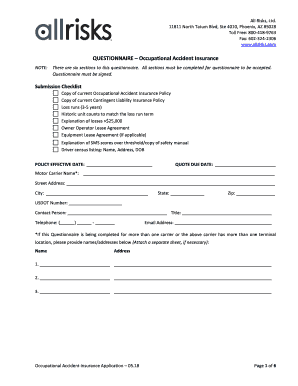

Fill and Sign the Occupational Accident Insurance Application Form

Helpful tips for finishing your ‘Occupational Accident Insurance Application’ online

Are you fed up with the burden of managing paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can conveniently complete and sign documents online. Take advantage of the robust features integrated into this user-friendly and cost-effective platform and transform your document handling. Whether you need to authorize forms or collect signatures, airSlate SignNow manages it all effortlessly, needing only a few clicks.

Follow these detailed instructions:

- Access your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Occupational Accident Insurance Application’ in the editor.

- Select Me (Fill Out Now) to finish the form on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with your teammates on your Occupational Accident Insurance Application or send it for notarization—our platform equips you with everything necessary to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to a new standard!

FAQs

-

What is the Occupational Accident Insurance Application provided by airSlate SignNow?

The Occupational Accident Insurance Application is a digital tool that streamlines the process of applying for occupational accident insurance. With airSlate SignNow, businesses can easily send and eSign necessary documents, ensuring a quick and efficient application process. This user-friendly solution is designed to help organizations manage their insurance needs effectively.

-

How much does the Occupational Accident Insurance Application cost?

Pricing for the Occupational Accident Insurance Application varies based on the specific features and integrations your business needs. airSlate SignNow offers flexible plans to accommodate different budgets, ensuring that you only pay for what you use. For a detailed pricing overview, visit our website or contact our sales team.

-

What features does the Occupational Accident Insurance Application offer?

The Occupational Accident Insurance Application includes features like customizable templates, secure eSignature capabilities, document tracking, and automated workflows. These features help simplify the insurance application process, making it easier for businesses to manage their occupational accident insurance needs. Additionally, users can access their documents anytime, anywhere, enhancing flexibility.

-

How can the Occupational Accident Insurance Application benefit my business?

Using the Occupational Accident Insurance Application can signNowly reduce the time and effort required to process insurance applications. By automating document management and eSigning, businesses can improve efficiency, minimize errors, and ensure compliance with regulatory requirements. This ultimately leads to a smoother experience for both employers and employees.

-

Is the Occupational Accident Insurance Application easy to integrate with existing systems?

Yes, the Occupational Accident Insurance Application is designed for seamless integration with various business systems and applications. airSlate SignNow's API allows for easy connectivity, ensuring that you can incorporate the application into your existing workflow without disruption. This flexibility makes it an ideal choice for businesses of all sizes.

-

What types of documents can I manage with the Occupational Accident Insurance Application?

With the Occupational Accident Insurance Application, you can manage a wide range of documents related to occupational accident insurance, including applications, claims forms, and policy documents. The application supports various file formats, making it easy to upload and share necessary paperwork. This comprehensive document management capability enhances your overall operational efficiency.

-

Can I track the status of my Occupational Accident Insurance Application?

Absolutely! The Occupational Accident Insurance Application provides real-time tracking of your application status. Users receive notifications when documents are viewed, signed, or completed, ensuring that you stay informed throughout the process. This feature enhances transparency and helps you manage your insurance applications more effectively.

Find out other occupational accident insurance application form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles