Division of Child Care and Early Childhood Education

http://www.arkansas.gov/childcare/

PROGRAM SUPPORT

P.O. Box 1437, Slot S160

Little Rock, AR 72203

501-682-9699

Fax: 501-682-4897

TDD: 501-682-1550

ARKANSAS CHILD CARE FACILITIES GUARANTEED LOAN PROGRAM

GUIDELINES FOR APPLICATION PROCESS

What is a guaranteed loan?

Often it can be difficult for child care providers to meet the requirements for typical business financing

from a bank. The Division of Child Care and Early Childhood Education administer funds established

to support the development and expansion of child care facilities in the state. With these funds, the

state of Arkansas acts as a guarantor for child care providers who otherwise would not qualify for the

loan at the provider’s selected lending institution. The total amount of the loan request is determined

by the business needs of the provider. If funding is approved, the bank issues the loan and the state

guarantees, in case of default, to reimburse the bank for 80% of the outstanding principle balance, up

to a maximum of $25,000. In other words, the state of Arkansas takes a role similar to that of a cosigner on the loan, but only for the amount established in a guarantee agreement with the bank.

Who is eligible for a guaranteed loan?

Those who desire to establish a new licensed child care facility or expand an existing licensed facility

and are in good standing with the Department of Human Services may apply for a guaranteed loan.

Any applicant or child care facility that is excluded from services through the Department of Human

Services cannot be approved for the guarantee. Either licensed child care family homes or licensed

child care centers may obtain support through the Guaranteed Loan Program. If the funding is for the

purpose of establishing a new facility, licensing requirements must be completed in a timely manner

after the funding is obtained.

What types of activities or items may be financed with the loan funds?

These funds may be used for any aspect of establishing or expanding a child care facility. This may

include, but is not limited to, the following: construction and remodeling costs; temporary support for

staff salaries; temporary support for operating expenses such as utilities, rent, food, supplies, and

other normal business expenses; equipment for playgrounds; equipment for learning environments;

training expenses; advertising; and transportation costs.

How do I apply for a guaranteed loan?

Application forms for Arkansas Child Care Facilities Guaranteed Loan Program may be obtained

through the Arkansas Division of Child Care and Early Childhood Education Program Support Office.

You may request an application by writing to P.O. Box 1437, Slot S-160, Little Rock, AR 72203-1437,

by phone at (501) 682-9699, by e-mailing Dee Walker at dee.walker@arkansas.gov to be e-mailed to

you, or by downloading the application via our website address at http://www.arkansas.gov/childcare.

www.arkansas.gov/dhs

Serving more than one million Arkansans each year

�What do I need to do to complete the application process?

Although it is not a complicated process, completion of a successful guaranteed loan application

requires some detailed work and planning. To make this work effectively, we ask you to complete the

following steps.

_____1.

_____2.

_____3.

_____4.

_____5.

_____6.

_____7.

_____8.

Request an application packet and read the information and requirements completely

and carefully. As you do this, write down any questions you may have and note anything

you do not understand.

Ask to talk to the Program Coordinator at the Arkansas Division of Child Care and Early

Childhood Education Program Support Office, phone (501) 682-9699. This individual will

be able to answer any questions and will work with you to help you develop the strongest

possible application for your facility.

Complete a beginning draft of the financial information section of your application to help

you determine a tentative level of financial need for your loan application.

Identify a local bank or other financial institution appropriate for your situation and

complete their application process. If they approve your loan, you will not be eligible for

the guaranteed loan and should continue your business plans by working with the bank

and local small business administration offices.

If the bank denies your loan, ask them if they would be willing to consider the loan if the

state acts as a guarantor for the loan. If the lending institution is not familiar with the

guaranteed loan program, share information from this packet with them and let them

know that they may also call the Program Coordinator at the Division of Child Care and

Early Childhood Education Program Support Office for answers to their questions.

Request a letter from your bank or lending institution stating reasons for denial of the

loan and stating they would be willing to reconsider the loan with the state guarantee.

Gather all required information for your application. This includes the following:

Completed Arkansas Child Care Facilities Guaranteed Loan Application.

All requests (including new, renovation or expansion) must be inspected and have a

letter from your local child care licensing specialist. If you do not have the name of that

individual, contact the licensing office at (501) 682-8590 or (800) 445-3316 and they

will assist you in making contact with your local specialist. New facilities will need to

arrange for a preliminary inspection of the proposed facility through their local

licensing specialist to obtain this letter.

Letters documenting zoning, health, and fire approvals.

Letter of denial from bank or lending institution. Letter should include information on

whether the bank would be willing to issue the loan if 80%, up to $25,000, is

guaranteed.

Five year business plan, using forms and formats in application packet.

Five year projected budget, using forms and formats in application packet.

Completed loan application for the bank or financial institution.

Submit the completed application form and all supporting information in a single packet,

fastened only with a single clip or staple in the upper, left-hand corner of the pages.

DO NOT use any binders, vinyl covers, folders or other special fastenings.

APPLICATIONS THAT DO NOT CONTAIN ALL OF THE REQUIRED ITEMS WILL NOT BE

CONSIDERED.

2

�How will I know if the guarantee is approved?

When your application packet is received, the Program Coordinator will review the information for

completeness and to assess the effectiveness of your proposal. If necessary, the Program

Coordinator will request additional information to support your application. You will receive a letter

acknowledging receipt of your application and informing you of any additional information required. It

is YOUR responsibility to follow through on the process and provide the information requested. Action

on your application will not move forward until all information requested has been received.

After the application is complete and all additional information has been provided, the Program

Coordinator will schedule a time for the applicant/provider to meet with the Finance Committee of the

Arkansas Early Childhood Commission. At this meeting, committee members will review the

application with representatives from the Division of Child Care and Early Childhood Education and

the applicant/provider, asking questions about the proposed business plan, projected budget, and any

other information they feel they need to make an informed decision about the proposed facility.

The commissioners make a recommendation to the Division. The Division has final authority to

approve the application, deny the application, or request additional information before making a

decision about the application. The applicant/provider will be informed as to the decision of the

committee within three business days following the meeting.

Is there anything I can do to make my application more successful?

The application packet contains detailed instructions for each section of the application. Please follow

the recommendations and complete each section thoroughly and carefully. Do not skip any sections

and do not leave anything blank.

The process of applying for the guarantee includes only information that is necessary for successful

development of a child care facility and business. If you do not understand some sections of the

application or do not have the information required, you need to take the time to get that information

and present it in a clear, fully-developed business plan and a projected budget is recommended as a

sound business practice in all businesses. Remember, even though we are in a caring business, it

still must be based on sound business practices if we want to succeed.

Don't hesitate to contact the Arkansas Division of Child Care and Early Childhood Education Program

Support Office or your licensing specialist with any questions or concerns. We are here to help you

succeed in meeting the needs of children and families in the state of Arkansas.

3

�ARKANSAS CHILD CARE FACILITIES GUARANTEED LOAN PROGRAM

APPLICATION FORM INSTRUCTIONS

Please read the instructions carefully and complete the forms accurately. Do not leave any

categories blank. If something does not apply to your facility, please mark the category with

the letters N/A. If you have any questions, contact the Program Coordinator.

A. Check the boxes that describe the facility you will be operating with completion of those plans

proposed in this loan application. Use the following guidelines:

Check New Center for the following:

1) starting a child care center at a new site; or

2) new owner planning to purchase existing center; or

3) plan to change family child care home to center care.

Check Expansion/Renovation Existing Center for the following:

1) adding space, remodeling, or making other changes to child care center applicant

currently operates; or

2) operating expenses, program development, staff development or other program support at

existing center.

Check New Family Home for the following:

1) starting a new child care family home in your name.

Check Expansion/Renovation Existing Family Home for the following:

1) adding space, remodeling, or making other changes to family home applicant currently

operates; or

2) operating expenses, program development, staff development or other program support at

existing family home.

Check Non-Profit for the following:

1) the applicant has submitted an application or completed the process of incorporating as a

non-profit corporation through the Arkansas Secretary of State office; or

2) the center is operated by an existing non-profit organization (i.e. church, boys/girls club,

etc.).

Check For-Profit for the following:

1) a sole proprietor or partnership with profits earned by the business retained as income for

one or more individuals; or

2) the center is operated by a for-profit corporation.

B. Complete applicant personal information (with home address) for individual who will act as

contact and take primary responsibility for the child care center or family home. If there are

additional applicants, note this after the first name and attach additional information for any coapplicants (including spouses or significant others who will be directly involved in the business)

on a separate sheet attached to the application form.

C. Complete this section’s information for the location and name you plan to use if the loan

application is approved and processed.

D. You must provide evidence of necessary approvals in each of these categories. You must also

provide copies of any licenses currently issued to any applicant or co-applicant. If you have

4

�been given an exemption or extension for approvals in any of the areas, you must attach a

letter from the appropriate authority stating the nature of the exemption or extension and what

will be required to complete the approval within the necessary time frames.

E. When opening a new business or expanding an existing business, it is important to do

research to be sure there is a real need for the service you offer in the location you plan to

offer this service. To obtain this information, you need to identify all other child care providers

in your area by checking your local phone book, contacting the Division of Child Care and

Early Childhood Education, and visiting the Division’s website at www.arkansas.gov/childcare

to search for providers in your area. You might want to talk directly with providers in your area

and ask about their services to obtain additional information.

F. Complete this section using information about the bank or other financial institution that will be

issuing the loan to you upon approval of the guarantee. Please make sure you include the full,

legal name of the bank or institution so it may be included accurately in the guarantee

agreement. For the contact, please give the name of the person who has been working with

you throughout your loan process and/or will be handling the account if the guarantee is

approved. You should have already been talking to a loan officer or other financial institution

representative as you are making plans and completing applications. Talk to your banker about

the monthly payment amount and the number of months it will take to pay the loan.

FIVE YEAR BUDGET PROJECTION SUMMARY FORM

This form provides a summary of the yearly totals the applicant plans for all income and

expenses over the next five years. The totals to be included on the summary form should be

calculated from the detailed information included in the matching sections of the Budget

Justification Form. More specific guidance for what to include in each section will be provided

in the instructions for that section of the application.

BUDGET JUSTIFICATION FORM

In this form, the applicant should provide concrete, specific details about all expenses and

income included in each line item on the Budget Summary Form. You should include the

following in your Budget Justification Form section:

INCOME

•

Weekly Fees: Calculate this figure by multiplying the number of children you will serve in

each category (i.e. infant/toddler, pre-school, school age) by the fee you charge for each of

these categories and then multiplying the total by the number of weeks you expect to

provide care in each of the categories. If you provide part-time care calculate that

separately and add to the full-time care total. Show all figures used in the Weekly Fees

section of this form.

•

Unless you have a very small facility and can demonstrate an ongoing waiting list (say this

clearly in your budget justification if it is accurate for you), you should not calculate these

figures based on 100% of your facility capacity through the entire year. With children

adding and dropping, figures for a fully functioning center should still only be calculated on

an average of 80% to 90% of total slots licensed. If you are starting a new facility, you

should plan on lower percentages in Year 1 and Year 2, building to a high of 80-90% in

Year 5.

•

If you plan to charge a registration fee (a one-time charge required for parents to enroll

their children in your center) you should calculate this in the following manner: multiply the

5

�average number of new enrollments each year by the amount you charge for an enrollment

fee.

•

If you transport children from your center to their school or pick up children from their

school and transport them to your center, you may want to calculate fees as follows:

multiply costs per trip times the number of children needing transport times the number of

trips needed per week times the number of weeks care will be provided for those children.

If you use a standard weekly amount you might want to use that times the number of weeks

of care.

•

As of October 1, 2000 the USDA food program is available for all child care centers and all

child care family homes (profit or non-profit). This program is similar to the school hot lunch

programs and providers may receive specific amounts of financial reimbursement for meals

served to children from low-income families. You may check our web site at

https://dhs.arkansas.gov/dccece/snp to obtain current rates of reimbursement or you may

call (800) 482-5850 for more information and answers to questions about this program.

•

Include in this category estimated funds expected from such events as bake sales, candy

sales, car washes, special church offerings, etc. List in the budget justification the specific

planned events each year and the amount estimated to be raised through that event.

•

In this category include donations expected from outside organizations and local

businesses. Include both cash donations and the estimated value of any anticipated in-kind

donations (such as food items, room space for meetings, equipment, supplies, etc.)

Possible sources of these donations could include local civic and social clubs, schools,

grocery stores, retail stores, etc.

•

Anticipate the estimated amounts you hope to receive through grant funding sources.

These may include (but are not limited to) the incentive grants offered through the

Arkansas Division of Child Care and Early Childhood Education Better Beginnings

Program. For more information regarding the incentive grant contact the Program Support

Office at (800) 445-3316 or (501) 682-9699 or visit our web site at

www.arkansas.gov/childcare/qris.html.

•

Include in this section all other income from sources not included above. Make sure to

provide a description of this in your budget justification. If needed, please attach additional

pages with the information.

EXPENSES

•

Include salaries and wages for all full-time and part-time staff. Non-profit organizations

should also include a salary for the applicant/provider as part of staff salaries. For-profit

facilities may include the owner’s salary here, or may choose to show this as profit. Make

sure your figures for staff wages match the numbers of staff reported in the

FACILITY/BUSINESS INFORMATION section of your application form.

•

Social Security withholding by an employer is required by law. Check with your local

Employment Security Division office for current information on rate of withholding as well as

information on other programs such as Worker’s Compensation.

•

Include in this section costs for such benefits as health insurance, child care provided for

employee’s children, etc. These costs can change annually and you should make sure that

6

�costs for any benefits or training mentioned in the staff development section are reflected in

your budget either in this section or the “Other Expenses” section.

FIVE YEAR BUSINESS PLAN FORM

In each section of this form, make a brief statement of what you will do during that year in each

category. Financial growth should include statements about how you will reduce your total debt

or improve the financial status of your business. Marketing should include specific types of

advertising you intend to use such as flyers, bulletin boards, and/or ads in newspapers. Staff

development should include the specific training and other professional development activities

your staff will attend. Facility improvement should state exactly what changes, repairs or

additions you will make to your actual building and grounds such as adding playground

equipment or remodeling rooms. Program improvement should include the changes you will

make to your program such as adding learning centers, changing curriculum or creating new

materials and activities. If needed, please attach additional pages with the information.

RESOURCES

For information that might help you with your application you can contact the Arkansas Small

Business Development Center at http://asbdc.ualr.edu/consulting/toolbox.asp or call (501)

682-7700. The Small Business Administration website at www.sba.gov may also help you. You

will find many different trainings and other help at both of these websites.

7

�ARKANSAS CHILD CARE FACILITIES GUARANTEED LOAN PROGRAM APPLICATION FORM

A. APPLICATION TYPE (CHECK ALL THAT APPLY)

New Center-Planned

Expansion/Renovation Existing Center

Anticipated Opening Date (If New Center-Planned)

New Family Child Care Home

Expansion/Renovation Existing Family Child Care Home

For Profit

Non-Profit (Attach copy of non-profit incorporation form)

B. APPLICANT PERSONAL INFORMATION

Name:

SSN:

Address:

Email Address:

City:

State:

Home Phone:

Education:

ZIP:

Work Phone:

H.S. Diploma/GED

Yes

Bachelor’s Degree

No

Date Earned:

Master’s Degree

CDA

Other (specify)

Major:

EMPLOYMENT HISTORY

Place of Employment

From

To

Job Duties/Title

C. FACILITY/BUSINESS INFORMATION

Facility/Business Name:

License #:

Address:

Director Name:

City:

State:

Business Phone:

TIN/SSN:

Director

Qualifications

Total Staff:

B.A.

Degree

ZIP:

AA

Degree

CDA

Credential

H.S. +

4 Yr. Exp

PROPOSED CAPACITY

Birth to 3 Years Old

3 to 5 Year Olds

+

Provide Transportation:

Yes

School-Age

+

Total Children

=

No

Operation Hours Planned

Monday

Tuesday

Wednesday

Thursday

Friday

Saturday

Sunday

Open

Close

8

�D. APPROVALS (ATTACH DOCUMENTS VERIFYING ALL APPROVALS AND LICENSES)

Plans approved by Licensing Unit

Current Child Care License in good standing

Previous adverse action against any license

Local Zoning Board approval

Local Fire Marshal approval

Health Department approval

Yes

Yes

Yes

Yes

Yes

Yes

No

No

No

No

No

No

E. LOCAL NEED ANALYSIS

Total Child Care Facilities

in Local Area

Total Child Care Slots

in Local Area

Infant Care Slots

in Local Area

Pre-School Care Slots

in Local Area

School-Age Care Slots

in Local Area

Please write a short paragraph describing why there is a need for more child care in your community and explaining how

opening and/or expanding your facility will help to meet those needs:

F. LOAN INFORMATION

Bank Name:

Address:

City:

State:

Contact Name:

ZIP:

Contact Phone:

Total amount requested from bank:

Describe briefly the purpose(s) of this loan:

Proposed repayment plan:

months at $

per month

I certify that the information in this application is true and correct to the best of my knowledge.

Signature of Applicant

Date

9

�ANTICIPATED GUARANTEED LOAN EXPENDITURES

Please list all items that you plan to use the loan for. Make sure that the total amount you request is

the same as the total amount on this list.

DESCRIPTION

AMOUNT NEEDED

TOTAL AMOUNT REQUESTED

10

�FIVE YEAR BUDGET INCOME PROJECTION SUMMARY FORM

(Attach detailed budget justification sheet for all lines of summary form—see instructions.)

YEAR 1

YEAR 2

YEAR 3

YEAR 4

YEAR 5

BUSINESS INCOME

a. Weekly Fees

b. Registration/Sign-up Fees

c.

Transportation Fees

d. USDA Food Program

e. Fund Raising

f.

Donations (In-kind/cash)

g. Grants

h. Other Income (specify)

i.

Other Income (specify)

TOTAL INCOME

BUSINESS EXPENSES

a. Salaries/Wages

b. Payroll Taxes

c.

Fringe Benefits

d. Food

e. Materials/Supplies

f.

Equipment/Furniture

g. Rent/lease/Mortgage

h. Utilities

i.

Insurance

j.

Fees/Licensing

k.

Contract Services

l.

Repairs/Improvements

m. Vehicle Payment/Lease

n. Gasoline/Maintenance

o. Other Expenses (specify)

p. Other Expenses (specify)

q. Other Expenses (specify)

TOTAL EXPENSES

11

�BUDGET JUSTIFICATION FORM

BUDGET ITEMS

YEAR 1

YEAR 2

YEAR 3

YEAR 4

YEAR 5

INCOME

a. Weekly Fees

b. Registration/Sign-up Fees

c.

Transportation Fees

d. USDA Food Program

e. Fund Raising

f.

Donations (in-kind/ cash)

g. Grants

h. Other Income (specify)

i.

Other Income (specify)

12

�BUDGET JUSTIFICATION FORM

BUDGET ITEMS

BUSINESS EXPENSE

YEAR 1

YEAR 2

YEAR 3

YEAR 4

YEAR 5

a. Salary/Wages

b. Payroll Taxes

c.

Fringe Benefits

d. Food

e. Materials/Supplies

f.

Equipment/Furniture

g. Rent/Lease/Mortgage

h. Utilities

i.

Insurance

j.

Fees/Licensing

k.

Contract Services

l.

Repairs/Improvements

m. Vehicle Payment/Lease

n. Gasoline/ Maintenance

o. Other Expense (specify)

p. Other Expense (specify)

q. Other Expense (specify)

13

�FIVE-YEAR BUSINESS PLAN

MARKETING

STAFF DEVELOPMENT

FACILITY IMPROVEMENT

PROGRAM

IMPROVEMENT

Year 5

Year 4

Year 3

Year 2

Year 1

FINANCIAL GROWTH

14

�

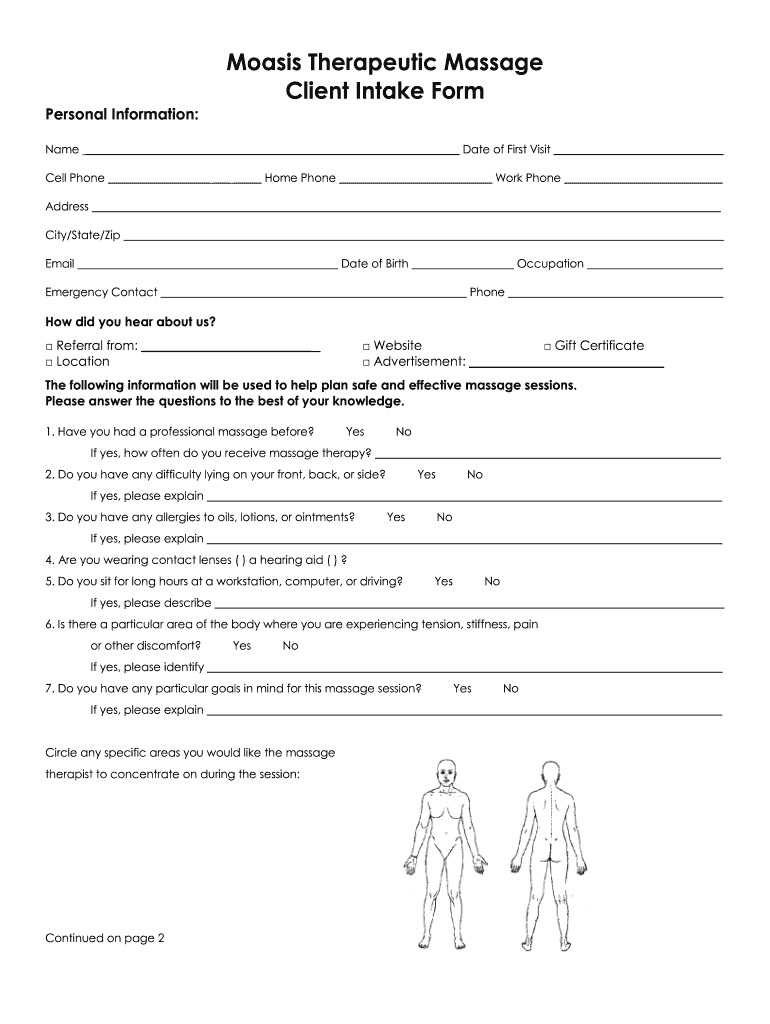

Useful tips for finalizing your ‘Moasis Therapeutic Massage Client Intake Form’ online

Are you fatigued by the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and authorize paperwork online. Utilize the extensive features integrated into this user-friendly and cost-effective platform to transform your methods of paperwork administration. Whether you need to approve documents or collect signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Adhere to this comprehensive guide:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template repository.

- Access your ‘Moasis Therapeutic Massage Client Intake Form’ in the editor.

- Select Me (Fill Out Now) to set up the form on your end.

- Insert and allocate fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from additional parties.

- Save, print your version, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Moasis Therapeutic Massage Client Intake Form or send it for notarization—our platform provides everything required to accomplish such tasks. Sign up with airSlate SignNow today and take your document management to a higher level!