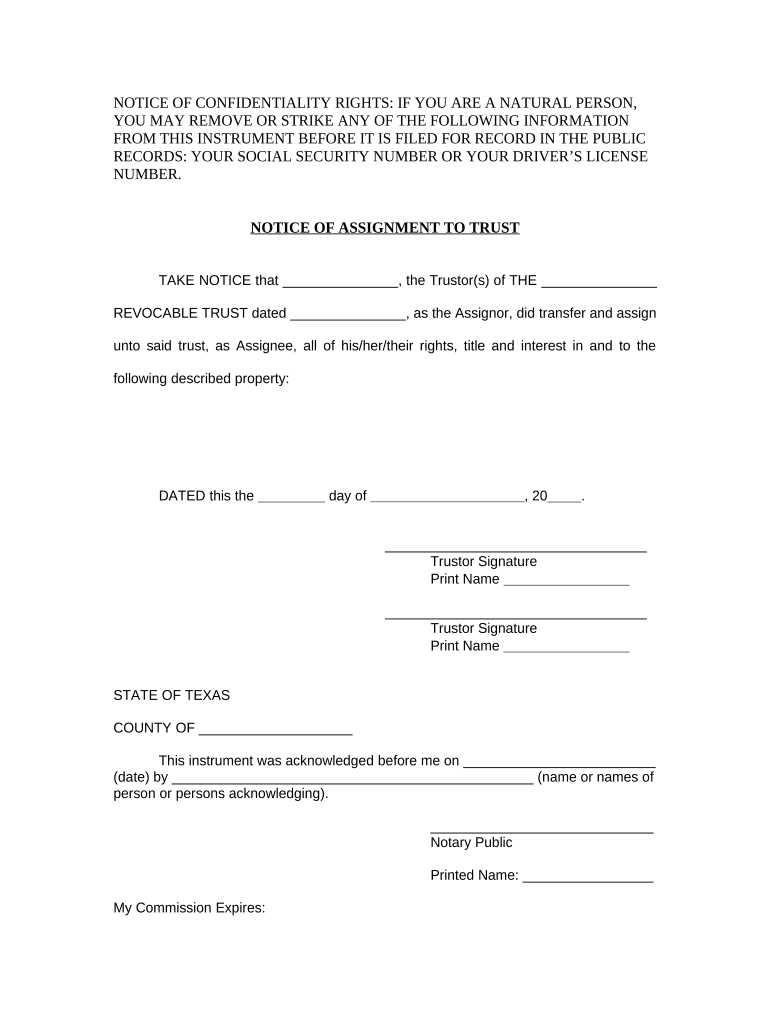

Fill and Sign the Notice of Assignment to Living Trust Texas Form

Practical suggestions for finishing your ‘Notice Of Assignment To Living Trust Texas’ online

Are you fatigued from the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and organizations. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and sign documents online. Take advantage of the extensive features incorporated into this straightforward and cost-effective platform and transform your strategy for document management. Whether you need to endorse forms or gather electronic signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Adhere to these comprehensive instructions:

- Access your account or initiate a free trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘Notice Of Assignment To Living Trust Texas’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or transform it into a multi-use template.

No concerns if you need to collaborate with your colleagues on your Notice Of Assignment To Living Trust Texas or send it for notarization—our solution offers everything you require to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is a living trust in Texas?

A living trust in Texas is a legal document that allows you to place your assets into a trust during your lifetime. This facilitates the management and distribution of your property according to your wishes, avoiding the lengthy probate process. It can be revocable, meaning you can modify it at any time, making it a flexible estate planning tool.

-

How does a living trust in Texas work?

In Texas, a living trust works by transferring ownership of your assets into the trust while you are alive. You retain control over the trust and can manage it just like your own property. Upon your passing, the assets in the living trust are distributed to your beneficiaries without going through probate, ensuring a faster and more private transfer.

-

What are the benefits of establishing a living trust in Texas?

Establishing a living trust in Texas offers several benefits, including avoiding probate, maintaining privacy, and providing for the management of your assets should you become incapacitated. Additionally, it can simplify the transfer of assets to your heirs, making the process smoother and less stressful for your loved ones.

-

How much does it cost to set up a living trust in Texas?

The cost to set up a living trust in Texas can vary widely depending on the complexity of your estate and the services you choose. Generally, you may pay anywhere from a few hundred to several thousand dollars when using an attorney. However, using an online service like airSlate SignNow can provide a more cost-effective solution for creating a living trust in Texas.

-

Can I change my living trust in Texas once it's created?

Yes, you can change your living trust in Texas if it is revocable. This means you can add or remove assets, change beneficiaries, or alter the terms of the trust at any time during your lifetime. It's essential to keep your trust updated to reflect your current wishes and circumstances.

-

Is a living trust in Texas necessary if I have a will?

While having a will is important for estate planning, a living trust in Texas can provide additional benefits that a will cannot. A living trust allows for the direct transfer of assets without probate, which can save time and money. Therefore, many people choose to have both a will and a living trust to ensure comprehensive estate planning.

-

What types of assets can be placed in a living trust in Texas?

You can place various types of assets in a living trust in Texas, including real estate, bank accounts, stocks, bonds, and personal property. Almost any asset that you own can be included, allowing for comprehensive management and distribution according to your wishes. It's crucial to properly fund your living trust to ensure all intended assets are covered.

The best way to complete and sign your notice of assignment to living trust texas form

Find out other notice of assignment to living trust texas form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles