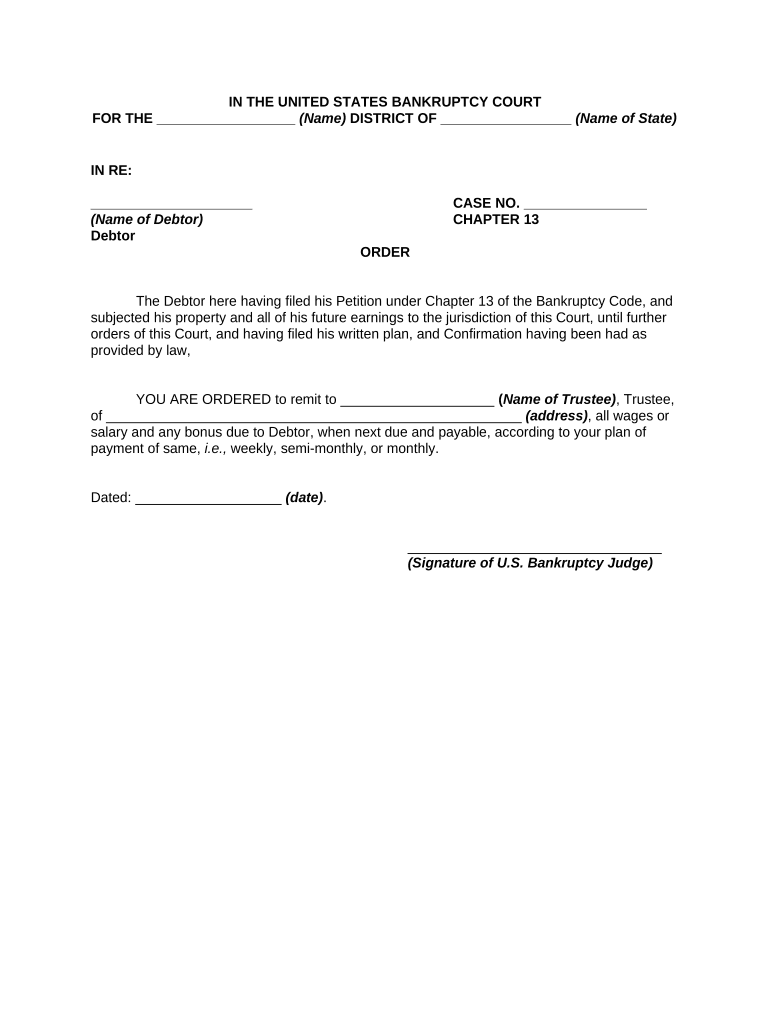

Fill and Sign the Employer Deductions from Form

Valuable assistance on finalizing your ‘Employer Deductions From’ online

Are you fed up with the burden of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and organizations. Wave goodbye to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and endorse paperwork online. Utilize the powerful features integrated into this straightforward and cost-effective platform, and transform your method of document management. Whether you need to authorize forms or gather electronic signatures, airSlate SignNow manages it all seamlessly, requiring only a few clicks.

Follow this comprehensive guide:

- Sign in to your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud, or our form library.

- Open your ‘Employer Deductions From’ in the editor.

- Click Me (Fill Out Now) to set up the document on your side.

- Insert and allocate fillable fields for others (if required).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you need to work with others on your Employer Deductions From or send it for notarization—our platform offers everything you require to complete such tasks. Register with airSlate SignNow today and enhance your document management to a whole new level!

FAQs

-

What are Employer Deductions From an employee's salary?

Employer deductions from an employee's salary are amounts withheld for taxes, benefits, and other contributions. These deductions may include federal and state taxes, Social Security, Medicare, and retirement plan contributions. Understanding these deductions is crucial for both employers and employees for accurate payroll processing.

-

How does airSlate SignNow help with Employer Deductions From payroll documents?

airSlate SignNow simplifies the process of managing employer deductions from payroll documents by providing a secure platform for electronic signatures. This ensures that all necessary approvals are obtained quickly and efficiently, reducing the time spent on manual paperwork. Our solution helps maintain compliance and accuracy in payroll management.

-

Are there any additional fees for Employer Deductions From services with airSlate SignNow?

With airSlate SignNow, there are no hidden fees for handling employer deductions from your payroll documents. Our pricing plans are straightforward and include access to all features necessary for managing eSignatures and document workflows, ensuring that you get the best value for your investment.

-

Can airSlate SignNow integrate with payroll systems that handle Employer Deductions From?

Yes, airSlate SignNow seamlessly integrates with various payroll systems that manage employer deductions from employee salaries. This integration allows you to streamline the process of collecting signatures on payroll-related documents, ensuring that all deductions are processed accurately and efficiently.

-

What benefits does airSlate SignNow provide regarding Employer Deductions From documents?

Using airSlate SignNow for employer deductions from documents offers numerous benefits, including improved efficiency and compliance. The platform enables quick and secure eSigning, reducing the turnaround time for payroll approvals. Additionally, our solution enhances tracking and record-keeping for all deductions.

-

Is airSlate SignNow user-friendly for managing Employer Deductions From?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for both employers and employees to manage employer deductions from documents. The intuitive interface allows users to navigate the platform with ease, ensuring that everyone can efficiently eSign and manage important payroll documentation.

-

How can I ensure compliance with Employer Deductions From using airSlate SignNow?

airSlate SignNow helps ensure compliance with employer deductions from payroll documents by providing a secure and legally binding eSignature process. Our platform is compliant with electronic signature laws, enabling you to maintain accurate records and adhere to regulatory requirements. Regular updates also keep your business aligned with the latest compliance standards.

The best way to complete and sign your employer deductions from form

Find out other employer deductions from form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles