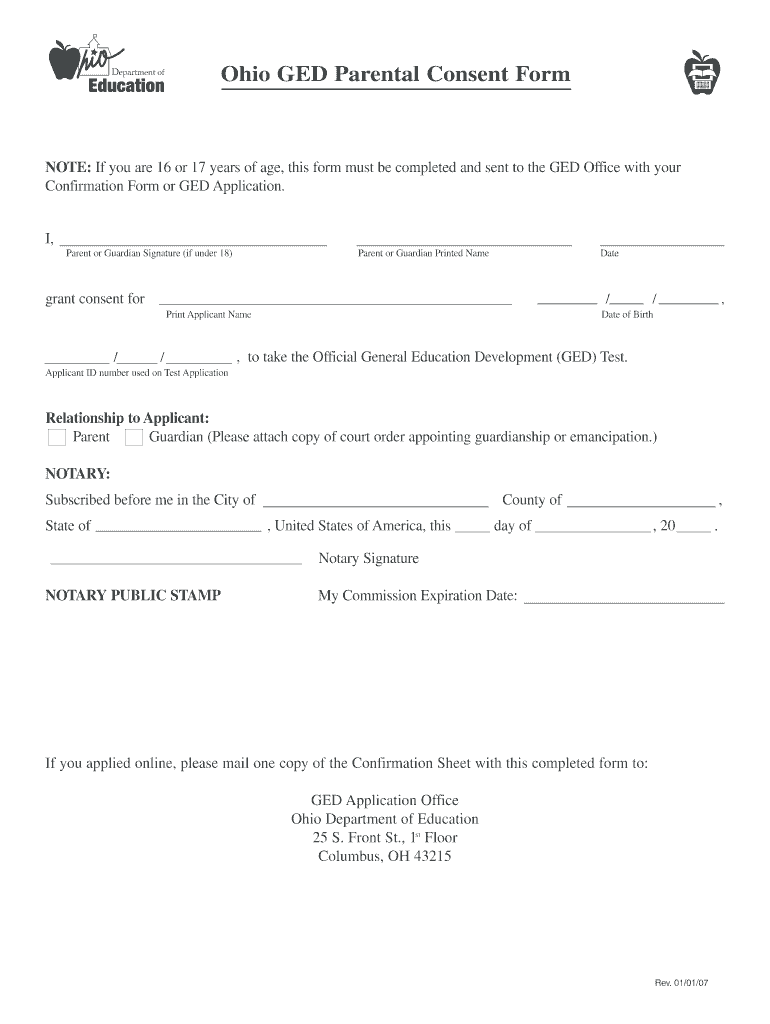

Fill and Sign the Ged Consent Form Ohio

Valuable tips for finalizing your ‘Ged Consent Form Ohio’ online

Are you fed up with the struggle of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature tool for individuals and companies. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Leverage the powerful features included in this user-friendly and cost-effective platform and transform your method of document handling. Whether you need to approve forms or gather eSignatures, airSlate SignNow manages it all smoothly, with just a few clicks.

Follow this detailed guide:

- Sign in to your account or initiate a free trial with our platform.

- Hit +Create to upload a file from your device, cloud, or our form repository.

- Open your ‘Ged Consent Form Ohio’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a template for future use.

Don’t be concerned if you need to collaborate with your coworkers on your Ged Consent Form Ohio or send it for notarization—our service provides everything you require to accomplish such tasks. Sign up with airSlate SignNow today and take your document management to the next level!

FAQs

-

What is an Ohio Parental Consent Form?

An Ohio Parental Consent Form is a legal document that allows parents or guardians to give permission for their child to participate in specific activities, such as medical treatment or school events. With airSlate SignNow, you can create and customize your Ohio Parental Consent Form quickly, ensuring all necessary permissions are obtained in a streamlined manner.

-

How can airSlate SignNow help with Ohio Parental Consent Forms?

airSlate SignNow simplifies the process of creating, sending, and eSigning Ohio Parental Consent Forms. Our platform offers templates and easy customization options, allowing you to tailor the form to meet your specific needs while ensuring compliance with Ohio regulations.

-

Is airSlate SignNow cost-effective for managing Ohio Parental Consent Forms?

Yes, airSlate SignNow provides a cost-effective solution for managing Ohio Parental Consent Forms. Our pricing plans are designed to cater to businesses of all sizes, offering flexibility and value while ensuring that you can efficiently handle document signing without breaking the bank.

-

What features does airSlate SignNow offer for Ohio Parental Consent Forms?

airSlate SignNow includes features like customizable templates, secure eSigning, and document tracking for Ohio Parental Consent Forms. Additionally, our platform allows for easy integration with other tools, ensuring a seamless workflow for your document management needs.

-

Can I integrate airSlate SignNow with other software for Ohio Parental Consent Forms?

Absolutely! airSlate SignNow offers integrations with various software solutions, making it easy to manage your Ohio Parental Consent Forms alongside other applications. This capability enhances productivity and ensures that your documentation process is smooth and efficient.

-

What are the benefits of using airSlate SignNow for Ohio Parental Consent Forms?

Using airSlate SignNow for Ohio Parental Consent Forms offers numerous benefits, including time savings, increased accuracy, and enhanced security. With our platform, you can easily track the status of your forms and ensure that all necessary approvals are secured in a timely manner.

-

How secure are Ohio Parental Consent Forms signed through airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform for Ohio Parental Consent Forms, your documents are protected with advanced encryption and secure access controls, ensuring that sensitive information remains confidential and compliant with legal standards.

Find out other ged consent form ohio

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles