Fill and Sign the New Zealand Form Statutory

Helpful suggestions for preparing your ‘New Zealand Form Statutory’ online

Are you weary of the burdens of handling paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and organizations. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Utilize the robust features embedded in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to sign forms or collect eSignatures, airSlate SignNow manages it all smoothly, with just a few clicks.

Adhere to this comprehensive guide:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form repository.

- Open your ‘New Zealand Form Statutory’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for other participants (if needed).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a multi-usable template.

Don’t fret if you need to collaborate with others on your New Zealand Form Statutory or send it for notarization—our solution provides everything you require to accomplish such tasks. Register with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

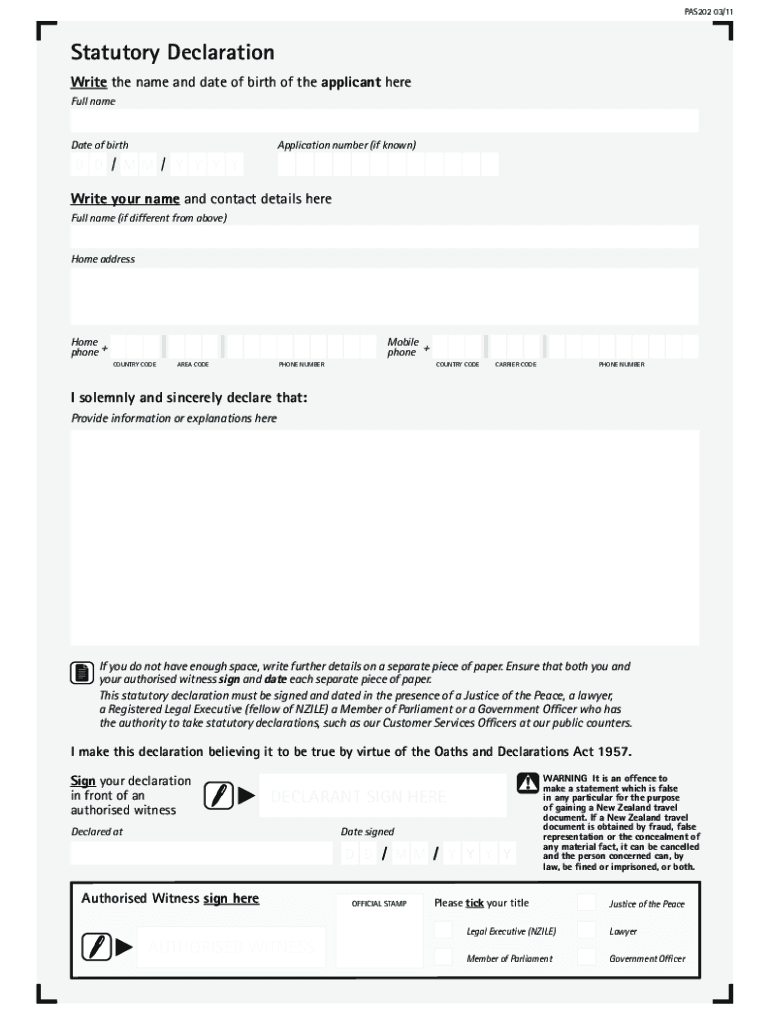

What is a Statutory Declaration NZ and when do I need one?

A Statutory Declaration NZ is a legal document used to affirm or declare something to be true, often required for processes such as applying for a passport or making a claim. This document must be witnessed by an authorized person, ensuring its validity. Understanding when to use a Statutory Declaration NZ can help streamline your legal processes.

-

How does airSlate SignNow simplify the creation of Statutory Declarations NZ?

airSlate SignNow offers a user-friendly platform that allows you to easily create and customize your Statutory Declaration NZ. With our templates and intuitive interface, you can generate legally compliant declarations in minutes, making it convenient for both personal and professional use.

-

What features does airSlate SignNow offer for Statutory Declarations NZ?

Our platform provides a range of features specifically designed for Statutory Declarations NZ, including e-signature capabilities, document tracking, and secure storage. Additionally, you can collaborate with others, ensuring that all parties can review and sign the document effortlessly.

-

Is airSlate SignNow cost-effective for managing Statutory Declarations NZ?

Yes, airSlate SignNow is a cost-effective solution for managing Statutory Declarations NZ. We offer various pricing plans that cater to different business needs, ensuring that you only pay for what you use while accessing a comprehensive suite of features.

-

Can I integrate airSlate SignNow with other applications for Statutory Declarations NZ?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, enhancing your workflow for Statutory Declarations NZ. Whether you use CRM systems, cloud storage, or productivity tools, our integrations simplify the document management process.

-

What security measures are in place for Statutory Declarations NZ created with airSlate SignNow?

Security is a top priority for airSlate SignNow. We implement advanced encryption methods and secure access protocols for all Statutory Declarations NZ, ensuring that your sensitive information remains protected throughout the signing process.

-

How can businesses benefit from using airSlate SignNow for Statutory Declarations NZ?

Businesses can greatly benefit from using airSlate SignNow for Statutory Declarations NZ by saving time and reducing paperwork. Our platform streamlines the signing process, enhances collaboration, and ensures compliance, leading to increased efficiency and productivity.

Find out other new zealand form statutory

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles