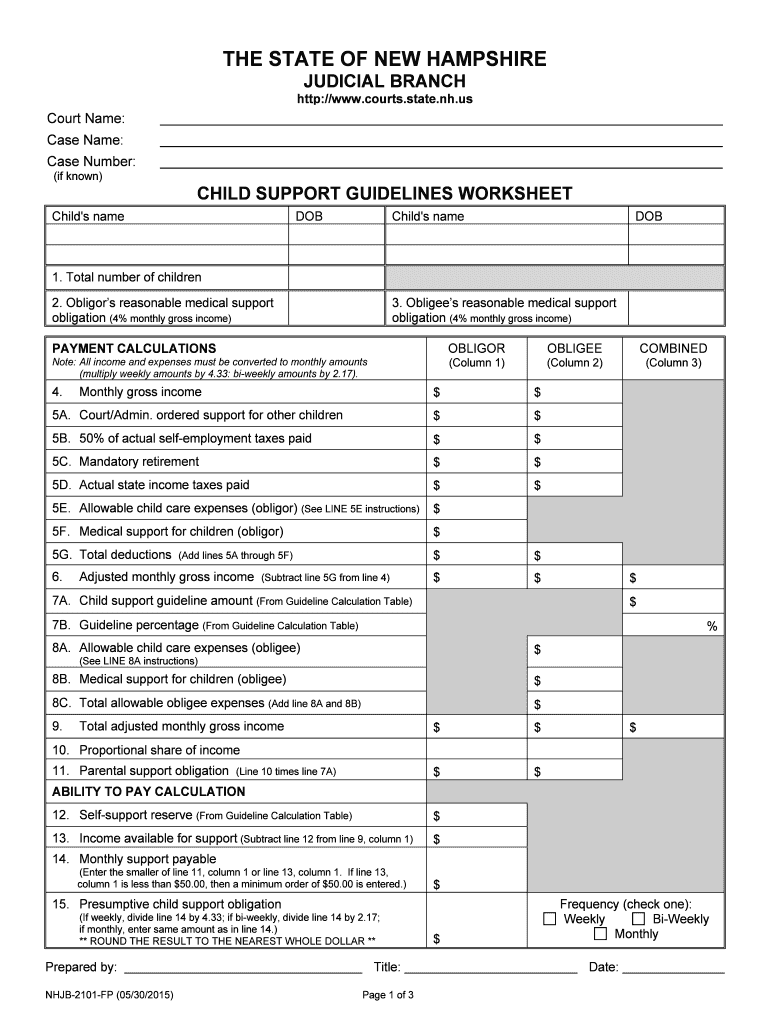

Fill and Sign the Obligation 4 Monthly Gross Income Form

Valuable tips on finalizing your ‘Obligation 4 Monthly Gross Income’ online

Are you weary of the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading electronic signature platform for individuals and organizations. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and authorize paperwork online. Utilize the powerful features embedded in this user-friendly and affordable platform and transform your method of document management. Whether you need to approve forms or gather signatures, airSlate SignNow manages it all with ease, needing just a few clicks.

Refer to this comprehensive guide:

- Log into your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud, or our form library.

- Access your ‘Obligation 4 Monthly Gross Income’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you wish to collaborate with your colleagues on your Obligation 4 Monthly Gross Income or send it for notarization—our platform offers everything required to accomplish such tasks. Register with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

What is the Obligation 4% Monthly Gross Income in relation to airSlate SignNow?

The Obligation 4% Monthly Gross Income refers to the financial commitment businesses may consider when budgeting for document management solutions like airSlate SignNow. Understanding this obligation helps businesses assess their monthly expenses and ensure they are investing wisely in eSigning and document automation.

-

How does airSlate SignNow help manage the Obligation 4% Monthly Gross Income?

airSlate SignNow offers a cost-effective solution that can help businesses stay within their Obligation 4% Monthly Gross Income. By streamlining document workflows and reducing paper usage, companies can save money and allocate resources more efficiently, ensuring they meet their financial obligations.

-

What features does airSlate SignNow offer to support my business's financial obligations?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning, all designed to enhance productivity while keeping costs low. These features help businesses manage their Obligation 4% Monthly Gross Income effectively by minimizing operational expenses.

-

Is there a free trial available for airSlate SignNow to evaluate its impact on my Obligation 4% Monthly Gross Income?

Yes, airSlate SignNow offers a free trial that allows businesses to explore its features and assess how it can help manage their Obligation 4% Monthly Gross Income. This trial period enables users to experience the benefits firsthand without any financial commitment.

-

Can airSlate SignNow integrate with other tools to help manage my financial obligations?

Absolutely! airSlate SignNow integrates seamlessly with various business tools such as CRM systems and accounting software. These integrations can help streamline processes and provide a clearer picture of your Obligation 4% Monthly Gross Income, making it easier to manage your finances.

-

What are the pricing plans for airSlate SignNow, and how do they relate to my Obligation 4% Monthly Gross Income?

airSlate SignNow offers flexible pricing plans that cater to different business needs, allowing you to choose a plan that aligns with your Obligation 4% Monthly Gross Income. By selecting the right plan, you can ensure that your document management costs remain manageable and within budget.

-

How can airSlate SignNow improve my business's efficiency while considering the Obligation 4% Monthly Gross Income?

By automating document workflows and reducing the time spent on manual processes, airSlate SignNow signNowly enhances business efficiency. This improvement can lead to cost savings that help you stay within your Obligation 4% Monthly Gross Income, allowing for better financial management.

The best way to complete and sign your obligation 4 monthly gross income form

Find out other obligation 4 monthly gross income form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles