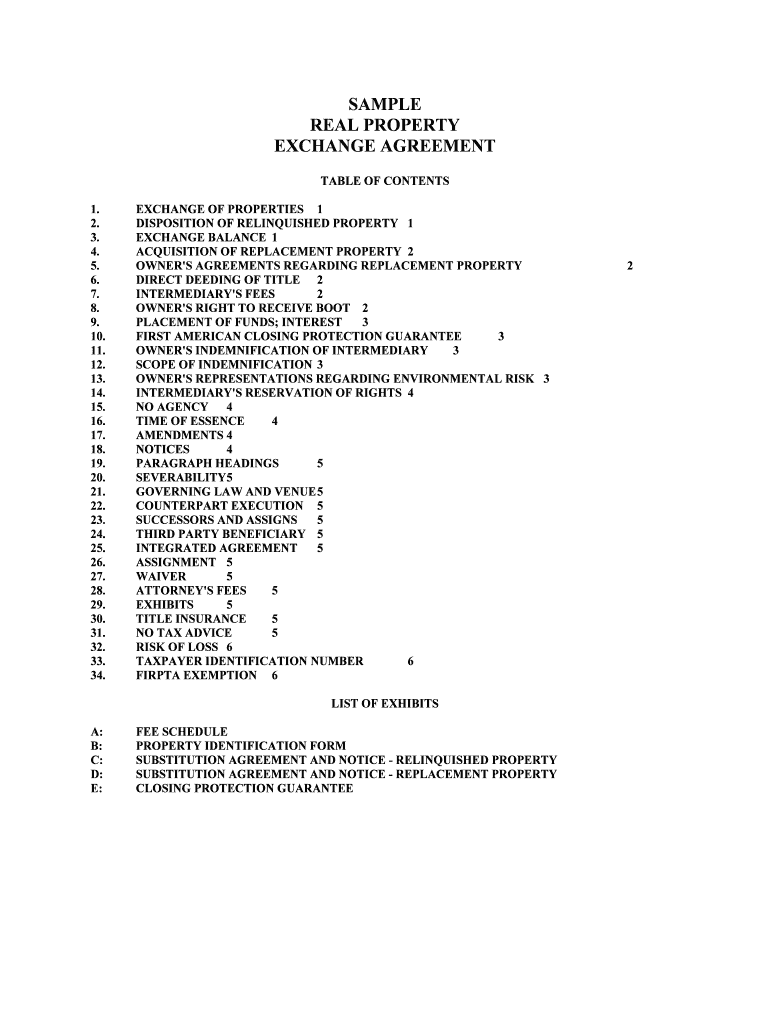

SAMPLE

REAL PROPERTY

EXCHANGE AGREEMENT

TABLE OF CONTENTS

1. EXCHANGE OF PROPERTIES 1

2. DISPOSITION OF RELINQUISHED PROPERTY 1

3. EXCHANGE BALANCE 1

4. ACQUISITION OF REPLACEMENT PROPERTY 2

5. OWNER'S AGREEMENTS REGARDING REPLACEMENT PROPERTY 2

6. DIRECT DEEDING OF TITLE 2

7. INTERMEDIARY'S FEES 2

8. OWNER'S RIGHT TO RECEIVE BOOT 2

9. PLACEMENT OF FUNDS; INTEREST 3

10. FIRST AMERICAN CLOSING PROTECTION GUARANTEE 3

11. OWNER'S INDEMNIFICATION OF INTERMEDIARY 3

12. SCOPE OF INDEMNIFICATION 3

13. OWNER'S REPRESENTATIONS REGARDING ENVIRONMENTAL RISK 3

14. INTERMEDIARY'S RESERVATION OF RIGHTS 4

15. NO AGENCY 4

16. TIME OF ESSENCE 4

17. AMENDMENTS 4

18. NOTICES 4

19. PARAGRAPH HEADINGS 5

20. SEVERABILITY5

21. GOVERNING LAW AND VENUE 5

22. COUNTERPART EXECUTION 5

23. SUCCESSORS AND ASSIGNS 5

24. THIRD PARTY BENEFICIARY 5

25. INTEGRATED AGREEMENT 5

26. ASSIGNMENT 5

27. WAIVER 5

28. ATTORNEY'S FEES 5

29. EXHIBITS 5

30. TITLE INSURANCE 5

31. NO TAX ADVICE 5

32. RISK OF LOSS 6

33. TAXPAYER IDENTIFICATION NUMBER 6

34. FIRPTA EXEMPTION 6 LIST OF EXHIBITS

A: FEE SCHEDULE

B: PROPERTY IDENTIFICATION FORM

C: SUBSTITUTION AGREEMENT AND NOTICE - RELINQUISHED PROPERTY

D: SUBSTITUTION AGREEMENT AND NOTICE - REPLACEMENT PROPERTY

E: CLOSING PROTECTION GUARANTEE

SAMPLE

REAL PROPERTY

EXCHANGE AGREEMENT

This Real Property Exchange Agreement ("Agreement") is entered into by and between

___________________________________("Owner") and FIRST EXCHANGE

CORPORATION, a California corporation ("Intermediary"), in consideration of the following:

A. Owner is presently the owner of certain real property located in the County of

_________________, State of _______________, commonly known as Assessor's Parcel #

_________, located at _____________________________, ____________________

("Relinquished Property").

B. Owner desires to acquire in exchange as replacement property certain other "Like-

kind" real property by way of an Internal Revenue Code ("Code") Section 1031 exchange (an

"Exchange Transaction").

C. Intermediary has agreed to act as a qualified intermediary to facilitat e the

Exchange Transaction by discharging the contractual obligation of Owner to transfer the

Relinquished Property to one or more third-party buyers (the “Buyer"), acquiring other United

States real property (the 'Replacement Property") of "like kind" (within the meaning of Sec tion

1031 of the Code) to the Relinquished Property from one or more third-party sellers (the

"Seller"), and causing the transfer of the Replacement Property to Owner pursuant to the t erms of

this Agreement.

D. 1. Title to Relinquished Property shall be deeded directly from Owner to the

Buyer, and title to the Replacement Property shall be deeded directly from the Seller to Owner.

E. The parties intend to achieve a valid exchange as set forth in applicable law and

regulations, including Treasury Regulations Section 1.1031(k)-1, now and as it may be amended

or modified.

F. Owner shall bear the sole and exclusive risk of whether the transactions

contemplated by this Agreement qualify under Section 1031 of the Code. Intermediary, its

agents, and its counsel shall have no responsibility or liability concerning such qualification.

NOW, THEREFORE, in consideration of the recitals above, and the other agreements

set forth in this Agreement, the parties agree as follows:

1.EXCHANGE OF PROPERTIES. Subject to the terms of this Agreement,

Owner agrees to transfer to Intermediary the Relinquished Property, and Intermediary agrees

immediately after this transfer to retransfer the Relinquished Property tot he Buyer. In

consideration of and in exchange for this transfer, subject to the terms of this Agreement,

Intermediary shall acquire and transfer to Owner one or more Replacement Properties of "like

kind".

2.DISPOSITION OF RELINQUISHED PROPERTY.

a. At least (5) business days prior to the closing of the sale of Relinquished

Property to Buyer ("Initial Closing Date"), Owner shall provided Intermediary with a copy of the

final agreement for the sale of the Relinquished Property to Buyer.

b. Prior to Initial Closing Date, Owner shall cause the Intermediary to be

substituted as seller of the Relinquished Property, using the assignment attached as Exhibi t "C",

and Intermediary shall cause the transfer and conveyance of the Relinquished Property to B uyer

by direct deed in accordance with Paragraph 6.

3. EXCHANGE BALANCE. Owner and Intermediary agree that the gross fair

market value of Owner's interest in Relinquished Property is that value shown on the purchase

contract or exchange instructions signed by Owner in connection with the transfer of

Relinquished Property (the "Exchange Value"). Intermediary shall credit Owner, in exchange

for the transfer of Relinquished Property, with an amount ("Exchange Balance") equal to such

Exchange Value, plus any additional cash deposited by Owner with Intermediary for the

acquisition of Replacement Property and any prorations credited to Owner, less all of the

following:

a. The amount of all principal and accrued interest on any obligation secured

by relinquished Property as of the Initial Closing Date of Relinquished Property (including any

prepayment penalty).

b. All settlement costs, prorations, and other transactional expenses charged

to Owner or Intermediary in connection with the exchange, acquisition and disposition

transaction contemplated by this Agreement,

c. Any actual direct costs and expenses incurred or expended by

Intermediary to third parties pursuant to this Agreement (less any of such amounts returned to

Intermediary),

d. Any amount of tax that Intermediary shall have been required to withhold

pursuant to state oInitial Closing Date and subject to the time limits set fort h in the next sentence,

as Owner locates each Replacement Property, Owner shall give written notice to Intermediary

("Identification Notice") using the Replacement Property Identification Form attached as Exhibit

"B" that such property is to constitute Replacement Property. This shall occur during t he

identification period beginning on the Initial Closing Date (the "Identification Period"). Owner

shall have the right to rescind any such Identification Notice at any time during the Identification

Period by written notice to Intermediary. Upon entering any agreement for the acquisition of

Replacement Property (and in no event less than two (2) business days prior to the closing of

such agreement), Owner shall promptly provide Intermediary with copies of such final

agreement for Intermediary's review. Prior to the closing of the acquisition of Replaceme nt

Property (which shall be within the "Exchange Period", which is the period beginning on the

Initial Closing Date and ending at the close of the one hundred eightieth (180th) day aft er the

Initial Closing Date), Owner shall cause Intermediary to be substituted as purchaser of the

Replacement Property, using the assignment attached as Exhibit "D". If all conditions to the

transfer of the Replacement Property have been satisfied or waived, Intermediary shall c ause the

transfer of the Replacement Property to Owner by direct deed in accordance with Para graph 6 in

consideration of and in exchange for the transfer by Owner of Relinquished Property pursuant to

the terms of this Agreement.

b. Obligation limited to Exchange Balance. Intermediary shall participate in

the acquisition of Replacement Property upon specific terms and conditions as negotiate d and

specified in writing by Owner and agreed to by Intermediary. In the event that additional cash or

other consideration is required by Intermediary to acquire Replacement Property, all of suc h

additional cash and otntermediary by Owner through the Exchange Transactions. Intermediary

shall have no obligation to participate in the acquisition of Replacement Prope rty unless all such

additional consideration has been deposited in the Exchange Transaction by Owner. Owner

agrees that Owner must approve in writing all final terms and conditions for the acquisit ion of

Replacement Property.

c. Intermediary shall not be in breach of its obligations under this

Agreement, nor shall Intermediary incur any liability under this Agreement, on account of

Intermediary's inability to acquire any Replacement Property on the terms and condit ions

specified by Owner in any Identification Notice or on account of Intermediary inability to

perform under any Replacement Property purchase agreement unless such failure shall arise out

of the willful default by Intermediary under this Agreement. If notwithstanding Intermediary's

good faith attempts, Intermediary is unable to acquire a Replacement Property, Inte rmediary

shall, within five (5) business days following Intermediary's or Owner's written notice tot he

other assign to Owner (without recourse and without any warranty or representation in

connection therewith) all rights, claims, causes of action, or other rights that Inte rmediary may

have under such Replacement Property purchase agreement.

5.OWNER'S AGREEMENTS REGARDING REPLACEMENT PROPERTY.

Owner agrees as follows:

a. Every designation of Replacement Property, and any Identification Notice

delivered to Intermediary by Owner, shall be made on the basis of Owner's own investigation of

the physical condition of the land and improvements, including subsurface conditions and

environmental conditions; and

b. Each and every transfer made by Intermediary to Owner of any

Replacement Property shall be conveyed to Owner "as-is" and with all defects, whether la tent or

patent, and Owner shall assume all risks relating tot he Replacement Property, incl uding adverse

physical conditions which may not have been revealed by its investigation.

6.DIRECT DEEDING OF TITLE. Owner and Intermediary agree that

Intermediary shall cause the Relinquished Property to be directly conveyed to Buyer from Owner

and the Replacement Property to be directly conveyed to Owner from Seller of the Re placement

Property, in both cases using the services of First American Title Insurance Company or its

underwritten agent.

7.INTERMEDIARY'S FEES. Owner agrees to pay as consideration for the

activities undertaken by Intermediary pursuant to the terms and conditions of this Agreem ent, the

fees calculated pursuant to the schedule attached as Exhibit "A". Such sums shall be disbursed

to Intermediary directly from the funds held by Intermediary, and charged against the Exchange

Balance, without the requirement of authorization or further approvals by Owner.

8.OWNER'S RIGHT TO RECEIVE BOOT.

a. All funds received by Intermediary from the transactions described in

Paragraph 2 shall be utilized by Intermediary to acquire the Replacement Properties or for the

charges permitted under Paragraph 3 and Paragraph 7. Owner shall have no right to receive,

pledge, borrow or otherwise obtain the benefits of such funds or other consideration held by

Intermediary or anything other than "like kind" real property other than as set forth under

Paragraph 8.b. b. Notwithstanding the foregoing, Intermediary shall distribute any

unexpended portions of the Exchange Balance and accrued interest to Owner (i) after the e nd of

the Identification Period, if there are no identified Replacement Properties whic h have not been

acquired, (ii) upon or after the receipt by Owner of all of the Replacement Properties i dentified

within the Identification Period, (. Section 1.1031(k)-1(g)(6)(iii), or (iv) after the end of the

Exchange Period, if there shall be any remaining Exchange Balance.

c. Owner acknowledges that no Exchange Balance shall be distributed prior

to the occurrence of events listed in Paragraph 8.b.

9.PLACEMENT OF FUNDS; INTEREST. Owner and Intermediary agree that,

during the term of this Agreement, all funds held by Intermediary shall be placed in an interest-

bearing account with a financial institution or institutions approved by First American T itle

Insurance Company, with all interest in such account or accounts to accrue to the a ccount of

Intermediary and to be added to the Exchange Balance. Owner shall receive inte rest on the

funds to be utilized by Intermediary pursuant to this Agreement in an amount equal to the

interest earned by Intermediary on such funds. Owner shall have no right tot receive, to pledge,

borrow or otherwise obtain the benefits of such interest before the end of the Exchange Period,

except as otherwise provided in Paragraph 8. All monetary obligations of Intermediary under

this Agreement are specifically limited to the availability of funds from such account or

accounts, and Intermediary (as distinguished from First American Title Insurance Company

under Paragraph 10) shall have no liability on account of the failure or delay of any depository

financial institution (or other party holding funds( in repaying any deposit or interest on deposits.

10.FIRST AMERICAN CLOSING PROTECTION GUARANTEE.

Notwithstanding anything this Agreement to the contrary, if First American Title Insurance

Company approves the financial institution holding the funds comprising the Exchange Bala nce,

as an additional protection in this transaction, Owner shall be provided with an Exchange

Closing Protection Guarantee in the form of Exhibit "E".

11.OWNER'S INDEMNIFICATION OF INTERMEDIARY. Owner releases,

indemnifies, holds harmless, and agrees to defend Intermediary from any and all loss, cost s,

expenses, liability, damage or injury, including actual attorneys' fees (as defined in Para graph

28), in any manner arising out of or incident to Intermediary's participation in the acquisi tion,

ownership, and/or disposition of any interest in the Relinquished Property or the Replacement

Property or Intermediary's holding or holding or disposing of funds or other consideration

pursuant to this Agreement. This rmediary's participation in any aspect of the Exchange

Transaction, including, without limitation, any and all consequential damages arising therefrom,

except liability arising directly from Intermediary's own willful misconduct or gross neglige nce.

The parties further agree that Intermediary is participation in the disposition of Relinquished

Property and the obtaining of the Replacement Property in furtherance of Owner's desire to

accomplish an Exchange Transaction.

12.SCOPE OF INDEMNIFICATION. For purposes of this Agreement, the

indemnification by Owner shall include the active defense by attorneys selected by Inte rmediary

of any claim made against Intermediary, all legal expenses and costs incurred by Inte rmediary in

connection therewith, including the expense of duplication of the rate of Fifteen Cents ($0.15)

per page in response to any summons subpoena, judicial or administrative process or any

correspondence, and an allowance at the rate of One Hundred Fifty Dollars ($150.00) per hour

for the time of any employee of Intermediary (plus actual attorneys' fees of Intermedi ary) who is

required or asked to prepare or respond to summons, complaints, applications, discovery,

motions, demurrers, answers, affirmative defenses, counterclaims, crosscomplaints, and

administrative proceedings, or for time that is spend in negotiation toward settlement, or in

traveling to or from and attending hearings, trials, depositions, meetings or other proceedings

related to matters indemnified against pursuant to this Agreement, or for time that is incurred in

connection with any governmental tax audit or proceeding regarding the Exchange Transaction.

13.OWNER'S REPRESENTATIONS REGARDING ENVIRONMENT RISK.

a. Owner represents and warrants to Intermediary that there are no underground

storage tanks on Relinquished Property and, as to any Replacement Property, that there shal l not

be any such tanks, nor shall there be any evidence on the Relinquision by any hazardous or t oxic

materials as defined by any governmental agency, and that Owner has no reason to suspect the

existence thereof in or upon Relinquished Property, nor shall Owner shall such suspicion to exi st

as to any Replacement Property. For the purposes of this paragraph "hazardous or toxic

materials" shall include by not be limited to substances defined as "hazardous substance s,"

"hazardous material," or "toxic substances" in the Comprehensive Environmental Response,

Compensation and Liability Act of 1980, as amended, 42 U.S.C. Section 9601, et seq., the

Hazardous Materials Transportation Act, 49 U.S.C. Section 1801, et seq.; the Resources

Conservation and Recovery Act, 42 U.S.C. 6901, et seq.; and corresponding statutes enacted by

any state in which either Relinquished Property or any Replacement Property is located, as any

of the above mentioned laws may be amended from time to time, and in the regulations adopted

and the publications promulgated pursuant to such laws.

b. Intermediary is expressly relying upon these representations by Owner in

entering into this Agreement. Owner agrees that the indemnity and hold harmless provisions of

Paragraphs 11 and 12 shall specifically include any liability arising by reason of any

contamination found to have existed on Relinquished Property or on any Replacement Property

which in any way jeopardizes or causes liability to Intermediary. Owner assigns to Intermediary

any and all rights to indemnification which Owner may have against any third party t o the extent

Intermediary suffers any damage, liability and/or cost as a result of the presence of

environmental contamination or hazardous or toxic materials upon Relinquished Property or any

Replacement Property.

14.INTERMEDIARY'S RESERVATION OF RIGHTS. Intermediary reserves

the right, in its absolute discretion, to resign as an intermediary pursuant to this Agreement.

Intermediary also reserves the right, in its absolute discretion, to withhold acceptance and

participation in the assignment of rights substituting Intermediary in the contract for disposition

of Relinquished Property or the contract to acquire of this paragraph, Intermediary shall

immediately cease to act as intermediary, Intermediary shall return to Owner any remaining

balance of the Exchange Balance and Intermediary shall have no further obligations under this

Agreement. Notwithstanding the resignation of the Intermediary, the indemnification provisions

of Paragraphs 11, 12, and 13, and the provisions of Paragraphs 21, 28, 31, and 32 shall survive

the resignation of Intermediary.

15.NO AGENCY. Intermediary shall not have any obligations to Owner as an agent

of Owner nor shall Owner have any obligations to Intermediary as a principal of Intermediary.

16.TIME OF ESSENCE. Time is of the essence of each and every term and

provision of this Agreement.

17.AMENDMENTS. This Agreement m party may be required or desires to serve

upon the other parties under the terms of this Agreement shall be in writing, and shall be served

upon the other parties at the following addresses:

If to Intermediary, to: If to Owner:

First Exchange Corporation

930 Laguna Street

Santa Barbara, CA 93101

Telephone: (805) 962-2264

Fax (805) 965-5996

19.PARAGRAPH HEADINGS. Paragraph and other headings contained in this

Agreement are for reference purposes only and are in no way intended to describe, to interpret ,

define or to limit the scope, extent or intent of this Agreement or any provision of this

Agreement.

20.SEVERABILITY. All paragraphs, clauses and covenants contained in this

Agreement are for reference purposes only and are in no way intended to describe, to interpret ,

define or to limit the scope, extent to intent of this Agreement shall be interpre ted as if the

invalid paragraphs, clauses or covenants were not contained in this Agreement.

21.GOVERNING LAW AND VENUE. The internal laws of the State of

California concerning contracts made and to be performed wholly within that state (other than its

rules for conflict or choice of laws), without regard to the conflicts of laws principles of suc h

state, shall govern the validity of this Agreement, the interpretation of its term s, and the rights

and duties of the parties (whether a cause of action is asserted in contract, in tort, or otherwise, at

equity or at law). Any suit brought in connection with this Agreement, whether in contract , tort,

equity or otherwise, shall be brought in the state courts sitting in Santa Barbara, C alifornia, the

parties waiving any claim or defense that such forum is not convenient or proper. Each party

agrees that any such court shall have in personam jurisdiction over it, consents to service of

process in any manner authorized by California law, and agrees that a final judgment in any such

action or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the

judgment or in any other manner specified by law.

22.COUNTERPART EXECUTION. This Agreement may be executed in any

number of counterparts wit the same effect as if all parties have signed the sam e document. All

counterparts shall be construed together and shall cod shall inure to the benefit of the respective

heirs, successors and assigns of the parties, provided, however, that Owner shall have no right to

assign Owner's interest under this Agreement without the prior written consent of Intermediary.

24.THIRD PARTY BENEFICIARY. Except as otherwise provided in this

Agreement, this Agreement is made for the sole benefit of the parties signatory to i t. Subject to

the provisions of Paragraph 23, no other persons shall have any rights or remedies by reason of

this Agreement against any parties signatory to it or shall be considered to be third pa rty

beneficiaries of this Agreement in any way.

25.INTEGRATED AGREEMENT. This Agreement and its exhibits and the

Exchange Closing Instructions entered into pursuant to this Agreement constitute the ent ire

understanding and agreement among the parties with respect to the subject matter of this

Agreement, and there are no agreements, undertakings, restrictions, representations or warrantie s

among the parties in writing. In the case of any conflict between this Agreement a nd any other

agreement entered into between the parties, this Agreement shall prevail.

26.WAIVER. The failure of any party at any time to enforce performance by

another party of any provision of this Agreement shall in no way affect the party's rights to

enforce that performance, nor shall the waiver by any party of any breach of any provision of this

Agreement be deemed to be a waiver by that party of any other breach of that provision or any

other provision of this Agreement.

28.ATTORNEYS' FEES. If any legal action, arbitration or other proceeding is

brought for the enforcement of this Agreement, or because of any alleged dispute, breach, defaul t

or misrepresentation in connection with this Agreement, the successful or prevailing party sha ll

be entitled to recover actual attorneys' fees (including fees for paraprofessionals and si milar

personnel and disbursements) and other costs it incurred in that action or proceeding, in a ddition

to any other relief to which it may be entitled. The parties agree that act ual attorneys' fees shall

be based on the attorneys' fees actually incurred (based on the attorneys' customary hourly bi lling

rates) rather than the court or arbitrator making an independent inquiry concerning

reasonableness.29.EXHIBITS. All exhibits are incorporated in this Agreement by reference.

30. TITLE INSURANCE. TITLE INSURANCE SHALL BE REQUIRED IN ALL

TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT AND SHALL BE

PROVIDED BY FIRST AMERICAN TITLE INSURANCE COMPANY OR THEIR

UNDERWRITTEN AGENT.

31.NO TAX ADVICE. OWNER HAS RECEIVED THE ADVICE OF AN

INDEPENDENT TAX ADVISOR OF OWNER'S CHOOSING CONCERNING THIS

TRANSACTION AND ITS STATUS AS AN EXCHANGE PURSUANT TO INTERNAL

REVENUE CODE SECTION 1031 AND CORRESPONDING PROVISIONS OF STATE

INCOME TAX LAW AND AGREES TO OBTAIN THIS TAX ADVISOR'S SIGNATURE

INDICATING TAX ADVISOR'S REVIEW OF THIS TRANSACTION. OWNER FURTHER

UNDERSTANDS AND AGREES THAT NO EMPLOYEE, OFFICER, AGENT, OR

COUNSEL OF EITHER INTERMEDIARY OR FIRST AMERICAN TITLE INSURANCE

COMPANY HAS MADE OR MAY BE RELIED UPON AS MAKING ANY

REPRESENTATIONS OR RENDERED ANY ADVICE CONCERNING THIS

TRANSACTION OR ITS COMPLIANCE, IN WHOLE OR IN PART, WITH THE

REQUIREMENTS OF SECTION 1031 AS A TAX-DEFERRED EXCHANGE FOR FEDERAL

OR STATE INCOME TAX PURPOSES.

32.RISK OF LOSS. OWNER SHALL BEAR THE SOLE AND EXCLUSIVE

RISK OF WHETHER THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT

QUALIFY UNDER SECTION 1031 OF THE CODE, AND INTERMEDIARY AND ITS

EMPLOYEES, OFFICERS AND AGENTS SHALL HAVE NO RESPONSIBILITY OR

LIABILITY CONCERNING SUCH QUALIFICATIONS.

33.TAXPAYER IDENTIFICATION NUMBER. Owner(s) represent(s) that

his/its/their social security/taxpayer/employer identification number

is/are______________________.

34.FIRPTA EXEMPTION. Prior to Initial Closing Date, Owner shall provide

Intermediary with satisfactory evidence of exemption from withholding under the Foreign

Investment in Real Property Tax Act, and other federal or state laws concerning tax withholding.

Executed effective _______________________, 199__. INTERMEDIARY

FIRST EXCHANGE CORPORATION,

a California corporation

By: ____________________________

____________, President

By: _____________________________

____________, Vice President

OWNER____________________________________________________________________

I HAVE ADVISED OWNER AS

TO THE TAX RAMIFICATIONS

OF THIS TRANSACTION:

_____________________________ Dated: _________________

Name:

Tax Advisor for Owner

FEE SCHEDULE

Fee Schedule for First Exchange Corporation acting as a Qualified Intermediary in a deferred

exchange:

Set Up Fee $500

For each month, or portion thereof,

that we hold each $100,000, or portion

thereof $100

Rates apply to either cash or notes held in the name of First Exchange Corporation. In the event

of cancellation of the transaction prior to the completion of an intended first closi ng, there is a

minimum fee of $500.

NOTE 1: We must have at least five working days notice for processing and documentation or a

RUSH FEE of $500 will apply.

NOTE 2: Should the exchangor acquire more than Two Replacements Properties, there will be

an additional administrate fee of $200 for each additional property.

E X H I B I T " A "

Replacement Property Identification Form

Pursuant to a Real Property Exchange Agreement, dated ________________, 199___,

between me/us and First Exchange Corporation, I/we identify the following United States rea l

property (which I/we certify meets the requirements set forth in that Agreement) as Re placement

Property:

Replacement Property __________________________________________________

Address/Description __________________________________________________ ____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Conditions: ___________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

_____ PROPERTY WHICH YOU DESIGNATE

E X H I B I T " B "

SUBSTITUTION AGREEMENT AND NOTICE - RELINQUISHED PROPERTY

This Substitution Agreement and Notice - Relinquished Property ("Agreement") is

made by and between _____________________________________________________________

("Owner"), ____________________ )"Buyer"), and FIRST EXCHANGE CORPORATION, a

California corporation ("Intermediary"), with reference to the following:

A. Owner is presently the owner of certain real property located in the County of

____________________, State of ______________ commonly known as Assessor's Parcel #

____, located at ____________________, ______________ ("Relinquished Property").

B. Owner and Buyer have entered into an agreement ("Purchase Agreement") that

provides, among other things, for Buyer to purchase the Relinquished Property from Owner for

such purchase price ("Purchase Price") as may be agreed to in writing by Owner.

C. Owner desires to structure Owner's disposition of the Relinquished Property by

way of an Internal Revenue Code ("Code") Section 1031 exchange (an "Exchange Transaction").

D. Intermediary has agreed to act as a qualified intermediary to facilitate the

Exchange Transaction.

E. Buyer agrees to cooperate in the Exchange Transaction by permitting

Intermediary to be substituted as the seller of the Relinquished Property.

F. The parties desire that the transfer of Relinquished Property to Buyer shall be

accomplished by a single direct deed from Owner to Buyer.

NOW, THEREFORE, in consideration of the recitals above, and the other agreements

set forth in this Agreement, the parties agree to amend the Purchase Agreement as follows:

1.SUBSTITUTION. Intermediary shall be substituted for Owner as the seller of

the Relinquished Property.

2.ACCEPTANCE OF PERFORMANCE. Buyer agrees to accept the

Relinquished Property and all other required performance from Intermediary and to render it s

performance of all of its obligations under the Purchase Agreement (including the payment ofe d

to Buyer from Owner using the services of First American Title Insurance Company of their

underwritten agents.

E X H I B I T " C "

4. BREACH BY OWNER OR INTERMEDIARY. In the event of the breach of

any representations, warranties, obligations or undertakings by Owner or Intermediary in

connection with the Purchase Agreement or the acquisition of the Relinquished Property by

Buyer or in the event of any claim upon any indemnity of Owner or Intermediary in connect ion

with the Purchase Agreement or the acquisition of the Relinquished Property by Buyer (whether

the representation, warranty, indemnity, obligation or undertaking is express or implied), Buyer's

exclusive recourse shall be against the Owner, and Buyer shall have no recourse of any type

against the Intermediary arising from the Purchase Agreement or the transfer of the Relinquished

Property, except for Intermediary's breach of its agreement to transfer the Relinquished Propert y

to Buyer if Intermediary shall have acquired it.

5.BREACH BY BUYER. All of Buyer's representations, warranties, obligations

and undertakings (whether express or implied) shall be enforceable by Owner, as if made

directly to Owner, without the need to join Intermediary as an additional party in order to enforce

such representations, warranties, obligations or undertakings.

6.REPRESENTATIONS AND WARRANTIES. Owner shall be treated as

making directly to Buyer any representations or warranties concerning the condition of

Relinquished Property contained in the Purchase Agreement or otherwise implied at law.

7.HOLD HARMLESS. Buyer shall hold Intermediary harmless with respect to

any condition of Relinquished Property.

8.COUNTERPART EXECUTION. This Agreement may be executed in any

number of counterparts with the same effect as if al parties have signed the sam e document.

All counterparts shall be construed together and shall constitute one agreement.Executed effective __________________, 199__.

INTERMEDIAR______

Barbara Hester, Vice President

OWNER____________________________________________________________________

BUYER____________________________________________________________________

SUBSTITUTION AGREEMENT AND NOTICE - REPLACEMENT PROPERTY

This Substitution Agreement and Notice - Replacement Property ("Agreement") is

made by and between ____________________ ("Owner"), _______________________

("Seller"), and FIRST EXCHANGE CORPORATION, a California corporation

("Intermediary"), with reference to the following:

A. Seller is presently the owner of certain real property located in the County of

______________, State of ______________, commonly known as Assessor's Parcel # ____,

located at ___________________, __________________ ("Replacement Property").

B. Owner and Seller have entered into an agreement ("Purchase Agreement") that

provides, among other things, for Owner to purchase the Replacement Property from Seller for

the purchase price of $__________________ ("Purchase Price"), payable at closing.

C. Seller acknowledged that Owner is including this Property in a deferred

exchanges transactions and agrees to cooperate in the exchange transaction by permitt ing

Intermediary to be substituted as the buyer of the Replacement Property.

D. The parties desire that the transfer of Replacement Property to Owner shall be

accomplished by a single direct deed from Seller to Owner.

NOW, THEREFORE, in consideration of the recitals above, and the other agreements

set forth in this Agreement, the parties agree to amend the Purchase Agreement as follows:

1.SUBSTITUTION. Intermediary shall be substituted for Owner as the purchase

of the Replacement Property.

2.ACCEPTANCE OF PERFORMANCE. Seller agrees to accept the Purchase

Price and all other required performance from Intermediary and shall transfer the Replace ment

Property at closing to Intermediary or its nominee.

3.TITLE TO THE REPLACEMENT PROPERTY. At closing, the Intermediary

shall cause all rights of ownership, including title, to Replacement Property to be di rectly

conveyed to Owner using the services of First American Title Insurance Company or their

underwritten agrmediary in connection with the Purchase Agreement or the acquisition of the

Replacement Property by Owner or in the event of any claim upon any indemnity of Owner or

Intermediary in connection with the Purchase Agreement or the acquisition of the

E X H I B I T " D "

Replacement Property by Owner (whether the representation, warranty, indemnity, obligation or

undertaking is express or implied), Seller's exclusive recourse shall be against the Owner, and

Seller shall have no recourse of any type against the Intermediary arising from the Purchase

Agreement or the transfer of the Replacement Property, except for Intermediary's breach of its

agreement to transfer the Replacement Property if it shall have acquired it.

5.BREACH BY SELLER. All of Seller's representations, warranties, obligations

and undertakings (whether express or implied) shall be enforceable by Owner, as if made

directly to Owner, without the need to join Intermediary as an additional party in order to enforce

such representations, warranties, obligations or undertakings.

6.HOLD HARMLESS. Seller shall hold Intermediary harmless with respect to

any condition of Replacement Property existing at the time of closing.

7.REPRESENTATIONS AND WARRANTIES. Seller shall be treated as

making directly to Owner any representations or warranties concerning the condition of

Replacement Property contained int he Purchase Agreement or otherwise implied at law.

8.TAX WITHHOLDING. Prior to closing, Seller shall provide Intermediary with

satisfactory evidence of exemption from withholding under the Foreign Investment in Real

Property Tax Act, and other federal or state laws concerning tax withholding.

9.COUNTERPART EXECUTION. This Agreement may be executed in any

number of counterparts with the same effect as if all parties have signed the sam e

document. All counterparts shall be construed together and shall constitute one agreement.Executed effective __________________, 199__.

INTERMEDIARY

FIRST EXCHANGE CORPORATION,

a Califo______________

SELLER____________________________________________________________________

CLOSING PROTECTION GUARANTEE

First American Title Insurance Company

(Date)

To: (Exchangor) Re: Exchange Closing Protection Guarantee

Dear ___________________: First American Title Insurance Company, a California corporation, hereinafter called

"First American" and First Exchange Corporation, a California corporation, hereinafter call ed

"Exchange Corp" have agreed to cooperate in an effort to allow parties interested in participating

in a delayed exchange the opportunity to consummate their transactions, preserve the procee ds of

the sale and, consistent with the instructions of all necessary parties, see to the proper disposition

of funds, documents and properties.

The following assurances shall apply subject to the conditions and exceptions hereinafter

stated:

A. When Exchange Corp is specified as an intermediary in connection with a delayed

exchange of real estate and First American issues all policies of title insura nce on the exchanged

properties, it is intended that First American, either directly or through one of its affiliated

companies, will direct the placement of funds resulting from the sale of the property de scribed in

Exhibit "A" attached hereto and incorporated herein. In such event First American exte nds its

indemnification to you, as the exchangor, that once proceeds of the sale are placed at the

direction of First American, that First American shall assure their safe keeping and t imely

availability to consummate the terms of an intended exchange or other authorized pe rmitted

distribution.

B. First American does not, however, guarantee the availability of funds placed with

any financial institution selected by the exchangor that is outside the control of Fi rst American

including, but no limited to, loss or impairment of such proceeds while on deposit with a bank or

other similar institution due to the institution's failure, insolvency or suspension, except as shall

result from First American or Exchange Corp's failure to comply with your written instructions

to drse you for the actual loss incurred in connection with the real estate transac tion settlement

and exchange services when such loss arises from the fraud or dishonesty of the Exchange Corp

in handling funds or documents in connection with the such exchange services.

T E R M S A N D C O N D I T I O N S

1. When First American shall have reimbursed you pursuant to this letter, it shall be

subrogated to all rights and remedies which you would have had against any person or property

had you not been so reimburse. Liability of First American for such reimbursement shall be

reduced to the extent that you have knowingly and voluntarily impaired the value of such ri ght or

subrogation.

2. Any liability of First American for losses incurred by you in connection with

closing of real estate transaction by Exchange Corp shall be limited to the prote ction provided by

this letter. However, this letter shall not affect the protection afforded or contrac t rights of

escrow instructions, a title insurance binder, commitment or policy of First American.

3. Claims shall be made promptly to First American at its principal office at 114

East Fifth Street, Santa Ana, California 92701. When the failure to give prompt notice shall

prejudice First American, then the liability of First American hereunder shall be re duced to the

extent of such prejudice.

The protection herein offered will be effective upon receipt by First American of your

acceptance in writing which may be made on the enclosed copy hereof.

FIRST AMERICAN TITLE INSURANCE COMPANY

SAMPLE ONLY

______________________________________ (Vice President)

Accepted: _____________________, 199__ SAMPLE ONLY

______________________________________