U.S. Department of Agriculture

Office of Inspector General

Western Region

Audit Report

RISK MANAGEMENT AGENCY

INDEMNITY PAYMENTS TO PRUNE

PRODUCERS IN CALIFORNIA –

PRODUCER A

Report No.

05099-3-SF

March 2001

�UNITED STATES DEPARTMENT OF AGRICULTURE

OFFICE OF INSPECTOR GENERAL

WASHINGTON, D.C. 20250

DATE:

March 30, 2001

REPLY TO

ATTN OF:

05099-3-SF

SUBJECT:

Indemnity Payments to Prune Producers in California –

Producer A

TO:

Phyllis Honor

Acting Administrator

Risk Management Agency

ATTN:

Garland Westmoreland

Deputy Admi nistrator

Risk Compliance

This report presents the results of our audit of Risk Management Agency (RMA)

indemnity payments made to a prune producer in California. Our objective was to

resolve production discrepancies that we identified for six producers during our survey

of prune production in California for 1997 through 1999. This report covers one of the

six producers, whom we are identifying as “producer A.” When filing an insurance claim

for 1998, producer A did not report 3.4 tons of prune production to the insurance

provider which resulted in an overpayment to the producer of $2,142.

BACKGROUND

The Federal Agriculture Improvement and Reform Act of 1996 established RMA. RMA is

responsible for supervision of the Federal Crop Insurance Corporation (FCIC),

administration and oversight of programs authorized under the Federal Crop Insurance Act

of 1980, and other programs designed to manage risk and support farm income. FCIC

provides crop insurance through a network of approved private insurance companies

that are reinsured by FCIC. With the implementation of the single delivery system in

1998, these companies have sold and serviced all crop insurance policies that insure

producers against losses due to natural causes such as drought, excessive moisture,

hail, wind, frost, insects, and disease.

A producer suffering an insured loss reports the loss to his insurance provider. For the

insurance provider to determine the amount of the loss, the producer must show the

insurance provider proof of his production. Prune producers generally use copies of

AUDIT REPORT

�Phyllis Honor

2

their “Inspection Report And Certification” Form (form P-1) as evidence of their

production.

The insurance provider is responsible for verifying that the production amounts reported

by the producer are correct. If the amount of production is less than the guaranteed

level of production, per the insurance policy, the producer is entitled to an indemnity,

i.e., a reimbursement against loss or damage. This is calculated by multiplying the

production loss amount by the price elected by the producer.

In California, the Dried Fruit Association (an independent third party) inspects the

prunes and generates the form P-1’s. After the prunes have been dried and delivered

to a packinghouse, the Dried Fruit Association inspects a sample from each lot and

determines its weight, size, and quality. The inspection results are reported on the form

P-1 and distributed to the producer, handler, and the Prune Marketing Committee

(PMC). PMC maintains records for all dried fruit production in California.

OBJECTIVE

Our objective was to resolve the discrepancies identified between the production reported

to PMC and the production reported by producer A to the insurance provider.

SCOPE

During the survey phase of our audit, we looked at concerns about the inaccurate

reporting of production by prune producers, which could be, among other things, an

indicator of shifting production to increase indemnities. We limited our review to California

producers because Cali fornia prune orchards produce 99 percent of U.S. production. We

selected a judgmental sample of 20 producers to review based on the following criteria:

(1) the policy had multiple units or parcels of land (which would allow shifting of

production), (2) at least one of the units received no indemnity payment (which might

indicate that production had been falsely assigned to that unit), and (3) the indemnity was

among the largest paid. Our scope covered crop years1 1997 through 1999.

We found discrepancies in the production reported by 6 of the 20 producers in our sample.

Based on the survey results, we decided to conduct audits of each of the six producers to

resolve the questions about the discrepancies. Producer A is one of the six producers.

Audit fieldwork was performed from April through August 2000 at RMA’s Davis Regional

Office and the Rural Community Insurance Service office (insurance provider), both

located in Davis, California, and the Sutter/Yuba FSA County office located in Yuba

City, California.

1

A crop year is designated by the calendar year in which the insured crop is normally harvested.

AUDIT REPORT

�Phyllis Honor

3

This audit was performed in accordance with generally accepted government auditing

standards.

METHODOLOGY

To accomplish our objectives and support our findings, we performed the following

procedures:

•

We compared form P-1’s obtained from PMC to production amounts used by the

insurance provider to calculate producer A’s indemnities.

•

We analyzed producer files obtained from the insurance provider to determine if

producer A’s indemnities were adjusted in accordance with approved

procedures.

•

We compared the producer’s disaster application at the Sutter/Yuba FSA County

office with loss records submitted to the insurance provider.

•

We interviewed RMA and FSA officials, producers, handlers, and other persons

to resolve production discrepancies.

FINDING

For crop year 1998, producer A underreported production by 3.4 tons on one of eight

insured units, resulting in an understated total production of 198.9 tons. This occurred

because a third-party handler initially reported the production as another producer’s.

Although the handler subsequently informed the producer of the mistake, the producer did

not correct his insurance claim. Because the 3.4 tons were not included in the calculation

to determine the loss sustained, producer A was overpaid $2,142 out of $269,501 in total

indemnity payments.

Prune Crop Provisions state that “the total production to count (in tons) from all

insurable acreage on the unit will include all harvested and appraised production of

natural condition prunes that grade substandard or better…” 2

We attempted to reconcile the 1998 production that producer A had reported to the

insurance provider with production data maintained by PMC. In PMC records, we found

one form P-1 for producer A representing 3.4 tons of production for unit 102 that had not

been reported to the insurance provider in 1998.

2

FCIC 98-036, section 11(c), dated 1998.

AUDIT REPORT

�Phyllis Honor

4

This form P-1 initially had an erroneous producer name and code because the handler

(a third party who purchased the prunes from producer A) had misidentified the lot.

Upon determining that an error had been made, the handler forwarded a correction

request to the Dried Fruit Association. The Dried Fruit Association generated a revised

production report that was mailed to the producer, handler, and PMC. Producer A told

us that he called the handler to state that the production did not belong to him. The

handler disagreed but the producer did not pursue the issue any further.

We reviewed the final settlement sheet that indicated the handler paid producer A for

the 3.4 tons. Based on the handler’s statement and settlement sheet, we concluded

that the production belonged to producer A and that he was subsequently overpaid

$2,142 in indemnity payments. RMA should collect the overpayment from the insurance

provider and instruct the insurance provider to update the producer’s production history

by correcting the 1998 production and yield for unit 102 (see exhibit B).

Recommendation No. 1:

Collect the overpayment of $2,142 for unit 102 from the insurance provider.

RMA Response:

Following an internal review, RMA will request recovery of $2,142.

completion date for completing the review is July 1, 2001.

RMA’s estimated

OIG Position:

To accept management decision, we will need documentation that the insurance provider

was billed for $2,142.

Recommendation No. 2:

Instruct the insurance provider to correct the 1998 production and yield for unit 102.

RMA Response:

Following an internal review, RMA will correct the production record. RMA’s estimated

completion date for completing the review is July 1, 2001.

OIG Position:

We accept RMA’s management decision on this recommendation.

AUDIT REPORT

�Phyllis Honor

5

CONCLUSIONS AND REQUIRED AGENCY ACTIONS:

Your March 19, 2001, response to the draft report has been included as exhibit C of this

report. We accept your management decision for Recommendation No. 2.

In

accordance with Departmental Regulation 1720-1, we will be able to accept your

management decision on Recommendation No. 1 when you provide us with

documentation that the insurance provider was billed for $2,142. Please note that the

regulation requires a management decision to be reached on all findings and

recommendations within a maximum of 6 months from the date of report issuance.

The Office of the Chief Financial Officer (OCFO), U.S. Department of Agriculture, has

responsibility for monitoring and tracking final action for the finding and recommendations.

Please note that final action on the finding and recommendations should be completed

within 1 year of each management decision. Follow your agency’s internal procedures in

forwarding final action correspondence to OCFO.

We appreciate the assistance and cooperation of your staff during our audit.

/s/

JAMES R. EBBITT

Assistant Inspector General

for Audit

AUDIT REPORT

�EXHIBIT A – SUMMARY OF MONETARY RESULTS

RECOMMENDATIO

N NUMBER

1

DESCRIPTION

AMOUNT

The producer’s indemnity claim did

not include all production.

TOTAL MONETARY

RESULTS

CATEGORY

$2,142

Questioned Costs –

Recovery Recommended

$2,142

AUDIT REPORT

PAGE 6

�EXHIBIT B – CLAIM COMPUTATION WORKSHEET FOR UNIT 102

-A-

-B-

-C-

-D-

-E-

(B x C)

Unit

No.

APH

Yield

3

Coverage

Level

4

Guarantee

Per Acre

-F-

-G-

-H-

(D x E)

5

Unit

Acres

-I-

-J-

(F - G)

Production

Guarantee To Count

6

(H x I)

Unit

Price

Loss

Election

Indemnity

7

Amount 8

Indemnity Calculation Per Insurance Provider:

102

2.8

0.70

2.0

48.5

97.0

27.7

69.3

$

630

$

43,659

2.0

48.5

97.0

31.1

65.9

$

630

$

41,517

$

2,142

Indemnity Calculation Per Audit:

102

2.8

0.70

Difference:

3.4

3

The actual production history (APH) yield is the sum of the annual yields divided by the number of

years in the database. The approved APH may contain up to 10 consecutive crop years of actual

and/or assigned yields.

4

The coverage amount is the insurance provided by the crop insurance policy against insured loss of

production or value, by unit, as shown on the producer’s summary of coverage. Producer A elected a

coverage level of 70 percent of the APH.

5

The guarantee per acre is shown in tons of production.

6

The total production to count (in tons) will include all harvested and appraised production of natural

condition prunes that grade substandard or better and any production that is harvested and intended

for use as fresh fruit.

7

RMA established a price election of $630 per ton for California prunes for crop year 1998.

8

The indemnity amount is the reimbursement against loss or damage.

AUDIT REPORT

PAGE 7

�EXHIBIT C – RMA’S WRITTEN RESPONSE TO THE DRAFT REPORT

AUDIT REPORT

PAGE 8

�

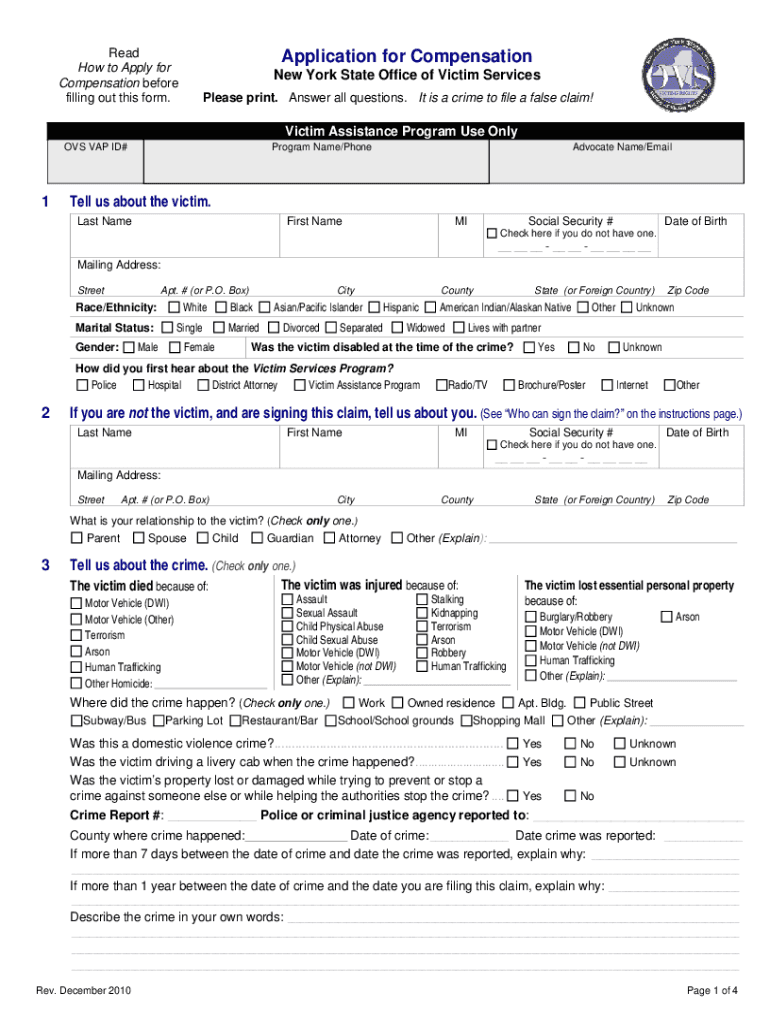

Useful advice for finalizing your ‘Ovs Application Form 2010’ digitally

Fed up with the burden of handling paperwork? Look no further than airSlate SignNow, the leading electronic signing solution for individuals and organizations. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documentation online. Take advantage of the extensive features offered by this user-friendly and cost-effective platform and transform your method of managing documents. Whether you have forms to sign or need to gather signatures, airSlate SignNow manages it all efficiently with just a few clicks.

Adhere to this step-by-step guide:

- Access your account or register for a complimentary trial of our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘Ovs Application Form 2010’ in the editing tool.

- Click Me (Fill Out Now) to finalize the document on your end.

- Include and designate fillable fields for other parties (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to stress if you need to collaborate with your coworkers on your Ovs Application Form 2010 or send it for notarization—our platform provides everything required to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!