Fill and Sign the Instructions for Form 4797 2018internal Revenue Service

Valuable instructions for finalizing your ‘Instructions For Form 4797 2018internal Revenue Service’ online

Are you exhausted by the difficulties of handling paperwork? Search no further than airSlate SignNow, the premier eSignature platform for individuals and organizations. Wave farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and approve paperwork online. Utilize the extensive features embedded in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve forms or collect signatures, airSlate SignNow manages it all seamlessly, needing just a few clicks.

Follow this comprehensive guide:

- Sign in to your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Instructions For Form 4797 2018internal Revenue Service’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your colleagues on your Instructions For Form 4797 2018internal Revenue Service or send it for notarization—our solution provides you with everything you require to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to unprecedented levels!

FAQs

-

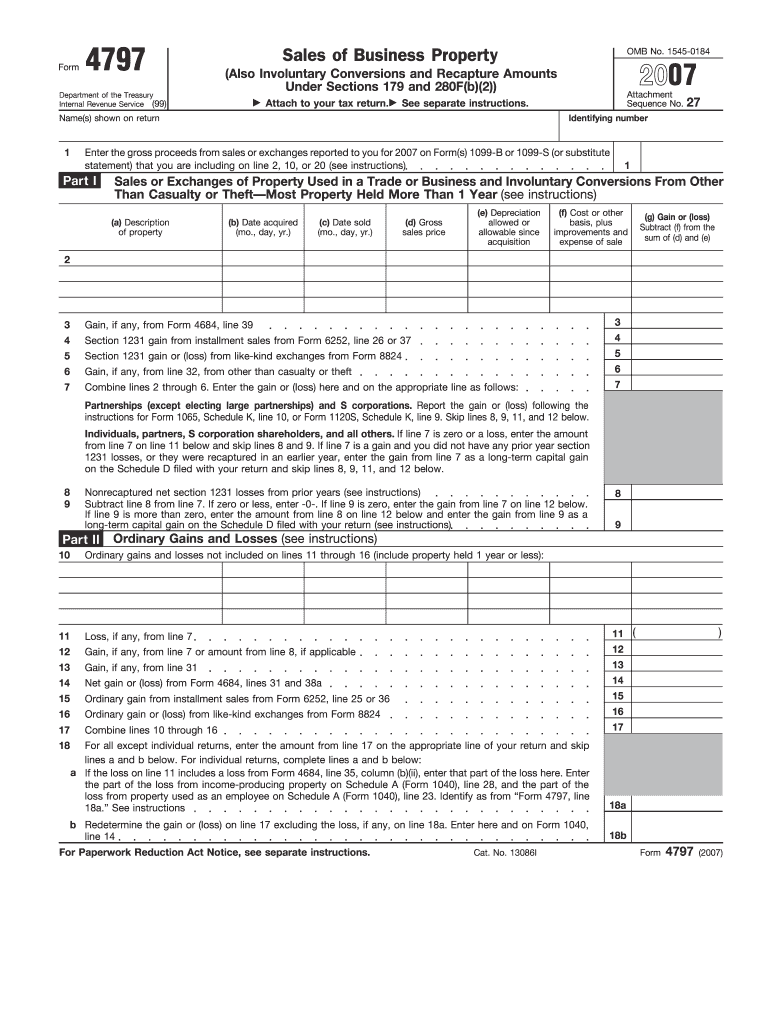

What are the Instructions For Form 4797 Internal Revenue Service?

The Instructions For Form 4797 Internal Revenue Service guide taxpayers on how to report the sale of business property. This form is used to report gains and losses from the sale or exchange of assets, including real estate and other properties. Understanding these instructions is essential for accurate tax reporting and compliance.

-

How can airSlate SignNow help with filling out the Instructions For Form 4797 Internal Revenue Service?

airSlate SignNow simplifies the process of filling out the Instructions For Form 4797 Internal Revenue Service by allowing users to create, edit, and eSign documents seamlessly. Our platform provides templates that can be customized to fit your specific needs, ensuring that you adhere to all IRS guidelines effectively.

-

What features does airSlate SignNow offer for managing tax forms like Form 4797?

airSlate SignNow offers features such as document templates, eSignatures, and collaboration tools that streamline the completion of tax forms like Form 4797. These features ensure that you can easily manage, sign, and send your documents while keeping them secure and compliant with IRS regulations.

-

Is airSlate SignNow a cost-effective solution for handling forms like the Instructions For Form 4797 Internal Revenue Service?

Yes, airSlate SignNow is a cost-effective solution for handling forms like the Instructions For Form 4797 Internal Revenue Service. Our pricing plans are designed to accommodate businesses of all sizes, providing essential features without the burden of high costs, making tax document management efficient and affordable.

-

Can I integrate airSlate SignNow with other applications for tax management?

Absolutely! airSlate SignNow integrates with various applications that facilitate tax management, allowing you to enhance your workflow when dealing with the Instructions For Form 4797 Internal Revenue Service. Popular integrations include accounting software and document management systems, ensuring a seamless experience.

-

What benefits does airSlate SignNow provide for businesses dealing with IRS forms?

airSlate SignNow provides numerous benefits for businesses dealing with IRS forms, including enhanced efficiency, improved accuracy, and secure document handling. By utilizing our platform for the Instructions For Form 4797 Internal Revenue Service, you can ensure that your forms are completed correctly and submitted on time.

-

Are there any customer support options available for using airSlate SignNow with tax forms?

Yes, airSlate SignNow offers comprehensive customer support options to assist you with using our platform for tax forms like the Instructions For Form 4797 Internal Revenue Service. Whether you need help with technical issues or have questions about formatting your documents, our support team is ready to help.

The best way to complete and sign your instructions for form 4797 2018internal revenue service

Find out other instructions for form 4797 2018internal revenue service

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles