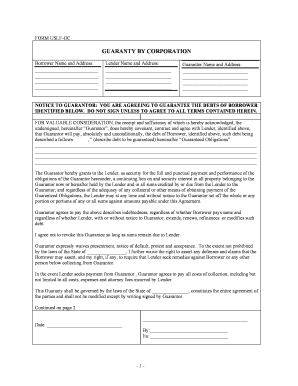

- 1 - FORM USLF-GC GUARANTY BY CORPORATION Borrower Name and Address:__________________________ __________________________ __________________________ __________________________Lender Name and Address:___________________________ ___________________________ ___________________________ ___________________________ Guarantor Name and Address:___________________________ ___________________________ ___________________________ ___________________________ NOTICE TO GUARANTOR: YOU ARE AGREEING TO GUARANTEE THE DEBTS OF BORROWER

IDENTIFIED BELOW. DO NOT SIGN UNLESS TO AGREE TO ALL TERMS CONTAINED HEREIN.FOR VALUABLE CONSIDERATION, the receipt and sufficiency of which is hereby acknowledged, the

undersigned, hereinafter “Guarantor”, does hereby covenant, contract and agree with Lender, identified above,

that Guarantor will pay, absolutely and unconditionally, the debt of Borrower, identified above, such debt being

described a follows: , ” (describe debt to be guaranteed) hereinafter “Guaranteed Obligations”

___________________________________________________________________________________________ ___________________________________________________________________________________________ ___________________________________________________________________________________________ ___________________________________________________________________________________________ The Guarantor hereby grants to the Lender, as security for the full and punctual payment and performance of the

obligations of the Guarantor hereunder, a continuing lien on and security interest in all property belonging to the

Guarantor now or hereafter held by the Lender and in all sums credited by or due from the Lender to the

Guarantor; and regardless of the adequacy of any collateral or other means of obtaining payment of the

Guaranteed Obligations, the Lender may at any time and without notice to the Guarantor set off the whole or any

portion or portions of any or all sums against amounts payable under this Agreement.Guarantor agrees to pay the above describes indebtedness, regardless of whether Borrower pays same and

regardless of whether Lender, with or without notice to Guarantor, extends, renews, refinances or modifies such

debt.I agree not to revoke this Guarantee so long as sums remain due to Lender. Guarantor expressly waives presentment, notice of default, protest and acceptance. To the extent not prohibited

by the laws of the State of ________________, I further waive the right to assert any defenses and claims that the

Borrower may assert, and my right, if any, to require that Lender seek remedies against Borrower or any other

person below collecting from Guarantor.In the event Lender seeks payment from Guarantor , Guarantor agrees to pay all costs of collection, including but

not limited to all costs, expenses and attorney fees incurred by Lender.This Guaranty shall be governed by the laws of the State of _______________; constitutes the entire agreement of

the parties and shall not be modified except by writing signed by Guarantor. Continued on page 2Date: __________________________________________________________________________By:________________________________Its: ________________________________

- 2 - Additional Provisions1.Unenforceability of Guaranteed Obligations:. If the Borrower is for any reason under no legal obligation

to discharge any of the Guaranteed Obligations, or if any other moneys included in the Guaranteed Obligations have

become unrecoverable from the Borrower by operation of law or for any other reason, including, without limitation,

the invalidity or irregularity in whole or in part of any Guaranteed Obligation or any Loan Document or any

limitation on the liability of the Borrower thereunder or any limitation on the method or terms of payment

thereunder which may now or hereafter be caused or imposed in any manner whatsoever, the guarantees contained

in this Agreement shall nevertheless remain in full force and effect and shall be binding upon the Guarantor to the

same extent as if the Guarantor at all times had been the Principal debtor on all such Guaranteed Obligations.2.Consents and Waivers. Etc: The Guarantor hereby acknowledges receipt of correct and complete copies

of each of the Loan Documents, consents to all of the terms and provisions thereof, as the same may be from time to

time hereafter amended or changed in accordance therewith, and waives (a) presentment, demand for payment and

protest of nonpayment of any principal of or interest on any of the Guaranteed Obligations, (b) notice of acceptance

of this Agreement and of diligence, presentment, demand and protest, (c) notice of any default hereunder and any

default, breach, nonperformance or Event of Default (as defined therein) under any of the Loan Documents or the

Guaranteed Obligations, (d) notice of the terms, time and place of any private or public sale of collateral held as

security for the Guaranteed Obligations, (e) demand for performance or observance of, and any enforcement of any

provision of, or any pursuit or exhaustion of rights or remedies against the Borrower or any other guarantor of the

Guaranteed Obligations, under or pursuant to the Loan Documents, or any agreement directly or indirectly relating

thereto and any requirements of diligence or promptness on the part of the holders of the Guaranteed Obligations in

connection therewith, and (f) to the extent the Guarantor lawfully may do so, any and all demands and notices of

every kind and description with respect to the foregoing or which may be required to be given by any statute or rule

of law and any defense of any kind which the Guarantor now or thereafter have with respect to this Agreement, any

of the Loan Documents or any of the Guaranteed Obligations.3.No Impairment. Etc: The obligations, covenants, agreements and duties of the Guarantor under this

Agreement shall not be affected or impaired by (a) any assignment or transfer in whole or in part of any of the

Guaranteed Obligations without notice to the Guarantor, or (b) any waiver by the Lender or any holder of any of the

Guaranteed Obligations or by the holders of all of the Guaranteed Obligations of the performance or observance by

the Borrower or any other guarantor of any of the agreements, covenants, terms or conditions contained in the

Guaranteed Obligations or the Loan Documents, or (c) any indulgence in, or the extension of the time for, payment

by the Borrower or any other guarantor of any amounts payable under or in connection with the Guaranteed

Obligations or the Loan Documents or in any other instrument or agreement relating to the Guaranteed Obligations

or of the extension of time for performance by the Borrower or any other guarantor of any other obligations under or

arising out of any of the foregoing or the extension or renewal thereof, or (d) the modification or amendment

(whether material or otherwise) of any duty, agreement or obligation of the Borrower or any other guarantor set

forth in any of the foregoing, or (e) the voluntary or involuntary sale or other disposition of all or substantially all

the assets of the Borrower or of any other guarantor, or (f) the insolvency, bankruptcy or other similar proceedings

affecting the Borrower or any such other guarantor or any assets of the Borrower or any such other guarantor, or (g)

the release or discharge of any of the collateral securing the repayment of the Guaranteed Obligations or securing

any other amounts payable under or in connection with the Guaranteed Obligations or the Loan Documents, or of

the Borrower or any other guarantor from the performance or observance of any agreement, covenant, term or

condition contained in any of the foregoing, without the consent of the holders of the Guaranteed Obligations by

operation of law, or any other cause, whether similar or dissimilar to the foregoing.4. Reimbursement or Subrogation: The Guarantor hereby covenants and agrees that the Guarantor will not

enforce or otherwise exercise any rights of reimbursement, subrogation, contribution or other similar rights against

the Borrower or any other person with respect to the Guaranteed Obligations prior to the payment in full of the

Guaranteed Obligations, and until all indebtedness to the Lender shall have been paid in full, the Guarantor shall

have no right of subrogation, and the Guarantor waives any defense the Guarantor may have based upon any

election of remedies by the Lender which destroys the Guarantor's subrogation rights or the Guarantor's rights to

proceed against the Borrower for reimbursement, including, without limitation, any loss of rights the Guarantor may

suffer by reason of any rights, powers or remedies of the Borrower in connection with any anti-deficiency laws or

- 3 - any other laws limiting, qualifing or discharging the indebtedness to the Lender. The Guarantor further waives any

right to enforce any remedy which the Lender now has or may in the future have against the Borrower, any other

guarantor or any other person and any benefit of, or any right to participate in, any security whatsoever now or in the

future held by the Lender. Notwithstanding anything to the contrary in this Agreement, the Guarantor hereby

irrevocably waives all rights which the Guarantor may have at law or in equity (including, without limitation, any

law subrogating the Guarantor to the rights of the Lender) to seek contribution, indemnification or any other form of

reimbursement from the Borrower, any other guarantor of the Guaranteed Obligations, or any other person now or

hereafter primarily or secondarily liable for any obligations of the Borrower to the Lender, for disbursement,

payment or other transfer, directly or indirectly, made by the Guarantor or of an interest in property of the Guarantor

(including foreclosure of liens) under or in connection with this Agreement or otherwise.5.Guarantor's Understanding with Respect to Waivers: The Guarantor warrantsand agrees that each of the waivers set forth above is made with the Guarantor's full knowledge of their significance

and consequences and that, under the circumstances, the waivers are reasonable and not contrary to public policy or

law. If any such waiver is determined to be contrary to any applicable law or public policy, such waiver shall be

effective only the extent permitted by law.6.Defeasance: This Agreement shall terminate at such time as the Commitment has terminated and all of]

the Guaranteed Obligations have been paid in full and all other obligations of the Guarantor to the Lender under this

Agreement have been satisfied in full; provided, however, that, notwithstanding anything to the contrary contained

in this Agreement, all the provisions of this Agreement and the other Loan Documents shall continue to be effective

or shall be reinstated, as the case may be, if any payment hereunder or in connection with any of the Guaranteed

Obligations or the Loan Documents at any time made by or on behalf of the Guarantor or the Borrower is rescinded

or otherwise must be returned as a result of the bankruptcy, insolvency or reorganization of the Guarantor or the

Borrower or otherwise, all as if such payment had not been made.7.Corporate Representations: The Guarantor represents, warrants, covenants and agrees that this Guaranty

is valid and executed on behalf of the corporation after being authorized by the corporation so to do. The Guarantor

shall do or cause to be done all things necessary to preserve and keep in full force and effect the Guarantor's

corporate existence; provided, however, that nothing in this Section shall prevent a consolidation, combination or

merger of the Guarantor with any other person.