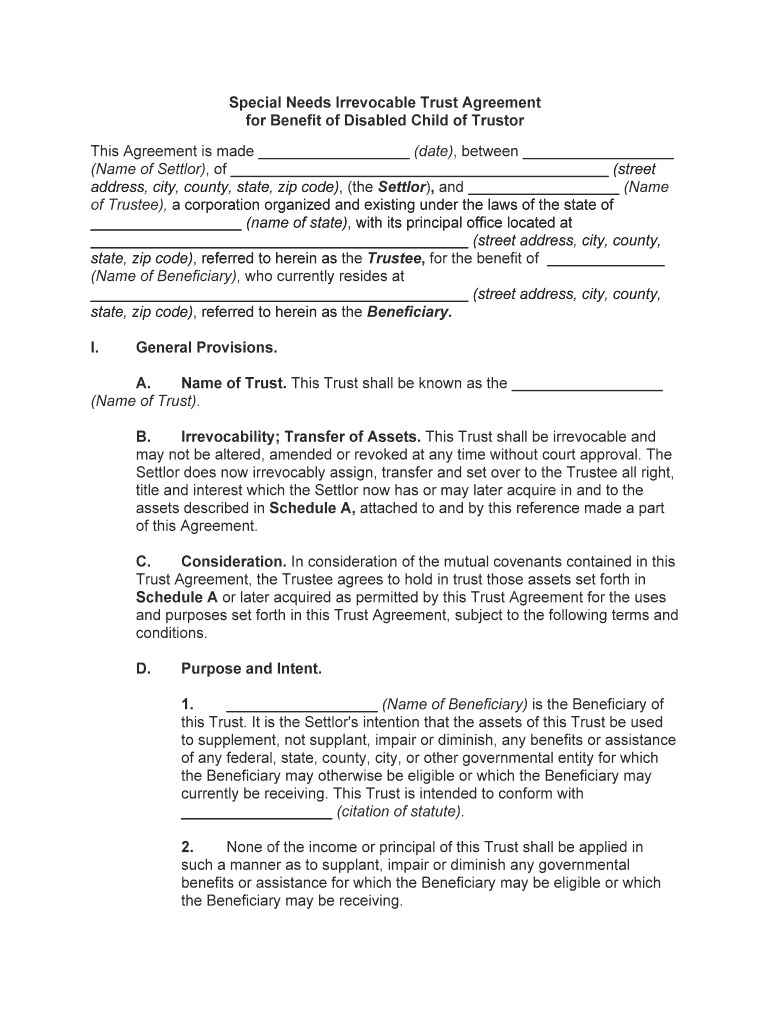

Special Needs Irrevocable Trust Agreement

for Benefit of Disabled Child of Trustor

This Agreement is made __________________ (date) , between __________________

(Name of Settlor) , of _____________________________________________ (street

address, city, county, state, zip code), (the Settlor ), and __________________ (Name

of Trustee), a corporation organized and existing under the laws of the state of

__________________ (name of state), with its principal office located at

_____________________________________________ (street address, city, county,

state, zip code), referred to herein as the Trustee , for the benefit of ______________

(Name of Beneficiary) , who currently resides at

_____________________________________________ (street address, city, county,

state, zip code), referred to herein as the Beneficiary.

I. General Provisions.

A. Name of Trust. This Trust shall be known as the __________________

(Name of Trust).

B. Irrevocability; Transfer of Assets. This Trust shall be irrevocable and

may not be altered, amended or revoked at any time without court approval. The

Settlor does now irrevocably assign, transfer and set over to the Trustee all right,

title and interest which the Settlor now has or may later acquire in and to the

assets described in Schedule A, attached to and by this reference made a part

of this Agreement.

C. Consideration. In consideration of the mutual covenants contained in this

Trust Agreement, the Trustee agrees to hold in trust those assets set forth in

Schedule A or later acquired as permitted by this Trust Agreement for the uses

and purposes set forth in this Trust Agreement, subject to the following terms and

conditions.

D. Purpose and Intent.

1. __________________ (Name of Beneficiary) is the Beneficiary of

this Trust. It is the Settlor's intention that the assets of this Trust be used

to supplement, not supplant, impair or diminish, any benefits or assistance

of any federal, state, county, city, or other governmental entity for which

the Beneficiary may otherwise be eligible or which the Beneficiary may

currently be receiving. This Trust is intended to conform with

__________________ (citation of statute).

2. None of the income or principal of this Trust shall be applied in

such a manner as to supplant, impair or diminish any governmental

benefits or assistance for which the Beneficiary may be eligible or which

the Beneficiary may be receiving.

3. Consistent with the Trust's purpose, before expending any amounts

from the net income or principal of this Trust, the Trustee shall consider

the availability of all benefits from government or private assistance

programs for which the Beneficiary may be eligible. The Trustee, where

appropriate and to the extent possible, shall endeavor to maximize the

collection, and facilitate the distribution of, these benefits for the benefit of

the Beneficiary. Notwithstanding the foregoing, the Trustee shall distribute

income to the Beneficiary, or on

__________________ (his/her) behalf,

such that the total annual distributions during a calendar year shall be

actuarially sound consistent with HCFA Transmittal 64 §3257.

4. The Beneficiary does not have the power to assign, encumber,

direct, distribute, or authorize distributions from this Trust.

E. Waiver. The parties intend to negate and eliminate any discretion granted

to any court pursuant to

__________________ (citation of statute) . Neither Trust

principal nor income shall be subject to any court directed invasion pursuant to

the provisions of

__________________ (citation of statute) .

II. Distribution of Income and Principal.

A. Distribution.

1. The Trustee shall pay to or apply for the benefit of the Beneficiary

such amounts from the income or principal, as the Trustee in his or her

sole discretion may from time to time deem necessary or advisable, for

special needs of the Beneficiary, who because of the nature of the

disability may be dependent on governmental entitlements for life. Any

income not distributed shall be added to the principal of the Trust.

Notwithstanding the foregoing, the Trustee shall distribute income to the

Beneficiary, or on

__________________ (his/her) behalf, such that the

total annual distributions during a calendar year shall be actuarially sound

consistent with HCFA Transmittal 64 §3257.

2. The Trustee shall, in making distributions to the Beneficiary for

__________________ (his/her) special needs, take into consideration the

applicable resource and income limitations of the governmental benefit or

assistance programs for which the Beneficiary is eligible.

3. Notwithstanding the above provisions, the Trustee may, in the

Trustee's sole discretion, make distributions to third parties to meet the

Beneficiary's need for food, clothing, shelter, health care, or personal

needs, even if those distributions will impair or diminish the Beneficiary's

receipt or eligibility for government benefits or assistance, but only if the

Trustee determines (i) that the Beneficiary's basic needs will be better met

if such distribution is made, and (ii) if is in the Beneficiary's best interests

to suffer the consequent effect, if any, on the Beneficiary's eligibility for, or

receipt of, government benefits or assistance.

4. If the mere existence of this authority, set forth in the preceding

Subparagraph 3, to make distributions, whether exercised by the Trustee

or not, would, under the terms of any program of government benefits or

assistance, result in the Beneficiary's reduction or loss of such benefits or

assistance, then, the preceding Subparagraph 3 shall be null and void

and the Trustee's authority to make such distributions shall cease and the

Trustee's authority shall be limited as provided in Subparagraphs 1 and 2

of this Paragraph A.

B. Additions to Trust. With the Trustee's consent, any person may,

at any time, from time to time, by court order, assignment, gift, transfer,

deed, or will, add to the principal of the Trust created in this Trust

Agreement. Any property so added shall be held, administered, and

distributed under the terms of this Trust as a Supplemental Needs Trust.

The Trustee shall execute documents necessary to accept additional

contributions to the Trust. Such additions may be listed in a rider similar in

form to the attached Schedule A and shall be attached to this Trust

Agreement.

C. Other Needs and Comforts. The Trustee has discretion to use

income and/or principal to insure that the Beneficiary enjoys the benefits

of education, recreation, hobbies, vacation, modes of transportation,

entertainment, and any other needs and/or comforts the Beneficiary may

require to maximize the Beneficiary's life and to keep the Beneficiary in the

general community for so long as medically possible and safe. This

discretion shall include the use of income for needed medical care and/or

supplies or equipment not paid for by private insurance or government

entitlements. This provision shall include the purchase of any equipment

or treatment which would enhance the quality of the life of the Beneficiary.

III. Termination of Trust.

A. Disposition of Trust on Death of Beneficiary. The Trust shall terminate

upon the death of the Beneficiary, and the Trustee shall distribute any principal

and accumulated interest as follows:

1. The __________________ (name of state) Department of Social

Services, Department of Health, or other appropriate Medicaid entity

within

__________________ (name of state) shall be reimbursed for

Medical Assistance provided to the Beneficiary during _____________

(his/her) lifetime, as consistent with federal and state law. If the

Beneficiary received Medical Assistance in more than one state, then the

amount distributed to each state shall be based on each state's

proportionate share of the total amount of Medical Assistance benefits

paid by all states on behalf of the Beneficiary.

2. All the rest and remainder that then remains in the Trust shall be

distributed to the estate of

__________________ (Name of Beneficiary) .

IV. Trustees

A. Identity; Successor Trustees; Resignation of Trustees.

1. The initial Trustee of this Trust Agreement shall be

__________________ (Name of Trustee) , residing at

_____________________________________________ (street address,

city, county, state, zip code), __________________ (Name of Successor

Trustee) , residing at _________________________________________

(street address, city, county, state, zip code), shall serve as successor

Trustee upon the incapacity, removal, resignation, or death of the initial

Trustee.

2. If no Trustee or successor Trustee exists to administer the Trust

Estate, and if the Settlor is unable to appoint a successor Trustee, then a

successor Trustee shall be appointed by:

a. Anyone holding a valid durable power of attorney on behalf

of the Settlor; or if no such person exists, then by

b. The last surviving Trustee to serve; or in default of such

appointment by the last surviving Trustee, then by

c. A majority of the then-income beneficiaries of this Trust; or if

there are no income beneficiaries, then by

d. The remainder beneficiaries, or their legal representative if

under a disability, who may petition the court having jurisdiction

over this Trust to appoint a successor Trustee.

3. A Trustee may resign by giving written notice, a signed and

acknowledged instrument, delivered to (i) the Beneficiary; (ii) the guardian

of the Beneficiary; and (iii) any person or entity required by statute or

regulation to receive such notice.

4. Upon execution by a successor Trustee of a written acceptance of

successor Trusteeship, the successor Trustee shall be vested with all the

estate, title, powers, duties, discretions and immunities granted to the

Trustee under this Trust Agreement. The previous Trustees or Trustee

shall execute and deliver to the successor Trustee such assignments or

other instruments as may be necessary or advisable. No successor

Trustees shall be charged with any default occurring prior to becoming a

Trustee under this Trust Agreement.

B. Powers and Duties of Trustees.

1. In addition to any powers which may be conferred upon the Trustee

under the laws of

__________________ (name of state) in effect during

the life of this Trust, the Settlor confers upon the Trustee all those

discretionary powers of

__________________ (citation of statute) or

similar statute or statutes governing the discretion of Trustees so as to

confer upon the Trustee the broadest possible powers available for the

management and investment of the trust assets and consistent

with

__________________ (citation of statute), as may be amended from

time to time. If the Trustee wishes to exercise powers beyond the express

and implied powers of

__________________ (citation of statute) , the

Trustee shall seek, and must obtain, judicial approval.

2. No person, firm or corporation dealing with the Trustee or a

nominee of the Trustee or performing any act pursuant to action taken or

order given by the Trustee or such nominee shall be obliged to inquire as

to the propriety, validity or legality of such action or order under this Trust

Agreement, nor shall any such person be liable for the application of any

money or other consideration paid to the Trustee or such nominee, but

instead may rely upon any action taken by the Trustee or such nominee

pursuant to the powers and authorities conferred upon it under the

provisions of this Trust Agreement in all respects as if the same were

completely unlimited. No transfer agent or registrar of any security held

under this Trust Agreement shall be required to inquire as to the propriety,

validity or legality of any transfer made by the Trustee or such nominee.

3. If more than one Trustee shall be serving as Trustee at any time,

then any bank, brokerage firm, or other financial or insurance institution

doing business with the Trustees is authorized to open any account in

such a manner as to permit the transaction of any business upon the

signature of both Trustees rather than the signature of a single Trustee.

C. Compensation of Trustee. The Trustee shall be entitled to compensation

as may be allowable under the laws of

__________________ (name of

state) pursuant to __________________ (citation of statute) , or as may be

amended. The Trustee shall be entitled to be reimbursed for reasonable

expenses incurred by the Trustee in the administration of this Trust.

D. Bond. The Trustee shall be not required to execute and file a bond unless

and until determined by a court having jurisdiction over this Trust.

E. Annual Trustee Accounting.

1.The Trustee shall provide a summary of this Trust to the

appropriate

Medicaid entity as part of the Settlor's or the Beneficiary's

annual recertification for

Medicaid eligibility.

2. The Trustee shall render an annual account of the administration of

this Trust to the income Beneficiary, which accounting shall be made as

soon as practical after the close of the Trust's calendar year. A sufficient

accounting shall be deemed as having been made by the submission to

the Beneficiary of a copy of the federal fiduciary income-tax return filed for

the Trust, if any. If no objection to an account has been made in writing by

the party entitled to it within

__________________ (number) days after

the mailing of such account by the Trustee, it shall be deemed approved

and shall be conclusive upon all persons interested and their successors

in interest. However, if such an objection is made, the Trustee shall

provide a formal accounting which reflects the Trust's assets, obligations,

income, distributions, and expenditures.

3.The records of the Trustee shall be open at all reasonable times to

the inspection by the Beneficiary and such other entity, including a

Medicaid entity, and/or court having jurisdiction over this Trust Estate, as

may be applicable.

4. The Trustee shall be entitled at any time to have a judicial

settlement of his or her accounts.

V. Miscellaneous Provisions.

A. Governing Law; Severability. All questions relating to the validity and

construction of this Trust, the determination of the share of the Beneficiary, the

dates, powers, authority and discretion of the Trustee, and all other matters

arising in connection with this Trust Agreement, shall be governed by, and the

Trust shall be administered in accordance with the laws of

__________________

(name of state) . If any provision of this Trust Agreement shall be invalid or

unenforceable, the remaining provisions of this Trust Agreement shall subsist

and be carried into effect.

B. Continuation of Powers upon Termination. The title, powers, duties,

immunities and discretion conferred upon the Trustee by this Trust Agreement

shall continue after termination of the Trust and until final distribution.

C. Notification to State upon Death of Beneficiary. On the death of the

Beneficiary, the Trustee shall provide the required notification to the Social

Services District or state agency which provided medical assistance to the

Beneficiary. The Trustee shall verify an itemized printout of the total medical

assistance provided to the Beneficiary during the Beneficiary's lifetime. The

Trustee shall then satisfy such claim in accordance with Section III of this Trust

Agreement and in accordance with federal and state law.

D. Notification to Social Services District in Advance of Any Transfers

from Trust Principal for Less Than Fair Market Value. If the Beneficiary is

receiving Medical Assistance (

Medicaid ), then in that event, the Trustee shall

notify the local Social Services District in advance of any transactions involving

transfers from the Trust principal for less than fair market value.

E. Notification to Social Services District in Advance of Any

Transaction that Substantially Depletes Principal. The Trustee shall notify the

local Social Services District in advance of any transaction that substantially

depletes the principal, in accordance with federal and state laws.

__________________ (Citation of statute) currently requires such notification in

the case of trusts exceeding $ __________________ .

F. Construction. In construing this Trust, feminine or neuter pronouns shall

be substituted for those of the masculine form and vice versa, and the plural for

the singular and vice versa, in any case in which the context may so require.

G. Headings. Any headings or captions in the Trust Agreement are for

reference only, and shall not expand, limit, change, or affect the meaning of any

provision of the Trust.

The Settlor and the Trustee have executed this Trust Agreement at

_____________________________________________ (place of execution) the day

and year first above-written.

____________________________

(Signature of Settlor)

________________________

(Printed Name of Settlor)

________________________

(Name of Trustee)

____________________________

(Signature of Officer of Trustee)

________________________

(Printed Name of Officer)

(Acknowledgments)

(Attachment of schedule)