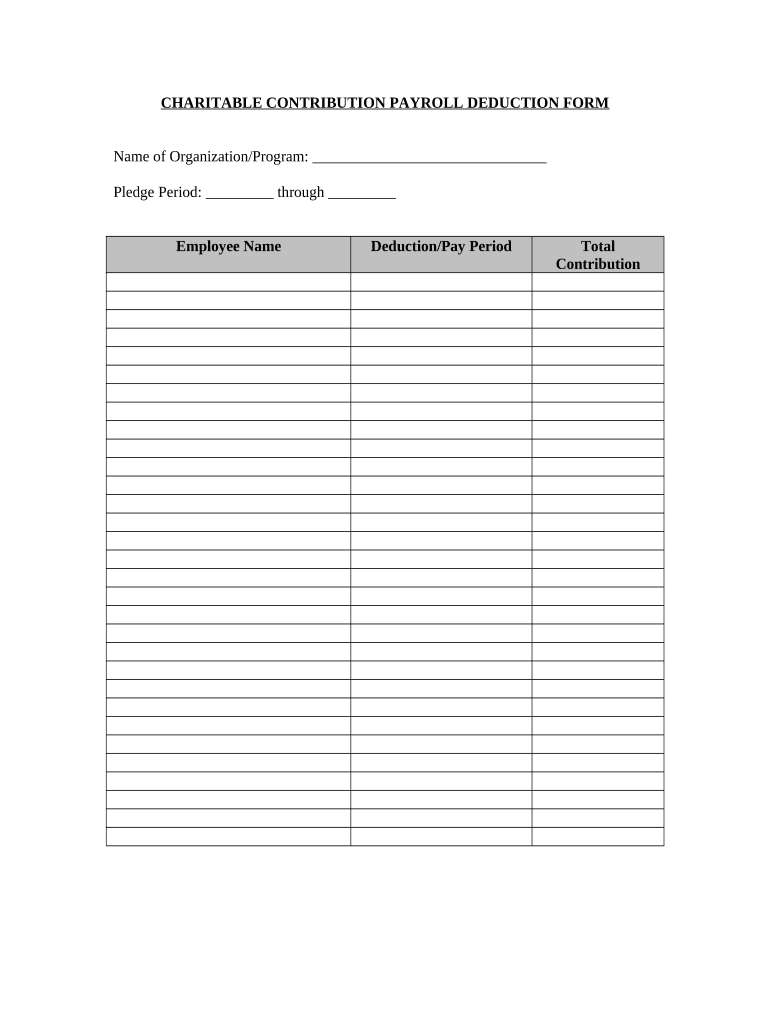

Fill and Sign the Payroll Deduction Form 497334404

Useful advice for preparing your ‘Payroll Deduction Form 497334404’ online

Fed up with the trouble of dealing with paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and businesses. Bid farewell to the monotonous chore of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the extensive features included in this user-friendly and affordable platform, and transform your method of paperwork organization. Whether you need to approve forms or collect eSignatures, airSlate SignNow manages everything efficiently, with just a few clicks.

Follow this detailed guide:

- Access your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form collection.

- Open your ‘Payroll Deduction Form 497334404’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Insert and designate fillable fields for additional participants (if required).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with others on your Payroll Deduction Form 497334404 or send it for notarization—our platform has everything necessary to achieve these tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is a Payroll Deduction Form and why is it important?

A Payroll Deduction Form is a document used by employees to authorize deductions from their paycheck for various purposes, like retirement plans or health insurance. This form is crucial for ensuring accurate payroll processing and compliance with regulations, making it a vital tool for HR departments.

-

How can airSlate SignNow help with Payroll Deduction Forms?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning Payroll Deduction Forms. With our solution, businesses can streamline the process, ensuring that forms are filled out correctly and securely, which saves time and reduces errors.

-

Are there any costs associated with using airSlate SignNow for Payroll Deduction Forms?

Yes, airSlate SignNow offers flexible pricing plans tailored to your needs, including options for businesses that require a high volume of Payroll Deduction Forms. Our plans are designed to be cost-effective, allowing you to manage your document signing needs without breaking the bank.

-

What features does airSlate SignNow offer for Payroll Deduction Forms?

airSlate SignNow offers features such as customizable templates for Payroll Deduction Forms, secure eSigning, and automated reminders to ensure timely completion. Our platform also allows for easy tracking and management of all signed forms, enhancing efficiency in your HR processes.

-

Can I integrate airSlate SignNow with my existing payroll software for Payroll Deduction Forms?

Absolutely! airSlate SignNow integrates seamlessly with various payroll software, allowing you to manage Payroll Deduction Forms within your existing systems. This integration helps streamline your payroll processes and enhances data accuracy.

-

What are the benefits of using airSlate SignNow for Payroll Deduction Forms?

Using airSlate SignNow for Payroll Deduction Forms increases efficiency by reducing paperwork and manual processes. Additionally, our solution provides a secure, compliant way to handle sensitive employee information, giving both employers and employees peace of mind.

-

Is it easy to create a Payroll Deduction Form with airSlate SignNow?

Yes, creating a Payroll Deduction Form with airSlate SignNow is straightforward. Our user-friendly interface allows you to customize forms quickly, add necessary fields, and prepare them for eSigning in just a few clicks.

The best way to complete and sign your payroll deduction form 497334404

Find out other payroll deduction form 497334404

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles