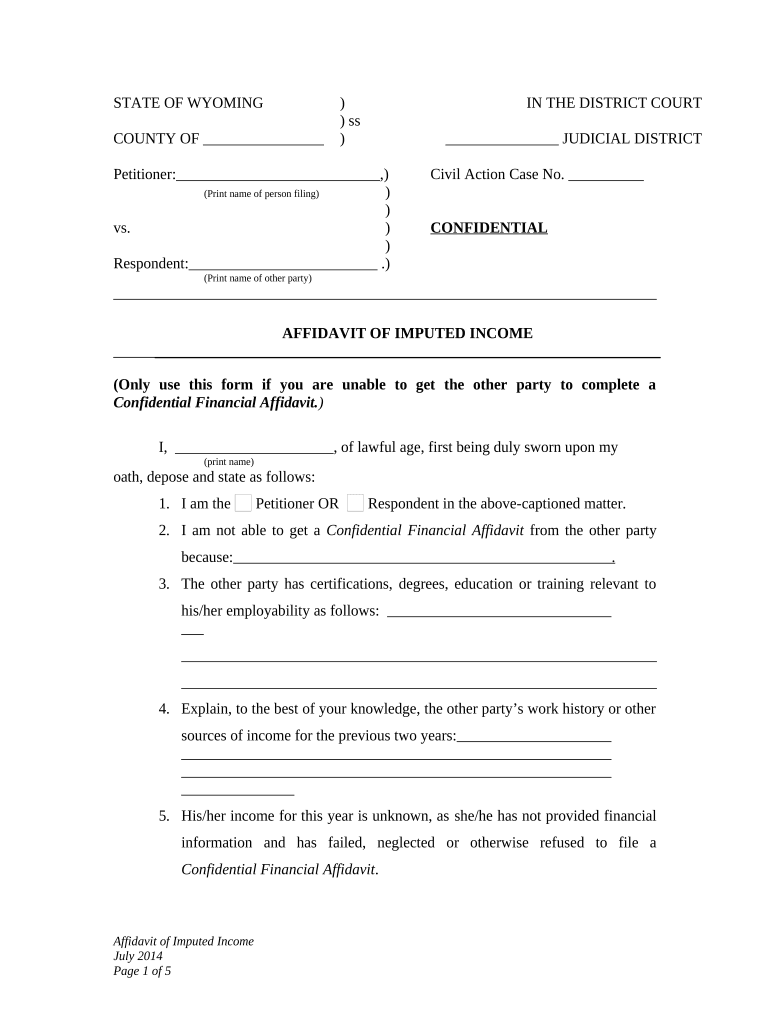

Fill and Sign the Imputed Income Child Form

Practical tips for preparing your ‘Imputed Income Child’ online

Are you weary of the burden of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and small to medium-sized businesses. Bid farewell to the monotonous routine of printing and scanning documentation. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the robust features embedded in this user-friendly and cost-effective solution and transform your strategy for document management. Whether you need to approve forms or gather eSignatures, airSlate SignNow manages everything with ease and just a few clicks.

Follow this comprehensive guide:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Edit your ‘Imputed Income Child’ in the editor.

- Select Me (Fill Out Now) to finalize the form on your end.

- Add and assign fillable fields for other participants (if needed).

- Continue with the Send Invite setup to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don't fret if you need to collaborate with your teammates on your Imputed Income Child or send it for notarization—our solution covers all you need to accomplish such tasks. Sign up with airSlate SignNow today and enhance your document management to a new standard!

FAQs

-

What is imputed income and how does it relate to e-signatures?

Imputed income refers to the value of benefits or perks provided by an employer that are not directly paid in cash. Understanding imputed income is essential for businesses using e-signatures, as it may impact tax calculations and reporting. With airSlate SignNow, you can streamline the signing process of related documents while ensuring compliance with tax regulations.

-

How can airSlate SignNow help manage imputed income documentation?

airSlate SignNow simplifies the management of all documentation related to imputed income by allowing businesses to send and eSign necessary forms quickly. This ensures that all records are easily accessible and properly signed, reducing the risk of compliance issues. By automating these processes, you save time and minimize errors in your documentation.

-

What are the pricing options for airSlate SignNow regarding imputed income management?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses managing imputed income. These plans provide access to essential features like document templates and e-signature capabilities, ensuring you can handle imputed income documentation efficiently. You can choose a plan that fits your budget while still leveraging a robust e-signature solution.

-

Does airSlate SignNow integrate with accounting software for imputed income tracking?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making it easier to track imputed income. This integration enhances your ability to manage financial records while ensuring that all e-signed documents are automatically updated in your accounting system. This eliminates manual data entry and helps maintain accurate financial records.

-

What features of airSlate SignNow support compliance with imputed income regulations?

airSlate SignNow includes features like secure e-signatures, audit trails, and document storage, all of which support compliance with imputed income regulations. These features ensure that your documents are signed and stored securely, providing a clear record of transactions. This is essential for businesses wanting to adhere to tax laws and regulations regarding imputed income.

-

Can I customize documents related to imputed income using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your documents related to imputed income easily. You can create templates that include necessary fields for employee benefits and other relevant information, ensuring that every document meets your specific needs. This customization capability makes it easier to manage compliance-related documents.

-

What benefits does airSlate SignNow provide for handling imputed income?

Using airSlate SignNow for handling imputed income offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. By digitizing the signing process, you can quickly send, sign, and store documents, which saves time and resources. Moreover, it helps maintain accurate records that are crucial for tax reporting and compliance.

The best way to complete and sign your imputed income child form

Find out other imputed income child form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles