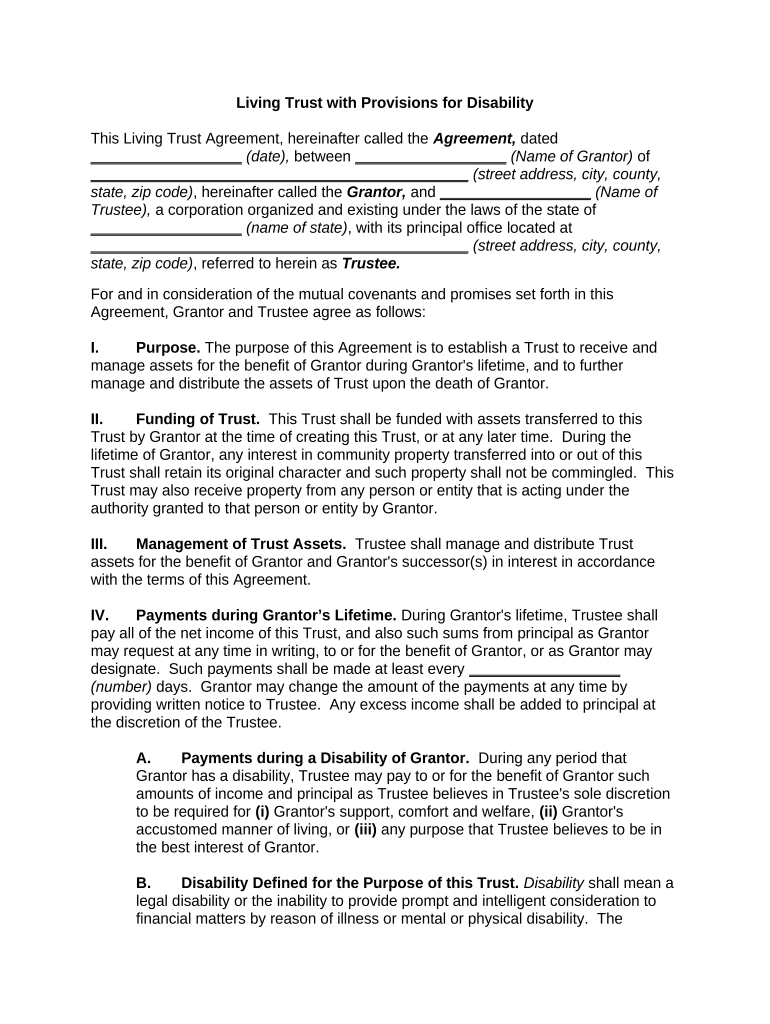

Living Trust with Provisions for Disability

This Living Trust Agreement, hereinafter called the Agreement, dated

__________________ (date), between __________________ (Name of Grantor) of

_____________________________________________ (street address, city, county,

state, zip code) , hereinafter called the Grantor, and __________________ (Name of

Trustee), a corporation organized and existing under the laws of the state of

__________________ (name of state) , with its principal office located at

_____________________________________________ (street address, city, county,

state, zip code) , referred to herein as Trustee.

For and in consideration of the mutual covenants and promises set forth in this

Agreement, Grantor and Trustee agree as follows:

I. Purpose. The purpose of this Agreement is to establish a Trust to receive and

manage assets for the benefit of Grantor during Grantor's lifetime, and to further

manage and distribute the assets of Trust upon the death of Grantor.

II. Funding of Trust. This Trust shall be funded with assets transferred to this

Trust by Grantor at the time of creating this Trust, or at any later time. During the

lifetime of Grantor, any interest in community property transferred into or out of this

Trust shall retain its original character and such property shall not be commingled. This

Trust may also receive property from any person or entity that is acting under the

authority granted to that person or entity by Grantor.

III. Management of Trust Assets. Trustee shall manage and distribute Trust

assets for the benefit of Grantor and Grantor's successor(s) in interest in accordance

with the terms of this Agreement.

IV. Payments during Grantor’s Lifetime. During Grantor's lifetime, Trustee shall

pay all of the net income of this Trust, and also such sums from principal as Grantor

may request at any time in writing, to or for the benefit of Grantor, or as Grantor may

designate. Such payments shall be made at least every __________________

(number) days. Grantor may change the amount of the payments at any time by

providing written notice to Trustee. Any excess income shall be added to principal at

the discretion of the Trustee.

A. Payments during a Disability of Grantor. During any period that

Grantor has a disability, Trustee may pay to or for the benefit of Grantor such

amounts of income and principal as Trustee believes in Trustee's sole discretion

to be required for (i) Grantor's support, comfort and welfare, (ii) Grantor's

accustomed manner of living, or (iii) any purpose that Trustee believes to be in

the best interest of Grantor.

B. Disability Defined for the Purpose of this Trust. Disability shall mean a

legal disability or the inability to provide prompt and intelligent consideration to

financial matters by reason of illness or mental or physical disability. The

determination of whether Grantor has a disability shall be made by Grantor's

most recent attending physician. Trustee shall be entitled to rely on written

notice of that determination.

V. Death of Grantor. Upon the death of Grantor, and after the payment of Grantor's

just debts, funeral expenses, and expenses of last illness, the following distributions

shall be made:

A. Specific Distributions. The following specific distributions shall be made

from the assets of the Trust. However, such distributions (other than

distributions, if any, to Grantor's spouse) shall be made only if the Grantor's

spouse does not survive Grantor. __________________ (Amount or

Percentage of Assets) shall be distributed to __________________ (Name of

Beneficiary). If this Beneficiary does not survive Grantor and Grantor’s spouse,

this bequest shall be distributed with the residuary assets of this Trust.

B. Tangible Personal Property. Upon the death of Grantor and subject to

the preceding provisions of this Trust, all clothing, jewelry, automobiles,

household furniture and furnishings, recreational equipment, all personal effects

used by Grantor about Grantor's person or home, and other items of tangible

personal property shall be distributed to __________________ (Name) of

_____________________________________________ (street address, city,

county, state, zip code) . If this person does not survive Grantor, the tangible

personal property shall be distributed to __________________ (Name) of

_____________________________________________ (street address, city,

county, state, zip code) . If this person does not survive Grantor and Grantor’s

spouse, the tangible personal property shall be distributed with the residuary

assets of this Trust.

C. Residuary Assets. The residuary assets of this Trust shall be distributed

to __________________ (Name) of ________________________________

(street address, city, county, state, zip code) . If such beneficiary does not survive

Grantor and Grantor’s Spouse, the residuary assets shall be distributed to the

following beneficiaries in the percentages as shown:

1. _______ % to ________________________ (Name) of

________________________________ (street address, city, county, state, zip

code) .

2. _______ % to ________________________ (Name) of

________________________________ (street address, city, county, state, zip

code) .

3. _______ % to ________________________ (Name) of

________________________________ (street address, city, county, state, zip

code) .

If any of these people do not survive Grantor and Grantor’s spouse, this share

shall be distributed proportionately to the other distributee(s) listed under this

provision.

VI. Powers of Trustee. Trustee, in addition to other powers and authority granted

by law or necessary or appropriate for proper administration of Trust, shall have the

following rights, powers, and authority without order of court and without notice to

anyone:

A. Receive Assets. To receive, hold, maintain, administer, collect, invest

ant re-invest the trust assets, and collect and apply the income, profits, and

principal of the Trust in accordance with the terms of this instrument.

B. Receive Additional Assets. To receive additional assets from other

sources including assets received under the Will of Grantor or any other person.

C. Standard of Care. To acquire, invest, reinvest, exchange, retain, sell,

and mortgage estate and trust assets, exercising the judgment and care, under

the circumstances then prevailing, that persons of prudence, discretion and

intelligence exercise in the management of their own affairs, not in regard to

speculation but in regard to the permanent disposition their funds, considering

the probable income as well as the probable safety of their capital. Within the

limitations of that standard, Trustee is authorized to acquire and retain every kind

of property, real, personal or mixed, and every kind of investment, specifically

including, but not by way of limitation, bonds, debentures and other corporate

obligation, and stocks, preferred or common, that persons of prudence, discretion

and intelligence acquire or retain for their own account, even though not

otherwise a legal investment for trust funds under the laws and statutes of the

United States or the state under which this instrument is administered.

D. Retain Assets. To retain any asset, including uninvested cash or original

investments, regardless of whether it is of the kind authorized by this instrument

for investment and whether it leaves a disproportionately large part of the estate

or trust invested in one type of property, for as long as the Trustee deems

advisable.

E. Dispose of or Encumber Assets . To sell, option, mortgage, pledge,

lease or convey real or personal property, publicly or privately, upon such terms

and conditions as may appear to be proper, and to execute all instruments

necessary to effect such authority.

F. Settle Claims. To compromise, settle, or abandon claims in favor of or

against Trust.

G. Manage Property. To manage real estate and personal property, borrow

money, exercise options, buy insurance, and register securities as may appear to

be proper.

H. Allocate Between Principal and Income. To make allocations of

charges and credits as between principal and income as in the sole discretion of

the Trustee may appear to be proper.

I. Employ Professional Assistance. To employ and compensate counsel

and other persons deemed necessary for proper administration and to delegate

authority when such delegation is advantageous to the Trust.

J. Distribute Property. To make division or distribution in money or kind, or

partly in either including disproportionate in-kind distributions, at values to be

determined by Trustee, and Trustee's judgment shall be binding upon all

interested parties.

K. Enter Contracts. To bind the Trust by contracts or agreements without

assuming individual liability for such contracts.

L. Exercise Stock Ownership Rights. To vote, execute proxies to vote,

join in or oppose any plans for reorganization, and exercise any other rights

incident to the ownership of any stocks, bonds or other properties of Trust.

M. Duration of Powers. To continue to exercise the powers provided in this

Agreement after the termination of Trust until all the assets of Trust have been

distributed.

N. Hold Trust Assets as a Single Fund. To hold the assets of Trust,

shares, or portions of Trust created by this instrument as a single fund for joint

investment and management, without the need for physical segregation, dividing

the income proportionately among them. Segregation of the various trust shares

need only be made on the books of Trustee for accounting purposes.

O. Compensation. To receive reasonable compensation for Trustee's

services under this Agreement and be exonerated from and to pay all reasonable

expenses and charges of Trust.

P. Loans to Beneficiaries. To make loans to any trust beneficiary for the

purpose of providing the beneficiary with the funds necessary to take advantage

of exceptional business opportunities or to provide for the needs of the

beneficiaries and their families.

Q. Methods of Distribution. To make payments to or for the benefit of any

beneficiary (specifically including any beneficiary under any legal disability) in

any of the following ways: (a) directly to the beneficiary, (b) directly for the

maintenance, welfare and education of the beneficiary, (c) to the legal or natural

guardian of the beneficiary, or, (d) to anyone who at the time shall have custody

and care of the person of the beneficiary. Trustee shall not be obliged to see to

the application of the funds so paid, but the receipt of the person to whom the

funds were paid shall be full acquittance of Trustee.

VII. Additional Trustee Provisions. These additional provisions shall apply

regarding Trustee:

A. Grantor as Trustee. If at any time Grantor is Trustee, Grantor may

appoint a successor Trustee, to become effective immediately or upon any stated

contingency, by making such designation in writing. Such designee shall

become the successor Trustee upon acceptance of the terms and conditions of

this Agreement.

B. Successor Trustee. If at any time a Trustee cannot serve because of the

Trustee's disability (as previously defined), death, or other reason,

__________________ (Name) of ________________________________

(street address, city, county, state, zip code) , is designated as the successor

Trustee, without bond. If such designee(s) is/are unable to serve for any reason,

__________________ (Name) of ________________________________

(street address, city, county, state, zip code) , i s designated as the alternate

successor Trustee, without bond. Such designees shall become the successor

Trustee upon acceptance of the terms and conditions of this Agreement.

C. Resignation of Trustee. Any Trustee may resign by giving written notice

to the beneficiaries to whom income could then be distributed. Such resignation

shall take effect on such date specified in the notice, but not earlier than thirty

(30) days after the date of delivery of such written resignation unless an earlier

effective date shall be agreed to by the income beneficiaries.

D. Adult Beneficiary Rights. If Trustee resigns or for any reason ceases to

serve as Trustee, and if the successor Trustee(s) designated by the Grantor, if

any, fail or cease to serve as Trustee, then the adult beneficiaries to whom

income could then be distributed, together with the adult beneficiaries to whom

principal would be distributed if the Trust were then to terminate, may by majority

action in writing appoint a successor Trustee. If agreement of a majority of the

beneficiaries cannot be obtained within sixty (60) days, a successor Trustee shall

be appointed by the court having general jurisdiction of the Trust. Any successor

Trustee appointed shall have all the rights conferred upon the original Trustee

and shall be bound by the provisions of this Trust.

E. Accounting. Trustee shall provide an accounting to the Beneficiary (or

beneficiaries) on at least a quarterly basis. If a beneficiary has a disability,

Trustee shall provide the accounting to a guardian or conservator, if any.

F. Bond. No bond shall be required of any Trustee.

VIII. Right to Direct Investments. At any time that Trust has investments, and

provided that Grantor does not have a disability, Grantor may direct any Trustee to

purchase, sell, or retain any trust investment.

IX. Revocation or Amendment. During Grantor's lifetime, Grantor may revoke at

any time, and/or the Grantor may amend, this Agreement by delivering to Trustee an

appropriate written revocation or amendment, signed by Grantor. If Trustee consents,

the powers of revocation, but not the power of amendment, may be exercised by a duly

appointed and acting attorney-in-fact for Grantor for the purpose of withdrawing assets

from Trust.

X. Governing Law. This Agreement shall be construed in accordance with the

laws of the State __________________ (name of state).

XI. Perpetuities Savings Clause. Despite any other provision of this Agreement to

the contrary, trust created by this Agreement shall terminate no later than 21 years after

the death of the last surviving beneficiary of this Agreement who is living at the time of

the death of Grantor.

XII. Severability . If any portion of this Agreement shall be held to be invalid or

unenforceable for any reason, the remaining provisions shall continue to be valid and

enforceable. If a court finds that any provision of this Agreement is invalid or

unenforceable, but that by limiting such provision it would become valid and

enforceable, then such provision shall be deemed to be written, construed, and

enforced as so limited.

XIII. Miscellaneous.

A. Paragraph Titles and Gender. The titles given to the paragraphs of this

Trust are inserted for reference purposes only and are not to be considered as

forming a part of this Trust in interpreting its provisions. All words used in this

Trust in any gender shall extend to and include all genders, and any singular

words shall include the plural expression, and vice versa, specifically including

child and children, when the context or facts so require, and any pronouns shall

be taken to refer to the person or persons intended regardless of gender or

number.

B. Thirty Day Survival Requirement. For the purposes of determining the

appropriate distributions under this Trust, no person or organization shall be

deemed to have survived Grantor, unless such person or entity is also surviving

(or in existence) on the thirtieth day after the date of the Grantor's death.

C. Common Disaster. If Grantor and Grantor's spouse die under

circumstances such that there is no clear or convincing evidence as to the order

of their deaths, or if it is difficult or impractical to determine which person survived

the death of the other person, it shall, for the purpose of distribution of Grantor's

life insurance, property passing under any will or other contracts, if any, and

property passing under this Trust, be conclusively presumed that Grantor

predeceased the death of Grantor's spouse, and notwithstanding any other

provision of this Trust, Grantor's spouse (or Grantor's spouse's estate as the

case may be) shall receive the distribution to which Grantor's spouse would

otherwise be entitled to receive without regard to a survivorship requirement, if

any.

D. Liability of Fiduciary. No fiduciary who is a natural person shall, in the

absence of fraudulent conduct or bad faith, be liable individually to any

beneficiary of Grantor's trust estate, and Grantor's trust estate shall indemnify

such natural person from any and all claims or expenses in connection with or

arising out of that fiduciary's good faith actions or nonactions of the fiduciary,

except for such actions or nonactions which constitute fraudulent conduct or bad

faith. No successor trustee shall be obliged to inquire into or be in any way

accountable for the previous administration of the trust property.

E. Spouse. Grantor is married to (Name) and all references in this Trust to

Grantor's spouse are references to __________________ (Name) .

F. Children. The names of Grantor's children are:

_____________________________________________ (names).

All references in this Trust to Grantor's child or Grantor's children include the

above child or children, and any other children born to or adopted by the Grantor

after the signing of this Trust.

___________________________

(Signature of Grantor)

________________________

(Printed Name of Grantor)

________________________

(Name of Trustee)

By: ___________________________

(Signature of Officer)

________________________

(Title of Officer)

(Acknowledgement before Notary Public)