207F ESA - First Installment

Estimated Insurance Premiums Tax Payment Coupon

Foreign and Nonresident Insurance Companies

(Rev. 5/05)

CT Insurance Premiums Tax Reg. No.

X

Date Received (DRS USE ONLY)

X

Federal Employer ID Number

X

1

Enter 30% (.30) of the tax shown on 2004 Form 207F, Line 15

1

2

Enter amount from Schedule 1, Line 5 (on back)

2

3

Enter the lesser of Line 1 or Line 2

3

4

Enter overpayment from prior year applied to estimated tax for current year

4

5

Payment due with this coupon (Subtract Line 4 from Line 3)

X 5

Please change

name or

mailing

address, or

both,

if shown

incorrectly

at right

Due Date:

Estimated Insurance Premiums Tax Payment Coupon

Foreign and Nonresident Insurance Companies

(Rev. 5/05)

CT Insurance Premiums Tax Reg. No.

Date Received (DRS USE ONLY)

X

Federal Employer ID Number

Enter 60% (.60) of the tax shown on 2004 Form 207F, Line 15

1

2

Enter amount from Schedule 1, Line 5 (on back)

2

3

Enter the lesser of Line 1 or Line 2

3

4

Enter amount paid with Form 207F ESA plus overpayment from prior year

applied to estimated tax for current year

4

5

Payment due with this coupon (Subtract Line 4 from Line 3)

Please change

name or

mailing

address, or

both,

if shown

incorrectly

at right

X

Federal Employer ID Number

Department of Revenue Services

State of Connecticut

PO Box 2990 Hartford CT 06104-2990

1

2

Enter amount from Schedule 1, Line 5 (on back)

2

3

Enter the lesser of Line 1 or Line 2

3

4

Enter amount paid with Forms 207F ESA and 207F ESB plus overpayment

from prior year applied to estimated tax for current year

4

Payment due with this coupon (Subtract Line 4 from Line 3)

Please change

name or

mailing

address, or

both,

if shown

incorrectly

at right

Federal Employer ID Number

Department of Revenue Services

State of Connecticut

PO Box 2990 Hartford CT 06104-2990

Organized Under Laws of

For Calendar Year Ending

1

Enter the tax shown on 2004 Form 207F, Line 15

1

2

Enter amount from Schedule 1, Line 5 (on back)

2

3

Enter the lesser of Line 1 or Line 2

3

4

Enter amount paid with Forms 207F ESA, 207F ESB, and 207F ESC plus

overpayment from prior year applied to estimated tax for current year

4

X

5

Please change

name or

mailing

address, or

both,

if shown

incorrectly

at right

September 15

Make Checks Payable To:

Commissioner of Revenue Services

Mail To:

Department of Revenue Services

Processing Section

PO Box 2990

Hartford CT 06104-2990

(Rev. 5/05)

X

X 5

Due Date:

207F ESD - Fourth Installment

Estimated Insurance Premiums Tax Payment Coupon

Foreign and Nonresident Insurance Companies

Date Received (DRS USE ONLY)

Organized Under Laws of

________________

For Calendar Year Ending

Enter 80% (.80) of the tax shown on 2004 Form 207F, Line 15

5

CT Insurance Premiums Tax Reg. No.

June 15

1

X

X

5

Make Checks Payable To:

Commissioner of Revenue Services

Mail To:

Department of Revenue Services

Processing Section

PO Box 2990

Hartford CT 06104-2990

(Rev. 5/05)

Date Received (DRS USE ONLY)

X

Due Date:

207F ESC - Third Installment

Estimated Insurance Premiums Tax Payment Coupon

Foreign and Nonresident Insurance Companies

X

________________

Organized Under Laws of

For Calendar Year Ending

Department of Revenue Services

State of Connecticut

PO Box 2990 Hartford CT 06104-2990

1

X

CT Insurance Premiums Tax Reg. No.

March 15

Make Checks Payable To:

Commissioner of Revenue Services

Mail To:

Department of Revenue Services

Processing Section

PO Box 2990

Hartford CT 06104-2990

207F ESB - Second Installment

X

Organized Under Laws of

________________

For Calendar Year Ending

Department of Revenue Services

State of Connecticut

PO Box 2990 Hartford CT 06104-2990

_____________

X 5

Payment due with this coupon (Subtract Line 4 from Line 3)

Due Date:

December 15

Make Checks Payable To:

Commissioner of Revenue Services

Mail To:

Department of Revenue Services

Processing Section

PO Box 2990

Hartford CT 06104-2990

�Who Must File This Coupon

Each foreign or nonresident insurance company carrying on an insurance

business in Connecticut whose insurance premiums tax, after the application

of guaranty association assessment credits, Insurance Department

assessment credit (if applicable), and general business tax credits (as defined

in Special Notice 2003(17), 2003 Legislation Affecting the Insurance

Premiums Tax), for calendar year 2005 will be $1,000 or more must file this

coupon.

Required Annual Payment

For estimated insurance premiums tax purposes, a foreign or nonresident

insurance company’s required annual payment is the lesser of:

•

90% (.90) of the tax that will be shown on its 2005 Form 207F (after the

application of guaranty association assessment credits, the Insurance

Department assessment credit (if applicable), and general business tax

credits); or

• 100% of the tax shown on your 2004 Form 207F, Line 15.

Interest

If the payment due with this coupon is not made on or before the due date of

this coupon, interest will accrue at the rate of 1% (.01) per month, or fraction

of a month, on the amount not paid from the due date of this coupon until the

date of payment.

Schedule 1

1 Enter estimated insurance premiums tax due for calendar year 2005 prior to the application of guaranty association

assessment credits, Insurance Department assessment credit (if applicable), and general business tax credits.

00

2 Multiply Line 1 by 70% (.70)

00

3 Enter estimated Insurance Department assessment credit (if applicable), and general business tax credits against

insurance premiums tax due for calendar year 2005. (May not exceed amount entered on Line 2)

00

4 Subtract Line 3 from Line 1

00

5 Multiply Line 4 by 27% (.27)

00

207F ESA Back (Rev. 5/05)

Who Must File This Coupon

Each foreign or nonresident insurance company carrying on an insurance

business in Connecticut whose insurance premiums tax, after the application

of guaranty association assessment credits, Insurance Department

assessment credit (if applicable), and general business tax credits (as defined

in Special Notice 2003(17), 2003 Legislation Affecting the Insurance

Premiums Tax), for calendar year 2005 will be $1,000 or more must file this

coupon.

Required Annual Payment

For estimated insurance premiums tax purposes, a foreign or nonresident

insurance company’s required annual payment is the lesser of:

•

90% (.90) of the tax that will be shown on its 2005 Form 207F (after the

application of guaranty association assessment credits, the Insurance

Department assessment credit (if applicable), and general business tax

credits); or

•

100% of the tax shown on your 2004 Form 207F, Line 15.

Interest

If the payment due with this coupon is not made on or before the due date of

this coupon, interest will accrue at the rate of 1% (.01) per month, or fraction

of a month, on the amount not paid from the due date of this coupon until the

date of payment.

Schedule 1

1 Enter estimated insurance premiums tax due for calendar year 2005 prior to the application of guaranty association

assessment credits, Insurance Department assessment credit (if applicable), and general business tax credits.

00

2 Multiply Line 1 by 70% (.70)

00

3 Enter estimated Insurance Department assessment credit (if applicable), and general business tax credits against

insurance premiums tax due for calendar year 2005. (May not exceed amount entered on Line 2)

00

4 Subtract Line 3 from Line 1

00

5 Multiply Line 4 by 54% (.54)

00

207F ESB Back (Rev. 5/05)

Who Must File This Coupon

Each foreign or nonresident insurance company carrying on an insurance

business in Connecticut whose insurance premiums tax, after the application

of guaranty association assessment credits, Insurance Department

assessment credit (if applicable), and general business tax credits (as defined

in Special Notice 2003(17), 2003 Legislation Affecting the Insurance

Premiums Tax), for calendar year 2005 will be $1,000 or more must file this

coupon.

Required Annual Payment

For estimated insurance premiums tax purposes, a foreign or nonresident

insurance company’s required annual payment is the lesser of:

•

90% (.90) of the tax that will be shown on its 2005 Form 207F (after the

application of guaranty association assessment credits, the Insurance

Department assessment credit (if applicable), and general business tax

credits); or

• 100% of the tax shown on your 2004 Form 207F, Line 15.

Interest

If the payment due with this coupon is not made on or before the due date of

this coupon, interest will accrue at the rate of 1% (.01) per month, or fraction

of a month, on the amount not paid from the due date of this coupon until the

date of payment.

Schedule 1

1 Enter estimated insurance premiums tax due for calendar year 2005 prior to the application of guaranty association

assessment credits, Insurance Department assessment credit (if applicable), and general business tax credits.

00

2 Multiply Line 1 by 70% (.70)

00

3 Enter estimated Insurance Department assessment credit (if applicable), and general business tax credits against

insurance premiums tax due for calendar year 2005. (May not exceed amount entered on Line 2)

00

4 Subtract Line 3 from Line 1

00

5 Multiply Line 4 by 72% (.72)

00

207F ESC Back (Rev. 5/05)

Who Must File This Coupon

Each foreign or nonresident insurance company carrying on an insurance

business in Connecticut whose insurance premiums tax, after the application

of guaranty association assessment credits, Insurance Department

assessment credit (if applicable), and general business tax credits (as defined

in Special Notice 2003(17), 2003 Legislation Affecting the Insurance

Premiums Tax), for calendar year 2005 will be $1,000 or more must file this

coupon.

Required Annual Payment

For estimated insurance premiums tax purposes, a foreign or nonresident

insurance company’s required annual payment is the lesser of:

•

90% (.90) of the tax that will be shown on its 2005 Form 207F (after the

application of guaranty association assessment credits, the Insurance

Department assessment credit (if applicable), and general business tax

credits); or

• 100% of the tax shown on your 2004 Form 207F, Line 15.

Interest

If the payment due with this coupon is not made on or before the due date of

this coupon, interest will accrue at the rate of 1% (.01) per month, or fraction

of a month, on the amount not paid from the due date of this coupon until the

date of payment.

Schedule 1

1 Enter estimated insurance premiums tax due for calendar year 2005 prior to the application of guaranty association

assessment credits, Insurance Department assessment credit (if applicable), and general business tax credits.

00

2 Multiply Line 1 by 70% (.70)

00

3 Enter estimated Insurance Department assessment credit (if applicable), and general business tax credits against

insurance premiums tax due for calendar year 2005. (May not exceed amount entered on Line 2)

00

4 Subtract Line 3 from Line 1

00

5 Multiply Line 4 by 90% (.90)

00

207F ESD Back (Rev. 5/05)

�

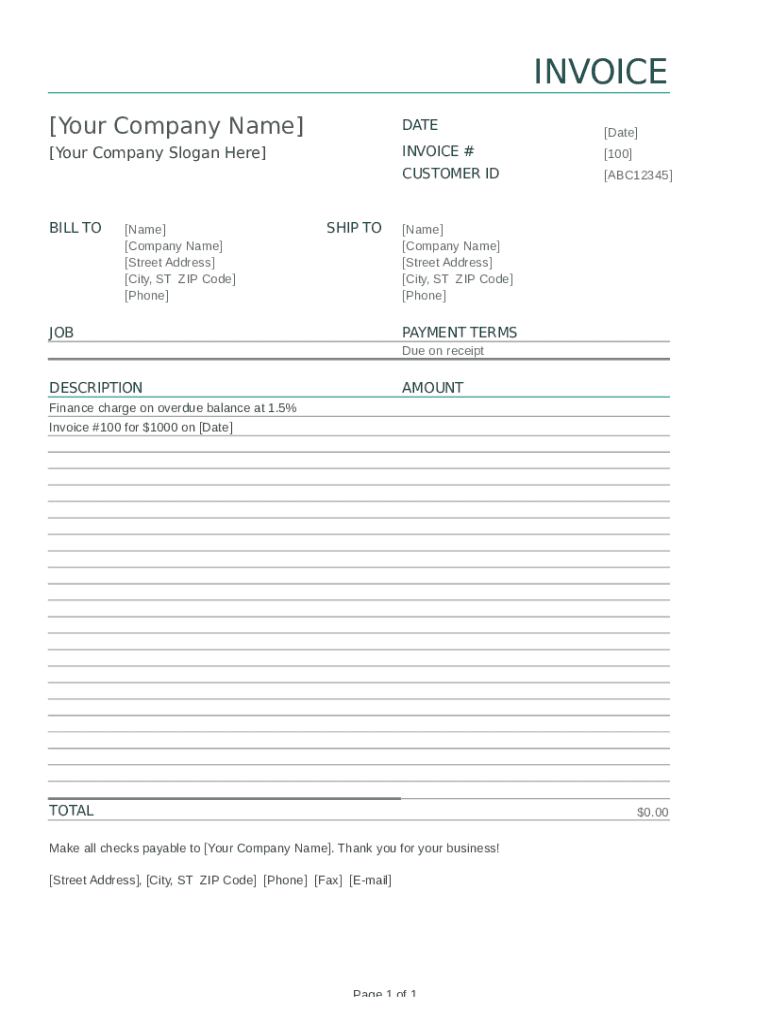

Practical suggestions for preparing your ‘Finance Invoice Editing Template’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and enterprises. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly fill out and sign documents online. Utilize the robust features embedded in this user-friendly and affordable platform and transform your approach to document management. Whether you need to approve forms or gather signatures, airSlate SignNow manages everything seamlessly, requiring only a few clicks.

Follow this comprehensive guide:

- Log into your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud, or our template collection.

- Open your ‘Finance Invoice Editing Template’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your side.

- Add and designate fillable fields for others (if required).

- Proceed with the Send Invite options to request eSignatures from others.

- Download, print your copy, or convert it into a multi-use template.

Don’t worry if you need to collaborate with others on your Finance Invoice Editing Template or send it for notarization—our solution has everything you need to achieve these tasks. Register with airSlate SignNow today and elevate your document management to new heights!