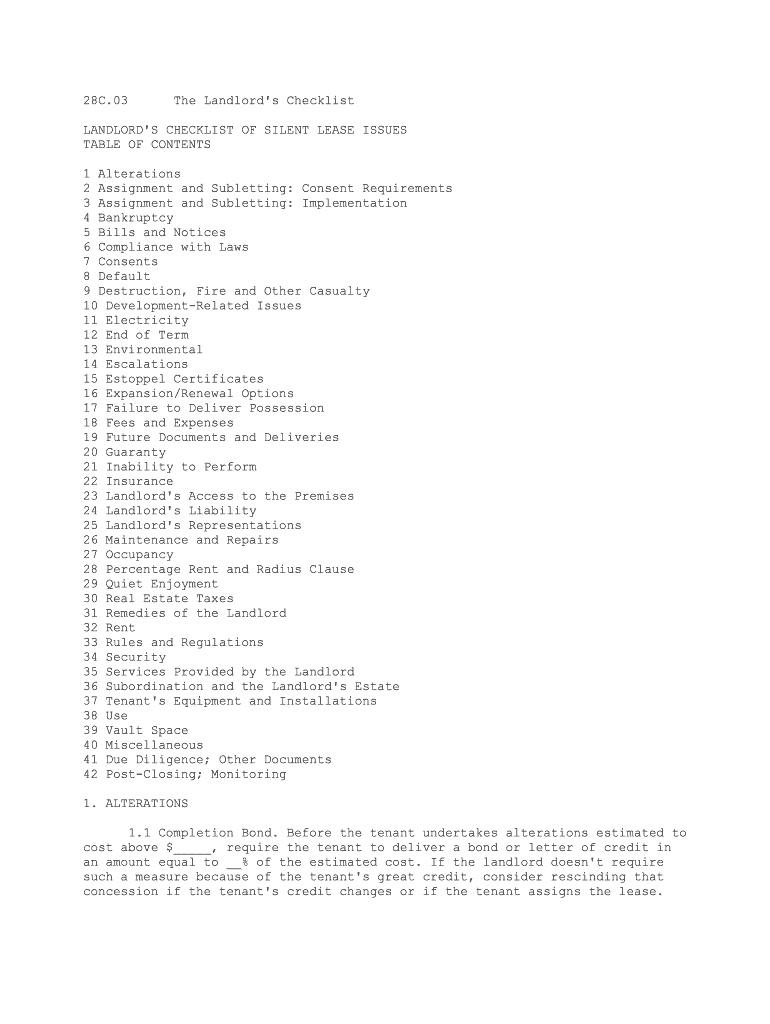

28C.03 The Landlord's Checklist LANDLORD'S CHECKLIST OF SILENT LEASE ISSUES

TABLE OF CONTENTS

1 Alterations

2 Assignment and Subletting: Consent Requirements

3 Assignment and Subletting: Implementation

4 Bankruptcy

5 Bills and Notices

6 Compliance with Laws

7 Consents 8 Default

9 Destruction, Fire and Other Casualty

10 Development-Related Issues

11 Electricity

12 End of Term

13 Environmental

14 Escalations

15 Estoppel Certificates

16 Expansion/Renewal Options

17 Failure to Deliver Possession

18 Fees and Expenses

19 Future Documents and Deliveries

20 Guaranty

21 Inability to Perform

22 Insurance

23 Landlord's Access to the Premises

24 Landlord's Liability

25 Landlord's Representations

26 Maintenance and Repairs

27 Occupancy

28 Percentage Rent and Radius Clause

29 Quiet Enjoyment

30 Real Estate Taxes

31 Remedies of the Landlord32 Rent

33 Rules and Regulations

34 Security

35 Services Provided by the Landlord

36 Subordination and the Landlord's Estate

37 Tenant's Equipment and Installations 38 Use

39 Vault Space

40 Miscellaneous

41 Due Diligence; Other Documents

42 Post-Closing; Monitoring

1. ALTERATIONS 1.1 Completion Bond. Before the tenant undertakes alterations estimated to

cost above $_____, require the tenant to deliver a bond or letter of credit in

an amount equal to __% of the estimated cost. If the landlord doesn't require

such a measure because of the tenant's great credit, consider rescinding that

concession if the tenant's credit changes or if the tenant assigns the lease.

1.2 Restoration. State that the landlord's consent to any alteration does

not waive the tenant's obligation to remove it and restore the premises at the

end of the term.

1.3 Artists' Rights. Prohibit the tenant from installing any artwork that

could give the artist a right under federal law to prevent the artwork from

being removed.

1.4 Third-Party Fees. Require the tenant to reimburse the landlord for its

architect's and other professional fees in reviewing plans and specifications.

1.5 Supervisory Fee. Provide that the landlord may charge a supervisory

fee for supervising the making of alterations and reviewing environmental

conditions. The landlord's wage schedule or standard rates in effect from time

to time should constitute prima facie evidence of reasonableness.

1.6 ADA. Require tenant's alterations to comply with The Americans with

Disabilities Act of 1990, 42 U.S.C. §§ 12101 et seq. (the "ADA").

1.7 Labor Harmony. The tenant's obligation to maintain labor harmony

should relate not merely to construction, but also to any other activities at

the property.

1.8 Exterior Hoist. If the tenant wants to use a hoist outside the

building, all lease provisions, rules and regulations that govern alterations

and activities within the premises should also apply to the hoist. Require the

tenant to remove the hoist by a certain date. Should the landlord have the right

to "free rides" on any such hoist? If other tenants complain about the hoist or

even try to claim rent offsets because of it, the tenant should indemnify the

Landlord. If the landlord has installed the hoist, provide for scheduling,

charges, and the right to remove it.

1.9 Tenant's Records. Consider requiring the tenant to maintain records of

the costs of its improvements for six years. This information may help in real

estate tax protest proceedings.

1.10 Warranties. Require the tenant to provide a warranty on completed

restoration work or at least an assignment of any warranty it receives from its

contractor. If the tenant surrenders space (either at the end of the term or

because the tenant reduces its occupancy), require the tenant to assign to the

landlord any warranties the tenant received for any improvements or equipment

surrendered.

1.11 Modifications to Plans and Specifications. If the tenant modifies its

plans and specifications after the landlord approves them, the alterations as

modified should still meet a certain level of quality, whether or not the

landlord can control changes.

1.12 Plans and Specifications. Require the tenant to deliver plans and

specifications (initial and as-built) in a specified (or more current) computer

aided design ("CAD") format using naming conventions and other criteria as the

landlord approves or requires.

1.13 Activities Outside Premises. If the lease lets the tenant perform any

alterations outside the premises (e.g., cable or riser installations, or changes

in elevator operation), then require the tenant to comply with all the same

requirements that would govern alterations within the premises.

2. ASSIGNMENT AND SUBLETTING: CONSENT REQUIREMENTS2.1 Change of Control. Treat a change of control of the tenant (unless a

public company) as an assignment. To monitor, require the tenant to: (a)

represent and warrant current ownership structure when the parties sign the

lease, to establish a baseline and define "change of control"; (b) deliver an

annual certificate from its accountant or attorney confirming the tenant's then-

current ownership structure; and (c) report any change of control. Do not refer

only to corporations, partnerships, and limited liability companies. The

restriction on transferring equity should apply even to future entity types not

yet known.

2.2 Continuing Status as Affiliate. If the lease allows "free transfers"

to the tenant's affiliates, require that the assignee or subtenant thereafter

remain an affiliate throughout the lease term. If affiliation ceases, the tenant

must notify the landlord (but the landlord should not assume the tenant will

remember to do so). At that point the transaction becomes a prohibited

transaction requiring the landlord's consent and may, if not cured, become an

event of default.

2.3 Restriction. Prohibit assignments/sublets to existing tenants in the

building or for less than fair market rent or the present rent. Prohibit the

tenant from subleasing to any entity (a) that occupies any other building the

landlord (or its affiliate?) owns within a specified area, or (b) with whom the

landlord is actively negotiating or has recently negotiated. Consider

prohibiting any assignment/sublet to (1) any party with whom the landlord (or

its affiliate) is in litigation (or its affiliate), or perhaps even any party

with whom other landlords have had significant litigation; (2) a controversial

entity such as a terrorist organization even if for a permitted use; or (3)

specified entities or their affiliates (such as a chain store or multi-site

restaurant operator that may have become notorious for its aggressive litigation

programs against landlords). On the other hand, the landlord may prefer not to

limit itself to any particular grounds for disapproval and rely instead on its

right to "reasonably" reject proposed transactions on grounds such as those

suggested in this paragraph. This approach has the disadvantage, though, of

creating an amorphous factual issue that may require litigation to resolve.

2.4 Future Sublease-Related Transactions. If the tenant sublets in

compliance with the lease, future transactions might arise from that subletting.

Therefore, require the tenant to obtain the landlord's approval for any future

modification or termination of a sublease, any recapture, or any assignment by

the subtenant.

2.5 Discretionary Consents. If the business agreement between the parties

does not require the landlord to be reasonable about assignment or subletting,

simply ban both-instead of requiring "consent in Landlord's sole discretion"-to

avoid possible claims of an implied obligation to be reasonable. Also try to

negate any implication that the landlord must at least consider whatever

proposal the tenant presents.

2.6 Prohibit Collateral Assignment of Lease. Any prohibition against

assignment and subletting should also prohibit any collateral assignment of the

lease (i.e., mortgaging, encumbering, or hypothecating the lease).

2.7 Assignment/Sublet of Other Tenants' Leases. Even if other tenants'

leases permit assignment or subletting, ask this tenant to agree not to accept

an assignment of any other tenant's lease or a subletting of any of its premises

in the building without the landlord's consent.2.8 Diplomatic Immunity. Even if the landlord has agreed to be reasonable

in granting its consent, prohibit assignment/subletting to any person entitled

to claim diplomatic immunity, or to any domestic or foreign governmental entity.

2.9 Fixture Financing. Prohibit the tenant from financing its fixtures, or

impose appropriate protective conditions upon any such financing arrangements.

3. ASSIGNMENT AND SUBLETTING: IMPLEMENTATION

3.1 Tenant's Profit. If the tenant must pay the landlord a share of the

consideration or other profit the tenant receives from a subletting or

assignment: (a) the landlord can audit the tenant's books and records, (b) any

tenant revenue attributable to rent concessions under the lease belongs entirely

to the landlord (a proposition that has a ring of fairness to it but may

reverberate with a dull thud); (c) if the tenant does not furnish the necessary

information for the landlord to calculate assignment/subletting profits, the

landlord may estimate and the tenant must pay the estimated amount until a

correct amount is established; (d) the landlord may condition the closing of any

assignment/subletting transaction on the tenant's acknowledging the amount of

the landlord's profit participation and making any payments due on closing that

transaction; (e) the landlord may collect profit payments from the assignee or

sublessee if the tenant fails to pay; and (f) for a sublease, amortize the

tenant's transaction costs over the term of the sublease rather than up front.

Consider requiring the tenant to pay the landlord's share of sublet profits in a

present valued lump sum at sublease execution.

3.2 Assignor Guaranty. As a condition to any assignment that the lease

allows, consider requiring any unreleased assignor-and any guarantor of the

lease-to deliver a guaranty with full suretyship waivers or at least an estoppel

certificate to confirm that the signer remains liable. In either case, state

that any future changes in the lease obligations do not exonerate the guarantor,

but the guarantor is not responsible for any incrementally greater obligations.

3.3 Subtenant Nondisturbance. If the landlord agrees to provide

nondisturbance or recognition rights to subtenants, require that the

"nondisturbed" (or "recognized") subleases satisfy clear and objective

standards. Before agreeing to nondisturb (or recognize) any actual or potential

sublease, the landlord must ask whether it is willing to be "stuck with" that

sublease and all its terms if the main lease terminates. The landlord may want

to require minimum rents, a certain form of sublease, arm's length negotiations,

a reasonable configuration (at least a full floor?), and other characteristics.

If the tenant occupies multiple floors, try to limit the nondisturbed space to

full floor(s) at the top or bottom of the tenant's stack. Subtenant

nondisturbance or recognition agreements can create issues similar to partial

release clauses in mortgages (concern about cherry picking and/or destruction of

expected value), and opportunities for fraud or abuse. Any landlord obligation

to deliver agreements to protect subtenants should be conditioned on the absence

of any default under the main lease. If the landlord does agree to enter into a

nondisturbance agreement with any subtenant, the landlord may want to hold the

subtenant's security deposit and may want the tenant to reimburse the landlord's

legal fees in reviewing the sublease and negotiating the nondisturbance

agreement.

3.4 Contiguous Subleased Floors. Consider requiring sublet floors to be

contiguous--ideally at the top or bottom of the tenant's stack. Perhaps require

that any subleasing maximize contiguity (in some defined way), to facilitate

future transactions and flexibility.

3.5 Recapture Right. If the tenant wants to sublease any space, give the

landlord a right to recapture that particular space. If the tenant wants to

sublease 50% or more of its space, also give the landlord a recapture right for

the entire leased space. If the landlord exercises any recapture right, consider

requiring the tenant to pay the landlord a brokerage commission equal to what

the tenant would have paid a third party to broker a comparable transaction. For

any partial recapture right, require the tenant to pay for any demising wall or

other space separation expenses that may arise. These could include code

compliance expenses to establish a legally separate occupancy.

3.6 Transactional Requirements. For any assignment/sublet, independent of

any consent requirements, the tenant must also satisfy certain conditions (e.g.,

permitted use, reputation and net worth of assignee/subtenant, no violation of

exclusives) and delivery of certain documents satisfactory to the landlord

(e.g., assignee/subtenant's certified financial statements, unconditional

assumption of the lease, reaffirmation of guaranties).

3.7 Prohibited Use. Even if the tenant has certain rights to assign or

sublet, the new occupant should expressly remain bound by the use clause in the

lease. Although that proposition may seem self-evident, courts may infer some

unintended flexibility on use if the parties negotiate a right to assign or sublet.

3.8 Rent Increase upon Assignment. If the tenant assigns, let the landlord

increase base rent to fair market rent. When assigning a lease with percentage

rent, consider resetting the base for the rent calculation-either to current

market rent or, in the case of retail space, the sum of existing base rent plus

the average percentage rent for some specific period before the assignment.

(Anemic percentage rent will, however, often correlate with a tenant request to

assign or sublet.)

3.9 Leasing Agent. Require the tenant to designate the landlord's managing

agent as leasing agent for any contemplated assignment or sublet.

3.10 Processing Fee. Charge a processing fee for any

assignment/subletting, payable when the tenant submits an application.

3.11 Advertisements. The landlord should have the right to pre-approve any

advertisements for assignment or subletting.

3.12 ADA. Prohibit any assignment or subletting that triggers incremental

ADA compliance requirements in the building or by the landlord in the premises.

3.13 Confidentiality. Require the tenant to keep confidential the terms of

any assignment or sublease, particularly if the tenant's pricing is below

current market value (or the landlord's conception of current market value) or

the landlord's asking price for direct space.

3.14 Partial Subleases. Wherever the lease refers to subletting, it should

refer to a subletting of "all or any part of" the premises, because a bare

reference to subletting may let the tenant argue that the provision relates to a

sublet of the entire premises only. This is yet another example of how a literal

and narrow reading (or the possibility of a literal and narrow reading) produces

ever-longer legal documents.3.15 Breach of Anti-Assignment Covenant. A breach of the covenant not to

assign the lease without the landlord's consent should create an automatic event

of default, not merely a generic default for which the tenant might have a cure period.

4. BANKRUPTCY

4.1 Multiple Leases. If the same tenant leases multiple locations, try to

structure the transaction as a single combined lease for all locations to

prevent the tenant from cherry picking in bankruptcy. If the landlord must use

multiple leases, try to provide cross-defaults and give all the leases the same date.

4.2 Shopping Center Premises. Bankruptcy Code § 365 (11 U.S.C. § 365)

gives a landlord greater rights upon a tenant's bankruptcy if the landlord's

building is a "shopping center." But the statute does not define "shopping

center." Within reason and the bounds of good taste, the landlord can perhaps

include favorable language in the lease to confirm that the building is a

"shopping center."

4.3 Characterize Tenant Improvement Contribution as Loan? To the extent

that the tenant's rent represents reimbursement to the landlord for tenant

improvements, consider restructuring such payments as payments on a loan,

independent of the lease, evidenced by a note. Require the tenant to pledge (at

least) its leasehold as security. This structure may give the landlord an

argument to avoid Bankruptcy Code limitations on the landlord's claim for

"rent," although the landlord would then face all the risks of being a secured

or unsecured creditor instead. The landlord's choice of poison will vary with

the circumstances, but the landlord and its counsel may want to consider the

issue in structuring the lease.

4.4 Letters of Credit. If the tenant delivers a letter of credit in place

of a security deposit for more than a year's rent, consider the effect of

Bankruptcy Code § 502(b)(6) (11 U.S.C. § 502(b)(6)). Check the drawdown

conditions of the letter of credit to confirm that the landlord has the right

(though not the obligation) to draw on the letter of credit if the tenant files

bankruptcy, even if the tenant is totally current in its rent obligations.

5. BILLS AND NOTICES

5.1 Who May Give Notices. State that the landlord's counsel or managing

agent (as engaged from time to time) may give notices for the landlord.

5.2 Tenant's Notices. Copies of notices from the tenant (or perhaps just

notices of alleged landlord defaults) should also go to the landlord's counsel.

5.3 Next Business Day Delivery. Define "overnight" delivery as "next

business day" delivery, to avoid occasional case(s) saying "overnight" doesn't

mean any particular number of nights (more bad cases producing ever-long

documents).

5.4 Routine Rent Bills. Avoid any suggestion that the landlord cannot send

routine rent bills by ordinary mail and only to the tenant (no copies to, e.g., counsel).

6. COMPLIANCE WITH LAWS6.1 Notice. Require the tenant to give prompt notice to the landlord of

any violation of any legal requirement that applies to the premises or the building.

6.2 Legally Required Improvements. Require the tenant to perform all

improvements to the premises required by law. If the tenant resists (which it

probably will, and should), consider limiting the tenant's obligation to future

enacted laws. (The tenant will probably still resist and the parties will

probably reach the usual negotiated outcome in any space lease. The landlord

will bear the risk of present and future laws that generally govern similar

buildings and generic occupancies like the tenant's. The tenant will be

responsible for legal requirements that arise from the tenant's nongeneric or

unusual use of the space.)

6.3 ADA. If the tenant uses the premises as "public accommodation" or for

any other use that triggers extra ADA requirements in the building, the tenant

should pay for the work necessary to bring the premises into compliance with

such legal requirements.

6.4 Definition. Define "Laws" broadly to include future enactments and

amendments, insurance regulations and requirements, utility company

requirements, administrative promulgations, and recorded declarations.

7. CONSENTS

7.1 Reasonableness. When the landlord agrees to be "reasonable," set

criteria for reasonableness. Any mortgagee's disapproval of a matter should

automatically constitute a "reasonable" basis for the landlord to withhold

consent. Without some criteria or clear flexibility for the landlord, the

interpretation of "reasonableness" can result in litigation that will often be

stacked in favor of the tenant.

7.2 Scope of Consent. Any consent applies only to the particular matter

under consideration.

7.3 Deemed Consent. If the landlord has agreed that failure to grant or

withhold consent within ___ days is deemed consent, try to: (a) have this

concept apply only in particular areas (e.g., consents to transfers), (b)

require a reminder notice before the deemed consent arises, and (c) require both

the original notice and the reminder notice to state conspicuously (in all

capital boldface letters) that the landlord must respond within that period and

what happens if the landlord does not.

7.4 Expenses. Require the tenant to pay any expenses the landlord incurs,

including legal costs, in connection with any consent.

7.5 Conditions to Consent. Even when the landlord has agreed to be

reasonable about a consent, build in conditions such as no pending default.

Require the tenant to deliver an estoppel certificate and copies of all relevant

documents. Set other requirements tailored to the particular consent at issue.

Remember that the landlord may forget to impose any such requirements as a

condition to the consent when issued.

7.6 No Representation. Make clear that the landlord's consent to anything

is not a representation or warranty that the matter consented to complies with

law or will meet the tenant's needs.

7.7 Survival of Conditions to Consent. Whenever the tenant must satisfy

certain conditions to obtain the landlord's consent (or to take any action

without the need for the landlord's consent), consider as a general proposition

whether the lease should require the tenant to cause those conditions to remain

satisfied even after the consent is granted or the action is taken.

7.8 Limitation of Remedies. The lease should say that the tenant's only

remedy is specific performance-not monetary damages-if the landlord wrongfully

withholds consent (for example, acts unreasonably after agreeing to act

reasonably). Backup position: require expedited arbitration, perhaps with the

potential arbitrator(s) designated in the lease.

8. DEFAULT

8.1 Guarantor's Net Worth. Provide that a decline in a guarantor's net

worth or the bankruptcy of a guarantor (either an express guarantor or an

unreleased assignor of the lease) is an event of default. This should be

perfectly enforceable against a tenant.

8.2 Cross Defaults. Provide for cross defaults as against other leases

with the landlord or its affiliates, or even against other obligations of the

tenant or its affiliates.

8.3 Default Notices. Provide that default notices need not specify cure

periods.

8.4 Impairment of Business. Define an event of default to include events

(beyond the usual insolvency list) that may indicate the tenant is preparing to

shut down. These might include the tenant's announcing that it will make

substantial distributions/dividends outside the ordinary course of business;

shutdown of other locations; suspension or termination of a substantial part of

the tenant's business; or layoffs.

8.5 No Right to Cure Event of Default. Once an event of default has

occurred, should the tenant have a wide-open cure right even after a cure period

has already lapsed? Whenever the landlord can exercise remedies "if an event of

default shall have occurred and be continuing," this language effectively gives

the tenant an open-ended right to cure the event of default. Does the landlord

really want that?

8.6 Discount for Timely Payment. Consider increasing "face rent" in the

lease by __%; provided however, that if the tenant pays by the ____ day of the

month, the tenant is entitled to a discount equal to the overstated portion of the rent.

8.7 All Rent Due at Signing. Consider requiring the tenant to pay all rent

for the term of the lease at signing, but state that the landlord agrees to

accept monthly installment payments only so long as no event of default exists.

9. DESTRUCTION, FIRE AND OTHER CASUALTY

9.1 Rent Abatement. Limit the tenant's rental abatement right to the

amount of rental income insurance proceeds the landlord receives under the

landlord's casualty insurance. (A landlord must, however, carefully coordinate

any such provision with the insurance program for the property, to prevent

surprises and problems.)9.2 Time to Restore. If the landlord has the right or obligation to

restore after casualty, measure any deadline from the landlord's receipt of

insurance proceeds--not from the date of casualty.

9.3 Termination Right; Limitation on Restoration. Provide no right (or a

limited right) for the tenant to cancel upon casualty. To the extent the lease

requires the landlord to restore, impose appropriate conditions, including

recovery of adequate insurance proceeds.

9.4 Tenant Waiver. Require the tenant to waive the provisions of New York

Real Property Law § 227 (which allows a tenant to terminate a lease in the event

of a casualty that renders the premises untenantable), and comparable provisions

in other states.

10. DEVELOPMENT-RELATED ISSUES

10.1 Air and Development Rights. If the project includes development

rights from other locations, should the landlord include them as part of in the

definition of the project? The answer may vary depending on state and municipal

law. Have the tenant waive any right to object to any merger or transfer of

development rights, and agree to sign any zoning lot merger if requested to do so.

10.2 Landmark District; Historic Designation. If the building is located

in a landmark district or similarly protected area and local law (e.g., New York

City law) requires it, include in the lease a notice of such landmark status.

The tenant should agree: (a) not to file for historic designation of the

premises, and (b) to oppose any such designation if the landlord so requests.

10.3 Relocation Right. Give the landlord the right to relocate the tenant

to comparable premises in the building or in some other specific building the

landlord or its affiliate owns.

10.4 Demolition. Allow the landlord to terminate the lease after

reasonable notice if the landlord intends to demolish the building. Set as low

as possible a standard for the landlord to satisfy. For example, avoid any

requirement that the landlord must be unalterably committed to demolition or

must have terminated other leases or obtained a demolition permit. Give the

tenant incentives to cooperate. Set up a process so the landlord will find out

quickly whether the tenant will try to fight the early termination of the lease.

For example, the lease can require the tenant, promptly after receiving a

termination notice, to deliver an estoppel certificate and an increased security

deposit. Pay the tenant a demolition fee only if the tenant vacates strictly on time.

10.5 Building Name and/or Address. Allow the landlord to change the name

or address of the building. Require the tenant to refer to the building only by

whatever name or address the landlord gives it.

10.6 Construction Restrictions. State that nothing in the lease limits by

implication the landlord's right to construct or alter any improvements anywhere

on the landlord's property. If the lease does contain any such restrictions,

state that they are limited to their express terms.

10.7 Building Standard Specifications. The landlord should reserve the

right to modify building standard specifications.

11. ELECTRICITY

11.1 Change of Provider. State that if the landlord changes the

electricity provider for the building, the tenant must use the new provider, to

the extent legally allowed, even if the tenant directly meters its own

consumption.

11.2 Delivery of Electrical Service. The tenant should comply with

electrical conservation measures and any limits on power grid availability.

11.3 Electrical Service. If the tenant's space is directly metered,

require the tenant to keep the landlord informed of the tenant's electrical

consumption, with copies of bills. This may facilitate the landlord's long-term

planning of electrical service for the building.

12. END OF TERM

12.1 Obligation to Restore. Require the tenant to restore the premises at

the end of the term. That obligation should survive expiration or sooner

termination of the lease. Provide that if the tenant does not complete

restoration or other end of term activities (e.g., remediation?) by the

expiration date, the tenant must pay holdover rent until completion.

12.2 Landlord's Property. At the landlord's option, the tenant should

leave behind any improvements, fixtures, or personal property that the landlord

paid for (including through a rent abatement).

12.3 Cables, Conduits. The landlord should retain ownership of all cables

and other wiring in the building. Require the tenant to remove cables, conduits,

wires, raised floors, and rooftop equipment at the end of the lease term either

in all cases or at the landlord's request. Require the tenant to indemnify the

landlord from all liability in connection with that removal.

12.4 Holdover. Consider providing that if the tenant fails to vacate the

premises at the end of the term, the tenant must pay the greater of (a) ___% of

final adjusted rent under the lease and (b) [150%] of fair market rent as a use

and occupancy charge. Calculate the charge on a monthly basis for an entire

month for every full (or partial) month the tenant holds over.

12.5 Tenant Waiver. Have the tenant waives the provisions of any civil

procedure rule that would allow a court to issue a stay in connection with any

holdover summary proceedings the landlord might institute. (In New York, refer

to New York Civil Practice Law and Rules § 2201.)

12.6 Abandoned Personalty. State that upon lease termination, any

personalty in the premises is deemed abandoned and the tenant must pay to remove

and store it.

12.7 Consequential Damages. If the tenant holds over, the tenant should

agree to pay all damages the landlord incurs, including consequential damages

such as the loss of the next prospective tenant.

12.8 Time of Essence. State that "time is of the essence" with respect to

the tenant's obligation to vacate the premises.

13. ENVIRONMENTAL

13.1 Reports; Inspections. The tenant should agree to deliver, or

reimburse the landlord's cost to obtain, updated environmental reports. State

that the landlord has the right to inspect the premises if the landlord

reasonably believes that a violation of environmental law exists, all at the

tenant's expense.

13.2 High Risk Uses. For a gas station or other high-risk use, consider:

(a) establishing an environmental baseline by undertaking a sampling plan before

occupancy (this will establish what problems, if any, already exist); (b)

requiring periodic monitoring, especially at locations where groundwater might

be readily affected, and along perimeter areas where migrating oil can be

detected; (c) obtaining an indemnification that is both very broad (all

environmental risks) and very specific (particular environmental issues arising

from the tenant's particular business); (d) requiring the tenant to post a bond

if the tenant cannot obtain environmental liability insurance; (e) if

underground tanks already exist, requiring the tenant to: (1) accept the tanks

"as-is," (2) comply with all applicable laws, including obtaining all permits

(as well as annual registration and recertification), (3) post all state-

required financial assurances, (4) maintain, repair and replace, if required,

all tanks, and (5) maintain all required records and inventory controls.

13.3 Required Tank Removal. The landlord might want the right to perform a

further environmental assessment at the end of the term, and require the tenant

to remove any tanks and perform any required remediation.

13.4 Landlord Indemnification. If the landlord agrees to indemnify the

tenant for past environmental problems, limit this indemnification to any

liability that exists under present law based on present violations. Exclude any

liability arising from future laws or amendments of existing laws.

13.5 Interior Air Quality. Disclaim any landlord liability for bad air or

"sick building syndrome." Also state that the landlord may prohibit smoking

anywhere in the building or at adjacent sites.

14. ESCALATIONS

14.1 Operating Costs.

(A) Reality Connection. When negotiating the operating cost

escalation clause, confirm that the clause, particularly as negotiated, matches

the landlord's actual practices in operating the building, so the landlord can

actually make the necessary calculations and adjustments.

(B) Off-Site Costs. Avoid limiting "operating costs" to those

incurred physically within the particular building. The landlord may incur off-

site operating costs, such as in a multi-use project (e.g., holiday decorations

in a central plaza) or for off-site equipment, installations, traffic

improvements, shuttle bus services, or the like to benefit the building.

(C) Use of Generally Accepted Accounting Principles ("GAAP"). In

defining operating "costs" (not "expenses," perhaps an accounting term of art),

try not to refer to GAAP. The term often arises in two places: (a) when defining

what the landlord can pass through to tenants; and (b) when excluding "capital"

items. Regarding (a), GAAP requires matching of revenue and expenses, perhaps

forcing the landlord to reduce costs by any related income received. Examples:

recovery of heating, ventilation, and air-conditioning ("HVAC") overtime costs

from tenants (not all of this is actually expended, such as amortization of an

energy management system); telecommunications (revenue from rooftop antennas);

and parking garage income. Regarding (b): (1) Positive for landlords-the

American Institute of Certified Public Accountants ("AICPA") is reviewing

disparity of practice as to capitalization and expense, and this may help

landlords pending issuance of a formal statement and (2) Negative for landlords-

GAAP may treat preventive maintenance as "capital." (D) CAM. Avoid the term "CAM" (common area maintenance) because

operating cost escalations cover far more than common area maintenance.

(E) Major Repairs. Do not necessarily limit multiyear amortization

of large repair costs to "capital" items. Particularly if leases limit

escalations or if the landlord is concerned about base years for new leases, the

landlord may want the ability to spread major noncapital repair costs over

multiple years.

(F) Broad Definition of Costs. Consider any special characteristics

of the property that may lead to landlord costs outside the escalation

definitions in the lease. For example, if a reciprocal easement agreement

imposes costs similar to real estate taxes or operating costs, expand the

appropriate definition to include them.

(G) Timing. Try not to agree to tight time limits (or, worse, a

"time is of the essence" provision) for the landlord's obligation to provide

operating statements. The landlord should, of course, try to be timely, based on

cases that have required such timeliness based in part on an inferred "fiduciary

duty" because the landlord controls the information.

(H) No Fiduciary Duty. Negate any fiduciary duty regarding operating

cost escalations and their administration.

(I) Reserve Charge. To avoid the common arguments about how to treat

"capital" items, consider establishing an annual per square foot capital reserve

charge. The landlord would not need to account for these funds and the lease

would define categories of "capital type" costs to which tenants need not

contribute. (If, however, this reserve charge stays constant from year to year,

including the base year, then the landlord will never be able to collect a penny

of escalations under the typical pass-through of only increases in operating

costs. Therefore, make it a separate additional charge.)

14.2 Audit Issues (Operating Costs). (A) Condition for Audit. Allow the tenant to audit operating costs

only if those costs increase more than a specified percentage over a specified

prior year or base year.

(B) Auditors. Prohibit contingent fee auditors. If the landlord

agrees to reimburse audit costs (such as if the tenant's audit reveals a certain

level of mistakes), then negate any reimbursement to contingent fee auditors.

Consider requiring a national CPA firm. Insist that such firm agree to notify

the landlord of any undercharges or errors in the tenant's favor that the audit

discloses.

(C) Costs of Audit. Ask the tenant to pay for the landlord's out-of-

pocket costs in connection with any audit of operating costs (e.g. photocopying,

staff time, document retrieval, accountants' time spent answering inquiries, etc.).

(D) Confidentiality. Require the tenant to sign a confidentiality

agreement satisfactory to the landlord for any audit and its results before

disclosing any records or information to the tenant or to a lease auditor. The

agreement should, among other things, prohibit the tenant and its advisors from

disclosing the existence of any audit or any of its results, particularly to

other tenants in the building. The tenant's breach of the confidentiality

agreement should constitute an incurable default under the lease.

(E) Limits. Limit timing, frequency, and duration of audits.

(F) Inspection Restrictions. Allow the tenant (or its

representative) to examine specified books and records only, and only for a

specified period, but prohibit copying. Require that any audit comply with the

landlord's reasonable requirements and instructions.

(G) Threshold for Payment. If overcharges (net of undercharges)

total 3% or less of total annual operating costs (a generally accepted

definition of "materiality"), then the tenant should not receive any adjustment

or reimbursement of its audit costs. Define carefully the factor to which the

lease applies the3% factor. Use as large a number as possible. For example,

refer to 3% of gross annual operating costs rather than 3% of the tenant's

escalation payment.

(H) Dispute Resolution. Provide a private and final mechanism (e.g.,

arbitration) to resolve disputed operating costs.

(I) Claims. Require specificity, completeness, and finality in any

tenant claim of discrepancy or error.

14.3 Other Escalations.(A) Porter's Wage. Include fringe benefits and all other labor

costs. The wage rate used should not reflect "new hire" or other transitional

wage rates.

(B) Consumer Price Index. Use the Consumer Price Index for all Urban

Areas ("CPI-U") index. Many believe that this index has historically increased

faster than the Consumer Price Index for Urban Wage Earners and Clerical Workers

("CPI-W") index.

14.4 Generally.

(A) No Decrease. Escalation formulas should never allow rent to go

down.

(B) Examples. For any complex or intricate escalation formula,

consider adding an example, but don't make the numbers dramatic.

(C) Liability for Refunds. The landlord's liability for any refund

of overpaid escalations should terminate after a specified number of years (and

automatically upon any sale of the building?), to prevent open-ended obligations

or issues upon a sale of the building.(D) Survival; Timing. Limit the time during which the tenant may

challenge any escalation. (Be careful, though. The tenant may try to make this

reciprocal for the landlord's billings.) All the tenant's obligations regarding

escalations should survive the expiration or sooner termination of the lease.

15. ESTOPPEL CERTIFICATES

15.1 Lender Requirements. In defining the scope of an estoppel

certificate, allow the landlord to require any additional information a lender

might request.

15.2 Ratify Guaranty. Allow the landlord to obtain a

confirmation/ratification of any guaranty, not merely an estoppel certificate

from the tenant.

15.3 Exhibit. Attach a form of estoppel certificate as a lease exhibit

(conform to typical lender requirements), but build in flexibility for future

lender requirements.

15.4 Estoppels. Require the tenant to agree to deliver future estoppel

certificates at any time on the landlord's request. Provide that such

certificates shall bind the tenant whether or not the landlord can demonstrate

detrimental reliance. (Is such a concept enforceable?)

15.5 Reliance. Allow reliance by prospective purchasers, mortgagees or any

participant in a future securitization, including rating agencies, servicers,

trustees, and certificate holders.

15.6 Failure to Respond. Establish specific meaningful remedies for

failure to sign an estoppel certificate within a short period. These might

include: deemed estoppel; a power of attorney to execute it for the tenant; or a

nuisance fee (e.g., $100 per day).

15.7 Attach Lease. Require the tenant (if asked) to attach a copy of the

lease and all amendments to any estoppel certificate.

15.8 Legal Fees. If the landlord agrees to give an estoppel, require the

tenant to pay the landlord's legal fees and expenses.

16. EXPANSION/RENEWAL OPTIONS

16.1 Timing. Make time of the essence for exercising any option or right

of first refusal. Say that timely notice constitutes an agreed and material

condition of exercise. Recognize that the courts sometimes validate late

exercise after the fact. Perhaps provide for a protective rent adjustment in

this case (e.g., to fair market if the lease would not otherwise require fair

market rent).

16.2 Multiple Bites at the Apple. If the landlord offers "first refusal"

space and the tenant does not take it (or if the tenant declines to exercise an

option), then for a specified number of months deem the tenant to have waived

any first refusal rights (and any options that would otherwise apply), at least

where they relate to comparable space, broadly defined.

16.3 Timing. Make the exercise deadline early enough to give the landlord

time to relet if the tenant does not exercise its option. Coordinate the timing

with other leases to facilitate assembling large blocks of space if the landlord

wants to do so. A landlord usually wants plenty of lead time and notice, but may

want to give the tenant as little lead time and notice as possible, to maximize

the landlord's flexibility in dealing with unexpected changes in occupancy.

16.4 Coordination of Options. Time the exercise and lapse dates for

options so that adjacent blocks of space may become available to the landlord at

the same time.

16.5 Update Due Diligence. Reconfirm the due diligence requirements (e.g.,

financial statements) for the tenant.

16.6 Option Subject. Make any expansion option subject to existing

exclusives and renewal clauses of other tenants. Avoid overlapping expansion

options. Limit the tenant's remedy if the landlord inadvertently allows

overlapping options.

16.7 Carveouts from Purchase Rights. If the tenant negotiates an option or

right of first refusal to purchase, exclude: (a) foreclosure or its equivalent;

(b) any subsequent conveyance; (c) transactions between the landlord and

affiliates or family members; (d) other permitted transactions, such as

transfers of passive interests or creation of preferred equity for mezzanine

lenders (and any exercise of remedies by the lender); and (e) if the tenant

"passes" on its preemptive right, then all subsequent transactions.

16.8 Conditions. Condition any option exercise on the tenant's: (a) not

being in default (and not potentially being in default) both on the exercise

date and on the effective date, and perhaps even for ____ years before the

exercise date; (b) not having assigned the lease; (c) retaining a certain

minimum occupancy; (d) actually operating in the space; and (e) satisfying a net

worth test (fixed dollars or rent multiple) for at least ____ years before

exercising the option.

16.9 Option Rent. Set a "floor" for option rent equal to the previous rent

under the lease.

16.10 Covenant to Notify. Require the tenant to notify the landlord if

the tenant needs more space, to give the landlord a chance to provide it in this

or some other building. (The landlord might, however, better achieve the same

result by saying nothing in the lease and just maintaining a good relationship

with the tenant.)

16.11 Option Maintenance Fee. Require the tenant to pay a nominal annual

fee to preserve future options. This gives the tenant an incentive to terminate

any option rights that it does not truly need.

16.12 Miscellaneous. State that the tenant may not separately assign any

option. The tenant's options should terminate if the tenant subleases more than

a certain percentage of the premises or assigns the lease, or if specified other

events occur.

17. FAILURE TO DELIVER POSSESSION

17.1 No Liability. The landlord should incur no liability for failing to

deliver possession on the commencement date for any reason, including holdover

or construction delays. The tenant's obligation to pay rent should commence on

possession. Perhaps extend the term by the duration of any landlord delay in

delivering the premises.17.2 Delivery Procedure. Try to tie the "Commencement Date" to an

objective event-preferably within the landlord's control-or a date, rather than

to any notice from the landlord. Notices are often not as easy to give (and give

quickly) as they would seem to attorneys drafting leases. Any delay in giving a

commencement date notice will mean lost revenue.

17.3 Condition of Premises. Substantial completion should suffice (e.g.,

temporary certificate of occupancy) for the landlord's delivery of the premises.

17.4 Termination Right. The landlord may want a termination right if the

landlord ultimately cannot deliver possession by a date certain.

17.5 Delivery Dispute. Provide for a short deadline for the tenant to

report any issue or problem about the premises or the landlord's work. Better,

state that taking of possession constitutes acceptance for all purposes.

17.6 Rent Abatement. To the extent the landlord agrees to give the tenant

a rent abatement for late delivery, limit the duration of the abatement (e.g.,

if the rent abatement exceeds a set number of days, thereafter the tenant's only

rights are to terminate or wait). Try to defer any such abatement (e.g., spread

it out in equal annual installments over the remaining term of the lease). This

will reduce immediate damage to the landlord's cash flow at a time when the

landlord may be under financial stress.

18. FEE AND EXPENSES

18.1 Fee and Expenses. The tenant should pay a fee (and expenses) for the

landlord's review of any plans, specifications, or request for consent/waiver.

Avoid a flat fee. Set the fee according to a formula based on the size of the

job or hours necessary, with a minimum floor.

18.2 Attorneys' Fees and Expenses. The tenant should reimburse the

landlord's attorneys' fees and expenses both broadly and with specificity (e.g.,

for actions and proceedings, including appeals, and in-house counsel fees and

expenses). The reimbursement obligation should cover attorneys' fees and

expenses incurred in connection with: (1) any litigation the tenant commences

against the landlord, unless the tenant obtains a final favorable judgment; (2)

negotiating a lender protection agreement for the tenant's asset-based lender;

(3) the landlord's (or its employee's) acting as a witness in any proceeding

involving the lease or the tenant; (4) reviewing anything that the tenant asks

the landlord to review or sign; and (5) bankruptcy proceedings.

18.3 Witnesses. The tenant should indemnify the landlord if the landlord

or its personnel are called as a witness in any proceeding related to the lease

or the tenant.

19. FUTURE DOCUMENTS AND DELIVERIES

19.1 Tenant's Financial Condition. Require the tenant to deliver annual

financial statements for itself and any guarantor. Negotiate the right to

require a security deposit, rent adjustment, or other consequences to protect

the landlord in case the financial condition of either deteriorates.

19.2 Reporting. Require the tenant to immediately report if the tenant or

any guarantor experiences: (1) any adverse change in financial position; or (2)

any litigation that could adversely affect the ability to perform.

19.3 Further Assurances. Require the tenant to enter into any amendments

that the landlord reasonably requests to correct errors or otherwise achieve the

intentions of the parties, subject to reasonable limitations.

19.4 Future Events. The parties should agree to memorialize any

commencement date, rent adjustment, or option exercise in a lease amendment.

19.5 Termination of Lease Memo. If the tenant obtains a memorandum of

lease, then: (a) the tenant should covenant to execute and deliver a termination

of memorandum of lease in recordable form if the lease terminates early; and (b)

consider requiring the tenant to sign such a termination at lease execution, to

go in escrow.

19.6 Governmental Benefits, Generally. Require the tenant to cooperate, as

necessary, to help the landlord qualify for any tax or governmental benefits

(e.g., tax abatements) that would otherwise be available.

19.7 Permitted Disclosure. If the landlord agrees to any confidentiality

restrictions, or if governing law automatically infers such restrictions, then

the landlord should ask for the right to disclose to actual or prospective

mortgagees or purchasers any information about the tenant or any guarantor.

20. GUARANTY

20.1 Social Security Number/Address. State the social security (or

driver's license) number and home address of any individual guarantor beneath

his/or her signature line. This underscores the fact that the guaranty is

intended to constitute a personal obligation of the guarantor and may facilitate

enforcement.

20.2 Guarantor Consents. Tailor the guarantor's consent/waiver boilerplate

to reflect circumstances of the lease, such as pre-consent to any future

assignment of lease, and any state-specific language necessary or helpful for a

guaranty (e.g., a reference to New York Civil Practice Law and Rules § 3213).

20.3 Lease Assignment. If the landlord sells the property, then the

guaranty should, by its terms, automatically travel to the purchaser, whether or

not the transfer documents say so.

20.4 Net Worth. Any net worth test or other financial covenant should

apply to both the tenant and the guarantor. Tailor the covenant as appropriate.

20.5 Estoppel Certificate. The guarantor should agree to issue estoppel

certificates upon request.

20.6 Springing Guaranty. Consider a springing guaranty if certain adverse

events occur (such as a reduction in the tenant's or a guarantor's net worth).

Remember: the guarantor must sign the guaranty when the tenant signs the lease.

20.7 Tenant Bankruptcy. The guarantor (and any unreleased assignor) should

acknowledge its liability is not limited as a result of any limitation of the

landlord's claim against the tenant for "rent" in bankruptcy (11 U.S.C. §

502(b)(6)).

20.8 "Good Guy" Guaranty. Consider a "good guy" guaranty (i.e., a guaranty

of rent and perhaps all other obligations under the lease, continuing only until

the tenant surrenders the premises vacant, in satisfactory physical condition,

and free of any occupancy rights).

20.9 Security. Consider securing a lease guaranty obligation with a letter

of credit or other security. By tying such a letter of credit to a guaranty

rather than to the lease, the landlord may reduce the likelihood-perhaps already

low-that the tenant's bankruptcy estate could "claw back" any letter of credit

proceeds that exceed the landlord's permitted claim for rent in the tenant's

bankruptcy.

21. INABILITY TO PERFORM

21.1 Triggering Event. If the tenant negotiates a force majeure clause,

require the tenant to notify the landlord promptly of any "force majeure" event.

The extension of time should continue only so long as such triggering event

actually causes the tenant delay.

21.2 Exception to Force Majeure. Force majeure should never apply to any

monetary obligation.

21.3 Governmental Consents. For the landlord, force majeure should include

a failure to obtain governmental consents or permits.

22. INSURANCE

22.1 Additional Insureds. Include the landlord and its managing agent and

mortgagee as "additional insureds," not "named insureds." The latter may owe premiums.

22.2 Changed Requirements. Conform the insurance requirements in the lease

to those in the landlord's mortgage (and any future changes in the mortgage).

Allow the landlord to change the requirements in the lease as needed to comply

with the landlord's and any mortgagee's future reasonable requirements.

22.3 Business Interruption Insurance. Any rental/business interruption

insurance should cover additional rent (e.g., escalations and tax pass throughs)

and percentage rent as well as base rent.

22.4 Evidence of Insurance. Require "evidence" of insurance (the "ACORD

27" form)1 or a copy of the tenant's insurance policy at lease signing, not a

"certificate" of insurance (the "ACORD 25" form), which is often regarded as

worthless unless modified. Try to get an "ACORD 27" from (or its equivalent) not

only for property insurance, for which it was designed, but also for liability

insurance.

22.5 Landlord Insures. Consider having the landlord insure the tenant's

improvements (with the tenant reimbursing the allocable premium either directly

as additional rent or as an operating expense), and having the landlord restore

(or give the landlord the right to require the tenant to restore) with any

insurance proceeds.

22.6 Plate Glass Insurance. Require any retail tenant to carry plate glass

insurance.

22.7 Insurance Broker. Allow the landlord (at its option) to deal directly

with the tenant's insurance broker to obtain any insurance documents the lease

requires. But the lease should state that doing so imposes no liability or

obligation on the landlord.

22.8 Approval Rights. Allow the landlord to approve the identity and

financial condition of the tenant's insurance carriers.

22.9 Waiver of Subrogation. Understand "waiver of subrogation." This is a

tricky topic, often wrongly handled. These clauses should be mutual, covering

all losses caused by any insured risk (even negligence of the landlord or the

tenant), provided the insurance carrier has consented to the waiver. Such

consents often appear in standard insurance policies, although this should be

confirmed.

22.10 Tenant's Rights to Proceeds. Make any right of the tenant to receive

insurance proceeds subject to the rights of the landlord's mortgagee.

22.11 Tenant Failure to Insure. If the tenant fails to insure and a fire

occurs, then make the tenant liable for the entire loss and not merely the

unpaid insurance premiums-even if the landlord knew about the failure to insure.

(Such a provision responds to cases that limit the tenant's liability to the

amount of the unpaid premiums.)

22.12 Insurance Advice. Work with the landlord's insurance

broker/consultant to check, update, and improve the insurance requirements of

the lease as appropriate. Take into account whatever changes in insurance

requirements and practices ultimately arise from the resolution of "terrorism

insurance" in the wake of September 11.

23. LANDLORD'S ACCESS TO PREMISES

23.1 Emergency Contact. Require the tenant to provide the name and

telephone number of an emergency contact.

23.2 Reconfiguration. Reserve for the landlord the right to reconfigure or

change the means of access to the premises.

23.3 Notice Requirements. The lease should state that the landlord may

enter without notice in an emergency. Even absent an emergency, oral notice to

someone on site should suffice. This is yet another example of an area where a

requirement for "written notice" may sound perfectly reasonable, but in the real

world such a requirement is completely impractical.

23.4 Keys. The tenant should deliver copies of all keys and access codes

to the landlord. The landlord should consider, though, whether it truly wants

whatever liability travels with the keys and access codes, especially if the

tenant has unusually valuable personal property. The landlord may want to be

selective about requiring keys and access codes.

23.5 No Eviction. Make clear in the lease that the landlord's entry on to

or inspection of the premises is not an actual or constructive eviction and does

not entitle the tenant to any rights or remedies, it or any claim, offset,

deduction, or abatement of rent.

23.6 Purpose of Access. The landlord should insist on the right to: (1)

show the premises to prospective purchasers, mortgagees or appraisers and post

"for sale" signs; and (2) during the last [12] months of the term, show the

premises to prospective tenants and post "for rent" signs.

24. LANDLORD'S LIABILITY 24.1 Exculpation. Limit the landlord's liability to its interest in the

property. Negate personal liability of the landlord or its partners, members,

managers, officers, directors, and the like. Recent cases have applied the

"implied covenant of good faith and fair dealing"-a tort theory of liability-to

sidestep exculpation clauses in leases. To avoid the possible effect of such

cases, state that the landlord's exculpation applies not only to claims under

the express terms of the lease, but also claims of any kind whatsoever arising

from the relationship between the parties or any rights and obligations they may

have relating to the property, the lease, or anything related to either.

24.2 Landlord Default. Give the landlord the same open-ended cure periods

for nonmonetary defaults that tenants typically obtain-the landlord should not

be deemed in default so long as the landlord has commenced and is diligently

prosecuting the cure of its default.

24.3 Liability. Liability of the landlord should cease if the landlord

transfers its interest in the premises.

24.4 Liability for Prior Owners' Acts. As a rather aggressive position,

say that after any conveyance of the property (even outside foreclosure), the

new owner is not liable for (and the tenant may not assert any credit, claim or

counterclaim because of) any claims the tenant might have had against the former

owner, such as for overcharges and refunds of escalations.

25. LANDLORD'S REPRESENTATIONS

25.1 Express Not Implied. State that the landlord makes no implied

covenants, representations or warranties. Limit the landlord's responsibilities

to those expressly set forth in the lease.

25.2 Merger. State that any agreements, written or otherwise, predating

the lease merge into the lease. Indicate that any statements or representations

on the landlord's Web site or in the landlord's advertising are not part of the lease.

25.3 Other Leases. State that the landlord makes no representations,

warranties or covenants regarding other tenants (past, present or future) or the

terms of their leases.

26. MAINTENANCE AND REPAIRS

26.1 No Overtime. The landlord has no obligation to do any work at

overtime or premium rates.

26.2 Tenant's Obligation. The tenant must maintain and repair parts of the

building-including storefronts and sidewalks-that exclusively serve the premises.

26.3 Right to Perform. If the tenant's acts or omissions cause damage to

another tenant's premises, the landlord can repair them at this tenant's expense.

26.4 Broad Repair Obligations. Where the tenant has broad repair

obligations, expressly include "ordinary or extraordinary, structural or

nonstructural, foreseen or unforeseen" repairs.

26.5 Specify Repair Obligations. Avoid distinguishing repairs as

"structural" (the landlord's responsibility) and "nonstructural" (the tenant's

responsibility). Draw these lines specifically and in detail. Otherwise, a court

may decide what the parties intended.

26.6 Periodic Upgrades. Beyond maintaining the premises "as is," the lease

could require the tenant to upgrade and renovate every ___ years, to keep the

premises exciting and new, particularly for retail space.

27. OCCUPANCY

27.1 "As Is" Condition. The tenant should represent and acknowledge that

it takes possession of the premises in its "as is, where is" condition as of the

commencement date.

27.2 No Obligation Except Specific Work. Confirm that the landlord has no

obligation to perform any work or make any installations to prepare for the

tenant's occupancy, except as the lease expressly states.

27.3 Tenant Covenants. The tenant should covenant to file its plans

install its fixtures, and open for business, in each case by a certain date. The

tenant should then agree to operate for at least a certain minimum period.

28. PERCENTAGE RENT AND RADIUS CLAUSE

28.1 Increases. Provide for an increase in percentage rent upon any change

of use or change of the tenant.

28.2 Inclusions/Exclusions. For percentage rent purposes, include any

catalog or Internet sales that the tenant makes through the store. Prohibit the

tenant from claiming any credit for goods that a customer bought through a

catalog or over the Internet (unless previously included in store sales).

Exclude sales to the tenant's employees only if the tenant makes those sales at

a discount.

28.3 Limit Any Percentage Rent Penalty Period. If the lease allows the

tenant to pay "percentage rent only" if any cotenancy or other problem arises,

restore the fixed rent after the landlord solves the problem, or limit the

percentage-rent-only period. After a certain time, allow the landlord to require

the tenant to either terminate or resume paying full fixed rent.

28.4 Effect of Casualty. The lease should provide that if the premises are

closed part of the year because of a casualty or condemnation, the "breakpoint"

for percentage rent will drop. (This assumes the lease expresses the

"breakpoint" as a fixed dollar amount, and not a formula referring to actual

fixed rent payable from time to time. The latter would be more common, so this

problem usually does not arise.)

28.5 Gross Sales. Define gross sales to include sales by subtenants and

concessionaires.

28.6 Fixed Rent Increases. Increase fixed minimum rent (and the percentage

rent breakpoint) periodically over time based on increasing gross sales.

28.7 Audit Right. Let the landlord audit the tenant's gross sales. If the

tenant underpaid percentage rent by more than 3%, the tenant should pay interest

and the costs of the audit.

28.8 Kick-Out Right. Give the landlord the right to terminate the lease if

percentage rent does not reach a certain level by a certain date.

28.9 Recordkeeping. Require the tenant to maintain records sufficient to

make any audit meaningful.

28.10 Radius Clause. Include a "radius clause" in any lease requiring

percentage rent, i.e., the tenant may not compete with itself within a

restricted area without the landlord's consent.

28.11 Violation. Consider requiring the tenant to include as "gross

sales" (for percentage rent purposes) the greater of (a) a specified percentage

of gross sales at the premises; or (b) the gross sales of the tenant's store in

the restricted area if it violates the radius clause.

29. QUIET ENJOYMENT

29.1 Conditions. New York law (and probably the law of other states)

implies a covenant of quiet enjoyment if the lease is silent. Consider providing

that quiet enjoyment is subject to the rights of mortgagees, ground lessors, and

all other terms of the lease. Condition the covenant of quiet enjoyment upon the

tenant's not being in default.

29.2 Limit Obligation to Provide Services. Expressly limit the landlord's

obligation to provide services and other obligations regarding the building to

bare occupancy and express obligations under the lease. Try to prevent the

courts from using the "covenant of quiet enjoyment" as the basis to infer

possible landlord obligations to provide services beyond those the lease

requires.

30. REAL ESTATE TAXES

30.1 Tax Contests. Prohibit the tenant from contesting taxes without the

landlord's consent. If the landlord does consent, the landlord may want the

right to require the tenant to post a bond or letter of credit in the amount of

any contested taxes (if the tenant did not need to pay the taxes as a condition

to the contest).

30.2 Business Improvement District ("BID") Charges and Special

Assessments. Include any "BID" charges and special assessments in the definition

of "Real Estate Taxes."

30.3 Base Year Real Estate Taxes. Define "Base Year Real Estate Taxes" as

"net of any special assessments" and "as finally determined."

30.4 Further Assurances. The tenant should agree to assist the landlord,

as reasonably necessary, to qualify for tax abatements and benefits (e.g.,

Industrial Commercial Incentive Program ["ICIP"] in New York City). If the

landlord obtains such benefits, the lease should indicate whether the landlord

or the tenant will ultimately gain the economic benefits of the program and how

those benefits interact with real estate tax escalations.

30.5 Estimated Tax Payments. Require the tenant to make monthly estimated

tax payments, especially when the landlord's mortgage requires tax escrow

payments.

30.6 Management Fee.