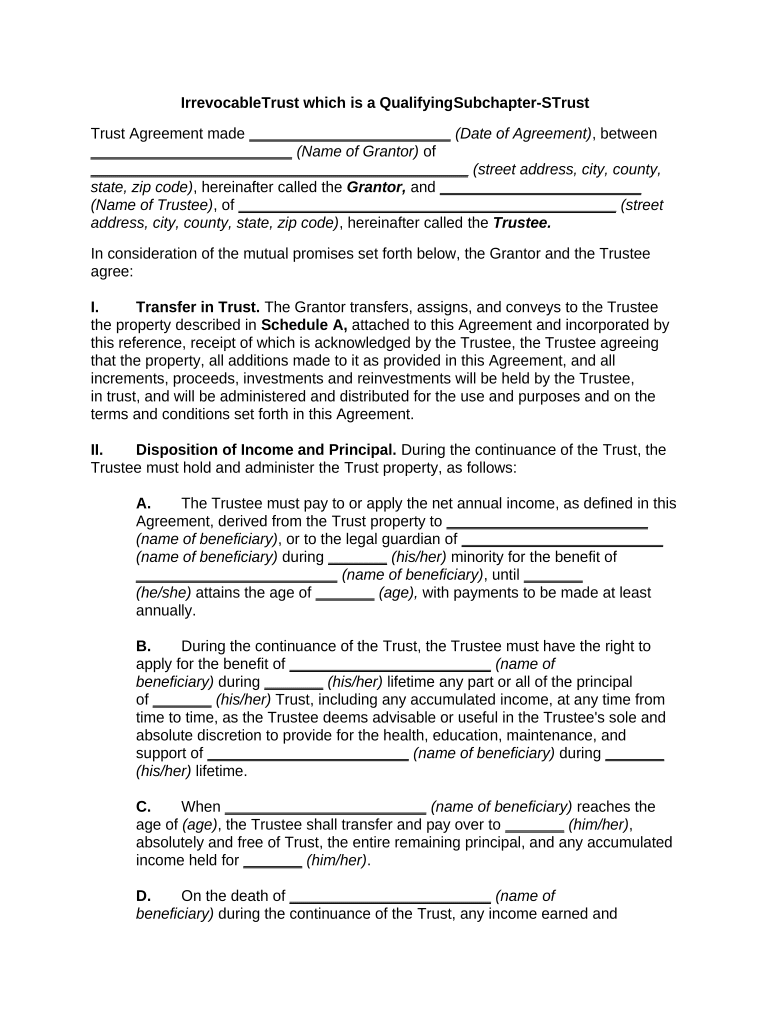

Fill and Sign the Irrevocable Trust Which is a Qualifying Subchapter S Trust 497333692 Form

Practical advice on finalizing your ‘Irrevocable Trust Which Is A Qualifying Subchapter S Trust 497333692’ online

Are you fed up with the inconvenience of managing paperwork? Search no further than airSlate SignNow, the premier eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can easily finalize and sign documents online. Utilize the extensive features embedded in this intuitive and cost-effective platform and transform your method of document administration. Whether you need to authorize forms or collect electronic signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Sign in to your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template repository.

- Open your ‘Irrevocable Trust Which Is A Qualifying Subchapter S Trust 497333692’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for other users (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or transform it into a reusable template.

No need to worry if you need to collaborate with your teammates on your Irrevocable Trust Which Is A Qualifying Subchapter S Trust 497333692 or send it for notarization—our platform has everything you require to complete those tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is an Irrevocable Trust Which Is A Qualifying Subchapter S Trust?

An Irrevocable Trust Which Is A Qualifying Subchapter S Trust is a specialized trust structure that allows assets to be managed and preserved for beneficiaries while maintaining compliance with Subchapter S tax regulations. This type of trust ensures that income is reported on the beneficiaries’ tax returns, providing potential tax benefits. Understanding its features is essential for effective estate planning.

-

How does an Irrevocable Trust Which Is A Qualifying Subchapter S Trust benefit me?

Using an Irrevocable Trust Which Is A Qualifying Subchapter S Trust can provide signNow benefits including asset protection, tax efficiency, and control over asset distribution. By designating specific terms and beneficiaries, you can ensure that your assets are managed according to your wishes. This trust can also help avoid probate, streamlining the transfer of assets.

-

What are the costs associated with setting up an Irrevocable Trust Which Is A Qualifying Subchapter S Trust?

The costs for establishing an Irrevocable Trust Which Is A Qualifying Subchapter S Trust vary depending on the complexity of the trust and the services of a legal professional. Generally, you can expect to pay for legal fees, filing fees, and any additional costs related to asset transfer. It's important to consult with a financial advisor to understand the total investment.

-

Can I integrate airSlate SignNow with my Irrevocable Trust Which Is A Qualifying Subchapter S Trust documents?

Yes, airSlate SignNow offers seamless integration options that allow you to manage and eSign documents related to your Irrevocable Trust Which Is A Qualifying Subchapter S Trust. This integration enhances efficiency by enabling easy document sharing and tracking. You can streamline your workflow, ensuring that all necessary documents are securely signed and stored.

-

What features does airSlate SignNow offer for managing an Irrevocable Trust Which Is A Qualifying Subchapter S Trust?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and advanced security measures for managing your Irrevocable Trust Which Is A Qualifying Subchapter S Trust. These tools make it easier to create, sign, and store important documents securely. Additionally, the platform supports compliance with legal standards, ensuring your trust documentation is valid.

-

Is airSlate SignNow secure for handling sensitive information related to my Irrevocable Trust Which Is A Qualifying Subchapter S Trust?

Absolutely, airSlate SignNow prioritizes security, utilizing advanced encryption and compliance with industry standards to protect sensitive information related to your Irrevocable Trust Which Is A Qualifying Subchapter S Trust. You can rest assured that your documents are safe from unauthorized access. Regular audits and security updates further enhance the safety of your data.

-

How can I ensure compliance when using an Irrevocable Trust Which Is A Qualifying Subchapter S Trust?

To ensure compliance with an Irrevocable Trust Which Is A Qualifying Subchapter S Trust, it's essential to work with legal and tax professionals who can guide you through the requirements. Keeping accurate records and utilizing reliable document management tools like airSlate SignNow can aid in maintaining compliance. Regular reviews of your trust’s terms and tax implications are also recommended.

The best way to complete and sign your irrevocable trust which is a qualifying subchapter s trust 497333692 form

Find out other irrevocable trust which is a qualifying subchapter s trust 497333692 form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles