Fill and Sign the Names as Shown on the Tax Return Form

Useful advice on finalizing your ‘Names As Shown On The Tax Return’ digitally

Are you weary of the complications of dealing with documentation? Look no further than airSlate SignNow, the premier eSignature tool for individuals and businesses. Bid farewell to the monotonous procedure of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and endorse documents online. Take advantage of the powerful features integrated into this user-friendly and cost-effective platform and transform your document management strategy. Whether you need to approve forms or collect electronic signatures, airSlate SignNow manages it all effortlessly, requiring just a few clicks.

Follow this detailed guide:

- Access your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Names As Shown On The Tax Return’ in the editor.

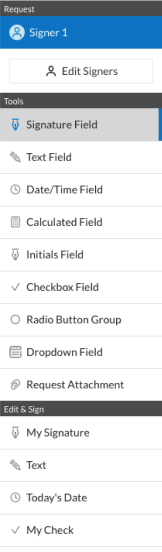

- Click Me (Fill Out Now) to finish the form on your end.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite options to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to stress if you need to collaborate with your colleagues on your Names As Shown On The Tax Return or send it for notarization—our solution offers everything necessary to achieve such tasks. Enroll with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

How does airSlate SignNow ensure accuracy for NAMES AS SHOWN ON THE TAX RETURN?

airSlate SignNow incorporates advanced verification features that help ensure the NAMES AS SHOWN ON THE TAX RETURN are accurate. Users can easily input and review names before signing, minimizing errors. This is crucial for tax documents where accuracy is paramount.

-

What features does airSlate SignNow offer for managing documents with NAMES AS SHOWN ON THE TAX RETURN?

airSlate SignNow offers a range of features including customizable templates and automated workflows that specifically cater to documents requiring NAMES AS SHOWN ON THE TAX RETURN. These tools streamline the process, making it easier to manage tax-related documents efficiently and securely.

-

Is it easy to correct NAMES AS SHOWN ON THE TAX RETURN in airSlate SignNow?

Yes, airSlate SignNow provides a user-friendly interface that allows you to easily edit NAMES AS SHOWN ON THE TAX RETURN. If you notice an error, you can quickly make changes before finalizing the document. This ensures that all signatures reflect the correct information.

-

What integrations does airSlate SignNow support for handling tax documents with NAMES AS SHOWN ON THE TAX RETURN?

airSlate SignNow seamlessly integrates with various accounting and tax software, allowing you to manage NAMES AS SHOWN ON THE TAX RETURN efficiently. These integrations facilitate easy data transfer and ensure that your documents are always up-to-date, enhancing your workflow.

-

How does airSlate SignNow ensure security when handling NAMES AS SHOWN ON THE TAX RETURN?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive information like NAMES AS SHOWN ON THE TAX RETURN. Our platform employs industry-standard encryption and compliance with data protection regulations to keep your documents safe.

-

What is the pricing structure for using airSlate SignNow for documents involving NAMES AS SHOWN ON THE TAX RETURN?

airSlate SignNow offers flexible pricing plans designed to fit the needs of businesses handling documents with NAMES AS SHOWN ON THE TAX RETURN. Whether you are a small business or a larger enterprise, you can choose a plan that offers the features you need at a competitive price.

-

Can airSlate SignNow handle bulk signing for multiple NAMES AS SHOWN ON THE TAX RETURN?

Absolutely! airSlate SignNow allows users to send documents for bulk signing, making it easy to manage multiple NAMES AS SHOWN ON THE TAX RETURN at once. This feature is particularly useful for businesses that need to collect signatures from multiple parties efficiently.

Related searches to names as shown on the tax return form

Find out other names as shown on the tax return form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles