Fill and Sign the Hudson Community Transcript Form

Practical advice on finalizing your ‘Hudson Community Transcript Form’ digitally

Are you fatigued from the burden of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and organizations. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and sign documents online. Leverage the comprehensive tools embedded in this intuitive and economical platform to transform your method of document management. Whether you need to authorize forms or gather signatures, airSlate SignNow accomplishes it all effortlessly, needing just a few clicks.

Follow this detailed walkthrough:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Access your ‘Hudson Community Transcript Form’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Insert and assign fillable fields for others (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don't be concerned if you need to collaborate with your team on your Hudson Community Transcript Form or send it for notarization—our platform has everything you require to accomplish those tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

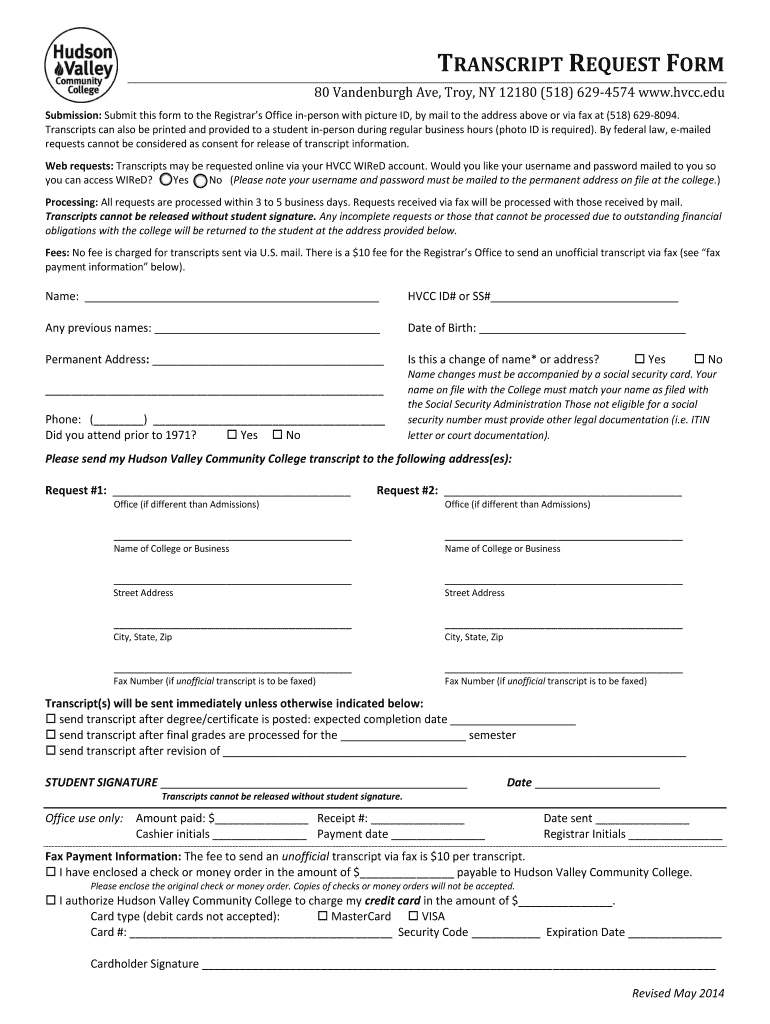

What is the Hudson Valley Transcript Request Form?

The Hudson Valley Transcript Request Form is an essential document designed for students and alumni to request their academic transcripts efficiently. Using airSlate SignNow, you can fill out and eSign this form online, ensuring a fast and secure submission process for your transcript requests.

-

How do I fill out the Hudson Valley Transcript Request Form?

Filling out the Hudson Valley Transcript Request Form is simple with airSlate SignNow. Just access the form online, enter the required information, and use our intuitive eSignature feature to sign it digitally. This streamlined process saves you time and effort.

-

Is there a fee associated with the Hudson Valley Transcript Request Form?

There may be a nominal fee associated with processing the Hudson Valley Transcript Request Form, depending on the institution’s policies. It's best to check directly with the institution for any specific costs related to transcript requests.

-

What are the benefits of using airSlate SignNow for the Hudson Valley Transcript Request Form?

Using airSlate SignNow for the Hudson Valley Transcript Request Form offers numerous benefits, including secure eSigning, easy document management, and the ability to track your request status. Our platform simplifies the entire process, making it more efficient and user-friendly.

-

Can I integrate airSlate SignNow with other applications for my Hudson Valley Transcript Request Form?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage your Hudson Valley Transcript Request Form alongside other tools you use. This integration enhances workflow efficiency and ensures that all your documents are in one place.

-

How long does it take to process the Hudson Valley Transcript Request Form?

The processing time for the Hudson Valley Transcript Request Form can vary based on the institution's workload and policies. Generally, you can expect a response within a few days to a couple of weeks. Using airSlate SignNow can help expedite the process.

-

Is the Hudson Valley Transcript Request Form secure with airSlate SignNow?

Absolutely! The Hudson Valley Transcript Request Form processed through airSlate SignNow is secure and compliant with industry standards. Our platform uses advanced encryption to protect your personal information and ensure that your documents are safe during transmission.

Find out other hudson community transcript form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles