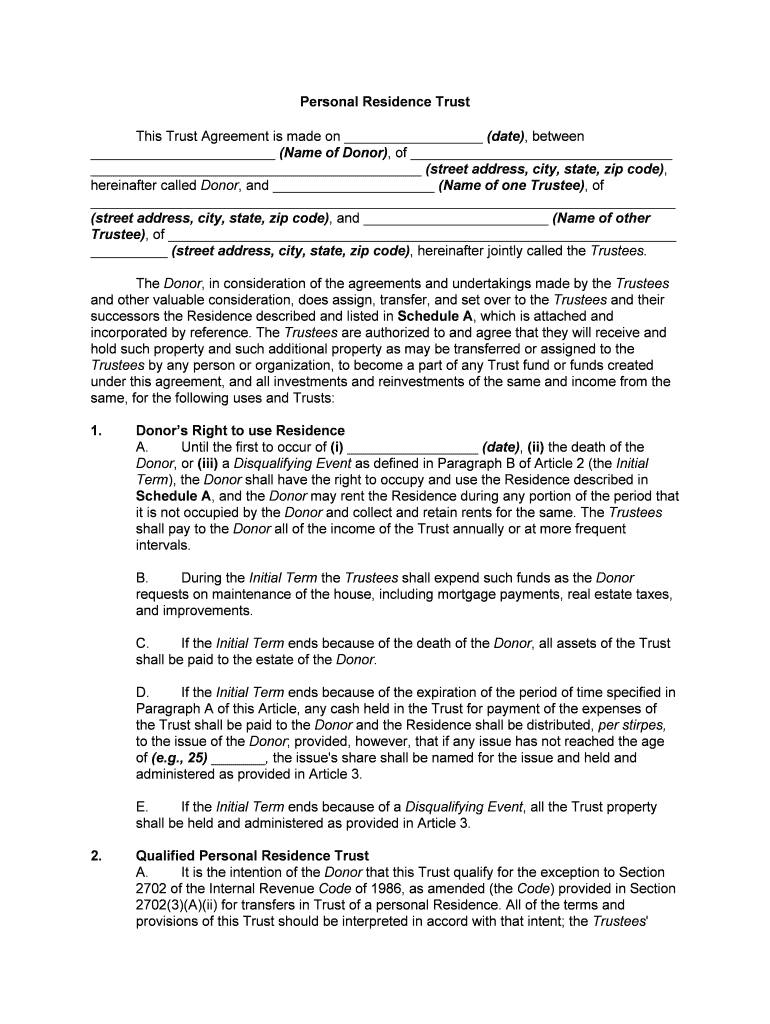

Personal Residence Trust

This Trust Agreement is made on __________________ (date), between

________________________ (Name of Donor), of __________________________________

___________________________________________ (street address, city, state, zip code),

hereinafter called Donor, and _____________________ (Name of one Trustee), of

____________________________________________________________________________

(street address, city, state, zip code) , and ________________________ (Name of other

Trustee) , of __________________________________________________________________

__________ (street address, city, state, zip code) , hereinafter jointly called the Trustees.

The Donor , in consideration of the agreements and undertakings made by the Trustees

and other valuable consideration, does assign, transfer, and set over to the Trustees and their

successors the Residence described and listed in Schedule A, which is attached and

incorporated by reference. The Trustees are authorized to and agree that they will receive and

hold such property and such additional property as may be transferred or assigned to the

Trustees by any person or organization, to become a part of any Trust fund or funds created

under this agreement, and all investments and reinvestments of the same and income from the

same, for the following uses and Trusts:

1. Donor’s Right to use Residence

A. Until the first to occur of (i) _________________ (date), (ii) the death of the

Donor , or (iii) a Disqualifying Event as defined in Paragraph B of Article 2 (the Initial

Term ), the Donor shall have the right to occupy and use the Residence described in

Schedule A , and the Donor may rent the Residence during any portion of the period that

it is not occupied by the Donor and collect and retain rents for the same. The Trustees

shall pay to the Donor all of the income of the Trust annually or at more frequent

intervals.

B. During the Initial Term the Trustees shall expend such funds as the Donor

requests on maintenance of the house, including mortgage payments, real estate taxes,

and improvements.

C. If the Initial Term ends because of the death of the Donor, all assets of the Trust

shall be paid to the estate of the Donor.

D. If the Initial Term ends because of the expiration of the period of time specified in

Paragraph A of this Article, any cash held in the Trust for payment of the expenses of

the Trust shall be paid to the Donor and the Residence shall be distributed, per stirpes,

to the issue of the Donor; provided, however, that if any issue has not reached the age

of (e.g., 25) _______ , the issue's share shall be named for the issue and held and

administered as provided in Article 3.

E. If the Initial Term ends because of a Disqualifying Event, all the Trust property

shall be held and administered as provided in Article 3.

2. Qualified Personal Residence Trust A. It is the intention of the Donor that this Trust qualify for the exception to Section

2702 of the Internal Revenue Code of 1986, as amended (the Code) provided in Section

2702(3)(A)(ii) for transfers in Trust of a personal Residence. All of the terms and

provisions of this Trust should be interpreted in accord with that intent; the Trustees'

powers shall be restricted to conform to that intent whether or not specified in this

document, and no power or term provided in this agreement shall be effective if it would

prevent qualification for that exception. The Trustees are specifically authorized to

amend the Trust to the extent the Trustees believe necessary to conform to the

requirements of the exception; provided, however, that this instrument may not be

amended in such a way that the Trusts created under this Article shall not so qualify.

