Fill and Sign the Ky Living Trust Form

Helpful Advice on Finalizing Your ‘Ky Living Trust’ Online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly finish and approve paperwork online. Utilize the extensive features integrated into this user-friendly and affordable platform and transform your document management strategy. Whether you need to approve forms or gather eSignatures, airSlate SignNow manages it all with ease, in just a few clicks.

Follow this detailed guide:

- Access your account or register for a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Ky Living Trust’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

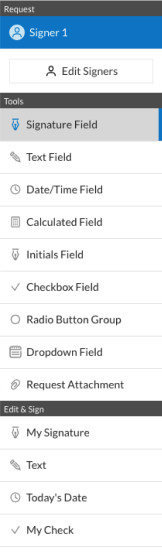

- Include and designate fillable fields for others (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or transform it into a multi-usable template.

No need to worry if you wish to collaborate with your teammates on your Ky Living Trust or send it for notarization—our platform provides everything you require to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to a new height!

FAQs

-

What is a Ky Living Trust?

A Ky Living Trust is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. It helps avoid probate, ensuring a smoother transition of your estate to your beneficiaries. With airSlate SignNow, you can easily create and manage your Ky Living Trust documents online.

-

How does airSlate SignNow help with creating a Ky Living Trust?

airSlate SignNow provides an intuitive platform for drafting and signing your Ky Living Trust documents. Our easy-to-use templates and eSignature capabilities streamline the process, making it accessible for everyone. You can customize your trust to fit your specific needs without the hassle of traditional paperwork.

-

What are the benefits of using a Ky Living Trust?

Using a Ky Living Trust offers several benefits, including avoiding probate, maintaining privacy, and providing flexibility in asset management. It allows you to specify terms for asset distribution, ensuring your wishes are honored. With airSlate SignNow, you can efficiently manage these benefits through our digital platform.

-

Is there a cost associated with creating a Ky Living Trust using airSlate SignNow?

Yes, there is a cost associated with creating a Ky Living Trust using airSlate SignNow, but it is designed to be cost-effective compared to traditional legal services. Our pricing plans are transparent, allowing you to choose the best option for your needs. You can save money while ensuring your estate planning is handled professionally.

-

Can I integrate airSlate SignNow with other tools for managing my Ky Living Trust?

Absolutely! airSlate SignNow offers integrations with various tools and platforms to enhance your experience in managing your Ky Living Trust. Whether you need to connect with cloud storage services or other document management systems, our platform is designed to work seamlessly with your existing workflows.

-

How secure is my information when using airSlate SignNow for my Ky Living Trust?

Your security is our top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your personal information and documents related to your Ky Living Trust. You can trust that your sensitive data is safe while using our platform.

-

Can I update my Ky Living Trust after it's created?

Yes, you can update your Ky Living Trust at any time using airSlate SignNow. Our platform allows you to make changes easily, ensuring that your trust reflects your current wishes and circumstances. Keeping your trust up-to-date is essential for effective estate planning.

The best way to complete and sign your ky living trust form

Get more for ky living trust form

Find out other ky living trust form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles