Articles of Incorporation – Page 1 State of Nebraska

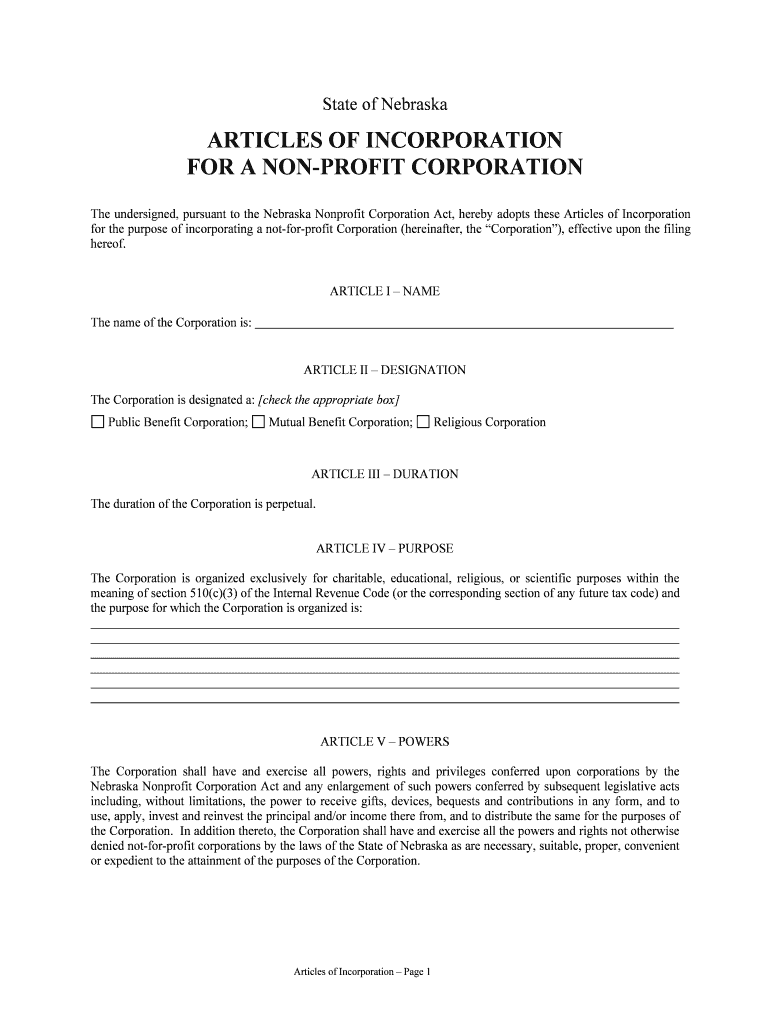

ARTICLES OF INCORPORATION

FOR A NON-PROFIT CORPORATION

The undersigned, pursuant to the Nebraska Nonprofit Corpor ation Act, hereby adopts these Articles of Incorporation

for the purpose of incorporating a not-for-profit Corporation (hereinafter, the “Corporation”), effective upon the filing

hereof.

ARTICLE I – NAME

The name of the Corporation is:

ARTICLE II – DESIGNATION

The Corporation is designated a: [check the appropriate box]

Public Benefit Corporation; Mutual Benefit Corporation; Religious Corporation

ARTICLE III – DURATION

The duration of the Corporation is perpetual.

ARTICLE IV – PURPOSE

The Corporation is organized exclusively for charitable, e ducational, religious, or scientific purposes within the

meaning of section 510(c)(3) of the Internal Revenue Code (or the corresponding section of any fut ure tax code) and

the purpose for which the Corporation is organized is:

ARTICLE V – POWERS

The Corporation shall have and exercise all powers, rights and privileges conferred upon corporations by the

Nebraska Nonprofit Corporation Act and any enlargement of such powers conferred by subsequent legislative acts

including, without limitations, the power to receive gifts, devices, bequests and contributions in any form, and to

use, apply, invest and reinvest the principal and/or income there from, and to distribute the same for th e purposes of

the Corporation. In addition thereto, the Corporation sha ll have and exercise all the powers and rights not otherwise

denied not-for-profit corporations by the laws of the State of Nebraska as are necessary, suitable, proper, convenient

or expedient to the attainment of the purposes of the Corporation.

Articles of Incorporation – Page 2

ARTICLE VI – LIMITATIONS

A. No part of the net earnings of the Corporation shall inure to the benefit of, or be dist ributable to, any

Executive Board member of the Corpora tion, any Member, Trustee, Officer, or any private individual (except that

reasonable compensation may be paid for services rendered to or for the Corporation affecting one or more of its

purposes), and no Executive Board member of the Corporation, Member, Trustee, Officer, or private individual shall

be entitled to share in the distribution of any of the corporate assets on dissolution of the Corporation. No

substantial part of the activities of the Corporation shall be the carrying on of propaganda, or otherwise attempting to

influence legislation, and the Corporation shall not participate in or intervene in (incl uding the publication and

distribution of statements) any political campaign on behalf of any candidate for public office.

B. The Corporation shall distribute its income for each taxable year at such time and in such manner as not to

subject the Corporation to the tax on undistributed income imposed by Section 4942 of the Internal Revenue Code

of 1986, or corresponding provisions of any future internal revenue laws.

C. The Corporation shall not engage in any act of self-dealing as defined in 4941(d) of the Internal Revenue

Code of 1986, or corresponding provisions of any future internal revenue laws.

D. The Corporation shall not retain any excess business holdings as defined in Section 4943(c) of the Intern al

Revenue Code of 1986, or corresponding provisions of any future internal revenue laws.

E. The Corporation shall not make any investment in a manner as to subject the Corporation to tax under

Section 4944 of the Internal Revenue Code of 1986, or corresponding provisions of any future intern al revenue laws.

F. The Corporation shall not make any taxable expenditure as defined in Section 4945(d) of the Internal

Revenue Code of 1986, or corresponding provisions of any future internal revenue laws.

G. Notwithstanding any other provisions of the Articles, the Corporation shall not carry on any activities not

permitted by an organization exempt under Section 501(c)( 3) of the Internal Revenue Code of 1986 and its

regulations as they now exist or they may be amended, or by an organization, contributions to which are deductible

under Section 170(c)(2) of the Internal Revenue Code of 1986, or corresponding provisions of any future internal

revenue laws.

ARTICLE VII – DISSOLUTION

Upon dissolution or final liquidation of the Corporation, the Executive Board shall, after p repaying or making

provisions for the payment of all the lawful debts and liabilities of the Corporation, dispose of all the property of the

Corporation by distributing such property exclusively for one or more charitable purposes in such manner as shall at

the time qualify under Section 501(c)(3) of the Internal Revenue Code of 1986, or to such organizat ion or

organizations organized and operated exclusively for char itable purposes as shall, at the time, qualify as exempt

under Section 501(c)(3) of the Internal Revenue Code of 1986 and as other than a private foundatio n under Section

509(a) of the Internal Revenue Code of 1986, as the Executive Board shall determine. The court shall dispose of

any assets not so disposed which has general jurisdiction for the county in which the principal office of the

Corporation shall then be located, exclusively for such charitable purposes or to such charitable organization or

organizations described herein, as said court shall select.

ARTICLE VIII – REGISTERED OFFICE & AGENT

The street address of the Corpora tion’s initial registered office is:

The name of the initial registered agent at said office is:

Articles of Incorporation – Page 3

ARTICLE IX – INCORPORATORS

The name and street address of each incorporator is as follows:

ARTICLE X – MEMBERS

The Corporation

SHALL; SHALL NOT; have members.

ARTICLE XI – BOARD OF DIRECTORS

The name and street address of each person serving as an initial director is as follows (if none, directors will be

appointed/elected at the organizational meeting and reflected in the bylaws):

* * *

This document must be executed by either (1) the presiding officer of the board of directors, presi dent or other

officer, or (2) if directors have not been selected or the Corporation has not been formed, by an incorporator.

_______________________________________________ ______________________

Signature Date

Type or print name of signatory Capacity/office of signatory

Disclaimer

Non-profit Corporation creation notes:

GENERAL DISCLAIMER:

Use of this form is subject to the U.S. Legal Forms, Inc., Disclaimer,

License and Liability Limitation located here:

http://www.uslegalforms.com/disclaimer.htm

TAX EXEMPTION DISCLAIMER:

Tax exemption is mentioned here only to inform yo u that there is an issue on this subject-- that

non-profit corporations are not automatically ta x exempt. The following information (including

the three paragraphs quoted below) may not be suff icient for you to gain tax exemption. It is

your responsibility to consult a tax expert or take additional steps to ensure that the tax

situation of your non-profit Corporation meets your expectations.

Corporations organized under the state non-profit Corporation acts DO NOT automatically qualify for

exemption from federal and state taxes. Before granting a tax exemption, the Internal Revenue

Service (IRS) requires that the articles of incorpor ation contain certain provisions. You must include

the following three paragraphs in your Articles of Incorporation, and you must adhere to the

provisions in the conduct of your operations. These para graphs are required by IRS to be Included in

Articles of Incorporation (or Restatement or Amendment) for 501(c)(3) Status Approval. They are

included in substantially similar format in the above Articles of Incorporation form.

"Said Corporation is organized exclusively for charitable, religious,

educational, and scientific purposes, including, for such purposes, the

making of distributions to organizations that qualify as exempt

organizations under section 501(c)(3) of the Internal Revenue Code, or

corresponding section of any future federal tax code."

"No part of the net earnings of the corporations shall inure to the benefit

of, or be distributable to its members, trustees, officers, or other

private persons, except that the Corporation shall be authorized and

empowered to pay reasonable compensation for services rendered and to make

payments and distributions in furtherance of the purposes set forth herein. No

substantial part of the activities of the Corporation shall be the carrying on of

propaganda, or otherwise attempting to influence legislation, and the Corporation

shall not participate in, or intervene in (including the publishing or distribution of

statements) any political campaign on behalf of any candidate for public office.

Notwithstanding any other pr ovision of these articles, the Corporation

shall not carry on any other activities not permitted to be carried on (a)

by a Corporation exempt from federal income tax under section 501(c)(3) of

the Internal Revenue Code, or corresponding section of any future federal

tax code, or (b) by a Corporation, contributions to which are deductible

under section 170(c)(2) of the Internal Revenue Code, or corresponding

section of any future federal tax code."

"Upon the dissolution of the Corporation, assets shall be distributed for

one or more exempt purposes within the meaning of section 501(c)(3) of the

Internal Revenue Code, or corresponding section of any future federal tax

code, or shall be distributed to the federal government, or to a state or

local government, for a public purpose. Any such assets not so disposed of

shall be disposed of by the Court of Common Pleas of the county in which

the principal office of the Corporation is then located, exclusively for

such purposes or to such organization or organizations, as said Court shall

determine, which are organized and operated exclusively for such purposes."

**This information maintained by the Nebraska Secretary of State.

STATUTES RELATING TO FILING ARTICLES OF INCORPORATION**

(Non Profit Corporations)

John A. Gale, Secretary of State

Room 1305 State Capitol, P.O. Box 94608

Lincoln, NE 68509

21-1903: Filing requirements.

(a) A document must satisfy the requirements of this sec tion, and of any other section that adds to or varies

these requirements, to be entitled to filing by the Secretary of State. (b) The Nebraska Nonprofit Corporation

Act must require or permit filing the document in the office of the Secretary of State. (c) The document must

contain the information required by th e act. It may contain other information as well. (d) The document must be

typewritten or printed. (e) The document must be in th e English language. However, a corporate name need not

be in English if written in English lette rs or Arabic or Roman numerals, and the certificate of existence required

of foreign corporations need not be in English if accompanied by a reasonabl y authenticated English translation.

(f) The document must be executed:

(1) By the presiding officer of its board of directors of a domestic or foreign Corporation, by its president, or by

another of its officers;

(2) If directors have not been select ed or the Corporation has not been formed, by an incorporator; or

(3) If the Corporation is in the hands of a receiver, trustee, or other court-appointed fiduciary, by that fiduciary.

(g) The person executing a document shall sign it and state beneath or opposite the signature his or her na me

and the capacity in which he or she signs. The document may, but need not, contain:

(1) The corporate seal;

(2) An attestation by the secretar y or an assistant secretary; or

(3) An acknowledgment, verification, or proof. (h) If th e Secretary of State has prescribed a mandatory form for

a document under section 21-1904, the document must be in or on the prescribed form. (i) The document must

be delivered to the office of the Secretary of State for filing and must be accompanied by one exact or

conformed copy (except as provided in sections 21-1936 and 21-19,154), the correct filing fee, and any tax,

license fee, or penalty required by the Nebraska Nonprofit Corporation Act or other law.

21-1905: Fees.

(a) The Secretary of State shall collect the following fees when the documents described in this subsection are

delivered for filing:

(1)(i) Articles of incorporation or documents relating to domestication $10.00

(2) Application for use of indistinguishable name $ 25.00

(3) Application for reserved name $ 25.00

(4) Notice of transfer of reserved name $ 25.00

(5) Application for registered name $ 25.00

(6) Application for renewal of registered name $ 25.00

(7) Corporation's statement of change of regist ered agent or registered office or both $ 5.00

(8) Agent's statement of change of re gistered office for each affected Corpor ation $ 25.00 (not to exceed a total

of $1,000.00)

(9) Agent's statement of resignation no fee

(10) Amendment of articles of incorporation $ 5.00

(11) Restatement of articles of incorporation with amendments $ 5.00

(12) Articles of merger $ 5.00

(13) Articles of dissolution $ 5.00

(14) Articles of revocation of dissolution $ 5.00

(15) Certificate of administrative dissolution no fee

(16) Application for reinstatement follo wing administrative dissolution $ 5.00

(17) Certificate of reinstatement no fee

(18) Certificate of judicial dissolution no fee

(19) Certificate of authority $ 10.00

(20) Application for amended certificate of $ 5.00

(21) Application for certificate of $ 5.00

**This information maintained by the Nebraska Secretary of State.

(22) Certificate of revocation of au

thority to transact business no fee

(23) Biennial report $ 20.00

(24) Articles of correction $ 5.00

(25) Application for certificate of good standing $ 10.00

(26) Any other document required or permitted to be filed by the Nebraska Nonprofit /Corporation Act $ 5.00

(i) Amendments $ 5.00

(ii) Mergers $ 5.00

(b) The Secretary of State shall collect a recording fee of fi ve dollars per page in addition to the fees set forth in

subsection (a) of this section. (c) The Secretary of State shall collect the following fees for copying and

certifying the copy of any filed document relating to a domestic or foreign Corporation:

(1) $1.00 per page; and

(2) $10.00 for the certificate.

(d) All fees set forth in this section shall be collect ed by the Secretary of State and remitted to the State

Treasurer and credited two-thirds to the General Fund and one-third to the Corporation C ash Fund.

21-1920: Incorporators.

One or more persons may act as the incorporator or in corporators of a Corporation by delivering articles of

incorporation to the Secretary of State for filing.

21-1921: Articles of incorporation.

(a) The articles of incorporation shall set forth:

(1) A corporate name for the Corporation that satisfies the requirements of section 21-1931;

(2) One of the following statements: (i) This Corporation is a public benefit Corporation;

(ii) This Corporation is a mutual be nefit Corporation; or (iii) This Corporation is a religious Corporation;

(3) The street address of the Corporation's initial registered office and the name of its initial registered agent at

that office;

(4) The name and street address of each incorporator;

(5) Whether or not the Corporation will have members; and

(6) Provisions not inconsistent with law regarding the distribution of assets on dissolution.

(b) The articles of incorporation may set forth:

(1) The purpose or purposes for which the Corporation is organized, which may be, eithe r alone or in

combination with other purposes, the transaction of any lawful activity;

(2) The names and street addresses of the individuals who are to serve as the initial directors;

(3) Provisions not inconsistent with law regarding: (i) Managing and regulating the affairs of the Corporation;

(ii) Defining, limiting, and regulating the powers of the Corporation, its board of directo rs, and members (or any

class of members); and (iii) The characteristics, qualifica tions, rights, limitations, and obligations attaching to

each or any class of members.

(4) Any provision that under the Nebraska Nonprofit Corpor ation Act is required or permitted to be set forth in

the bylaws. (c) Each incorporator and director named in the articles must sign the articles. (d) The articles of

incorporation need not set forth any of th e corporate powers enumerated in the act.

21-1922: Incorporation.

(a) Unless a delayed effective date is specified, the corporate existence begins when the articles of incorporation

are filed. (b) The Secretary of State's filing of the ar ticles of incorporation is conclusive proof that the

incorporators satisfied all conditions precedent to incorpor ation except in a proceeding by the state to cancel or

revoke the incorporation or involuntarily dissolve the Corporation.

21-1923: Liability for preincorporation transactions.

All persons purporting to act as or on behalf of a Corporation, knowing there was no incor poration under the

Nebraska Nonprofit Corporation Act, are jointly and severally liable for all liabilities created while so acting.

21-1924: Organization of Corporation.

(a) After incorporation:

(1) If initial directors are named in the articles of incorp oration, the initial directors shall hold an organizational

meeting, at the call of a majority of the directors, to complete the organization of the Corporation by appointing

officers, adopting bylaws, and carrying on any other business brought before the meeting; or

**This information maintained by the Nebraska Secretary of State.

(2) If initial directors are not named in the articles, the in

corporator or incorporators shall hold an organizational

meeting at the call of a majority of th e incorporators: (i) To elect directors and complete the organization of the

Corporation; or (ii) To elect a board of directors who shall complete the organization of t he Corporation.

(b) Action required or permitted by the Nebraska Nonprofit Corporation Act to be taken by incorporators at an

organizational meeting may be taken without a meeting if the action taken is evidenced by one or more written

consents describing the action take n and signed by each incorporator.

(c) An organizational meeting may be held in or out of this state in accordance with section 21-1 981.

21-1925: Bylaws.

(a) The incorporators or board of directors of a Corporation shall adopt bylaws for the Corporati on. (b) The

bylaws may contain any provision for regulating and managing the affairs of the Corporation that is not

inconsistent with law or the articles of incorporation.

21-1926: Emergency bylaws and powers.

(a) Unless the articles provide otherwise the directors of a Corporation may adopt, amend, or repeal bylaws to

be effective only in an emergency defined in subsection (d) of this section. The emergency bylaws, whi ch are

subject to amendment or repeal by the members, may provide special procedures necessary for managing the

Corporation during the emergency, including:

(1) How to call a meeting of the board;

(2) Quorum requirements for the meeting; and

(3) Designation of additional or substitute directors.

(b) All provisions of the regular bylaws consistent w ith the emergency bylaws remain effective during the

emergency. The emergency bylaws are not effective after the emergency ends.

(c) Corporate action taken in good faith in accordance with the emergency bylaws:

(1) Binds the Corporation; and

(2) May not be used to impose liability on a corporate director, officer, employee, or agent.

(d) An emergency exists for purposes of this section if a quorum of the Corporation's directors can not readily be

assembled because of some catastrophic event.

21-1927: Purposes.

(a) (1) Every Corporation incorporated under the Nebr aska Nonprofit Corporation Act has the purpose of

engaging in any lawful activity unless a more limited purpose is set forth in the articles of incorporation.

(2) A Corporation engaging in an activity that is subject to regulation under another statute of this state may

incorporate under the act on ly if incorporation under the act is no t prohibited by the other statute. The

Corporation shall be subject to all limitations of the other statute.

(b) Corporations may be incorporated under the Nebraska Nonprofit Corporation Act for any one or more of,

but not limited to, the following lawful purposes: Charitable; benevolent; eleemosynary; educational; civic;

patriotic; political; religious; social; fraternal; literary; cu ltural; athletic; scientific; agricultural; horticultural;

animal husbandry; and professional, commercial, industrial, or trade association. Corporati ons may also be

incorporated under the act for the purpose of providing for, erecting, owning, leasing, furnishing, and managing

any building, hall, dormitory or apartments, lands or grou nds for the use or benefit in whole or in part of any

governmental, religious, social, educational, scientific, fraternal, or charitable society or societies, body or

bodies, institution or institutions, incorporated or unincorp orated, or for the purpose of holding property of any

nature in trust for such society, body, or institution or for the purpose of assisting any governmental body in

obtaining grants from the federal government, the pe rformance of any requirements necessary to obtain a

federal grant or carrying out the purpose for which a federal grant is obtained. Such corporatio ns, as to the

ownership and taxation of their property, shall have all the rights, privileges, and exem ptions of the body,

society, or institution for whose use or benefit or for whom in trust such property is held.

21-1928: General powers.

Unless its articles of incorporation provide otherwise, every Corporation has perpetual duration and succession

in its corporate name and has the same powers as an individual to do all things necessary or convenient to carry

out its affairs including, without limitation, the power:

(1) To sue and be sued, complain, and defend in its corporate name;

(2) To have a corporate seal, which may be altered at will, and to use it, or a facsimile of it, by impressing or

affixing or in any other manner reproducing it;

**This information maintained by the Nebraska Secretary of State.

(3) To make and amend bylaws not inconsistent with its arti

cles of incorporation or with the laws of this state,

for regulating and managing the affairs of the Corporation;

(4) To purchase, receive, lease, or otherwise acquire, and own, hold, improve, use, and otherwise deal with, real

or personal property, or any legal or equitable interest in property, wherever located;

(5) To sell, convey, mortgage, pledge, lease, exchange, and otherwise dispose of all or any part of its prope rty;

(6) To purchase, receive, subscribe for, or otherwise acqui re, own, hold, vote, use, sell, mortgage, lend, pledge,

or otherwise dispose of, and deal in and with, shares or other interests in, or obligations of, any entity;

(7) To make contracts and guaranties, incur liabilities, borrow money, issue notes, bonds, and other obligations,

and secure any of its obligations by mortgage or pledge of any of its property, franchises, or income;

(8) To lend money, invest and reinvest its funds, and receive and hold real and personal property as security for

repayment, except as limited by section 21-1988;

(9) To be a promoter, partner, member, associate, or manager of any partnership, joint venture, trust, or other

entity;

(10) To conduct its activities, locate offices, and exerci se the powers granted by the Nebraska Nonprofit

Corporation Act within or without this state;

(11) To elect or appoint directors, of ficers, employees, and agents of the Corp oration, define their duties, and fix

their compensation;

(12) To pay pensions and establish pension plans, pension trusts, and other benefit and incentive plans for any

or all of its current or former dir ectors, officers, employees, and agents;

(13) To make donations not inconsistent with law for the public welfare or for charitable, religious, scientific, or

educational purposes and for other purposes that further the corporate interest;

(14) To impose dues, assessments, admission , and transfer fees upon its members;

(15) To establish conditions for admission of me mbers, admit members, and issue memberships;

(16) To carry on a business; and

(17) To do all things necessary or convenient, not incons istent with law, to further the activities and affairs of

the Corporation.

21-19,173: Notice of incorporation, amendmen t, merger, or dissolution; publication.

(a) Notice of incorporation, amendment, or merger of a domestic Corporation subject to the Nebraska Nonprofit

Corporation Act shall be published for three successive week s in some legal newspaper of general circulation in

the county where the Corporation's principal office or, if none in this state, its registered office is located. A

notice of incorporation shall show

(1) the corporate name of the Corporation,

(2) whether the Corporation is a public benefit, mutual benefit, or religious Corporation,

(3) the street address of the Corporation's initial registered office and the name of its initial registered agent at that office,

(4) the name and street addr ess of each incorporator, and

(5) whether or not the Corporation will have members. A brief resume of any amendment or merger of the

Corporation shall be published in the same manner for the same period of time as a notice of incorporation is

required to be published. (b) Notice of dissolution of a domestic Corporation shall be published for three

successive weeks in some legal newspaper of general circ ulation in the county where the Corporation's principal

office or, if none in this state, its registered office is located. A notice of dissolution shall show

(1) the terms and conditions of such dissolution,

(2) the names of the persons who are to wind up and liquidate its affairs and their official titles, and

(3) a statement of assets and liabilities of the Corporation. (c) Proof of publication of any of the notices required

to be published under this section shall be filed in the o ffice of the Secretary of State. In the event any notice

required to be given pursuant to this section is not gi ven, but is subsequently published for the required time,

and proof of the subsequent publication thereof is file d in the office of the Secretary of State, the acts of

such Corporation prior to, as well as after, such publication shall be valid.