Fill and Sign the Multistate Riders and Addenda Form 3183 Single Family Fannie Mae Uniform Instrument

Practical advice on preparing your ‘Multistate Riders And Addenda Form 3183 Single Family Fannie Mae Uniform Instrument’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and small to medium-sized businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and sign documents online. Utilize the extensive features integrated into this user-friendly and cost-effective platform and transform your approach to document management. Whether you need to authorize forms or gather eSignatures, airSlate SignNow manages it all efficiently, with just a few clicks.

Follow this detailed guide:

- Sign in to your account or apply for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Multistate Riders And Addenda Form 3183 Single Family Fannie Mae Uniform Instrument’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and designate fillable fields for additional users (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with others on your Multistate Riders And Addenda Form 3183 Single Family Fannie Mae Uniform Instrument or send it for notarization—our platform provides all the tools you need to achieve such objectives. Register with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

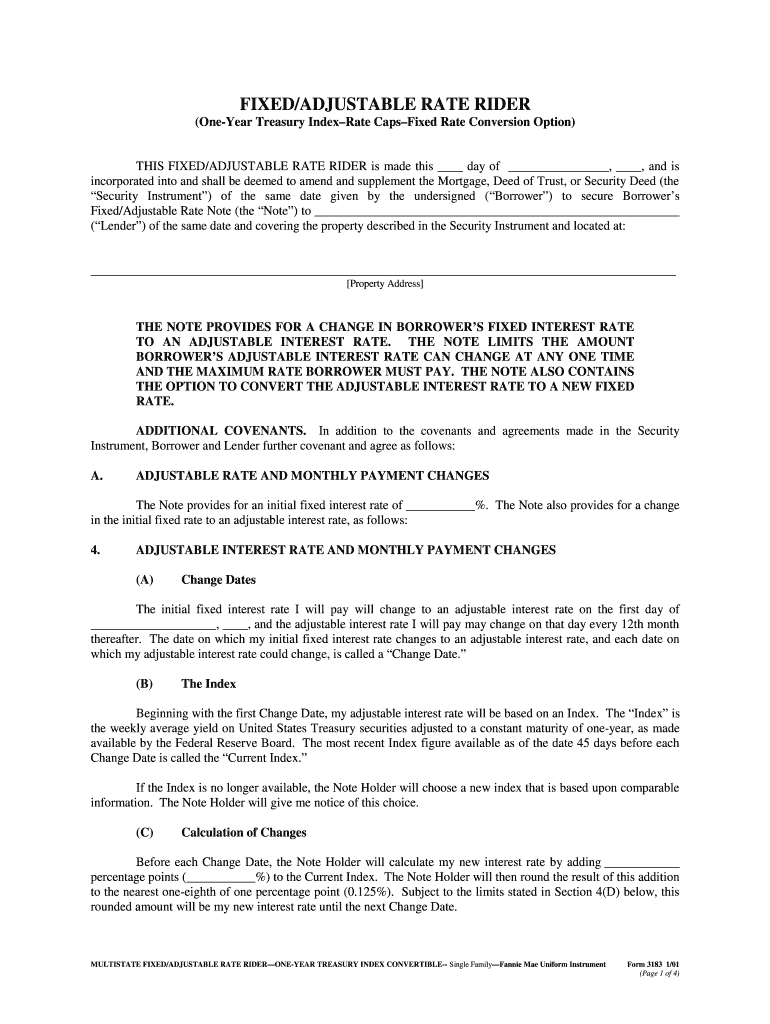

What is the Multistate Riders And Addenda Form 3183 Single Family Fannie Mae Uniform Instrument?

The Multistate Riders And Addenda Form 3183 Single Family Fannie Mae Uniform Instrument is a standardized document used in real estate transactions that allows for the inclusion of additional terms in a mortgage agreement. This form ensures compliance with Fannie Mae guidelines and provides clarity to borrowers and lenders alike. Using this form simplifies the process of adding riders and addenda to a primary mortgage document.

-

How can airSlate SignNow help me manage the Multistate Riders And Addenda Form 3183 Single Family Fannie Mae Uniform Instrument?

airSlate SignNow offers a user-friendly platform that allows you to easily create, send, and eSign the Multistate Riders And Addenda Form 3183 Single Family Fannie Mae Uniform Instrument. Our solution streamlines document management, making it simple to gather signatures and ensure that all parties have access to the most current version of the form. This efficiency saves time and reduces the risk of errors in your real estate transactions.

-

Is there a cost associated with using airSlate SignNow for the Multistate Riders And Addenda Form 3183?

Yes, airSlate SignNow offers various pricing tiers that cater to different business needs, including plans for individual users and larger teams. The cost-effectiveness of our solution means that even small businesses can afford to manage the Multistate Riders And Addenda Form 3183 Single Family Fannie Mae Uniform Instrument efficiently. You can explore our pricing options to find the best fit for your needs.

-

What features does airSlate SignNow offer for the Multistate Riders And Addenda Form 3183?

airSlate SignNow includes features like templates specifically for the Multistate Riders And Addenda Form 3183 Single Family Fannie Mae Uniform Instrument, automated reminders for pending signatures, and real-time tracking of document status. Additionally, our platform supports mobile access, allowing you to manage your documents on-the-go seamlessly. These features enhance the overall efficiency of your document workflow.

-

Can I integrate airSlate SignNow with other tools for managing the Multistate Riders And Addenda Form 3183?

Yes, airSlate SignNow provides integration capabilities with numerous business applications, allowing you to streamline your document processes for the Multistate Riders And Addenda Form 3183 Single Family Fannie Mae Uniform Instrument. Whether you use CRM systems, project management tools, or email platforms, you can connect them to enhance your workflow. This integration ensures that all your tools work seamlessly together.

-

What are the benefits of using airSlate SignNow for the Multistate Riders And Addenda Form 3183?

Using airSlate SignNow for the Multistate Riders And Addenda Form 3183 Single Family Fannie Mae Uniform Instrument offers several benefits, including increased efficiency, reduced paperwork, and improved compliance with lending regulations. Our solution minimizes the time spent on manual processes, allowing for faster transaction closures. Moreover, the eSigning feature enhances convenience for all parties involved.

-

Is airSlate SignNow secure for handling the Multistate Riders And Addenda Form 3183?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the Multistate Riders And Addenda Form 3183 Single Family Fannie Mae Uniform Instrument. Our platform utilizes advanced encryption protocols and complies with industry standards to protect your data. You can trust that your sensitive information is safe while using our eSigning services.

Find out other multistate riders and addenda form 3183 single family fannie mae uniform instrument

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles