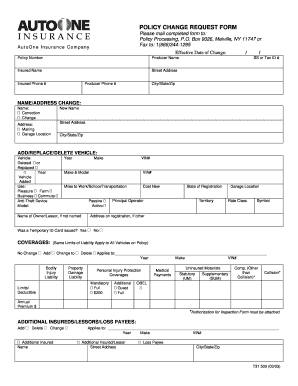

Fill and Sign the Insurance Policy Form

Valuable tips for preparing your ‘Insurance Policy Form’ digitally

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and small to medium businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the robust features included in this straightforward and budget-friendly platform and transform your document management strategy. Whether you need to authorize forms or collect electronic signatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Follow these comprehensive instructions:

- Sign in to your account or create a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Insurance Policy Form’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Insert and designate fillable fields for others (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Download, print a copy for yourself, or convert it into a reusable template.

No need to worry if you require collaboration with your colleagues on your Insurance Policy Form or need to send it for notarization—our platform provides everything you need to accomplish these tasks. Sign up with airSlate SignNow today and elevate your document management to a new height!

FAQs

-

What is an Insurance Policy Form and how can airSlate SignNow help?

An Insurance Policy Form is a document used to outline the terms and conditions of an insurance agreement. With airSlate SignNow, you can easily create, edit, and send these forms for eSignature, streamlining your insurance processes and ensuring compliance with legal standards.

-

How does airSlate SignNow ensure the security of my Insurance Policy Form?

airSlate SignNow prioritizes security by using advanced encryption methods to protect your Insurance Policy Form during transmission and storage. Additionally, we comply with industry standards and regulations to safeguard your sensitive information.

-

What features does airSlate SignNow offer for managing Insurance Policy Forms?

airSlate SignNow provides a range of features specifically designed for managing Insurance Policy Forms, including customizable templates, automated workflows, and real-time tracking of document status. This ensures that your forms are efficiently processed and signed without any delays.

-

Is airSlate SignNow suitable for small businesses handling Insurance Policy Forms?

Absolutely! airSlate SignNow is a cost-effective solution ideal for small businesses that need to manage Insurance Policy Forms efficiently. Our user-friendly platform allows you to create and send forms quickly, helping you save time and resources.

-

Can I integrate airSlate SignNow with other software to manage Insurance Policy Forms?

Yes, airSlate SignNow offers seamless integrations with popular software like Salesforce, Google Drive, and Dropbox. This allows you to enhance your workflow for managing Insurance Policy Forms, making it easier to access and share documents across platforms.

-

What is the pricing structure for using airSlate SignNow for Insurance Policy Forms?

airSlate SignNow offers flexible pricing plans tailored to your needs, starting with a free trial to test the platform. Our plans include essential features for managing Insurance Policy Forms, allowing you to choose the option that best fits your budget and requirements.

-

How can I track the status of my Insurance Policy Form with airSlate SignNow?

With airSlate SignNow, you can easily track the status of your Insurance Policy Form through our dashboard. You'll receive notifications when recipients view or sign your forms, ensuring you stay informed throughout the process.

Find out other insurance policy form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles