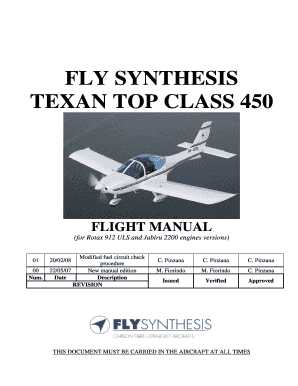

Fill and Sign the Flysynthesis Form

Useful tips for finishing your ‘Flysynthesis’ online

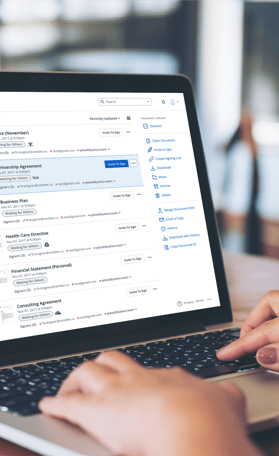

Are you fed up with the trouble of handling paperwork? Look no further than airSlate SignNow, the top electronic signature solution for individuals and businesses. Bid farewell to the tedious task of printing and scanning documents. With airSlate SignNow, you can effortlessly fill out and sign documents online. Utilize the powerful features included in this user-friendly and affordable platform and transform your approach to paperwork management. Whether you need to sign forms or collect eSignatures, airSlate SignNow takes care of everything seamlessly, needing just a few clicks.

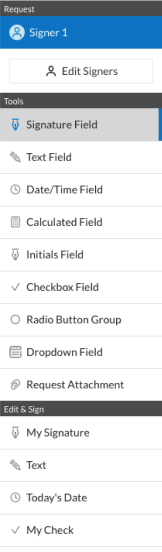

Follow this comprehensive guide:

- Log into your account or sign up for a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘Flysynthesis’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your side.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you require collaboration with others on your Flysynthesis or send it for notarization—our platform provides everything necessary to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is Flysynthesis and how does it work with airSlate SignNow?

Flysynthesis is an innovative feature within airSlate SignNow that enhances document management and eSigning processes. By leveraging Flysynthesis, businesses can streamline their workflows, ensuring that documents are sent, signed, and stored efficiently. This user-friendly tool integrates seamlessly with your existing systems for optimal performance.

-

How does Flysynthesis improve my document workflow?

Flysynthesis automates key aspects of your document workflow, reducing time spent on manual tasks. With features like auto-fill and reminders, Flysynthesis helps ensure that your documents are completed accurately and on time. This efficiency ultimately leads to faster turnaround times and improved productivity.

-

What are the pricing options for Flysynthesis on airSlate SignNow?

airSlate SignNow offers competitive pricing for its Flysynthesis feature, making it accessible for businesses of all sizes. Customers can choose from various subscription plans that cater to their specific needs, ensuring that they get the best value for their investment in document management. For detailed pricing information, visit the airSlate SignNow website.

-

Can I integrate Flysynthesis with other applications?

Yes, Flysynthesis offers robust integration capabilities with a wide range of applications and services. This means you can connect your existing tools such as CRMs, project management software, and more to streamline your document processes. Integrating Flysynthesis allows for a seamless flow of information across platforms.

-

What benefits does Flysynthesis provide for remote teams?

Flysynthesis is particularly beneficial for remote teams, as it enables easy collaboration and document sharing regardless of location. With features like real-time notifications and secure eSigning, Flysynthesis ensures that all team members can participate in the document workflow efficiently. This enhances communication and collaboration, leading to better outcomes.

-

Is Flysynthesis secure for handling sensitive documents?

Absolutely, Flysynthesis prioritizes security, employing advanced encryption and compliance standards to protect your documents. With airSlate SignNow, you can trust that your sensitive information is safeguarded against unauthorized access. This commitment to security makes Flysynthesis a reliable choice for businesses handling confidential data.

-

How user-friendly is the Flysynthesis feature in airSlate SignNow?

Flysynthesis is designed with user experience in mind, offering an intuitive interface that simplifies document management. Users can easily navigate the platform, making it accessible even for those who are not tech-savvy. The straightforward design of Flysynthesis helps ensure a smooth onboarding experience for all users.

Related searches to flysynthesis form

Find out other flysynthesis form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles