Fill and Sign the Exchange Addendum to Contract Tax Free Exchange Section 1031 Form

Valuable tips on finalizing your ‘Exchange Addendum To Contract Tax Free Exchange Section 1031’ online

Are you weary of the inconvenience of dealing with paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can seamlessly finalize and sign documents online. Utilize the robust features embedded in this user-friendly and cost-effective platform and transform your approach to document administration. Whether you need to approve forms or collect eSignatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow this step-by-step guide:

- Sign in to your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Exchange Addendum To Contract Tax Free Exchange Section 1031’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and allocate fillable fields for other parties (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you have to collaborate with others on your Exchange Addendum To Contract Tax Free Exchange Section 1031 or send it for notarization—our platform has everything you need to fulfill such tasks. Sign up with airSlate SignNow today and elevate your document management to a new standard!

FAQs

-

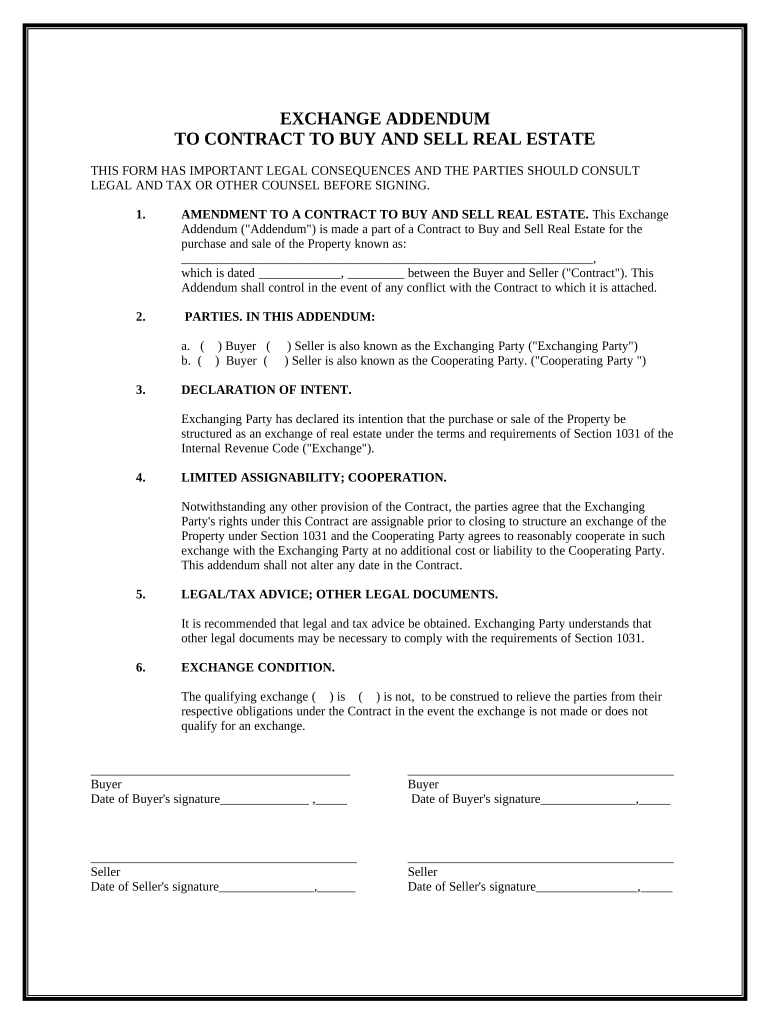

What is a 1031 addendum to real estate contract?

A 1031 addendum to real estate contract is a legal document that specifies the terms and conditions relating to a 1031 exchange of real estate properties. This addendum ensures that the buyer and seller agree to defer capital gains taxes on the sale of their properties. It's essential for facilitating tax-free exchanges and can help streamline the transaction process.

-

How can airSlate SignNow help with a 1031 addendum to real estate contract?

airSlate SignNow simplifies the process of creating, sending, and signing a 1031 addendum to real estate contract. With our user-friendly platform, you can easily customize templates to meet your specific needs, ensuring compliance with 1031 exchange regulations. This efficiency reduces paperwork and speeds up the transaction process.

-

Are there any costs associated with using airSlate SignNow for a 1031 addendum to real estate contract?

Yes, there are costs associated with using airSlate SignNow, but we offer competitive pricing plans suitable for businesses of all sizes. Our subscription plans provide access to features that streamline the creation and management of documents like the 1031 addendum to real estate contract, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing a 1031 addendum to real estate contract?

airSlate SignNow offers a range of features that enhance document management for a 1031 addendum to real estate contract, including electronic signatures, document templates, and real-time tracking of document status. Additionally, our integration capabilities allow seamless collaboration with other tools, making the signing process efficient and straightforward.

-

Is airSlate SignNow compliant with legal standards for a 1031 addendum to real estate contract?

Absolutely! airSlate SignNow ensures that all documents, including a 1031 addendum to real estate contract, comply with legal standards and regulations. Our platform adheres to electronic signature laws, providing you with peace of mind that your signed documents are legally binding.

-

Can I customize my 1031 addendum to real estate contract using airSlate SignNow?

Yes, you can fully customize your 1031 addendum to real estate contract using airSlate SignNow's intuitive document editor. This feature allows you to modify text, add clauses, and include necessary details to meet the specific requirements of your real estate transaction.

-

How does airSlate SignNow ensure the security of my 1031 addendum to real estate contract?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your documents, including the 1031 addendum to real estate contract. This ensures that your sensitive information remains confidential and secure throughout the signing process.

The best way to complete and sign your exchange addendum to contract tax free exchange section 1031 form

Find out other exchange addendum to contract tax free exchange section 1031 form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles