Prepared by:

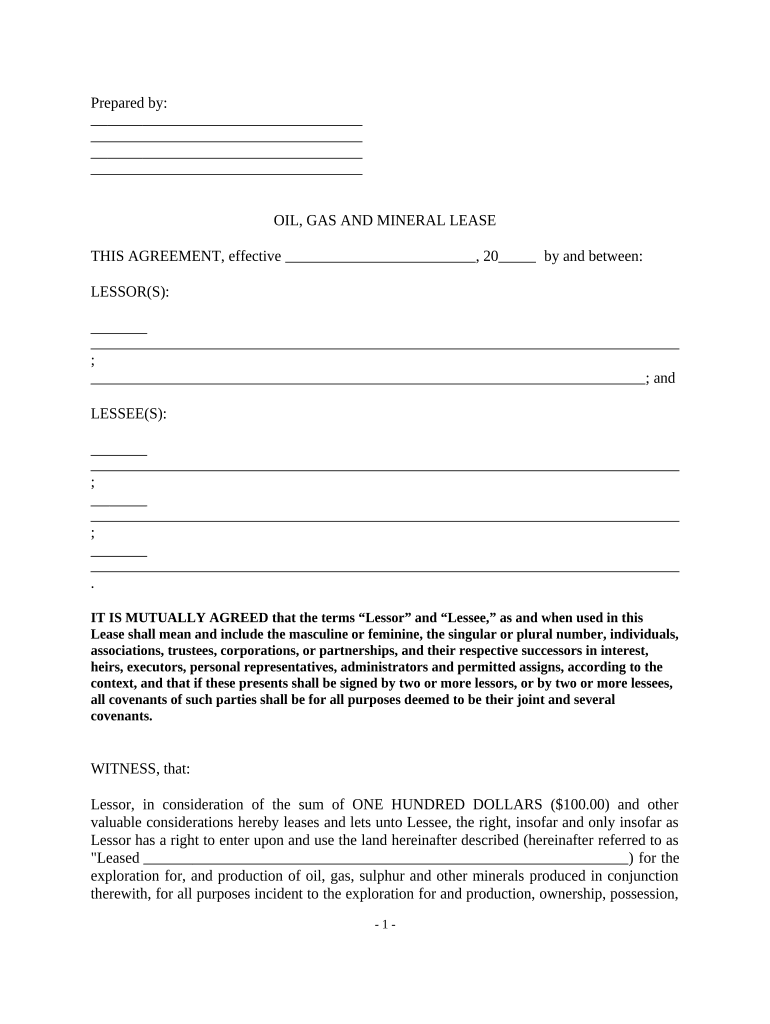

OIL, GAS AND MINERAL LEASE

THIS AGREEMENT, effective , 20 by and between:

LESSOR(S):

;

; and

LESSEE(S):

;

;

.

IT IS MUTUALLY AGREED that the terms “Lessor” and “Lessee,” as and when used in this

Lease shall mean and include the masculine or feminine, the singular or plural number, individuals,

associations, trustees, corporations, or partnerships, and their respective successors in interest,

heirs, executors, personal representatives, administrators and permitted assigns, according to the

context, and that if these presents shall be signed by two or more lessors, or by two or more lessees,

all covenants of such parties shall be for all purposes deemed to be their joint and several

covenants.

WITNESS, that:

Lessor, in consideration of the sum of ONE HUNDRED DOLLARS ($100.00) and other

valuable considerations hereby leases and lets unto Lessee, the right, insofar and only insofar as

Lessor has a right to enter upon and use the land hereinafter described (hereinafter referred to as

"Leased ) for the

exploration for, and production of oil, gas, sulphur and other minerals produced in conjunction

therewith, for all purposes incident to the exploration for and production, ownership, possession,

- 1 -

storage and transportation of said minerals and the right to dispose of salt water produced from

the Leased Premises with the right of Ingress and Egress to and from said land at all times for

such purposes, including the right to construct, maintain and use roads and pipelines on the

property for operations under this lease, Leased Premises being situated in the County of

, State of , and more particularly

described as follows, to wit:

See Legal Description Attached as Exhibit A incorporated by reference as though set forth in full

Legal Description:

The rights granted by this Lease, including but not limited to, Lessee's right to use the surface of

the Leased Premises are specifically limited to only the rights of Lessor acquired by Lessor in

that certain Deed No. , effective

,

20 , recorded in Book at Page of the Conveyance

Records of County, State of , and which Deed is

attached hereto as Exhibit B and incorporated by reference as though set forth in full.

For the purpose of calculating the shut-in royalty, the Leased Premises shall be considered to

comprise the number of acres as shown above totaling gross acres and net

acres, more or less.

This Lease shall be for a term of ( ______ ) years from the

effective date of this Lease (hereinafter referred to as ("Primary

”) and so long thereafter as oil, gas or other mineral is being produced in

paying quantities or or operations are

conducted either on the Leased Premises or on acreage pooled with the Lease Premises as

provided by this Lease.

This Lease shall be for a term of ( ______ ) years from the

effective date of this Lease, unless on or before said date

operations for of a well on the Leased Premises, or on acreage

pooled therewith in search of oil, gas or other minerals and continues such operations and

- 2 -

drilling to completion. Wherever used in this Lease, “operations for drilling,” “drilling

operations” and “operations” consists of all the activities designed and conducted in an effort to

obtain initial production from a well. As long as the actual spud date of the well occurs within a

reasonable time, a drilling operation begins when a drilling permit has been obtained and

preliminary work, such as grading roads, moving equipment, digging pits or staking locations,

has started. A drilling operation continues as long as operations progress in a diligent manner

toward the completion of that well. One drilling operation ends when lessee obtains production

in paying quantities or when lessee abandons efforts to obtain such production. Notwithstanding

the foregoing, drilling operations cease the day the well is completed or the date the completion

rig is released.

, at its option, is hereby given the authority and power to

pool or combine into a unit the acreage covered by this Lease or any portion thereof with other

land, lease or leases in the immediate vicinity thereof, when in

good faith judgment it to necessary or advisable to do so in order to properly develop and utilize

said Leased Premises. In with lawful spacing rules which may

be prescribed for the field in which Lease is by any

authorized authority, or when to do so would, in the good faith judgment of

, promote the conservation of the oil and gas in and

under and that may be produced from said premises.

shall execute and file for record an instrument identifying and describing the pooled acreage. The

entire acreage so pooled into a or unit shall be treated, for all

purposes except the payment of royalties on production from the pooled unit, as if it were

included in this Lease. If production is found on the pooled acreage, it shall be treated as

production had from the portion of this Lease in the unit, whether the well or wells be located on

the premises covered by this Lease or not. In lieu of the royalties elsewhere herein specified,

Lessor shall receive on production from a unit so pooled only such portion of the royalty as the

amount of its acreage placed in the unit or its royalty interest thereon on an acreage basis bear to

the total acreage so pooled in the particular unit involved.

At the end of the primary term of this Lease, or upon cessation of continuous drilling or

reworking operations after and of the Term as

provided above, this Lease will terminate automatically as to all horizons lying below a depth of

100 feet below the base of the deepest producing pool in each well drilled on the Leased

Premises or on other lands unitized with the Leased Premises on a bunk-by-bunk basis. Lessee

shall furnish Lessor a release as provided for herein in recordable form as to such deeper rights

within sixty (60) days of the expiration of the primary term, or cessation of continuous drilling or

reworking operations as provided herein.

Anything in this Lease to the contrary notwithstanding the drilling or reworking of a well or

production of oil or gas from any well included within a unit established by the ____________

State Oil and Gas Board or other governmental agency embracing a portion of the Leased

Premises shall serve to maintain this Lease in force only as to that portion of the Leased

Premises embraced in such unit. The Lease may be maintained in force as to the remainder of the

land in any other manner herein provided for.

- 3 -

Lessee may, at any time prior to or after the discovery and production of oil or gas on the lands,

execute and deliver to Lessor and place of record a release or releases of any portion or portions

of the leased land and be relieved of all requirements hereof as to the land surrendered, except

for any obligation incurred before the execution of such release or releases provided, however,

that no land within a producing unit may be released without the written consent of Lessor.

After the spudding in of a well and prior to the discovery and production of oil or gas in paying

quantities, or, after discovery of oil or gas in paying quantities, production thereof should cease

for any cause, Lessee may maintain in force the rights herein granted as to any unit during and

after the primary term by continuing or resuming operations for drilling or reworking on such

unit without the lapse of more than ninety (90) days between abandonment of work on one well

and beginning operations for reworking or actually spudding in another well, at the expiration of

the primary term of Lease, neither oil nor gas is being produced in paying quantities, but Lease

has spudded in a well and is then engaged in actual drilling or reworking operations or has

completed a dry hole within ninety (90) days prior to the expiration of the primary term, then the

Lease shall not terminate but shall continue in force so long as said actual drilling or reworking

is being continuously pursued on the premises as aforesaid, without lapse of more than ninety

(90) days, or until production is established or restored in paying quantities. If at the expiration

of the primary term of this Lease, oil or gas is not being produced in paying quantities and

Lessee has not spudded in a well and is not engaged in actual drilling or reworking operations or

has not completed a dry hole within ninety (90) days prior to the expiration of the primary term

this Lease shall terminate.

In the event oil or gas is being produced or is obtained in paying quantities from a unit after

expiration of the term and said

shall for any reason cease or terminate, Lessee shall have the right at any time within ninety (90)

days after the cessation of such production to resume drilling by actually spudding in a way or

begin operations in an effort to restore production, in which event this Lease shall remain in

force as to such unit so long as such operations are continuously prosecuted as above defined In

this paragraph and they result in production of oil or gas, so long thereafter as such production

continues from such unit in paying quantities.

If at the end of this primary term hereof, Lessee has spudded in a well on a unit from which

production has not theretofore been obtained, this Lease shall remain in affect as to the lands not

included in units until such well or work has been completed for production or plugged and

abandoned, and so long thereafter as actual drilling operations are continuously prosecuted on

additional units without a lapse of more than ninety (90) days between the cessation of

operations on one well and the spudding of the next subsequent additional ____________ . In the

ninety (90) days lapse between operations additional wells after the end of the primary term

hereof, this Lease shall terminate, subject to the provisions hereof.

In the event a well producing gas in paying quantities should be completed after the date of this

Lease within feet of and draining the Leased Premises,

Lessee shall either commence the drilling of an offset well on the Leased Premises within ninety

(90) days after sales of production from the off premises

producing and drill said

- 4 -

well with diligence and in a workmanlike manner into the same formation under the Leased

Premises from which the off-premises well is producing, or release those formations from which

production is left obtained from the off-promises well under that part of the Leased Premises not

located within a unit formed for a producing well drilled to a depth equivalent to or deeper than

the producing horizon in the off-premise well.

Should Lessee complete a well capable of producing gas in paying quantities but such gas is not

sold or used off the premises because of lack of a market therefor or inability to obtain any

necessary authority to produce the same, Lessee may pay or tender as royalty to the Lessor, on or

before the expiration of ninety (90) days from (a) the date of completion of such gas well, or (b)

the date such gas ceases to be sold or used, a sum equal to

($ ______ .00) per acre for all land within the shut-in gas unit, which payment will maintain this

Lease as to the acreage in said shut-in gas unit in full force and effect for a period of one (1) year

from the expiration of said ninety (90) day period. In similar manner, and upon the payment, on

or before the anniversary of the last payment, this Lease may be maintained in full force and

effect for

periods of one (1) year as long as such conditions exist, but not for a period In excess of three (3)

years beyond the primary term.

The royalties to be paid by are:

(a) On oil (which includes condensate and other liquid hydrocarbons when separated by

lease separator units), of that produced and

saved from the Leased Premises and not used for fuel in conducting operations on the

Leased Premises, or in treating such liquids to make them marketable;

(b) On gas produced from or attributable to the Leased Premises and sold, including the

gas remaining after the extraction of hydrocarbon products, of

the market value at the mouth of the well of the gas so sold, including casinghead gas

or other gaseous substances. The price to be used in computing the market value at

the mouth of the well shall be the price received by Lessee under an arm's length gas

sales contract prudently negotiated in the light of the facts and circumstances existing

at the time of consummation of such contract;

(c) With respect to gas used other than for operations hereunder, including casinghead or

other gaseous substances, royalty shall be of the market value at

the mouth of the well as provided in subparagraph (b) above; provided Lessee is not

selling gas under an arms length contract as provided in subparagraph (b) above. The

"market value of gas used other than for operations hereunder, including casinghead

gas or other gaseous substance, shall be the fair value at the mouth of the well at the

time of production but not below the average of the prices paid under similar

circumstances for gas of similar and quality from the field from which such gas is

being produced or if no gas is sold from the same field, the average of prices paid

under contract for gas of kind and quality in the three nearest fields;

(d) On gas, oil or other gaseous substance produced from or attributed to the Leased

- 5 -

Premises by , through any plant or facility, wholly

owned or operated by or any affiliate of Lessee or

by a company independent of Lessee, royalty shall be

of the market value at the mouth of the will less any reasonable charges for

processing such gas through said plant or facility;

(e) Lessee shall have free use of all oil, gas or any component thereof used in lease or

unit operations as well as gas, gaseous components thereof injected into subsurface

strata as hereinafter defined. Lessee shall have the right to inject water, brine or other

fluids into subsurface strata, and no royalties shall be due or computed on any fluids

or component thereof injected into subsurface strata through a well or wells located

either on the Leased Promises or a unit containing all or a part of the Leased

Premises;

(f) On sulphur, of that produced and saved from the Leased Premises,

payable when marketed;

(g) of the market value at the well or mine of all other minerals

produced and saved or mined and marketed;

(h) Oil royalties in kind shall be delivered to Lessor free of expense at Lessees option in

tanks furnished by at the wellhead or to Lessee’s credit in any

pipe line connected therewith. In the event Lessee does not furnish tanks for such

royalty oil and no pipe is connected with the well, Lessee shall sell such oil at the

most reasonable price obtainable and pay Lessor the royalty attributed to the Leased

Property less only severance or production tax imposed thereon;

(i) Lessor is entitled to and shall be paid royalty not only on the oil, gas and other

minerals, produced, saved and sold or used pursuant to the provisions of the Lease,

but on all other monetary benefit received by Lessees from purchasers of oil and gas

production by virtue of drilling or production operations on or attributed to the

Leased Premises; and

All royalty money due hereunder to Lessor during any month shall be paid on or before one

hundred twenty (120) days from to date of first production from, any well located on the leased

or on acreage pooled therewith, and thereafter shall be paid on or before the

day of each subsequent month. All royalty money due and not timely tendered shall accrue

interest at the rate of prime rate plus one (1%) percent on a daily basis determined by

National Bank, Street,

, . Failure to pay royalties within one

hundred twenty (120) days from the date of first production or any monthly payment within

days of the due date shall be grounds for termination of this Lease.

Any provisions herein shall inure to the benefit of and bind the successors and assigns of Lessor

and Lessee, but regardless of any actual or implied notice thereof, no change in the ownership of

- 6 -

the Leased Premises or any interest therein or change in the capacity or status of Lessor or any

other owner of rights hereunder shall impose any additional burden on Lessee, or be binding on

Lessee for making any payments hereunder unless, at least thirty (30) days before any such

payment is due, the owner of this Lease shall be been furnished with a certified copy of the

recorded instrument or equipment evidencing such change in status or number of Lessors. The

change in number or status of such Lessors shall not affect the validity of payments theretofore

made in advance. An assignee may exercise the rights and discharge the obligations of the Lessor

assuming joinder of any assignee. In the event of an assignment of the Lease, Lessor shall be

furnished a copy of such assignment within ninety (90) days of the recordation of same.

This Lease is granted by Lessor without warranty, express or implied, with Lessor’s liability

limited to the return of the purchase price, royalties or any other payments or consideration

received or due to Lessor. Lessee may, at Lessee’s option, discharge any tax, mortgage or lien

upon the Leased Premises. Lessor’s ownership or acquisition of less than the entire mineral

interest in all or any portion of the Leased Premises, or mineral rights relating thereto, will result

in all royalties or any other interest being reduced proportionate to the actual interest of Lessor.

All outstanding royalty rights in others shall be deducted from the royalties herein provided for.

In the event Lessor at any time considers that operations are not being conducted or payments

made in compliance with this Lease, Lessor shall notify Lessee in writing of the facts relied upon

as constituting a breach hereof, and Lessee shall have sixty (60) days after receipt of such notice

in which to commence or terminate any operations that are necessary to comply with the

requirements hereof. The service of said notice and the lapsed sixty (60) days without Lessee

meeting or commencing to meet the alleged breach shall be a condition precedent to any action

by Lessee for any breach under this Lease.

The requirements hereof shall be subject to any State and/or Federal law or order regulating

operations on the Leased Premises. Should Lessee be prevented from complying with any

express or implied covenants of this Lease other than the payment of royalty or in kind royalty,

from conducting drilling or reworking operations thereon, or from producing oil, gas or other

mineral therefrom by reason of scarcity or inability, after effort made in good faith, to obtain

equipment or material or authority to use same, or by failure of carriers to transport or furnish

facilities for transportation, or by operation of force majeure, any Federal or State law, or any

order, rule or regulation of governmental authority, or other cause beyond Lessee's control, then

while so hampered, Lessee's obligation to comply with such covenants shall be suspended and

Lessee shall not be liable for damages for failure to comply therewith; and this Lease shall be

extended while and so long as Lessee is prevented by any such cause from conducting drilling or

reworking operations on or from producing oil, gas or other mineral from the Leased Premises

and the time while Lessee is so impeded shall not be counted against Lessee, provided however,

in no event will this Lease be extended under the terms of this Paragraph for more than two (2)

consecutive years beyond the expiration of the Primary Term.

Payment of royalty shall be made to Lessors directly in their proportionate share at addresses to

be provided to Lessee by Lessors. Payment of shut-in royalty due under this Lease shall be made

to .

- 7 -

Lessor shall have the right at all reasonable times, personally or by representative, to inspect and

copy books, accounts, assignments, contracts, records and data pertaining to production and

marketing on the Leased Premises. As to any and all wells drilled on the Leased Premises, or

land pooled therewith, Lessee agrees to furnish Lessor the following:

(a) The representative of Lessor shall have full and free access to said well or wells and

to the derrick floor, at Lessor’s risk at all reasonable hours, and full and complete

information which shall include, but not be limited to, the right to examine samples,

cores and the right to observe all tests and producing operations of said well or wells;

(b) Daily drilling reports including depth, footage drilled within the last 24 hours, present

operation, formation, mud weight, water loss, deviation, pertinent remarks, and days

since spud, such report to be telephoned and/or telefaxed daily (exclusive of

Saturdays, Sundays and legal holidays) as per instructions of Lessor, at Lessees

expense;

(c) When mud logging, daily mud logs and mud log shows are to be telefaxed daily

(exclusive of Saturdays, Sundays and legal holidays) as per instructions of Lessor, at

Lessee's expense;

(d) Lessee agrees to furnish Lessor the following data and information, if available,

regardless of whether said well was completed as a producer or as a dry hole, and

additionally on any Reworking Operations;

(1) One copy of all applications and reports made by Lessor with any duly

authorized authority having jurisdiction in connection with Lessee’s

operations hereunder shall also be made to Lessor simultaneously with

Lessee's mailing of such application and reports to the said authority;

(2) Two printed copies and one digital copy of any clock log obtained, in LAS,

LIS, or ASCII ____________ final ____________ , drill stern test core

analysis, ____________ survey or any other ton MMA 1 survey made in such

well or work within 48 hours (exclusive of Saturdays, Sundays and legal

holidays) of such being available to Lessee. ____________ well is completed

as a producer, otherwise, only one copy, ____________ .

(3) Ten (10) days to the spudding of any well on the Leased Premises or on lands

pooled ____________ ;

(4) Any coring operation-A;

(5) Any drill stem tests;

(6) The running of any logs;

(7) Any plugging operation;

(8) Any reworking operations.

Such hereunder are to be delivered to Lessor free of charge;

- 8 -

(e) Lessee will maintain the confidentiality of all material furnished to Lessor upon

request;

(f) In addition, Lessee agrees to furnish to Lessor, free of charge, all field notes of land

surveys, maps, plats, ____________ tide curative records relating to Lessee’s title,

abstracts of title and ____________ opinions, in that entirety, ____________ or

obtained by the losses relating to the Leased Premises, and rendered by the attorney

for losses, any purchaser of the production hereunder, or furnished to Lessee by any

party; and

(g) By mutual agreement ____________ the parties herein, inspection (access) records

and information required by Paragraph 15 herein of ____________ lease shall extend

to:

(1) to initial well drilled on the prospect whether or not any of ____________

minerals are ____________ in the ____________ for said initial

____________ , and

(2) as to any well drilled on a unit ____________ or adjacent to losses, minerals

or any established ____________ which ____________ ____________

minerals.

Within sixty (60) days after the expiration, cancellation or termination of this Lease or any

portion thereof, for any cause whatsoever, except for Lessee’s release of acreage in accordance

with the terms of this lease, Lessor shall deliver to Lessee an instrument executed by Lessor in

recordable form, that designates the wells, if any, specifically retain lands as of the date of

execution of the instrument, specifically sets forth the description of the leased lands and

horizons that are retained by each such well, if any, as of the date of execution of the instrument

and releases all acreage and horizons that are not retained by such wells. Failure to furnish said

instrument subject losses to a penalty payable to Lessor in the amount of ____________ AND

NO/100 ($ ____________ ) DOLLARS per day for each and every day after sixty (60) days

allowed above during which Losses shall to furnish said ____________ receipt of said penalty

shall not affect Lessor’s right to collect from Lessees any actual damages incurred due to

Lessees's breach of the obligations of this paragraph.

Lessee shall be responsible for all damages caused by Lessee's operations. Lessee hereby

releases and discharges Lessor from and shall indemnify and save Lessor harmless from and

against any and all liability, damages (direct, remote and consequential damages) cost and

expenses including cost of investigation, litigation and a reasonable attorney’s fee incident to,

arising out of or in any way, directly or indirectly connected with Lessee’s damage to or spoilage

of property of any person whomever, or injury to (including injury resulting in death) or death of

any person whomsoever, which would not have occurred or accrued but for Lessee’s execution

of this instrument or for the exercise by Lessee (including Lessee’s agents, servants or

employee,s) Lessee’s contractors (and agents, servants, or employees of any of said contractors),

or Lessee’s licensees or assignees of the rights and privileges herein conferred on Lessees or

resulting from the operation of Lessee howsoever performed on or about the Leased Premises or

- 9 -

from the breach of all or any of the covenants or warranties hereof. Without limitation, Lessee

will be responsible and indemnify and hold Lessor harmless from any and all environmental and

physical damages. Lessee will comply in full with all applicable state and federal statutes and all

rules and regulations of Regulatory Body and will indemnify hold Lessor harmless from any and

all claims, demands, losses, fines and penalties arising out of Lessee violations, of any such

statute rules or regulations.

Any assignment, transfer or sublease of this Lease will contain specific provisions obligating all

assignees to protect the rights of Lessor within the term of this Lease. In no event shall any such

assignment be valid unless Lessor is furnished with a copy of the recorded assignment within

ninety (90) days from the date of recordation. However, should Lessee assign all rights, or any

portion of the rights herein delivered, in no event shall any operations or any portion of the

Leased Premises be included within the confines of a producing unit without Lessor first being

notified of any such assignment. In the event that Lessee should not provide such amendment(s)

or notification(s) as stipulated herein, then Lessee shall be subject to a penalty payable to Lessor

in the amount of AND NO/100 ($

)

DOLLARS per day for each and every day after ninety (90) days allowed above during which

Losses shall to furnish said amendments or notifications. Receipt of said penalty shall not affect

Lessor’s right to collect from Lessees any actual damages incurred due to Lessees's breach of the

obligations of this paragraph.

In case of execution, cancellation or termination of this Lease or any portion thereof, for any

cause whatsoever, except for fraud or failure to pay royalties as provided above, and, subject to

the provisions of this lease, Lessee shall have the right to retain under the terms hereof around

each well producing, being reworked, or being hereunder, or shut in

but capable of producing, Lessor’s interest in the number of acres allotted to each such well by

the spacing pattern validly fixed for the pool by the State Oil and

Gas Board or any other governmental body, State or Federal.

Lessee hereby assumes all obligations of every kind pertaining to the interests arising from the

date hereof and shall comply with any laws, ordinances, rules and regulations affecting the same.

Lessee shall fully protect, indemnify and defend Lessor and Lessor’s agents and/or employees

and hold them harmless from any and all claims, losses, damages, demands, suits, causes of

action and process (including attorneys fees, costs of litigation and/or investigation and other

costs also stated therewith) (collectively referred to as claims relating to injury or death of any

person or persons whomsoever; damage to or loss of property; or claims for liability under the

Comprehensive Environment, Compensation and Liability Act, 42 U.S.C. 9601, pl. M.. as the

same may be amended), arising out of or connected, directly or indirectly, with the ownership

operation of the interests, or any part thereof, accruing at or after the effective time, regardless of

cause, fault imposed by statute, rule or regulation, strict liability or negligent ads or omissions of

either party hereto or otherwise.

If Lessor brings suit to compel performance of or to recover for breach of any covenant or

condition herein contained or implied and prevails therein, Lessee agrees to pay Lessor

reasonable attorneys fees and expert witness fees in addition to the amount of judgment and cost.

- 10 -

All notices required or permitted to be sent hereunder shall be made as follows:

(a) To the Lessor.

Attention:

and

(b) To the Lessee.

Any notice should be sent by certified mail and shall be binding on the parties hereto as well as

their successors and assigns, except that either party hereto, and its successors and assigns shall

then the right by written notice to change the name or address to which any such notices shall be

directed.

IN WITNESS WHEREOF, this Lease is executed in multiple originals, and equal dignity and

effect as of the date hereinabove written.

LESSOR(S):

(1 st

Lessor’s Signature) (2 nd

Lessor’s Signature)

Print Name Print Name

Signature block for Entity Lessor

Name of Entity:

By:

- 11 -

Signature of authorized signatory

Type or Print Name:

Its:

Capacity of Signatory

LESSEE(S):

(1 st

Lessee’s Signature) (2 nd

Lessee’s Signature)

Print Name Print Name

Signature block for Entity Lessee

Name of Entity:

By:

Signature of authorized signatory

Type or Print Name:

Its:

Capacity of Signatory

WITNESSES:

(1 st

Witness Signature) (2 nd

Witness Signature)

Print Name Print Name

STATE OF _________________ , COUNTY OF _________________

The foregoing instrument was acknowledged before me this __________________ (date) by

- 12 -

________________________________________________ (person acknowledging, title, or

respective capacity, if any).

Notary Public for Oregon

Type or Print Name

My Commission expires:

STATE OF _________________ , COUNTY OF _________________

The foregoing instrument was acknowledged before me this __________________ (date) by

________________________________________________ (person acknowledging, title, or

respective capacity, if any).

Notary Public for Oregon

Type or Print Name

My Commission expires:

- 13 -

EXHIBIT A