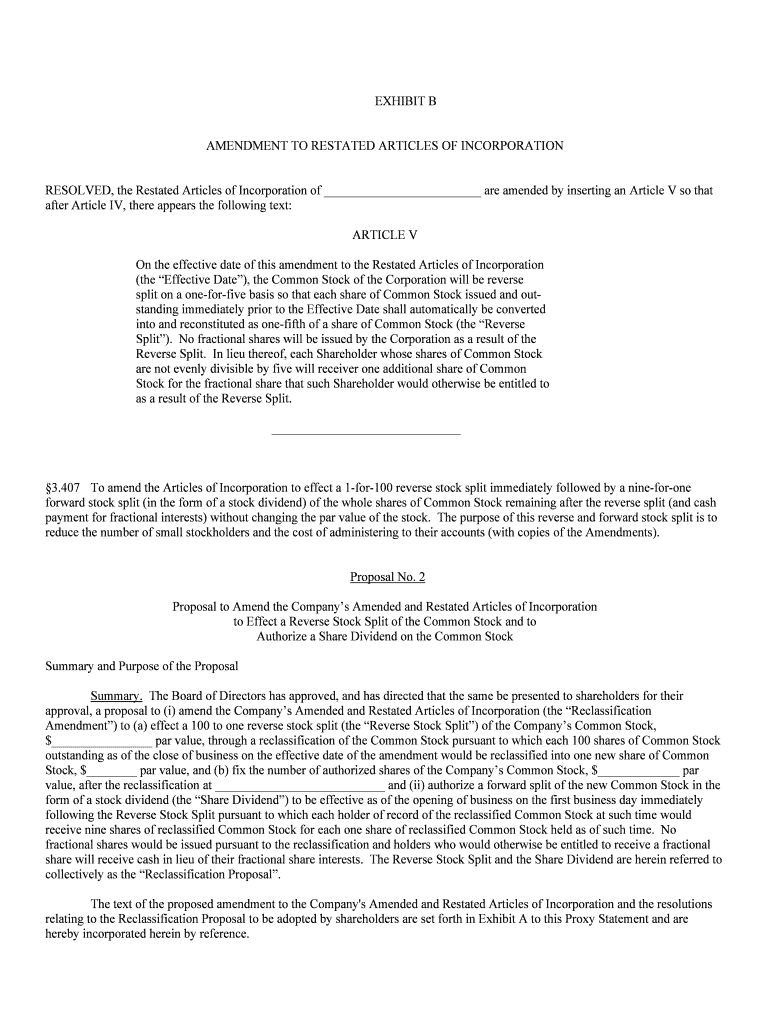

EXHIBIT B

AMENDMENT TO RESTATED ARTICLES OF INCORPORATION

RESOLVED, the Restated Articles of Incorporation of _________________________ are amended by inserting an Article V so that

after Article IV, there appears the following text: ARTICLE V

On the effective date of this amendment to the Restated Articles of Incorporation

(the “Effective Date”), the Common Stock of the Corporation will be reverse

split on a one-for-five basis so that each share of Common Stock issued and out-

standing immediately prior to the Effective Date shall automatically be converted

into and reconstituted as one-fifth of a share of Common Stock (the “Reverse

Split”). No fractional shares will be issued by the Corporation as a result of the

Reverse Split. In lieu thereof, each Shareholder whose shares of Common Stock

are not evenly divisible by five will receiver one additional share of Common

Stock for the fractional share that such Shareholder would otherwise be entitled to

as a result of the Reverse Split. ______________________________

§3.407 To amend the Articles of Incorporation to effect a 1-for-100 reverse stock split immediately followed by a nine-for-one

forward stock split (in the form of a stock dividend) of the whole shares of Common Stock remaining after the reverse split (and ca sh

payment for fractional interests) without changing the par value of the stock. The purpose of this reverse and forward stock split is t o

reduce the number of small stockholders and the cost of administering to their accounts (with copies of the Amendments).

Proposal No. 2

Proposal to Amend the Company’s Amended and Restated Articles of Incorporationto Effect a Reverse Stock Split of the Common Stock and toAuthorize a Share Dividend on the Common Stock

Summary and Purpose of the Proposal Summary. The Board of Directors has approved, and has directed that the same be presented to shareholders for their

approval, a proposal to (i) amend the Company’s Amended and Restated Articles of Incorporation (the “Reclassificat ion

Amendment”) to (a) effect a 100 to one reverse stock split (the “Reverse Stock Split”) of the Company’s Common Stock,

$________________ par value, through a reclassification of the Common Stock pursuant to which each 100 shares of Common Stock

outstanding as of the close of business on the effective date of the amendment would be reclassified into one new share of Comm on

Stock, $________ par value, and (b) fix the number of authorized shares of the Company’s Common Stock, $_____________ par

value, after the reclassification at ___________________________ and (ii) authorize a forward split of the new Common Stock in the

form of a stock dividend (the “Share Dividend”) to be effective as of the opening of business on the first business day immediately

following the Reverse Stock Split pursuant to which each holder of record of the reclassified Common Stock at such tim e would

receive nine shares of reclassified Common Stock for each one share of reclassified Common Stock held as of such time . No

fractional shares would be issued pursuant to the reclassification and holders who would otherwise be entitled to receive a fra ctional

share will receive cash in lieu of their fractional share interests. The Reverse Stock Split and the Share Dividend are herein referred to

collectively as the “Reclassification Proposal”.

The text of the proposed amendment to the Company's Amended and Restated Articles of Incorporation and the resolutions

relating to the Reclassification Proposal to be adopted by shareholders are set forth in Exhibit A to this Proxy Stateme nt and are

hereby incorporated herein by reference.

Purpose of the Proposed Reverse Stock Split and Share Dividend. As of the Record Date, the Company estimates that

approximately______________ record holders, or approximately _____________% of the record holders of Common Stock, owned

fewer than 100 shares of Common Stock. Of these _______________ record holders, the Company estimates that more than

____________ % held ten or fewer shares of Common Stock as of the Record Date. The small holdings of such shareholders with

fewer than 100 shares, however, represented, in the aggregate, less than ___________% of the Company's outstanding Common

Stock. The cost of administering each shareholder's account and the amount of time spent by management in responding to

shareholder requests is the same regardless of the number of shares held in the account. Accordingly, the cost to the Company of

maintaining many small accounts is disproportionately high when compared with the total number of shares involved. In view of the

disproportionate cost to the Company of maintaining small shareholder accounts, management believes it would be be neficial to the

Company and its shareholders as a whole to eliminate the administrative burden and cost associated with the m any accounts

containing fewer than 100 shares of the Company's Common Stock. The Company anticipates that the Reclassific ation Proposal will

reduce the number of shareholders of the Company by _____________, to approximately _____________. It is anticipated that the

cost of administering shareholder accounts will be reduced by up to $_______________ per year as a result of the Reclassification

Proposal. Based on the aggregate number of shares owned by record holders with fewer than 100 shares, and the recent market price

of the Common Stock, the Company estimates that payments for fractional shares resulting from the Reverse St ock Split will

aggregate approximately $________________. The Company intends to use its existing cash, including a portion of the proceeds from

prior issuances of Common Stock, for such purpose.

Based upon the closing sale price of the Common Stock on the American Stock Exchange, Inc. (the “AMEX”) on the

Record Date of $________________, the market value of _____ shares of Common Stock was $__________________. The

Reclassification Proposal will enable shareholders holding of record fewer than 100 shares to receive cash in l ieu of their shares

and, in effect, avoid percentage fees on the transaction. Shareholders owning fewer than 100 shares of Common Stock would, if

they choose to sell their shares, incur large commission expenses (generally at least $50) in relation to the market value of their

shares. Certain of such shareholders would, if they chose to sell their shares, incur commission expenses greater than the m arket

value of their shares. In some cases, it might be difficult to find a broker to handle such small transactions.

The Company is proposing the reclassification in lieu of a tender offer for shares held by holders with fewer than 100

shares because of the large number of shareholders with small holdings and as a means of reducing the administrative and

transactional cost that would be involved for the Company to acquire such shares through a self tender offer or a Company

sponsored odd-lot shareholder program. The reclassification also permits the Company to eliminate all odd-lot shareholdings,

which would not be possible through a self tender offer or an odd-lot shareholder program. Although the proposed reclassification

will eliminate the shareholdings of all shareholders who hold fewer than 100 shares of record, the Company believes that the

reclassification is fair to such shareholders in that it provides them with cash for their shares in an amount equal to the market

price thereof without the necessity of such shareholder incurring brokerage fees therefor.

The nine for one share dividend following the reclassification is intended to permit the Company to mainta in a sufficient

number of issued and outstanding shares of its Common Stock so as not to affect the availability of trading on the AMEX and to

return the market price of the Common Stock after the reclassification to a level that would be more at tractive to a broader range

of investors. The Reverse Stock Split will reduce the number of issued and outstanding shares of the Common Stock to

approximately _________________. The Company estimates that the number of issued and outstanding shares of Common Stock

after giving effect to the Share Dividend will be approximately _________________.

By effecting the Share Dividend on the basis of nine new shares for each share outstanding, as opposed to a share

dividend on the basis of _________ new shares for each share outstanding, the Board of Directors is also seeking to enhance and

improve the market for the Common Stock. A reduction in the number of issued and outstanding shares caused by the combined

effect of the Reclassification Proposal will increase proportionately the Company’s earnings per share and book value pe r share.

Such an increase, in turn, may make the Common Stock more attractive to a broader group of investors and permit the Comm on

Stock to be held on margin which, because of its current price, is not possible.

There is, however, no assurance that the market for the Common Stock will be improved. Shareholders should note that

the Board of Directors cannot predict what effect the proposed Reverse Stock Split and Share Dividend will have on the m arket

price of the Common Stock. However, a higher share price may diminish the adverse impact that low share prices have upon the

efficient operation of the trading market for the Common Stock. Also, the brokerage commission on the purchase or sale of a

stock with a relatively low price generally tends to represent a higher percentage of the sales price than the brokerage commission

charged on the purchase or sale of a stock with a relatively higher price, to the detriment of the Company's shareholders and the

market for the Common Stock.

Purpose of the Proposed Increase in the Number of Authorized Shares of Common Stock. The Reclassification

Amendment would fix the number of authorized shares of Common Stock after the reclassification at ________________.

Although the Reclassification Amendment will reduce the number of authorized shares of Common Stock, the resulting number of

authorized shares of Common Stock represents an increase of approximately __________________ shares over the number of

shares of Common Stock that would have been authorized if all shares of Common Stock, whether or not issued and outstanding,

had been equally adjusted pursuant to the reclassification. This increase in the number of authorized share s of Common Stock is

intended to provide the Company with the ability to effect financings and acquisitions with its Common St ock, to provide

employee incentives utilizing the Common Stock and to satisfy the Company's obligation to issue shares of C ommon Stock to

___________________, which the Company has been unable to satisfy due to the lack of available shares. Except with respect to

the shares to be issued to _________________ and the shares that are to be subject to the Company's proposed employee stock

option plan, the Company has no current plans for the use of any of the additional shares of Common Stock to be authorized.

Unless required by law or regulatory authorities, no further authorization by vote of shareholders will be sought for any future

share issuances. No shareholder of the Company will have any preemptive or other preferential rights to purchase any shares of

stock that may be issued and sold by the Company in the future.

Although the Company has no current plans or proposals to effect any financings or acquisitions with shares of Common

Stock, the fact that substantially all of the Company's Common Stock is currently reserved for issuance for outstanding securities

makes such financings and acquisitions difficult, and the need to obtain shareholder approval prior to any such issuance could

delay or effectively prevent a desired transaction. Accordingly, the Company believes that the availability of shares of Common

Stock that could be used for such purposes would be in the best interest of the Company.

The Company also requires additional shares of Common Stock with respect to the options to be granted under its

__________ Employee Stock Option Plan being presented to shareholders for approval at the Annual Meeting. Under the

___________ Employee Stock Option Plan, the Company has reserved, subject to shareholder approval, an aggregate of

________________ shares of Common Stock for issuance to key employees, including officers and employee directors, through

the exercise of employee stock options. If the Reclassification Proposal is approved by shareholders, the number of shares of

Common Stock reserved for issuance under the __________ Employee Stock Option Plan would be adjusted to an aggregate of

__________ shares of Common Stock. See Proposal No. 5. The purpose of the proposed _______ Employee Stock Option Plan is

to provide additional incentive to key employees for the future growth of the Company by providing them with a greater

proprietary interest in the Company. The Company believes that incentives using the Company's stock are important to its growth

and that the availability of a sufficient number of shares for such purpose is in the best interest of the Company.

The increase in the authorized number of shares of Common Stock after giving effect to the Reclassification Proposa l

will also permit the Company to comply with its contractual obligation to _______ ___________ with respect to the sal e of

_____________ shares of Common Stock (__________ shares after giving effect to the Reclassification Proposal). Such sale will

allow the Company to finally complete and satisfy its obligations under its _______ agreement with ______________ pursuant to

which _____________ provided substantial financial assistance to the Company which permitted the Company to substant ially

improve its financial condition. The Company will receive in the transaction approximately $____________, which will be

available to the Company for acquisitions, development and, if desirable, future purchases and acquisitions of stock, inc luding

shares of Senior Preferred Stock and Series A Preferred Stock.

The proposed increase in the number of authorized shares of Common Stock would be effected pursuant to the

Reclassification Amendment, the text of which is contained in the resolutions to this Proxy Statement .

Description and Effect of the Proposal The Company's Amended and Restated Articles of Incorporation currently authorize the issuance of _______________

shares of capital stock, consisting of ______________ shares of Common Stock, $.01 par value, and ______________ shares of

Preferred Stock, $.01 par value, of which ________________ shares have been designated Senior Preferred Stock,

_______________ shares have been designated Series A Preferred Stock and _________________ shares are available for future

designations (“Serial Preferred Stock”). As of the Record Date, the Company had outstanding ______________ shares of

Common Stock, _______________ shares of Senior Preferred Stock and _____________ shares of Series A Preferred Stock. As

of the Record Date, there was also reserved for issuance upon the conversion or exercise of various outstanding securities of the

Company ________________ shares of Common Stock, leaving a total of ________________ authorized, unissued and

unreserved shares of Common Stock available for future issuances.

Under the proposal, (i) one new share of Common Stock, $.01 par value, would be exchanged for every 100 shares of

Common Stock, $.01 par value, outstanding as of the close of business on the date on which the amendment to the Company's

Amended and Restated Articles of Incorporation is filed with the Secretary of State of the State of ______________ (the

“Effective Date”), (ii) the number of authorized shares of Common Stock would be fixed at _____________ and (iii) each holder

of shares of the reclassified Common Stock would receive nine shares of reclassified Common Stock for each whole share of

reclassified Common Stock held as the opening of business on the first business day immediately following the Effective Date.

The resulting number of authorized shares of Common Stock after the Reclassification Amendment represent s an increase of

_________________ shares, approximately ___________%, over the ___________ shares of Common Stock that would have

been authorized if all shares of Common Stock, whether or not issued and outstanding, had been equally adjusted pursuant to the

reclassification. Based upon information as of the Record Date, it is anticipated that the numbe r of outstanding shares of Common

Stock after giving effect to the Reclassification Proposal would be approximately ______________ shares. In addition, it is

anticipated that an additional ______________ shares of Common Stock will be reversed for issuance (i) upon the conversion or

exercise of various of the Company’s other outstanding securities (convertible debt, convertible preferred stock and warrant s), (ii)

under the Company’s proposed _______ Employee Stock Option Plan (see Proposal No. 5) and (iii) to ____________ to satisfy

the Company’s obligation to issue shares of Common Stock to ______________ (see Proposal No. 4), leaving a total of

approximately ____________ authorized, unissued and unreserved shares of Common Stock available for future issuances.

No fractional shares of new Common Stock will be issued for any fractional new share interest resulting from the

Reverse Stock Split. Rather, each shareholder who would otherwise receive a fractional new share of Common Stock a s a result of

the Reverse Stock Split will receive, in lieu of such fractional share interest, an amount of cash equa l to the closing sale price of a

share of Common Stock on the AMEX on the Effective Date (adjusted if necessary to reflect the per share price of the Com mon

Stock without giving effect to the Reverse Stock Split and the Share Dividend) multiplied by the number of shares of Comm on

Stock held by such holder that would otherwise have been exchanged for such fractional share interest. Because the price of the

Common Stock fluctuates, the amount to be paid for fractional shares cannot be determined until such date and m ay be greater or

less than the price on the date that any shareholder executes his proxy. Based on the aggregate number of shares owned by record

holders with fewer than 100 shares and the recent market price of the Common Stock, the Company estimates that pa yments for

fractional shares resulting from the Reverse Stock Split will aggregate approximately $_____________. The Company intends to

use its existing cash, including a portion of the proceeds from prior issuances of Common Stock, for such purpose.

If the Reclassification Proposal is approved, the Company will notify holders of the Common Stock of the filing of the

Articles of Amendment with the Secretary of State of the State of ________________ and will furnish holders of record of the

Common Stock as of the close of business on the Effective Date with a letter of transmittal for use in exchanging certificates. The

holders of the Common Stock, promptly after the Reclassification Amendment becomes effective and the rec eipt of the Letter of

Transmittal, will be required to mail their certificates representing their shares of Common St ock to exchange agent named in the

letter of transmittal in order that a new stock certificate giving effect to the Reverse Stock Spl it and Share Dividend may be issued

and the proceeds, if any, of the settlement of fractional interests may be delivered promptly.

The Amended and Restated Articles of Incorporation of the Company provide that the cash and shares issuable to

shareholders of the Company in connection with a reclassification of stock which are not claimed by the sharehol ders entitled

thereto within a reasonable time (not less than one year in any event) after the shares become issuable, de spite reasonable efforts

by the Company to deliver the cash and certificates for the shares to such shareholders within such time, wil l, at the expiration of

such time, revert in full ownership to the Company and the Company's obligation to pay such cash and to issue such share s will

thereupon cease. Pursuant to this provision, the resolutions providing for the reclassification of the Common Stock provide that

any shares of reclassified Common Stock to be issued in exchange for the outstanding Common Stock and any cash to be pa id in

lieu of fractional new share interests will revert in full ownership to the Company one year after the Effec tive Date if such shares

and cash are not claimed by the shareholders entitled thereto.

The Company estimates that the entire interest of approximately ____________ shareholders (those holding fewer than

100 shares) will be eliminated pursuant to the Reclassification Amendment. Such shareholders will enjoy the bene fit of

liquidating their relatively small holdings without paying brokers' commissions. However, because such transaction would be

mandatory, such shareholders who wish to retain their existing equity interest in the Company would be adversely affecte d.

Fractional shares settled by the Company are expected to aggregate approximately _______________ shares, or approximatel y

one percent of those currently outstanding. Shares no longer outstanding as a result of the fractional share settlement procedure

will be returned to authorized but unissued shares of the Company.

It is not anticipated that the Reclassification Proposal will affect the listing of the Common Stock on the AMEX or the

registration of such stock under the Securities Exchange Act of 1934 (the “Exchange Act”). A supplemental listing appl ication to

the AMEX will, however, need to be filed with and approved by such exchange.

After giving effect to the settlement of fractional shares of Common Stock, there will be no material differe nces between

the shares of Common Stock outstanding prior to the Reclassification Proposal and those to be outstanding after the

Reclassification Proposal is effected. The Reclassification Proposal will, however, result in certain a djustments to the voting

rights and conversion ratios of the Senior Preferred Stock and Series A Preferred Stock. Specifically, pursuant to the term s of the

Company's Amended and Restated Articles of Incorporation, the Reclassification Proposal will result in an adjust ment to the

voting rights of the Senior Preferred Stock and the Series A Preferred Stock so that once the Reclassification Proposal i s effected

the relative voting power of such shares to the voting power of the Common Stock will be in the same proportion as existed

immediately prior to the Reclassification Proposal. Assuming the Reclassification Proposal is adopted a nd made effective, such

adjustments would result in a reduction in the voting power of the Senior Preferred Stock from .01 of a vote per share to .001 of a

vote per share and a reduction in the voting power of the Series A Preferred Stock from .005 of a vote per share to .0005 of a vote

per share. The proportionate voting power of the holders of the stock of the Company, however, would not be affected. The

Reclassification Proposal will also result in adjustments being made to the conversion ratios of the Senior Preferred Stock and the

Series A Preferred Stock so that such shares will be convertible into such number of shares of Common Stock that a holder of

such preferred stock would have been entitled to receive if such preferred stock were to have been converted into Com mon Stock

immediately prior to the Reclassification Proposal. Under such adjustments, after the Reclassifi cation Proposal is made effective,

each share of the Senior Preferred Stock will be convertible into .00225 of a share of Common Stock, as compared to .0225 of a

share of Common Stock prior to the Reclassification Proposal, and each share of the Series A Preferred Stock will be conve rtible

into .002 of a share of Common Stock, as compared to .02 of a share of Common Stock prior to the Reclassification Proposal.

Similar adjustments will also be made to the conversion ratios and exercise provisions of the Company's vari ous other outstanding

convertible or exercisable securities.

Shareholders of the Company will have no appraisal rights with respect to the Reclassification Amendment under

______________ law or the Company's Amended and Restated Articles of Incorporation and no such rights will be afforded to

such shareholders by the Company.

In the Reclassification Proposal, cash proceeds received from the settlement of fractional shares may result in (i) the

realization by a shareholder whose interest in the Company is completely terminated of taxable gain or loss to the extent of the

difference between such proceeds and the cost or other basis applicable to the fractional shares and (ii) dividend i ncome to a

shareholder whose interest in the Company is not completely terminated. No officer, director, associate or a ffiliate of the

Company is expected to derive any material benefit in the Reclassification Proposal other than t he benefits that would be enjoyed

by any other person holding the same number of shares.

Certain Considerations Shareholders should note that certain disadvantages may result from the adoption of this Proposal No. 2. Such

disadvantages may include a significant reduction in their interest in the Company with respect to e arnings per share, voting,

liquidation value and book and market value per share if the additional authorized shares of Common Stock are issued. Al so, the

Reclassification Amendment would eliminate the shareholdings of all shareholders who hold fewer than 100 shares of record.

In addition, ________________, an affiliate of the Company, will directly benefit from the approval of the

Reclassification Amendment in that the Reclassification Amendment will permit the C ompany to issue to _________________

________________ shares of Common Stock at $_______________ per share (_____________ shares at $_____________ on a

reclassification basis) pursuant to an existing agreement with the Company. See Proposal No. 4. Such price is within the range of

recent sale prices of the Common Stock as reported by the AMEX. The issuance of additional shares of Common Stock to

________________ also increases the ownership position of _________________ in the Company. ___________________ and

____________________, who together control approximately _________% of the total voting power of the Company, have

advised the Company that they intend to vote all of their shares of stock of the Company in favor of this proposal. Accordingly, ft

is likely that this proposal will be adopted.

Vote Required and Recommendation for ApprovalThe Board of Directors recommends a vote FOR this proposal. The affirmative vote of the holders of at least two-thirds

of the total voting power of the outstanding shares of Common Stock, Senior Preferred Stock and Series A Preferred Stock as of

the Record Date, voting together as a single class, is necessary for the approval of the Reclassification Amendment. In addition,

the affirmative vote of the holders of at least the outstanding shares of Common Stock as of the Record Date, voting as a single

class, is necessary for the approval of the Reclassification Amendment. The enclosed form of proxy provides a means for

shareholders to vote for the approval of this proposal, to vote against the approval of this proposal or to abstain from voting with

regard to the approval of this proposal. Each property executed proxy received in time for the meeting will be voted as spec ified

therein. If a shareholder executes and returns a proxy but does not specify otherwise, the shares represented by such shareholders

proxy will be voted “FOR” the approval of this proposal.