Fill and Sign the Mississippi Tax Sales Form

Handy Suggestions for Preparing Your ‘Mississippi Tax Sales’ Online

Are you fed up with the burden of managing paperwork? Look no further than airSlate SignNow, the ultimate electronic signature solution for both individuals and organizations. Wave farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can easily finalize and sign paperwork online. Take advantage of the powerful features included in this user-friendly and cost-effective platform and transform your method of document handling. Whether you need to authorize forms or gather eSignatures, airSlate SignNow manages everything seamlessly, needing only a few clicks.

Adhere to these comprehensive instructions:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, the cloud, or our template collection.

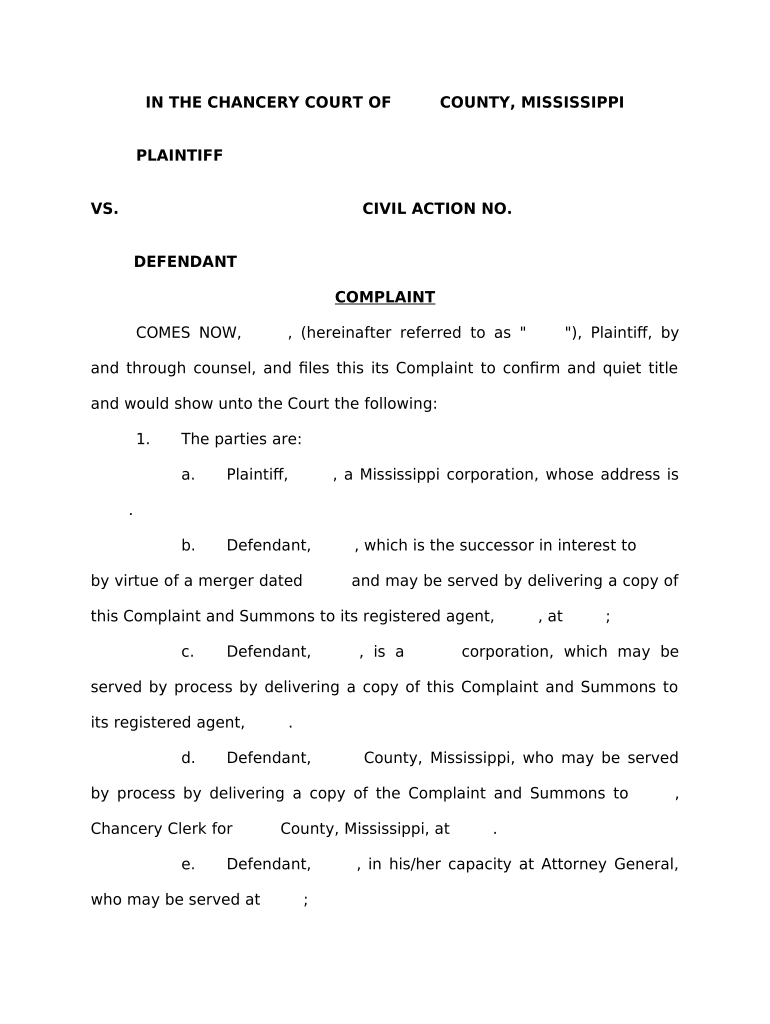

- Open your ‘Mississippi Tax Sales’ in the editor.

- Click Me (Fill Out Now) to finish the form on your end.

- Include and designate fillable fields for others (if required).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Download, print your copy, or convert it into a multi-use template.

No need to worry if you have to collaborate with others on your Mississippi Tax Sales or send it for notarization—our platform supplies everything necessary to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What are Mississippi Tax Sales and how do they work?

Mississippi Tax Sales occur when property owners fail to pay their property taxes, leading the state to auction off the property to recover owed taxes. These sales allow buyers the opportunity to purchase properties at potentially lower prices, making it essential to understand the process involved. airSlate SignNow can assist in managing the necessary documentation for participating in Mississippi Tax Sales, streamlining your experience.

-

How can airSlate SignNow help with documents for Mississippi Tax Sales?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the essential documents required for Mississippi Tax Sales. With customizable templates and a seamless eSigning process, you can ensure all paperwork is handled efficiently, allowing you to focus on your investment opportunities.

-

What features does airSlate SignNow offer for Mississippi Tax Sales?

airSlate SignNow offers a variety of features that are beneficial for those involved in Mississippi Tax Sales, including secure eSignature capabilities, document tracking, and automated workflows. These features enhance the efficiency of managing your tax sale documents, ensuring you stay organized and compliant throughout the process.

-

Is there a cost associated with using airSlate SignNow for Mississippi Tax Sales?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective, especially for those engaged in Mississippi Tax Sales. The pricing model is flexible, allowing you to choose a plan that fits your business needs while providing signNow value through time savings and increased efficiency.

-

Can I integrate airSlate SignNow with other tools for Mississippi Tax Sales?

Absolutely! airSlate SignNow integrates seamlessly with various applications that are commonly used in the context of Mississippi Tax Sales, such as CRM systems and document management tools. This integration capability helps streamline your workflow and ensures that all your documents are accessible in one place.

-

What are the benefits of using airSlate SignNow for Mississippi Tax Sales documentation?

The benefits of using airSlate SignNow for Mississippi Tax Sales documentation include increased efficiency, enhanced security, and improved collaboration. By digitizing and automating the signing process, you can reduce the time it takes to complete transactions and ensure that your documents are secure and easily retrievable.

-

How secure is airSlate SignNow for handling Mississippi Tax Sales documents?

Security is a top priority for airSlate SignNow when handling documents related to Mississippi Tax Sales. The platform employs advanced encryption and secure data storage practices to protect your sensitive information, ensuring that your documents remain confidential and tamper-proof throughout the signing process.

The best way to complete and sign your mississippi tax sales form

Find out other mississippi tax sales form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles