State of Colorado

Department of the Treasury

Cary Kennedy

State Treasurer

Eric Rothaus

Deputy Treasurer

TIME DEPOSIT RULES

EFFECTIVE SEPTEMBER 1, 2007

CORRESPONDENCE AND INQUIRIES

All correspondence relating to the Colorado Time Deposit

Program should be addressed to:

Time Deposit Manager

140 State Capitol Building

Denver, Colorado 80203

Questions about time deposit policy or application

procedures should be directed to Helen DiBartolomeo,

Time Deposit Manager, at 303/866-5650.

ELIGIBILITY

Banks and savings and loans must be certified as eligible

public depositories by either the Colorado Division of

Banking or the Colorado Division of Financial Services

in accordance with the Public Funds Deposit Protection

Acts, as amended. Contact the Colorado Division of

Banking or the Colorado Division of Financial Services

regarding certification and the collateralization of public

fund deposits. Final eligibility determination will be at

the discretion of the Time Deposit Manager. Depositories

must have positive equity capital. Undivided profits and

capital reserves should be positive.

Bank minimum capital/assets ratio is 4%. Capital

includes capital stock, surplus, undivided profits and

capital reserves less intangible assets. Assets includes the

quarterly average assets less intangible assets. Capital

and intangible assets are currently listed on the Balance

Sheet Schedule RC line 28 or 28a and line 10 and

quarterly average assets are found on Schedule RC-K line

7 or 9 of the Consolidated Report of Condition and

Income.

Savings and loan minimum total risk-based

capital/adjusted total asset ratio is 4%. Total risk-based

capital and adjusted total assets are currently listed on

lines CCR 39 and CCR 25 of the Office of Thrift

Supervision Thrift Financial Report Consolidated Capital

Requirement Schedule CCR.

CALL REPORTS

Each bank's and saving and loan's principal office shall

place this office on a permanent mailing list to receive

copies of their entire signed consolidated reports of

condition sent quarterly to the depository's regulatory

agency within forty-five days from the end of each

quarter. The Treasurer reserves the right to request

monthly statements of condition and other data at any

time before approving deposits. The current five quarters'

complete signed consolidated statement of condition and

requested reports must be on file with the Treasurer five

working days prior to an application date. The maximum

total state time deposit eligibility and deposit limits for

each bank and savings and loan are calculated quarterly

by the Treasurer's staff from copies of these reports.

DEPOSIT LIMIT FORMULAS

Formulas for determining state time deposit eligibility

are:

1. Banks: 50% of the current four quarter average

of equity capital. Equity capital includes capital

stock, surplus, undivided profits and capital

reserves less intangible assets. (Consolidated

Report of Condition and Income Balance Sheet

RC lines 28 or 28a and 10). The minimum

deposit is $100,000; the maximum is

$20,000,000.

2. Savings and Loans: 50% of the current four

quarter average of risk-based capital (Office of

Thrift Supervision Thrift Financial Report

consolidated Capital Requirement Schedule

Page 1 of 3

�CCR line 39).

The minimum deposit is

$100,000; the maximum is $20,000,000.

The Treasurer’s Office reserves the right to accept or

reject all or any portion of applications submitted.

Credit worthiness evaluation factors, including but not

limited to the capital/asset ratios, will be considered in

decisions on individual deposit eligibility limits.

Institutions

whose

condition

meets

minimum

requirements set by the Treasurer may be limited to a

minimum deposit. Institutions with evaluation factors

and ratios below current limits set by the Treasurer will

be prohibited from applying for or receiving state time

deposits until their financial condition improves

measurably and is sustained for a period of time.

The Time Deposit manager allocates all accepted

applications based on current investable fund balances.

Presently the State Treasurer, as official custodian of the

public unit may be insured up to $100,000 per public unit.

However, the two-year SBA Mainstreet program deposits

shall only be in the name of the Treasury General Cash

fund and will count against the total insurance available

for that fund. Applicants should keep in mind that the

deposit or portion thereof, including accrued interest may

increase the bank’s or savings and loan’s collateralization

requirements. However, every attempt will be made to

insure the maximum possible.

FUNDS PLACEMENT AND AUTHORIZED

APPLICANTS

RATES AND RESULTS

Where branches exist, funds are placed with the bank or

savings and loan principal office only. Only the officers

of banks' and savings and loans' principal offices in the

state of Colorado are eligible to apply for state funds.

Depositories shall appoint three authorized applicants (see

Exhibit C). A person may be temporarily appointed to

apply for state time deposits. Appointments, changes,

additions, and temporary appointments must be confirmed

via letter to the State Time Deposit Manager.

APPLICATION PROCEDURE

Applications shall be telephoned to the Treasury 303/866-5650 - between 10:00 a.m. and 2:00 p.m.

Mondays (Tuesdays when Monday is a holiday). The

following information is required:

1. Bank or savings and loan name and location;

2. Applicant's name and telephone number;

3. Wire instructions:

a. Federal Reserve - with transit (ABA)

number, or

b. To correspondent bank - with name and

account number;

4. Dollar amount - per term.

One application for each of the terms offered may be

submitted.

Application will be read back for

confirmation or correction. Applications for deposit

terms of one year or less shall be in the amount of

$100,000 or multiples thereof ($200,000; $300,000, etc.)

Applications for the two-year SBA Mainstreet program

deposits shall be in the amount of $50,000 or multiples

thereof ($100,000, $150,000, etc.).

Applications will not be accepted after 2:00 p.m. on the

application dates. Applications may be changed only

between 10 a.m. and 2:00 p.m. on the application date.

Rates are set by the Treasurer based on current market

information. Call the recording on 303/866-2728 after

9:45 a.m. on Mondays (Tuesdays when Monday is a

Holiday) for this information.

ACCEPTED APPLICATIONS

Accepted applications will be evidenced by a deposit

agreement (see Exhibit A) issued by the Treasurer. The

deposit agreement is the primary contract for the deposit.

The terms of the agreement, payment dates and amounts

due on those dates are printed on the agreement. The

bank or savings and loan acknowledges, accepts and

pledges compliance with all conditions of the deposit

agreement and these time deposit rules via officer

signature. The projected mailing date of agreements is

within one working day following application. Please

arrange for temporary accounting for the funds until

deposit agreements arrive.

Banks and savings and loans will draw a non-negotiable,

non-transferable certificate of deposit from the

information contained in the agreement. The public unit

fund name will be printed on each agreement. The

certificates must be made out to the named Public Unit,

Colorado State Treasurer, Custodian. Certificates drawn

to represent deposits must agree exactly with all

conditions and provisions of the deposit agreement. The

word "Custodian" must follow "Colorado State

Treasurer". Please use the specific PDPA identification

numbers required for the certificates issued as follows:

Treasury General Cash - 010022005101; Department of

Labor and Employment - 010014005101; and Water

Conservation Board - 080036005101. The applicable

payment instructions and "via wire" should appear on the

certificate face. The Treasurer’s Tax ID number is 846000537. Normally an alternate will sign agreements for

the Treasurer. However, the Treasurer's or alternate's

name should not appear on the certificate. The original of

Page 2 of 3

�each deposit agreement issued and its matching certificate

of deposit are to be mailed together to this office within

two working days of receipt by the depository.

FUNDS TRANSFER

Good funds will be transferred per the depository's

instructions from the Treasurer's Account at the Wells

Fargo Bank West, N.A., Denver, Colorado. Transfers are

processed within established conventions. If notice of

credit is not received by 1:00 p.m. on the settlement date,

please notify this office by calling 303/866-5650.

INTEREST AND PRINCIPAL PAYMENTS

Principal and interest is due and payable without notice

on the stated due dates. Interest is computed on a 360day basis and for the exact number of days between

payment dates. Payment dates and amounts are printed

on deposit agreements. These are the only acceptable

dates for payment. The depository will pay at least one

day's interest for each day the payment is late at the

higher of the contracted rate or the current market rate as

determined by the time deposit manager.

All interest and principal due should be transferred in the

aggregate amount (total principal and interest due for all

deposits with the same maturity) to Wells Fargo Bank

West, N.A., Denver, Colorado, ABA #1020-0007-6, for

credit and advice Treasurer, State of Colorado, account

#1010038362. Payments by check will not be accepted.

Totals appear on the "Notice of Cash Due" (see Exhibit

B) mailed to each institution prior to payment dates.

Wiring instructions are printed on the notice. The

"Notice of Cash Due" and accompanying maturing

certificates are mailed from this office approximately ten

calendar days prior to the due date. Cash due notices are

sent in a pre-printed envelope stating, "Attention:

Cashier, Certificate of Deposit Payment Notice".

DEPOSIT INSURANCE AND

COLLATERALIZATION

Currently certificates of deposit may be written for the

following public fund units: Treasury General Cash,

Department of Labor and Employment and the Colorado

Water Conservation Board. If any of these departments

or boards have NOW, Money Market Demand Accounts,

savings accounts or certificates of deposits in addition to

our time deposit with your bank or savings and loan, the

funds will be aggregated and the insurance applied to the

aggregate rather than the individual deposits. The NOW,

Money Market Demand Accounts, savings accounts,

certificates of deposit of other state agencies and

institutions whose public unit status has not been

established and ascertained by the FDIC may be

aggregated with the Treasury General Cash time deposits

and the federal insurance applied to the aggregate.

Any amount in excess of $100,000 (including accrued

interest) deposited by a public unit shall be collateralized

as required by the Public Deposit Protection Acts, article

10.5 of title 11, C.R.S., as amended, or article 47 of title

11, C.R.S., as amended. Contact the Colorado Division

of Banking (303) 894-7575 or the Colorado Division of

Financial Services (303) 894-2336 about collateralizing

of deposits above the insured amount.

EARLY WITHDRAWAL OF DEPOSITS AND PUBLIC

DEPOSIT PROTECTION ACT COMPLIANCE

In the event of an early withdrawal by the Treasurer, the

Treasurer will be subject to an early withdrawal penalty

as set forth in Regulation D of the Board of Governors of

the Federal Reserve System 12 C.F.R. Sec. 204.2 (c)(1)

with the following exceptions: the depository's eligibility

as an eligible public depository is revoked; the depository

is in violation of the Public Deposit Protection Acts,

article 10.5 or 47, title 11, Colorado Revised Statutes as

amended; the depository is in violation of the state time

deposit agreement or rules; the depository or its successor

attempts to alter the agreement in any manner. If the

Treasurer determines any of these exceptions apply, the

Treasurer may, at his/her discretion, call any or all

outstanding deposits, time deposits and accrued interest

thereon for payment immediately without penalty.

DEPOSITS WITH NEWLY OPENED BANKS,

SAVINGS AND LOANS, AND CONVERTED BANKS

Upon certification as an eligible public depository a

newly opened bank or savings and loan may apply for

initial deposits of state funds through the first six months

of operation. A converted bank, following conversion

from an industrial to a commercial bank and upon

certification as an eligible public depository and

completion of six months of operation, may make

application for an initial deposit.

The period for

submitting applications for initial deposits will extend

only through the end of the first year of operation as a

new or converted depository. The initial deposit will

range between $100,000-$300,000. The term will be for

six months. Deposits are due and payable at the end of

the term. The interest rate will be set by the State

Treasury Department. Applications for the balance of a

depository's deposit limit under the current formulas may

be submitted upon completion of twelve months of

operation. The depositories will supply the Time Deposit

Manager with complete quarterly consolidated reports of

financial condition and any other information requested.

All other rules contained herein apply.

Page 3 of 3

�

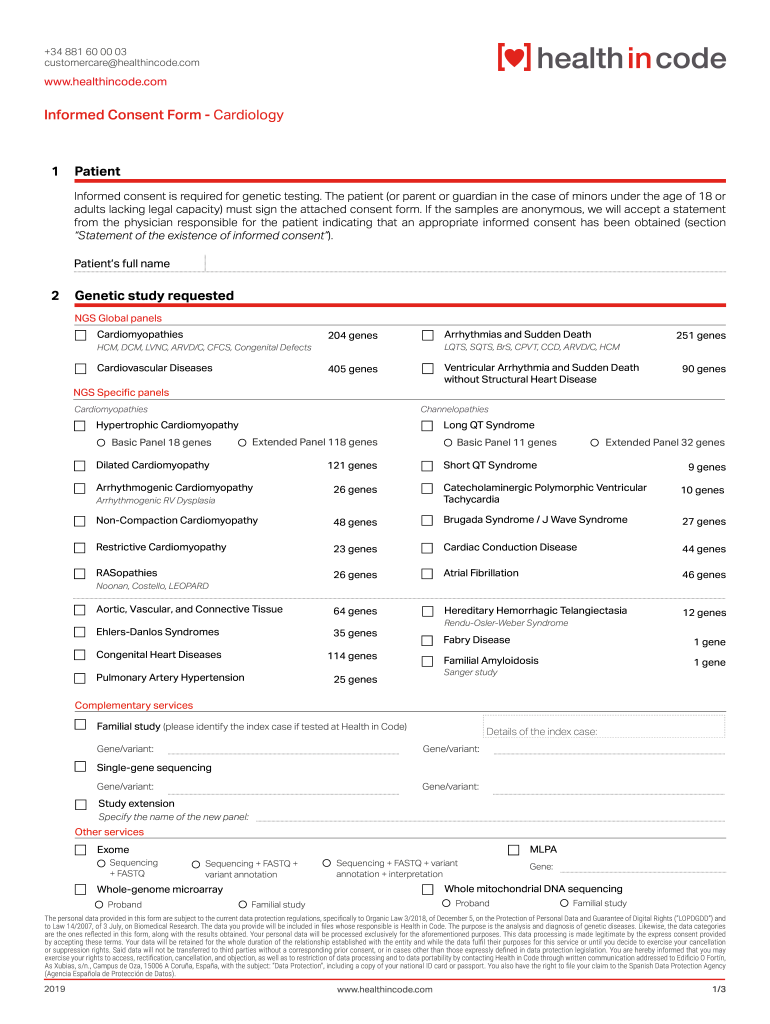

Valuable advice on finalizing your ‘Informed Consent Form Cardiology’ digitally

Are you fed up with the inconvenience of managing paperwork? Search no further than airSlate SignNow, the premier eSignature service for individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can smoothly complete and sign documents online. Utilize the extensive features embedded in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to authorize forms or collect digital signatures, airSlate SignNow takes care of it all effortlessly, needing only a few clicks.

Follow these detailed instructions:

- Log into your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Informed Consent Form Cardiology’ in the editor.

- Click Me (Fill Out Now) to complete the form on your end.

- Add and assign fillable fields for others (if required).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you have to collaborate with your colleagues on your Informed Consent Form Cardiology or send it for notarization—our solution has everything you need to accomplish these tasks. Register with airSlate SignNow today and take your document management to new levels!