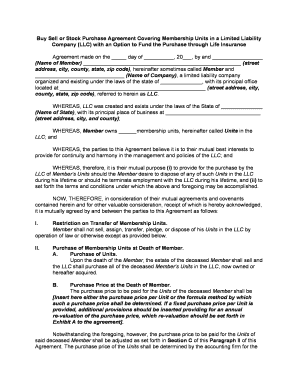

Buy Sell or Stock Purchase Agreement Covering Membership Units in a Limited Liability Company (LLC) with an Option to Fund the Purchase through Life Insurance

Agreement made on the _____ day of __________, 20___, by and _________________

(Name of Member) _____________________________________________________ (street

address, city, county, state, zip code) , hereinafter sometimes called Member and

______________________________ (Name of Company), a limited liability company

organized and existing under the laws of the state of ______________, with its principal office

located at _________________________________________________ (street address, city,

county, state, zip code) , referred to herein as LLC.

WHEREAS, LLC was created and exists under the laws of the State of ______________

(Name of State) , with its principal place of business at ________________________________

(street address, city, and county) ;

WHEREAS, Member owns ______membership units, hereinafter called Units in the

LLC ; and

WHEREAS, the parties to this Agreement believe it is to their mutual best interests to

provide for continuity and harmony in the management and policies of the LLC; and

WHEREAS, therefore, it is their mutual purpose (i) to provide for the purchase by the

LLC of Member’s Units should the Member desire to dispose of any of such Units in the LLC

during his lifetime or should he terminate employment with the LLC during his lifetime, and (ii) to

set forth the terms and conditions under which the above and foregoing may be accomplished.

NOW, THEREFORE, in consideration of their mutual agreements and covenants

contained herein and for other valuable consideration, receipt of which is hereby acknowledged,

it is mutually agreed by and between the parties to this Agreement as follows:

I. Restriction on Transfer of Membership Units. Member shall not sell, assign, transfer, pledge, or dispose of his Units in the LLC by

operation of law or otherwise except as provided below.

II. Purchase of Membership Units at Death of Member. A. Purchase of Units.

Upon the death of the Member, the estate of the deceased Member shall sell and

the LLC shall purchase all of the deceased Member’s Units in the LLC, now owned or

hereafter acquired.

B. Purchase Price at the Death of Member. The purchase price to be paid for the Units of the deceased Member shall be

[Insert here either the purchase price per Unit or the formula method by which

such a purchase price shall be determined. If a fixed purchase price per Unit is

provided, additional provisions should be inserted providing for an annual

re-valuation of the purchase price, which re-valuation should be set forth in

Exhibit A to the agreement].

Notwithstanding the foregoing, however, the purchase price to be paid for the Units of

said deceased Member shall be adjusted as set forth in Section C of this Paragraph II of this

Agreement. The purchase price of the Units shall be determined by the accounting firm for the

LLC, using the accounting principles generally applied to the LLC, and said determination by the

LLC’s accounting firm shall be final and conclusive upon all parties to this Agreement.

C. Insurance on the Member’s Life.

At the time of execution of this Agreement, the LLC is the owner and beneficiary

of certain life insurance policies described in Exhibit A attached hereto, insuring the life

of the Member . In the event of the death of Member, the face value of the insurance

policies shall be paid to the estate of the deceased Member in full or partial payment of

the purchase as soon after receipt by the LLC of the face value of the insurance policies

(as is reasonably practicable). In the event that any action, omission, or misstatement on

the part of a deceased Member results in the nonpayment by the insurance carrier of all

or part of the face value of the insurance policies described in Exhibit A to this

Agreement, then and in such events the purchase price set forth in Section B of this

Paragraph II of the Agreement shall be reduced by a like amount and the LLC shall

have no liability to the deceased Member’s estate for that portion of the face value of the

insurance policies which is not paid by the insurance carrier. The LLC agrees to pay

premiums on the insurance policies listed in Exhibit A to this Agreement and shall give

proof of payment of premiums to the Member whenever he requests. If a premium is not

paid within 10 days after its due date, the insured Member shall have the right to pay

such premium and be reimbursed therefore by the LLC. The LLC shall have the right to

purchase additional insurance on the life of the Member. Such additional insurance shall

be listed in Exhibit A to this Agreement, along with any substitution or withdrawal of life

insurance policies subject to this Agreement. In the event that the Member decides to

purchase additional life insurance on Member, the Member hereby agrees to cooperate

fully by performing all of the requirements of the life insurer which are necessary

conditions precedent to the issuance of life insurance policies. The LLC shall be the sole

owner of the policies issued to it and it may apply any dividends toward the payment of

premiums.

D. Payment of Balance of Purchase Price.

In the event that the amount of insurance proceeds listed in Exhibit A to this

Agreement as applied toward the purchase price of a deceased Member’s Units in the

LLC shall exceed said purchase price as determined in Section B of Paragraph II of

this Agreement, then the excess insurance proceeds shall be distributed to the

deceased Member’s estate as an additional death benefit from the LLC, payable to the

estate of the deceased Member in equal consecutive monthly installments over a period

of months, with the first installment due on the first day of the month beginning no later

than days from the date of death. Said excess purchase price shall be evidenced

by an installment note, bearing interest at __ %. The note shall provide for

prepayment at any time without prepayment penalty.

III. Purchase of Membership Units During Lifetime of Selling Member A. Purchase of Membership Units of Member While in the Employ of the LLC.

In the event that a Member (the Selling Member ) desires to sell, assign, transfer,

pledge, or dispose of any Unit in the LLC owned by him at a time when the Selling

Member is in the employ of the LLC, he shall first offer in writing to sell all of his Units in

the LLC to the LLC. The written offer by the Selling Member shall state the name of any

other intended transferee (the Intended Transferee) and the terms and conditions of the

intended transfer, including the proposed purchase price. At any time during the period

of 30 days beginning with the day on which such written offer is received, the LLC may

purchase all of the Units of such Member at a purchase price equal to the lesser of (i)

the price offered by the Intended Transferee or (ii) the price determined in accordance

with Section C of Paragraph III of this Agreement. Any shares not purchased by the

LLC within 30 days after receipt of such offer in writing shall be offered in writing at the

same price to the other Members, each of whom shall have the right to purchase such

portion of the remaining Units offered for sale as the number of Units owned by him at

such date shall bear to the total number of Units owned by all of the other Members

excluding the Selling Member . If any of the Members elect to purchase less than his pro

rata proportion of the offered Units, or elect to purchase none at all, then the purchasing

Members shall have the right to purchase the Units which the Member declines to

purchase in such proportion as the number of Units purchased by each Member

exercising his right to purchase bears to the total number of Units purchased by all

Members exercising their right to purchase. If the LLC or the remaining Members do not

purchase all of the Units owned by the Selling Member in the LLC within 60 days of the

initial receipt of the offer to sell by the LLC, the Selling Member may sell the Units to the

Intended Transferee, but only on the same terms and conditions, including the same

purchase price, as set forth in the written offer. If the sale to the Intended Transferee is

not completed within 120 days of the initial receipt of the offer to sell by the LLC, the

right of the Selling Member to sell his Units to the Intended Transferee shall terminate

and such Selling Member must again comply with the requirements of this Section A in

order to sell or otherwise transfer his Units hereunder.

B. Purchase of Units of Member While Not in the Employ of the LLC. In the event that a Member’s employment with the LLC is terminated prior to his

Retirement (as such term is defined in Section D of Paragraph III of this Agreement) or

his Total Disability (as such term is defined in Section B of Paragraph IV of this

Agreement) the terminated Member shall sell and the LLC shall purchase all, but not

less than all, of his Units in the LLC at a price determined in accordance with Section C

of Paragraph III of this Agreement.

C. Purchase Price During Lifetime Sale. The purchase price to be paid for the Units of the Member who desires to sell his

Units during his lifetime pursuant to the terms of Section A or Section B of Paragraph

III of this Agreement shall be [Insert here either the purchase price per Unit or the

formula method at which such a purchase price shall be determined. If a fixed

purchase price per Unit is provided, additional provisions should be inserted

providing for an annual re-valuation of the purchase price, which re-valuation

should be set forth in Exhibit B to the Agreement.] .

The purchase price of the Units as set forth in this Section shall be determined by the

accounting firm for the LLC, using the accounting principles generally applied to the LLC, and

said determination by the LLC’s accounting firm shall be final and conclusive upon all parties to

this Agreement.

D. Purchase and Purchase Price of Units of Member at or Following Retirement.

In the event that a Member’s employment with the LLC is terminated due to

his Retirement, as such term is defined below, (and at such time or at any time

thereafter the retired Member desires to sell, assign, transfer, pledge, or dispose of any

Unit in the LLC owned by him), such retired Member shall sell and the LLC shall

purchase all of his Units in the LLC at a price determined in accordance with this

Section. The purchase price to be paid for the Units of a retired Member pursuant to the

terms of this Section shall be [Insert here either the purchase price per Unit or the

formula method at which such a purchase price shall be determined. If a fixed

purchase price per Unit is provided, additional provisions should be inserted

providing for an annual re-valuation of the purchase price, which re-valuation

should be set forth in Exhibit B to the Agreement.] .

The purchase price of the Units as set forth in this Section shall be determined by the

accounting firm for the LLC, using the accounting principles generally applied to the LLC, and

said determination by the LLC’s accounting firm shall be final and conclusive upon all parties to

this Agreement. For purposes of this Section, the term Retirement shall mean the termination of

the Member’s employment with the LLC on or after said Member’s having reached the age of

(e.g., 70) _______ and with the then present intention on the part of the retired Member neither

to seek employment either with another employer nor to become self-employed and provide

services or products similar in nature as those provided by the LLC. Whether or not a Member’s

termination of employment is on account of his Retirement (and, therefore, whether or not

Member said is entitled to the benefits of this Section of the Agreement) shall be made at the

time of termination of employment.

E. Installment Purchase of Units. In the event of a sale of Units during the Selling Member’s lifetime, _____

percent of the purchase price shall be paid on the date falling _______ days after the

close of the LLC’s fiscal year in which the Member terminates employment or the written

offer to sell or written notice of sale is first received by the LLC. The balance of the

purchase price shall be evidenced by an installment note executed by the LLC, the

purchasing Members, or both, providing for ______ equal consecutive monthly

installments, with the first installment due on the first day of the month following the

initial percent payment, said note to bear interest at ______%. The note shall provide for

prepayment at any time without prepayment penalty.

F. Purchase of Life Insurance. In the event of a sale of Units during the Selling Member’s lifetime, or if this

Agreement terminates before the death of a Member, then such Member shall have the

right to purchase the policy or policies on his life owned by the LLC by paying an amount

in cash equal to the cash surrender value as of the date of transfer, less any existing

indebtedness charged against the policy or policies. This right shall lapse if not

exercised within 30 days after such sale or termination.

IV. Purchase of Units in the Event of Disability A. Purchase of Units in the Event of Disability.

In the event that anytime from and after the end of six months of continuous Total

Disability, as defined in Section C of Paragraph IV of this Agreement, a disabled

Member desires to sell, assign, transfer, pledge, or dispose of any Unit in the LLC

owned by him, he shall sell and the LLC shall purchase all, but not less than all, of the

Units of the disabled Member in the LLC at a price determined in accordance with

Section B of Paragraph IV of this Agreement. The provisions of Sections E and F of

Paragraph III shall apply in the event of a sale of Units under this Paragraph IV.

B. Purchase Price in the Event of Disability.

The purchase price to be paid for the Units following six months of continuous

Total Disability, shall be [Insert here either the purchase price per Unit or the

formula method at which such a purchase price shall be determined. If a fixed

purchase price per Unit is provided, additional provisions should be inserted

providing for an annual re-valuation of the purchase price, which re-valuation

should be set forth in Exhibit B to the Agreement.].

The purchase price of the Units as set forth in this Section shall be determined by the

accounting firm for the LLC using the accounting principles generally applied to the LLC, and

said determination by the LLC’s accounting firm shall be final and conclusive upon all parties to

this Agreement.

C. Definition of Total Disability.

Total Disability shall have the same meaning as the term Totally Disabled (or

any term of like import) has under any policy or plan of group disability insurance

insuring the disabled Member pursuant to a plan of insurance carried by the LLC. In the

event that a disabled Member is not covered by any such plan of group disability

insurance, then and in such event Total Disability shall mean a physical or mental

condition of the Member resulting from bodily injury, disease, or mental disorder which

renders him incapable of continuing his usual and customary employment with the LLC.

In the event that the preceding sentence shall apply, the disability of a Member shall be

determined by a licensed physician chosen by the LLC. In the event that the disabled

Member shall disagree with the findings of the licensed physician chosen by the LLC,

the disabled Member shall have the right to choose a second licensed physician and the

licensed physician so chosen, together with the licensed physician chosen by the LLC,

shall agree upon a third licensed physician, and the decision of a majority of said three

licensed physicians shall be binding upon the LLC and the Member.

V. Endorsement on Membership Unit Certificates The following endorsement shall be printed on each membership unit certificate subject

to this Agreement: “Transfer is subject to the terms and provisions of a Membership Unit

Purchase Agreement on file with the Managing Member of this LLC.”

VI. Execution of Instruments to Effect the Terms of this Agreement The Selling Member or the legal representative of a deceased or disabled Member shall

make, execute, and deliver any documents necessary to carry out the provisions of this

Agreement. This Agreement shall be binding upon the LLC, the Member , their heirs, legal

representatives, successors, and assigns. It is hereby agreed by the parties hereto that the LLC

shall not merge or consolidate with any other limited liability company or corporation, except and

unless such successor limited liability company or corporation shall agree to the terms and

conditions of this Agreement.

VII. Termination of the Agreement

This Agreement shall terminate upon the occurrence of any of the following events:

1.The bankruptcy, receivership or dissolution of the LLC; or

2. Written agreement of the Members and the LLC. No modification,

termination, or waiver shall be valid unless in writing and signed by the parties

sought to be charged thereunder; or

3. Death or termination of employment of all of the Members simultaneously, or

within a period of 30 days.

VIII. LLC Restrictions on Purchase of Membership UnitsIf the LLC is unable to make any purchase required of it hereunder because of the

provisions of the applicable statutes or of its operating agreement or bylaws, the LLC agrees to

take such action as may be necessary to permit it to make such purchase.

IX. Notice

All notices, including offers and acceptances, shall be deemed to have been given if

delivered or mailed, by certified or registered mail, to all parties entitled thereto at their

addresses as contained in the records of the LLC. The date of such delivery, or the date of

mailing by certified or registered mail, shall be the date of such notice for purposes of this

Agreement.

X. Prior Agreements

This Buy Sell Agreement shall supersede and replace all prior buy sell or membership

unit purchase agreements executed by any or all of the Members or the LLC regarding the

Membership Units in the LLC. Any such previously executed agreements shall have no effect

upon the execution of this Agreement.

XI. Governing Law This Agreement shall be governed by the laws of the State of ______________.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the

_____ day of _____________, 20____.

_________________________

(Name of Company)

By: _______________________ ___________________________

Managing Member Member

(Acknowledgement before Notary Public)

Exhibit A to Buy Sell Agreement

The following policies of life insurance are owned by and insure the life of

_____________________ (Name of Member) for the purpose of this Agreement:

Issuer: Policy Number:

Restricted Face

Amount1

___________________________ ___________________

1 Portion of the Face Amount of the Policy which Is Restricted for Payment Pursuant to Section C of

Paragraph II of this Agreement

___________________________ ___________________Exhibit B to Buy Sell Agreement

(Exhibit B should set forth the re-valuation procedures for setting a fixed purchase price for

shares at death of a Member. See Paragraph II, Section B, Paragraph III, Section C, Paragraph

III, Section D, and Paragraph IV, Section A).