Fill and Sign the New Jersey Commercial Building or Space Lease Form

Valuable tips on finalizing your ‘New Jersey Commercial Building Or Space Lease’ online

Are you fed up with the difficulties of managing paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and organizations. Bid farewell to the labor-intensive process of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and authorize paperwork online. Take advantage of the robust features embedded in this user-friendly and affordable platform and transform your approach to document management. Whether you need to authorize forms or collect electronic signatures, airSlate SignNow manages it all effortlessly, needing just a few clicks.

Adhere to this detailed guide:

- Access your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template repository.

- Open your ‘New Jersey Commercial Building Or Space Lease’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and designate fillable fields for others (if required).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with others on your New Jersey Commercial Building Or Space Lease or send it for notarization—our solution provides everything you require to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

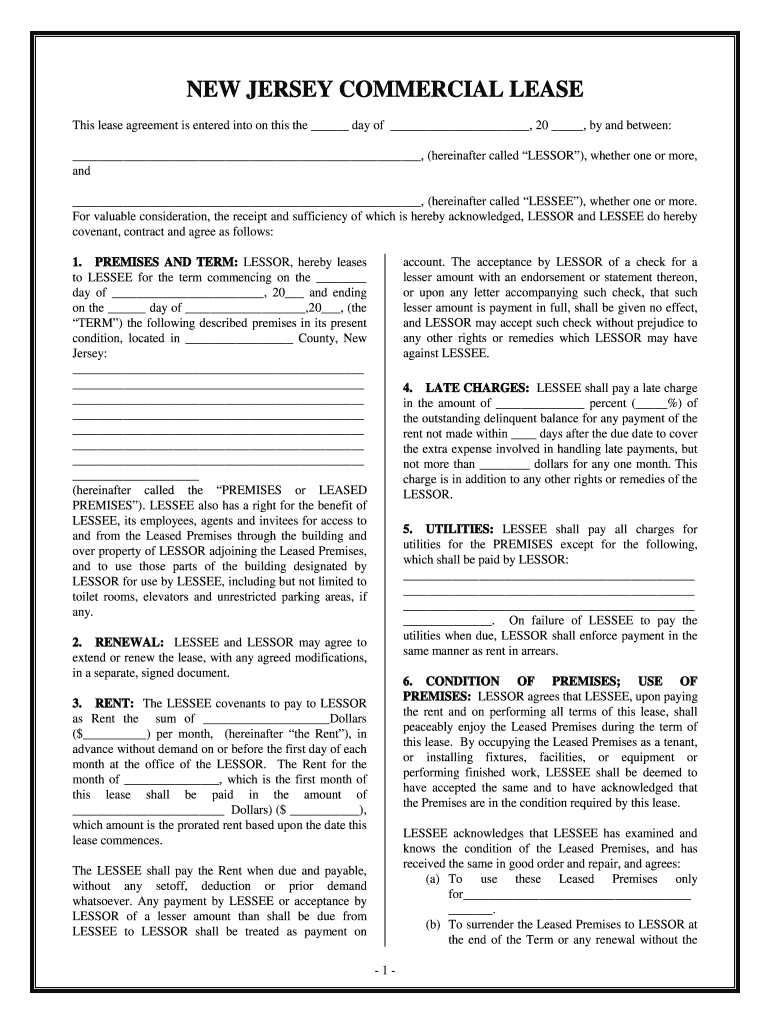

What is a New Jersey Commercial Building Or Space Lease?

A New Jersey Commercial Building Or Space Lease is a legally binding agreement that allows a business to rent a commercial space or building in New Jersey. This lease outlines the terms, conditions, and duration of the rental arrangement, providing security for both the landlord and tenant. Understanding the specifics of your lease is crucial for successful business operations.

-

How can airSlate SignNow assist with New Jersey Commercial Building Or Space Lease agreements?

airSlate SignNow simplifies the process of managing New Jersey Commercial Building Or Space Lease agreements by providing an intuitive platform for eSigning and sending documents. With our user-friendly interface, businesses can quickly create, send, and track lease documents, ensuring a seamless leasing experience. This efficiency saves time and reduces paperwork hassles.

-

What are the benefits of using airSlate SignNow for commercial leases in New Jersey?

Using airSlate SignNow for your New Jersey Commercial Building Or Space Lease offers several benefits, including faster approval times and reduced paperwork. The platform ensures that all parties can sign documents electronically, streamlining the leasing process. Additionally, our solution enhances security and compliance, giving you peace of mind.

-

Is airSlate SignNow cost-effective for New Jersey Commercial Building Or Space Lease management?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing New Jersey Commercial Building Or Space Lease agreements. With competitive pricing plans, businesses can choose a package that suits their needs without breaking the bank. This affordability, combined with our powerful features, makes us an ideal choice for lease management.

-

Can I integrate airSlate SignNow with other tools for my commercial lease processes?

Absolutely! airSlate SignNow offers seamless integrations with various business tools and applications, enhancing your workflow for New Jersey Commercial Building Or Space Lease processes. Whether you use CRM systems, document management software, or accounting tools, our platform can connect and streamline all your operations.

-

What features does airSlate SignNow provide for New Jersey Commercial Building Or Space Lease agreements?

airSlate SignNow provides a range of features tailored for New Jersey Commercial Building Or Space Lease agreements, including customizable templates, advanced eSigning options, and document tracking. Additionally, our platform allows multiple signers and offers authentication methods to ensure the security and validity of your lease documents.

-

How secure is airSlate SignNow for handling lease documents?

Security is a top priority at airSlate SignNow, especially when handling sensitive New Jersey Commercial Building Or Space Lease documents. Our platform employs industry-standard encryption protocols and secure data storage to protect your information. You can confidently send and sign documents, knowing that your data is safe.

Find out other new jersey commercial building or space lease form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles