personal Property. Our platform allows you to easily draft donation agreements and collect eSignatures, ensuring that the transfer of property is legally documented and streamlined. This efficient workflow saves you time and reduces paperwork hassle.

-

Are there any costs associated with using airSlate SignNow for donations?

Using airSlate SignNow for a Donation Or Gift To Charity Of Personal Property is cost-effective. We offer various pricing plans that cater to different organizational needs, ensuring that you can find a suitable option without breaking the bank. Our plans include features that enhance your document management experience.

-

What features does airSlate SignNow offer for managing donation documents?

airSlate SignNow provides several features to assist with the Donation Or Gift To Charity Of Personal Property, including customizable templates, eSignature capabilities, and document tracking. These features ensure that your donation documents are professionally formatted, securely signed, and easily accessible, giving you peace of mind during the donation process.

-

Can I integrate airSlate SignNow with other applications for donation management?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage a Donation Or Gift To Charity Of Personal Property efficiently. You can connect our platform with CRM systems, cloud storage services, and other tools to streamline your workflow and maintain organized records of your charitable contributions.

-

What are the tax benefits of making a Donation Or Gift To Charity Of Personal Property?

Making a Donation Or Gift To Charity Of Personal Property can provide signNow tax benefits, including deductions based on the fair market value of the donated item. By donating personal property, you may reduce your taxable income and support a charitable cause at the same time. It's advisable to consult a tax professional for specific guidance related to your situation.

-

Is there a limit to how much I can donate as a Donation Or Gift To Charity Of Personal Property?

While there is no strict limit on the amount you can donate as a Donation Or Gift To Charity Of Personal Property, the IRS does have rules regarding the deductibility of such gifts. Generally, you can deduct donations up to 50% of your adjusted gross income, with some limits based on the type of property donated. Always consult with a tax advisor to understand your specific circumstances.

The best way to complete and sign your donation or gift to charity of personal property form

Find out other donation or gift to charity of personal property form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles