INCOME WITHHOLDING FOR SUPPORT (OMB 0970-0154 exp. 7/31/2017) – Instruct ions

JD-FM-1(i) P age 1 of

11

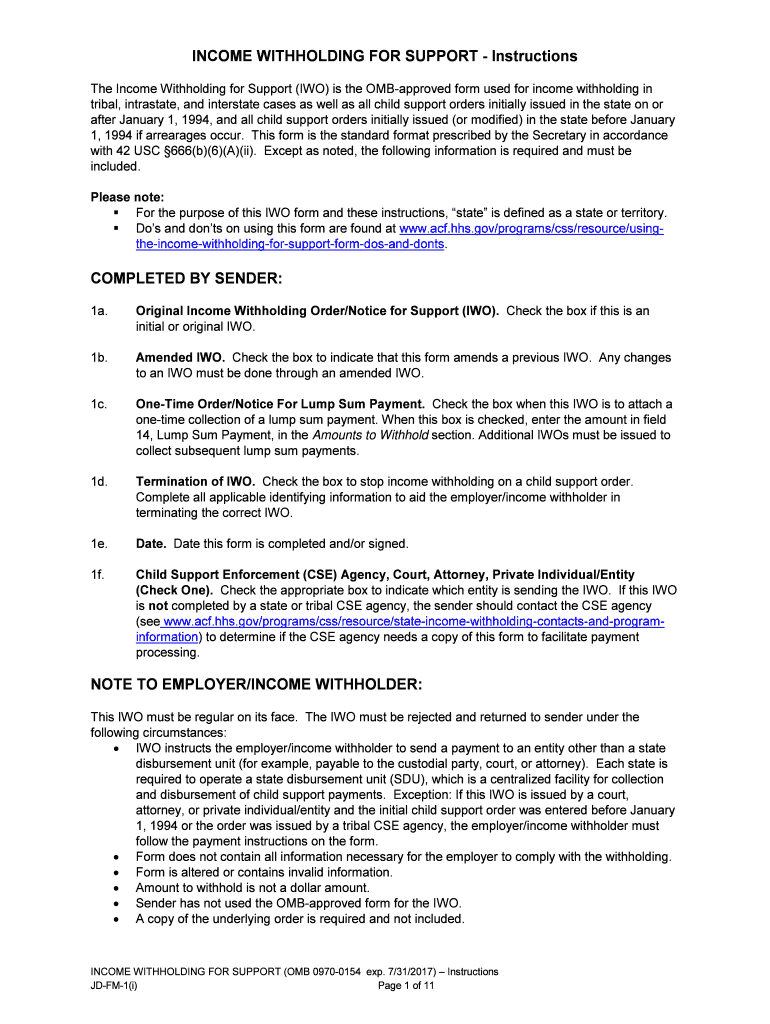

INCOME WITHHOLDING FOR SUPPORT - Instructions

The Income Withhol

ding for Support (IWO) is the OMB -approved form used for income withholding in

t rib al, intrastate, and interstate cases as well as all child support orders initially issued in the state on or

after January 1, 1994, and all child support orders initially issued (or modified) in the state before January

1, 1994 if arrearages occur. This form is the standard format prescribed by the Secretary in accordance

with 42 USC §666(b)(6)(A)(ii). Except as noted, the following information is required and must be

included.

Please note:

For the purpose of this IWO form and these instructions, “ state” is defined as a state or territory.

Do’s and don’ts on using this form are found at www.acf.hhs.gov/programs/css/resource/using-

the-income- withholding- for-support -form -dos -and- donts .

COMPLETED BY SEN

DER:

1a. Original In

come Withholding Order/Notice for Support (IWO). Check the box if this is an

initial or original IWO.

1b. Amended I

WO. Check the box to indicate that this form amends a previous IWO . A ny changes

to an IWO must be done through an amended IW O.

1c. One-Time Or

der/Notice For Lump Sum Payment. Check the box when this IWO is to attach a

one- time collection of a lump sum payment. When this box is checked, enter the amount in field

14, Lump Sum Payment, in the Amounts to Withhold section. Ad ditional IWOs must be issued to

collect subsequent lump sum payments.

1d. Terminati

on of IWO. Check the box to stop income withholding on a child support order.

Complete all applicable identifying information to aid the employer/income withholder in

t erminating the correct IWO.

1e. Date. Date t

his form is completed and/or signed.

1f. Child Su

pport Enforcement (CSE) Agency , Court, Attorney, Private Individual/Entity

(Check One). Check the appropriate box to indicate which entity is sending the IWO. If this IW O

is not completed by a state or trib al CSE agency, the sender should contact the CSE agency

(see

www.acf.hhs.gov/programs/css/resource/state- income-withholding- contacts-and- program -

information ) to determine if the CSE agency needs a copy of this form to facilitate payment

processing.

NOTE TO EMPLOYER/INCOME WITHHOLDER:

This IWO must

be regular on its face. The IWO must be rejected and returned to sender under the

following circumstances :

• IWO instructs the employer/income withholder to send a payment to an entity other than a s tate

d isbursement unit (for example, payable to the custodial party, court, or attorney). Each s tate is

required to operate a s tate disbursement unit (SDU), which is a centralized facility for collection

and disbursement of child support payments. Exception: If this IWO is issued by a court,

a ttorney, or private individual/ entity and the initial child support order was entered before Janu ary

1, 1994 or the order was issued by a trib al CSE agency, the employer/income withholder must

follow the payment instructions on the form.

• Form does not contain all information necessary for the employer to comply with the withholding.

• Form is altered or contains invalid information.

• Amount to withhold is not a dollar amount.

• Sender has not used the OMB -approved form for the IWO .

• A copy of the underlying order is required and not included.

INCOME WITHHOLDING FOR SUPPORT (OMB 0970-0154) – Instructions

JD-FM-1(i) Page 2 of

11

If you rec

eive this document from an attorney or private individual/ entity , a copy of the underlying order

containing a provision authorizing income withholding must be attached.

COMPLETED BY SENDER :

1g. State/T

ribe/Territory. Name of state or trib e sending this form. This must be a governmental

entity of the state or a trib al organization authorized by a trib al government to operat e a CSE

program. If you are a trib e submitting this form on behalf of another trib e, complete line 1i.

1h. Remitta

nce ID (include w/payment). Identifier that employers must include when sending

payments for this IWO. The Remittance ID is entered as the case identifier on the electronic

funds t ransfer/ electronic data interchange ( EFT/EDI) record.

NOTE TO EMPLOY

ER/INCOME WITHHOLDER:

The employer/ i

ncome withholder must use the Remittance I D when remitting payments so the SDU or

t rib e can identify and apply the payment correctly. The Remittance ID is entered as the case identifier on

the EFT/EDI record.

COMPLETED BY

SENDER:

1i. City/Co

unty/Dist./Tribe. Name of the city, county , or district sending this form. This must be a

government entity of the state or the name of the tribe authorized by a trib al government to

operate a CSE program for which this form is being sent. (A tribe should l eave this field blank

unless submitting this form on behalf of another t ribe.)

1j. Order

ID. U nique identifier associated with a specific child support obligation. It could be a court

case number, docket number, or other identifier des ignated by the sender.

1k. Privat

e Individual/Entity. Name of the private individual/entity or non- IV-D t ribal CSE

organization sending this form .

1l. CSE Agency Case I D. U nique identifier assigned to a state or tribal CSE case. In a state IV-D

case as defined at 45 Code of Federal Regulations (CFR) 305.1, this is the identifier reported to

the Federal Case Registry (FCR). One IWO must be issued for each IV -D case and must use the

unique CSE Agency Case ID. For trib es, this would be either the FCR ide ntifier or other

applicable identifier.

Fields 2 and

3 refer to the employee/obligor’s employer/income withholder and specific case information.

2a. Employer

/Income Withholder's Name. Name of employer or income withholder.

2b. Employer

/Income Withholder's Address. Employer/income withholder's mailing address

inclu ding street/PO box, city, state, and zip code. (This may differ from the employee/obligor’s

work site .) If the employer/income withholder is a federal government agency , the IWO should be

s ent to the address listed under Federal Agency Income Withholding Contacts and Program

Information at

www.acf.h hs.gov/programs/css/resource/federal -agency -income- withholding-

contact-information .

2c. Employ

er/Income Withholder's FEIN. Employer/income withholder's nine- digit Federal

Employer Identification Number (if available).

3a. Employee

/Obligor’s Name. Em ployee/obligor’s last name, first name, middle name.

3b. Employe

e/Obligor’s Social Security Number. Employee/obligor’s Social Security number or

INCOME WITHHOLDING FOR SUPPORT (OMB 0970-0154) – Instructions

JD-FM-1(i) Page 3 of

11

other taxpayer identification number.

3c. Custodial

Party/Obligee’s Name. Custodial party/obligee’s last name, first name, middle name.

Enter one custodial party/obligee’s name on each IWO form. Multiple custodial parties/oblige es

are not to be entered on a single IWO. Issue one IWO per state IV -D case as defined at 45 CFR

305.1

3d. Child(ren

)’s Name(s). Child(ren)’s last name(s), first name(s), middle name(s). (Note: If there

are more than six children for this IWO, list additional children’s names and birth dates in field 33

- Supplemental Information). Enter the child(ren) associated with the custodial party/obligee and

employee/obligor only. Child(ren) of multiple custodial parties/obligees is not to be entered on an

IW O.

3e. Child(ren

)’s Birth Date(s). Date of birth for each child named.

3f. Blank b

ox. Space for court stamps, bar codes , or other information.

ORDER INFORMAT

ION – Field 4 identifies which state or tribe issued the order. Fields 5 through 12

identify the dollar amount to withhold for a specific kind of support (taken directly from the support order)

for a specific time period.

4. State/Tr

ibe. Name of the state or trib e that issued the order.

5a-b. Current

Child Support. Dollar amount to be withheld per the time period (for example, week,

month) specified in the underlying order.

6a-b. Past -due Ch

ild Support. D ollar amount to be withheld per the time period (for example, week,

month) specified in the underlying order.

6c. Arrears G

reater Than 12 Weeks? The appropriate box (Yes/No) must be checked indicating

whether arrears are greater than 12 weeks so the employer/income withholder can determine the

withholding limit .

7a- b. Current

Cash Medical Support. Dollar amount to be withheld per the time period (for example,

week, month) specified in the underlying order.

8a-b. Past -due Cash Medi

cal Support. Dollar amount to be wi thheld per the time period (for

example, week, month) specified in the underlying order.

9a- b. Current

Spousal Support. (A lim ony) Dollar amount to be withheld per the time period (for

example, week, month) specified in the underlying order.

10a-b. Past -due Spou

sal Support. (Alimony) Dollar amount to be withheld per the time period (for

example, week, month) specified in the underlying order.

11a-c. Other . M is

cellaneous obligations dollar amount to be withheld per the time period (for example,

week, month) specified in the underlying order. Must specify a d escription of the obligation ( for

example, court fees) .

12a- b. Total Am

ount to Withhold. The total amount of the deductions per the corresponding time

period. Fields 5a, 6a, 7a, 8a, 9a, 10a, and 11a should total the amount in 12a.

NOTE TO EMPLOYER/INCOME WITHHOLDER:

An acceptable

method of determining the amount to be paid on a weekly or biweekly basis is to multipl y

the monthly amount due by 12 and divide that result by the number of pay periods in a year.

INCOME WITHHOLDING FOR SUPPORT (OMB 0970-0154) – Instructions

JD-FM-1(i) Page 4 of

11

AMOUNTS TO

WITHHOLD - Fields 13a through 13d specify the dollar amount to be withheld for this

IWO if the employer/income withholder’s pay cycle does not correspond with field 12b.

13a. Per Weekly Pay Pe

riod. Total amount an employer/income withholder should withhold if the

employee/obligor is paid weekly.

13b. Per Semimo

nthly Pay Period. Total amount an employer/income withholder should withhold if

the employee/obligor is paid twice a month.

13c. Per Biweekly Pay Period. Total amount an employer/income withholder should withhold if the

employee/obligor is paid every two weeks.

13d. Per Mon

thly Pay Period. Total amount an employer/income withholder should withhold if the

employee/obligor is paid once a month.

14. Lump Su

m Payment. Dollar amount withheld when the IWO is used to attach a lump sum

payment. This field should be used when field 1c is checked.

REMITTANCE INFORMATION - Payments are forwarded to the SDU in each state, unless the order was

issued by a tribal CSE agency. If the order was issued by a tribal CSE agency, the employer/income

withholder must follow the remittance instructions on the form.

15. State/Tri

be. Name of the s tate or trib e sending this document.

16. Days. Num

ber of days after the effective date noted in field 17 in which withholding must begin

according to the s tate or trib al laws/procedures for the employee/obligor’s principal place of

employment.

17. Date. Effec

tive date of this IW O.

18. Working

Days. Number of working days within which an employer/income withholder must remit

amounts withheld pursuant to the state or trib al laws/procedures of the principal place of

employment.

19. %

of Disposable Income. The percentage of disposable income that may be withheld from the

em ployee/obligor’s paycheck.

NOTE TO EMPLOYER/INCOME WITHHOLDER:

For state order

s, the employer/income withholder may not withhold more than the lesser of: 1) the

amounts allowed by the Federal Consumer Credit Protection Act (15 USC §1673(b)); or 2) the amounts

allowed by the state of the employee/obligor’s principal place of employment.

For tribal ord

ers, the employer/income withholder may not withhold more than the amounts allowed under

the law of the issuing tribe. For t ribal employer s/in come withholders who receive a s tate order, the

employer/income withholder may not withhold more than the limit set by the law of the jurisdiction in which

the employer/income withholder is located or the maximum amount permitted under section 303 (b ) of the

Federal Consumer Credit Protection Act (15 USC §1673(b)).

A federal go

vernment agency may withhold from a variety of incomes and forms of payment, including

voluntary separation incentive payments (buy -out payments), incentive pay, and cash awards. For a

more complete list, see 5 CFR 581.103.

INCOME WITHHOLDING FOR SUPPORT (OMB 0970-0154) – Instructions

JD-FM-1(i) P age 5

of 11

COMPLETED BY SENDER :

20. State/Trib

e. Name of the state or trib e sending this document.

21. Documen

t Tracking ID. Optional unique identifier for this form assigned by the sender.

Please Note: E

mployer’s Name, FEIN, Employee/Obligor’s Name and SSN, Remittance ID, CSE Agency

Case ID, and Order ID must appear in the header on pages two and subsequent pages.

22. FIPS Code.

Federal Information Processing Standards code.

23. SDU/Trib

al Order Payee. Name of SDU (or pay ee specified in the underlying tribal support

order) to which payments must be sent. Federal law requires payments made by IWO to be sent

to the SDU except for payments in which the initial child support order was entered before

January 1, 1994 or paymen ts in tribal CSE orders.

24. SDU/Trib

al Payee Address. Address of the SDU (or payee specified in the underlying t ribal

support order) to which payments must be sent. Federal law requires payments made by IWO to

be sent to the SDU except for payments in which the initial child support order was entered

before January 1, 1994 or payments in t ribal CSE orders.

COMPLETED BY EMPLOYER/INCOME WITHHOLDER:

25. Return to

S

ende

r C heckbox. The employer /income withholder should check this box and return

the IWO to the sender if this IWO is not payable to an SDU or tribal payee or this IWO is not

regular on its face. Federal law requires payments made by IWO to be sent to the SDU except for

payments in which the initial child support order was entered before January 1, 1994 or payments

in trib al CSE orders.

COMPLETED BY SENDER :

26. Signatu

re of Judge/Issuing Official. Signature (if required by state or trib al law) of the official

authorizing this IWO.

27. Print N

ame of Judge/Issuing Official. Name of the official authorizing this IWO.

28. Title o

f Judge/Issuing Official. Title of the official authorizing this IWO.

29. Date of

Signature. Optional d ate the judge/ issuing official signs this IWO.

30. Copy of

IWO checkbox. Check this box for all intergovernmental IW Os. If checked, the

employer/income withholder is required to provide a copy of the IWO to the employee/obligor.

ADDITIONAL INFOR

MATION FOR EMPLOYERS/INCOME WITHHOLDERS

The following f

ields refer to f ederal, state, or trib al laws tha t apply to issui ng an IWO to an

employer/income withholder . State - or trib al-specific information may be included only in the fields below.

COMPLETED BY SENDER:

31. Liability.

Additional information on the penalty and/or citation of the penalty for an

employer/income withholder who fails to comply with the IWO. The state or trib al law/procedures

of the employee/obligor’s principal place of employment govern the penalty.

32. Anti -discr

imination. Additional information on the penalty and/or citation of the penalty fo r an

employer/income withholder who discharges, refuses to employ, or disciplines an

INCOME WITHHOLDING FOR SUPPORT (OMB 0970-0154) – Instructions

JD-FM-1(i) P age 6

of 11

employee/obligor as a result of the IWO. The state or trib al law/procedures of the

employee/obligor’s principal place of employment govern the penalty.

33. Supple

mental Information . Any state-specific information needed, such as maximum

withholding percentage for non- employees, fees the employer/income withholder may charge the

obligor for income withholding, or children’s names and DOBs if there are more than six children

on this IWO. Additional information must be consistent with the requirements of the form and the

instructions.

COMPLETED BY EMPLOYER/INCOME WITHHOLDER:

NOTIFICATION O

F EMPLOYMENT TERMINATION OR INCOME STATUS

The employer mus

t complete this section when the employee/obligor’s employment is terminated, income

withholding ceases, or if the employee/obligor has never worked for the employer.

34a- b. Employ

ment/Income Status C heckbox. Check the employment/income status of the

employee/obligor.

35. Termina

tion D ate. If applicable, d ate employee/obligor was terminated.

36. Last Know

n P hone Number. Last known (home/cell/other) phone number of the

employee/obligor.

37. Last Known

A ddress. Last known home/mailing address of the employee/obligor.

38. Final Pay

ment D ate. Date empl oyer sent final payment to SDU/t ribal payee.

39. Final

Payment A mount. Amount of final payment sent to SDU/t ribal payee.

40. New Employ

er’s Name. Name of employee’s/obligor’s new employer (if known) .

41. New Emp

loyer’s A ddress. Address of employee’s/obligor’s new employer (if known) .

COMPLETED BY SENDER :

CONTACT INFORMAT

ION

42. Issuer Nam

e (Employer/Income Withholder Contact). Name of the contact person that the

employer/income withholder can call for information regarding this IWO.

43. Issuer Pho

ne Number. Phone number of the contact person.

44. Issuer F ax Nu

mber. Fax number of the contact person.

45. Issuer E

- mail/W ebsite. E-mail or website of the contact person.

46. Termin

ation/Income Status and Correspondence Address. Address to which the employer

should return the Employment Termination or Income Status notice. It is also the address that

the employer should use to correspond with the issuing entity.

47. Issuer N

ame (Employee/Obligor C ontact). Name of the c ontact person that the

employee /obligor can call for information.

48. Issuer Ph

one N umber. Phone number of the contact person.

INCOME WITHHOLDING FOR SUPPORT (OMB 0970-0154) – Instructions

JD-FM-1(i) P age 7

of 11

49. Issuer Fax N umber. Fax number of the contact person.

50. Issuer E- m

ail/Website. E-mail or website of the contact person.

The Paperwork Reduction Act of 1995

This information collection and associated responses are conducted in accordance with 45 CFR 303.100 of the Child

Support Enforcement Program. This form is designed to provide uniformity and standardization. Public reporting

burden for this collection of information is estimated to average 5 minutes per response for Non-IV -D CPs; 2 minutes

per response for employers; 3 seconds for e-IWO employers, including the time for reviewing instructions, gathering

and maintaining the data needed, and reviewing the collection of information.

An agency may not

conduct or sponsor, and a person is not required to respond to, a collection of information unless

it displays a currently valid OMB control number.

INCOME WITHHOLDING FOR SUPPORT

1a

ORIGINAL INCOME WITHHOLDING ORDER/NOTICE FOR SUPPORT (IWO)

1b

AMENDED IWO

1c

ONE-TIME ORDER/NOTICE FOR LUMP SUM PAYMENT

1d

TERMINATION OF IWO Date: 1e

NOTE: This IWO must be regular on its face. Under certain circumstances you must reject this IWO and return it to the

sender (see IWO instructions www.acf.hhs.gov/programs/css/resource/income-withholding-for-support-instructions ). If

you receive this document from someone other than a state or tribal CSE agency or a court, a copy of the underlying order

must be attached.

1f Child Support Enforcement (CSE) Agency Court Attorney Private Individual/Entity (Check One)

State/Tribe/Territory

1g

Remittance ID (include w/payment) 1h

City/County/Dist./Tribe

Order ID 1i 1j

Private Individual/Entity

CSE Agency Case ID 1l

1k

Employer/Income Withholder's Name

Employer/Income Wi thholder's Address

RE: 3a

Employee/Obligor's Name (Last, First, Middle)

Employee/Obligor's Social Security Number

Custodial Party/Obligee’s Name (Last, First, Middle)

Employer/Income Withholder's FEIN

2c

Child(ren)'s Name(s) (Last, First, M iddle) Child(ren)'s Birth Date(s)

2a

2b

3b

3c

3d

3e

3f

ORDER INFORMATION

: This document is based on the support or withholding order from 4

(State/Tribe). You are required by law to deduct these amounts from the employee/obligor's income until further notice.

$ 5a Per 5b current child support

$

6a Per 6b past-due child support - Arrears greater than 12 weeks? Yes No 6c

$ 7a

Per 7b

current cash medical support

$

8a

Per 8b

past-due cash medical support

$ 9a

Per 9b

current spousal support

$

10a

Per 10b

past-due spousal support

$ 11a

Per 11b

other (must specify) 11c

.

for a Total Amount to Withhold of $

12a per 12b

.

AMOUNTS TO WITHHOLD: You do not have to vary your pay cycle to be in compliance with

the Order Information. If

your pay cycle does not match the ordered payment cycle, withhold one of the following amounts:

$

13a

per weekly pay period $ 13b

per semimonthly pay period (twice a month)

$ 13c

per biweekly pay period (every two weeks) $ 13d

per monthly pay period

$ 14

Lump Sum Payment: Do not stop any existing IWO unless you receive a termination order.

Document Tracking ID 21

OMB 0970-0154

Page 8 of 11

Employer's Name: 2a

Employer FEIN: 2c

Employee/Obligor's Name: 3a

SSN: 3b

CSE Agency Case Identifier: 1l

Order Identifier: 1j

REMITTANCE INFORMATION : If the employee/obligor's princip al place of employment is 15

(State/Tribe), you must begin withholding no later than the first pay period that occurs 16 days after the date

of

17 . Send payment within 18 working days of the pay date . If you cannot withhold the full amount of support

for any or all orders for this employee/obligor, withhold up to

19 % of disposable income. If the obligor is a non-

employee, obtain withholding limits from

Supplemental Information on page 3. If the employee/obligor's principal place of

employment is not

20 (State/Tribe), obtain withholding limitations, time requirements,

and any allowable employer fees at www.acf.hhs.gov/programs/css/resource/state-income-withholding-contacts-and-

program-information for the employee/obligor's principal place of employment.

For electronic payment requirements and centralized payment collection and disbursement facility information (State

Disbursement Unit (SDU)), see www.acf.hhs.gov/programs/css/employers/electronic-payments .

Include the Remittance ID with

the payment and if necessary this FIPS code:

22 .

Remit payment to 23 (SDU/Tribal Order Payee)

at 24 (SDU/Tribal Payee Address)

25 Return to Sender [Completed by Employer/Income Withholder]. Payment must be directed to an SDU in

accordance with 42 USC §666(b )(5) and (b)(6) or Tribal Payee (see Payments to SDU below). If payment is not directed

to an SDU/Tribal Payee or this IWO is not regular on its face, you must check this box and return the IWO to the sender.

Signature of Judge/Issuing Official (if Required by State or Tribal Law):

Print Name of Judge/Issuing Official:

Title of Judge/Issuing Official:

Date of Signature:

26

27

28

29

If the employee/obligor works in a state or for a tribe that is different from the state or tribe that issued this order, a cop y of

this IWO must be provided to the employee/obligor.

If checked, the employer/income withholder must provide a copy of this form to the employee/obligor. 30

ADDITIONAL INFORMATI ON FOR EMPLOYERS/INCOME WITHHOLDERS

State-specific contact and withholding information can be found on the Federal Employer Services website located at

www.acf.hhs.gov/programs/css/resource/state-income-withholding-contacts-and-program-information.

Priority: Withholding for support has priority over any other legal process under State law against the same income (42

USC §666(b)(7)). If a federal tax levy is in effect, please notify the sender.

Combining Payments: When remitting payments to an SDU or tr ibal CSE agency, you may combine withheld amounts

from more than one employee/obligor's income in a single payment. You must, however, separately identify each

employee/obligor's port ion of the payment.

Payments To SDU: You must send child support payments payable by in come withholding to the appropriate SDU or to a

tribal CSE agency. If this IWO instructs you to send a payment to an entity other than an SDU (e.g., payable to the

custodial party, court, or attorney), you must check the box above and return this notice to the sender. Exception: If this

IWO was sent by a court, attorney, or private individual/entity and the initial order was entered before January 1, 1994 or

the order was issued by a tribal CSE agency, you must f ollow the “Remit payment to” instructions on this form.

Reporting the Pay Date: You must report the pay date when sending the payment. The pay date is the date on which the

amount was withheld from the employee/obligor's wages. You must comply with the law of the state (or tribal law if

applicable) of the employee/obligor's principal place of employment regarding time periods within which you must

implement the withholding and forward the support payments.

Multiple IWOs: If there is more than one IWO against this employee/obligor and you are unable to fully honor all IWOs

due to federal, state, or tribal withholding limits, you must honor all IWOs to the greatest extent possible, giving priority t o

current support before payment of any past-due support. F ollow the state or tribal law/procedure of the employee/obligor's

principal place of employment to determine the appropriate allocation method.

OMB Expiration Date - 7/31/2017. The OMB Expiration Date has no bearing on the termination date of the IWO; it identifies the

version of the form currently in use.

Page 9 of 11

Employer's Name: 2a Employer FEIN: 2c

Employee/Obligor's Name: 3a SSN: 3b

CSE Agency Case Identifier: 1l Order Identifier: 1j

Lump Sum Payments: You may be required to notify a state or tribal CSE agency of upcoming lump sum payments to

this employee/obligor such as bo nuses, commissions, or severance pay. Contact the sender to determine if you are

required to report and/or withhold lump sum payments.

Liability: If you have any doubts about the validity of this IWO, contac t the sender. If you fail to withhold income from the

employee/obligor's income as the IWO directs, you are liable for both the accumulated amount you should have withheld

and any penalties set by stat e or tribal law/procedure.

31

Anti-discrimination: You are subject to a fine determined under state or tribal law for discharging an employee/obligor

from employment, refusing to employ, or taking disciplinary action against an employee/obligor because of this IWO.

32

Withholding Limits: You may not withhold more than the lesser of: 1) the amounts allowed by the Federal Consumer

Credit Protection Act (CCPA) (15 USC §1673(b)); or 2) the amounts allowed by the state of the employee/obligor's

principal place of employment or tribal law if a tribal order (see Remittance Information ). Disposable income is the net

income after mandatory deductions such as: state, federal, local taxes; Social Security taxes; statutory pension

contributions; and Medicare taxes. The federal limit is 50% of the disposable income if the obligor is supporting another

family and 60% of the disposable income if the obligor is not supporting another family. However, those limits increase

5% --to 55% and 65% --if the arrears are greate r than 12 weeks. If permitted by the state or tribe, you may deduct a fee

for administrative costs. The combined support amount and fee may not exceed the limit indicated in this section.

For tribal orders, you may not withhold more than the amounts allowed under the law of the issuing tribe. For tribal

employers/income withholders who receive a state IWO, you may not withhold more than the limit set by tribal law.

Depending upon a pplicable state or tribal law, you may need to consider amounts paid for health care premiums in

determining disposable income and applying appropriate withholding limits.

Arrears greater than 12 weeks? If the Order Information does not indicate that the arrears are greater than 12 weeks,

then the employer should calculate the CCPA limit using the lower percentage.

Supplemental Information:

33

IMPORTANT: The person completing this form is advised that the information may be shared with the employee/obligor.

Page 10 of 11

Employer's Name: 2a Employer FEIN: 2c

Employee/Obligor's Name: 3a SSN: 3b

CSE Agency Case Identifier: 1l Order Identifier: 1j

NOTIFICATION OF EMPLOYMENT TERMINATION OR INCOME STATUS: If this employee/obligor never worked for

you or you are no longer withholding income for this employee/obligor, you must promptly notify the CSE agency and/or

the sender by returning this form to the ad dress listed in the contact information below:

This person has never worked for this empl oyer nor received periodic income.

This person no longer works for this employer nor receives periodic income.

Please provide the following information for the employee/obligor:

Termination date: Last known phone number:

Last known address:

Final payment date to SDU/tribal payee: Final payment

amount:

New employer's name:

New employer's address:

34a

34b

35 36

37

38 39

40

41

CONTACT INFORMATION:

To Employer/Income Withholder: If you have questions, contact

by phone:

, by fax: , by e-mail or webs ite:

Send termination/income status noti ce and other correspondence to:

To Employee/Obligor: If the employee/obligor has questions, contact

by phone:

, by fax: , by e-mail or website:

43 44

46

48 49 42

47

45

50

(issuer name) .

(issuer address).

(issuer name)

.

The Paperwork Reduction Act of 1995

This information collection and associated responses are conducted in accordance with 45 CFR 303.100 of the Child Support Enforcement

Program. This form is designed to provide un iformity and standardization. Public reporting burden for this collection of inf ormation is

estimated to average 5 minutes pe r response for Non-IV-D CPs; 2 minutes per response for employers; 3 seconds for e-IWO employe rs,

including the time for reviewing instructions, gathering and maintaining the data needed, and reviewing the collection of infor mation.

An agency may not conduct or spon sor, and a person is not required to res pond to, a collection of information unless it displays a currently

valid OMB control number.

Page 11 of 11