rity

Priod

Rea

®

BUSINESS LAW UPDATE

MILLER, JOHNSON, SNELL & CUMMISKEY, P.L.C.

T

The Mutual Fund Scandal: What Should

Retirement Plan Sponsors and Fiduciaries Do?

SPRING 2004

Miller Johnson’s

Upcoming Workshops

by Frank E. Berrodin, 616.831.1769; berrodinf@mjsc.com

Do you know what mutual funds are offered as investment

options under your retirement plan? Do you know whether any of

them are implicated in the current mutual fund scandal? Do you

understand all the expenses being charged by the funds to participants’ accounts, and do you know how those expenses compare to

other fund options available to retirement plans? If you answered

"no" to any of these questions, and you have any decision making

authority over the investment alternatives available under your

retirement plan, you may be breaching your fiduciary duty to your

plan participants.

Many employers remain unaware of their obligation to monitor

the investment choices made available under their qualified retirement plans. Although the employer may have hired a bank or other

investment professional to assist it in selecting the mutual funds

offered, the individual or committee members who ultimately decide

which funds will be offered under the plan, have a fiduciary responsibility to the plan participants to be sure that those investment

options are prudent. Although plan fiduciaries can be relieved of

liability for bad investment decisions made by participants, this

protection is only available if a number of strict criteria are satisfied.

One of the most important is that the fiduciary properly selects and

monitors the fund choices from which the plan participants may

choose.

A staggering number of mutual funds are available to plan

sponsors, and a significant number of them have good long-term

performance records and low expense ratios and have not been

accused of allowing late trading or market timing of their funds.

Consequently, it will be difficult to defend a lawsuit against a plan

fiduciary who decides to continue to offer an implicated fund (or

any other poorly performing or expensive fund) unless the plan

fiduciary has strong reasons for doing so. It is critical that these

reasons be documented at the time the plan fiduciaries perform their

annual (or more frequent) review of the funds options available

under their plan.

If you would like more information on this topic, and/or would

like to know which fund companies have been accused of illegal or

improper behavior as part of this scandal, please contact the author

or visit our web site for a more detailed discussion of the issue.

Please feel free to copy Priority Read and pass it on to other associates.

APRIL

Remaining Union Free

MAY

Beyond HIPAA Privacy

JUNE

Workers Compensation

JULY

Health Savings Accounts

For more details, visit our web site at

www.millerjohnson.com/resource/

workshops.asp

or contact Jennifer Jenks at

616.831.1886 or jenksj@mjsc.com

www.millerjohnson.com

IN THIS ISSUE

s

THE MUTUAL FUND SCANDAL:

WHAT SHOULD RETIREMENT

PLAN SPONSORS AND

FIDUCIARIES DO?

p. 1

s

PRENUPTIAL AGREEMENTS:

p. 2

THE BASICS

s

WONDERING WHETHER HSAS

WILL REDUCE YOUR MEDICAL

COSTS?

p. 2

s

COURT’S SCAN REVEALS NO

BAR CODE INFRINGEMENT p. 3

s

MILLER JOHNSON IN THE

p. 3

NEWS

s

MILLER JOHNSON WELCOMES

NEW MEMBER

p. 4

�www.millerjohnson.com

P

Prenuptial Agreements: The Basics

by W. Jack Keiser, 616.831.1836, 269.226.2955; keiserj@mjsc.com

ARE PRENUPTIAL AGREEMENTS ENFORCEABLE?

It was long thought that prenuptial agreements were not enforceable in Michigan,

particularly those drafted to deal with

divorce rather than death. However, in

1990, a Miller Johnson attorney made the

argument in Kent County Circuit Court that

a prenuptial agreement was enforceable.

The judge agreed and wrote an opinion in

the well-known case of Rinveldt v. Rinveldt,

which was eventually decided by the

Michigan Court of Appeals in 1991. Since

that time courts have upheld prenuptial

agreements in many Michigan cases, citing

Rinveldt. An interesting side note of the

Rinveldt case is that the party seeking to

enforce the prenuptial agreement had very

little by way of assets. The prenuptial agreement provided that the less-wealthy party

would receive a percentage of the wealthier

party’s estate in the event of divorce.

Because the marriage was so short, the

prenuptial proved more beneficial for the

party with little wealth than did Michigan’s

general divorce law.

HOW DOES A COUPLE OBTAIN

AGREEMENT?

A

PRENUPTIAL

For some people, the most difficult part of

the process is approaching the future

spouse. Requesting a prenuptial may be

viewed as showing distrust of the other person or a lack of faith in the relationship.

However, once the subject is broached, it

often becomes comfortable for both of the

W

parties. Realistically, the issues surrounding

a prenuptial agreement are issues that

should be discussed, so that each person’s

expectations about the marriage, particularly

financial expectations, are known to the

other. Once the parties have discussed the

matter, they must move early to get attorneys involved. Serious discussion and drafting should occur months before the wedding

date. The closer to the wedding date these

events occur, the more tension they create

between the parties. A detailed schedule of

each party’s assets and liabilities should be

prepared and exchanged early on.

DOES A PRENUPTIAL AGREEMENT HAVE

PRECEDE THE MARRIAGE?

TO

Entry into the marital relationship is the

consideration for the prenuptial agreement,

so the agreement must precede the marriage.

However, there is much legal support for

the proposition that a married couple in a

deeply troubled marriage (for example

where there is a pending divorce action

and/or physical separation of the parties)

may enter into a postnuptial agreement if its

purpose is to save or restore the marriage.

To learn more about this subject, you

may wish to review the more detailed

article contained on our web page at

www.millerjohnson.com. You may contact

the author, who can assist you or refer you

to one of the Miller Johnson attorneys experienced in this area.

Wondering Whether HSAs Will Reduce Your Medical Costs?

by Frank E. Berrodin, 616.831.1769; berrodinf@mjsc.com

Mary V. Bauman, 616.831.1704; baumanm@mjsc.com

Miller Johnson

is a member

of Meritas, an

association

of independent

law firms

worldwide.

Have you heard about the provisions of

the 2003 Medicare law creating health savings accounts (HSAs)? Have you been

wondering if they will reduce your escalating annual medical expenses? While HSAs

will definitely be beneficial for the employees of certain employers, they are not for

everyone.

2 MILLER, JOHNSON, SNELL & CUMMISKEY, P.L.C.

HSAs are like IRAs that are used to

cover an employee’s unreimbursed medical

expenses. Contributions are tax deductible

by the employer and/or the employee and

distributions are also tax free if used to pay

unreimbursed medical expenses in the current or any future year.

So why shouldn’t every employer

(see HSAs on page 3)

SPRING 2004

�www.millerjohnson.com

C

Court’s Scan Reveals No Bar Code Infringement

by Barry C. Kane, 616.831.1770; kaneb@mjsc.com

A recent federal court decision will be of

interest, and also a source of relief, to makers and users of bar code scanners and readers.

The Automatic Identification and Data

Capture industry recently announced the

successful conclusion of litigation with the

Lemelson Foundation. The Foundation had

been making allegations that bar-code

scanners, readers and related machine vision

technology prevalent throughout the industry infringed on patents it owned.

In 1999, a number of manufacturers of

bar-code reading equipment and related

machine vision products (Auto ID) jointly

filed suit against the Foundation, seeking a

declaration that certain patents asserted by

the Foundation against end users of barcode reading equipment were invalid, unenforceable and not infringed. In 2000, the

case was consolidated with a similar case

filed by a maker of machine vision systems.

Now, the United States District Court

for the District of Nevada, has ruled the

Foundation patents invalid, unenforceable,

and not infringed – as the plaintiffs asserted.

This ruling brings great relief to those the

Foundation accused of infringement.

The Lemelson Foundation had put significant pressure on the entire Auto ID

industry, demanding the payment of millions in dollars in licensing fees. The new

ruling should lead to the cessation of the

Foundation’s demands for licensing fees for

the use of bar-code technology. The

Foundation is likely to pursue an appeal,

but leaders in the industry firmly believe

that the court’s ruling will be upheld by the

appellate court.

If your company was contacted by the

Lemelson Foundation and alleged to have

infringed upon its patents, you can rest substantially easier now that the court has rendered its decision. If your company took a

license from the Lemelson Foundation and

is paying royalties, you may wish to consider

whether the continued payment of those

monies makes sense.

As always, should you require any legal

counsel in these evaluations, please feel free

to contact either Barry Kane or Frank

Scutch in the Intellectual Property Group.

(HSAs cont’d from page 2)

establish HSAs for their employees? The

main reason is that contributions can only

be made to an employee’s HSA in the year

the employee is covered by a high

deductible health plan. Generally, in order

to be a high deductible health plan, the

deductible must be at least $1,000 for an

individual and $2,000 for a family.

Consequently, employees who already

participate in a high deductible health plan

will definitely want to contribute to an HSA

(and/or have their employer contribute for

them through a cafeteria plan or otherwise).

In addition, if an employer can reduce its

health insurance costs by switching to a

high deductible health plan and making

contributions to its employees’ HSAs, the

switch may make sense.

For a more detailed article on this topic,

go to www.millerjohnson.com. Also, look

for an email announcement regarding a

workshop we will be offering July 21 and

July 29 on HSAs after the IRS issues additional guidance (expected by June 2004).

Miller Johnson in the News

s ROBERT R. STEAD has been selected to serve on

the Pass-Through Entity Integration Task Force of

the American Bar Association's Tax Section. He is

the only person from Michigan to serve on this

Task Force which works with committees of

Congress, the Treasury, the

Internal Revenue Service and

the Joint Committee on

Taxation on developing tax

simplification proposals.

MILLER, JOHNSON, SNELL & CUMMISKEY, P.L.C.

SPRING 2004

3

�MILLER, JOHNSON, SNELL & CUMMISKEY, P.L.C.

SPRING 2004

Miller Johnson

Welcomes New

Member

www.millerjohnson.com

s MANAGING MEMBER

Jon G. March

616.831.1729

marchj@mjsc.com

Grand Rapids p 616.831.1700/f 616.831.1701

Kalamazoo p 269.226.2950/f 269.226.2951

Have a question about a specific legal area? If so, please contact one of the following

members of the Miller Johnson Business Section. We would welcome the opportunity

to assist you.

s JAMES

L. HOPEWELL joins

Miller Johnson as a member in

the Grand Rapids office. He will

continue his practice in the areas

of business counsel, mergers and

acquisitions, real estate and taxation. James received his education at University of Cincinnati

College of Law, Syracuse

University and Adrian College.

BUSINESS SECTION CHAIR

EMPLOYEE BENEFITS

MERGERS AND ACQUISITIONS

Jeffrey G. York

616.831.1764

yorkjg@mjsc.com

James C. Bruinsma

616.831.1708

bruinsmaj@mjsc.com

Jeffrey G. York

616.831.1764

yorkjg@mjsc.com

BUSINESS SECTION

VICE CHAIR

ENVIRONMENTAL

AND ENERGY

REAL ESTATE

John M. Sommerdyke

616.831.1757

sommerdykej@mjsc.com

Alan C. Schwartz

616.831.1751

schwartza@mjsc.com

CORPORATE AND

CORPORATE FINANCE

ESTATE PLANNING

AND PROBATE

Jeffrey G. York

616.831.1764

yorkjg@mjsc.com

Carol J. Karr

616.831.1723

karrc@mjsc.com

CREDITORS’/DEBTORS’

RIGHTS

INTELLECTUAL PROPERTY

Robert W. Scott

616.831.1752

scottr@mjsc.com

TAXATION

Mark E. Rizik

616.831.1744

rizikm@mjsc.com

Barry C. Kane

616.831.1770

kaneb@mjsc.com

Thomas P. Sarb

616.831.1748

sarbt@mjsc.com

Any of the above lawyers can also put you immediately in contact with firm attorneys who practice in

the areas of Banking, Environmental Law, Government Relations, Health Care, Health Professionals,

Immigration, International Contracting, Municipal Law, and Small Business.

This newsletter is a periodic publication of Miller, Johnson, Snell & Cummiskey, P.L.C., and should not be construed as legal advice or legal opinion on any specific facts or circumstances.

The contents are intended for general information purposes only, and you are urged to consult your lawyer concerning your own situation and any specific legal questions you may have. For

further information about these contents, please contact us.

© 2004 Miller, Johnson, Snell & Cummiskey, P.L.C. All rights reserved. Priority Read is a federally registered service mark of Miller, Johnson, Snell & Cummiskey, P.L.C.

PRSRT. STD

U.S. Postage

PAID

Attorneys and Counselors

GR, MI

Permit #657

250 Monroe Avenue NW, Suite 800

PO Box 306

Grand Rapids, MI 49501-0306

IN COMING ISSUES

s

WATCH OUT FOR THE TITLE

INSURANCE GAP

I

N T E R E S T E D

I

N

R

E C E I V I N G

O

U R

M

A I L I N G S

V

I A

E-M

A I L

?

Send your name, company name, and e-mail address to verleej@mjsc.com. Please indicate whether you would prefer to receive future

mailings by e-mail only or e-mail and hard copy.

�

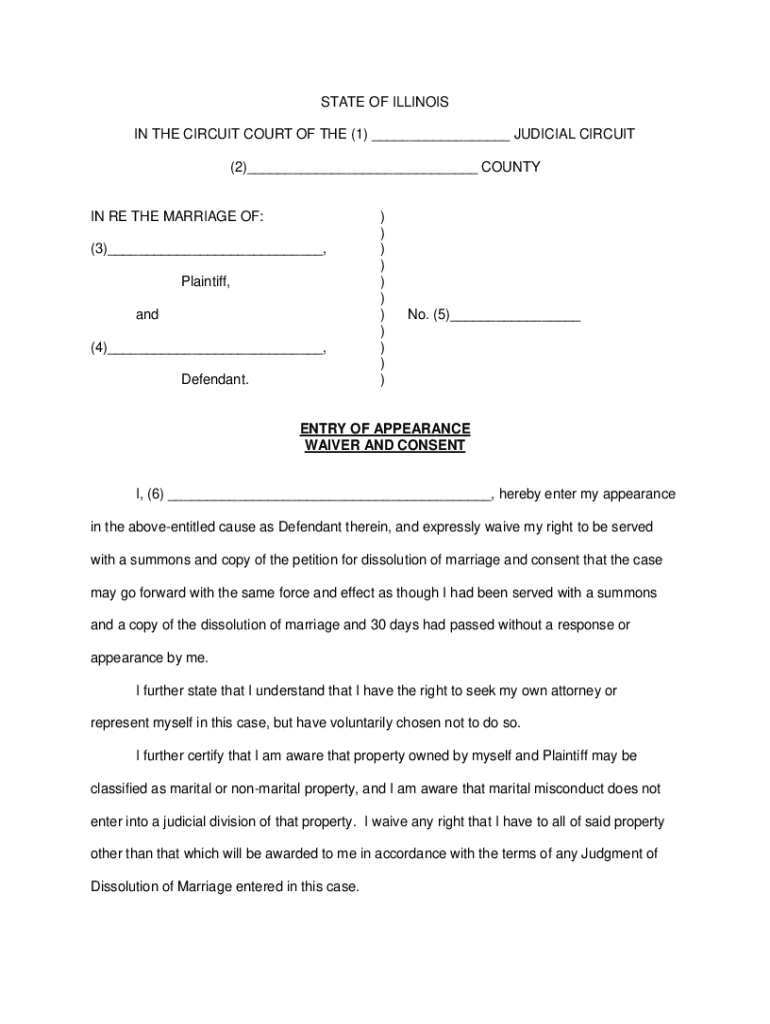

Valuable advice on preparing your ‘Entry Of Appearance Waiver And Consent Form’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and small to medium-sized businesses. Bid farewell to the lengthy task of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign paperwork online. Take advantage of the powerful features included in this intuitive and cost-effective platform and transform your strategy for managing paperwork. Whether you need to authorize forms or gather eSignatures, airSlate SignNow manages it all seamlessly, requiring only a few clicks.

Adhere to this detailed guideline:

- Sign into your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form collection.

- Access your ‘Entry Of Appearance Waiver And Consent Form’ in the editor.

- Click Me (Fill Out Now) to finish the document on your side.

- Insert and designate fillable fields for additional individuals (if necessary).

- Continue with the Send Invite settings to seek eSignatures from others.

- Save, print your copy, or transform it into a reusable template.

Don’t fret if you need to collaborate with your coworkers on your Entry Of Appearance Waiver And Consent Form or send it for notarization—our solution provides everything you require to accomplish such tasks. Register with airSlate SignNow today and take your document management to a new height!