B. In accordance with the foregoing intent, a Disqualifying Event shall be deemed to

have occurred if the property held by the Trusts ceases to be a personal Residence of

the Donor unless the Residence is sold and the proceeds used to purchase another

Residence of the Donor within (e.g. two years) ______________ from the date of sale.

If no Residence is purchased within (e.g. two years) ______________ after the date of

sale, or on the date specified in clause (i) of Paragraph A of Article 1, if earlier, or if there

is no longer an intent to purchase the Residence, a Disqualifying Event shall be deemed

to have occurred to the extent of the proceeds.

C. If the residential real property held by the Trust is damaged or destroyed so that

it is unusable as a personal Residence, a Disqualifying Event shall be deemed to have

occurred (e.g. two years) _____________ after the date of the damage or destruction

unless, prior to that date, the replacement of or repairs to the Residence are completed

or a new Residence is acquired by the Trust. If the replacement of or repairs to the

Residence are not completed or a new Residence is not acquired by the Trust within

(e.g. two years) _____________ from the date of damage or destruction, or on the date

specified in clause (i) of Paragraph A of Article 1, if earlier, or if there is no longer an

intent to repair or replace the Residence, a Disqualifying Event shall be deemed to have

occurred to the extent of the proceeds.

D. The following provisions are included to conform to the intent of Paragraph A of

this Article:

1. During the Initial Term no distributions of income or corpus may be made

to any beneficiary other than the Donor.

2. During the Initial Term the Trustees may not hold as part of the Trust any

assets other than one Residence to be used as a personal Residence by the Donor , cash to the extent permitted in Subparagraph 3 of this Paragraph D, and

improvements to the Residence which meet the requirements of a personal

Residence.

3. Additions of cash may be made to the Trust and cash subsequently may

be held in a separate account in the Trust which, when combined with the cash

already held in the Trust, does not exceed the amount required for:

a. Payment of Trust expenses (including mortgage payments)

already incurred or reasonably expected to be incurred within (e.g. six)

_______ months from the date the addition is made;

b. Improvements to the residential real property to be paid for by the Trust

within (e.g. six) _______ months from the date the addition of such cash

is made; and

c. Purchase by the Trust of a Residence to replace another

Residence, within (e.g. three) _______ months of the date the addition of

the cash is made, provided that no such addition may be made for this

purpose, and the Trust may not hold any such addition, unless the

Trustees have previously entered into a contract to purchase the

replacement Residence. The Trustees may hold, in a separate account,

the proceeds from the sale of a personal Residence for a period not to

exceed (e.g. two years) _______________, if the Trustees intend to use

the proceeds to purchase another Residence. The Trustees may also

hold, in a separate account, insurance proceeds paid as a result of

damage to or destruction of the personal Residence for a period not to

exceed (e.g. two years) _______________, if the Trustees intend to use

the proceeds to repair or improve the Residence.

4. Any amounts of cash held in excess of the amounts specified in

Subparagraph 3 of this Paragraph D shall be distributed to the Donor at least

quarterly.

5. Commutation of the Donor's interest in this Trust is prohibited.

3. Disposition of Income and Principal A. If a Disqualifying Event has occurred from the time the Residence held by the

Trust ceases to be a personal Residence, until _________________ (date), there shall

be paid to the Donor an annual annuity amount equal to an amount determined by

dividing the value of all interests retained by the Donor as of the date of the

establishment of this Trust by an annuity factor determined as of the date of the

establishment of the Trust using the rate determined under Section 7520 of the Code as

of that date, and for the original term of the Donor's interest.

B. On _________________ (date), all the assets of the Trust shall be distributed,

per stirpes, to the issue of the Donor; provided, however, if any issue has not reached

the age of (e.g. 25) ________, the issue's share shall be named for the issue and held

and administered as provided in Article 4.

C. If the Donor dies before ________________ (date), all of the assets of the Trust

created under this Article 3 shall be paid and distributed to the personal representative of

the Donor 's estate.

D. Any such distributions pursuant to Paragraph A of this Article shall be paid from

the net income of the respective Trust for the current tax year, or to the extent that the

net income is insufficient, from the principal of the Trust, using to the extent available,

first net short term capital gains from the current tax year, then net long term capital

gains from the current tax year, and then the balance of the principal of the Trust.

E. In the case of the period beginning with the time the Residence held by the Trust

ceases to be a personal Residence, the amount distributed under Paragraph A of this

Article shall be the amount which must be distributed at least yearly multiplied by a

fraction, the numerator of which is the number of days in the taxable year of the Trust

after the Residence held by the Trusts ceases to be a personal Residence and the

denominator of which is 365 (366 if February 29 is a day included in the numerator). In

the case of any other taxable year which is a period of less than 12 months (other than

the taxable year in which the annuity interest created in this Article terminates), the

amount distributed under Paragraph A of this Article shall be the amount which must be

distributed at least yearly multiplied by a fraction, the numerator of which is the number

of days in the taxable year of the Trust and the denominator of which is 365 (366 if

February 29 is a day included in the numerator). In the case of the taxable year of a

Trust in which the annuity interest created in this Article terminates, the amount required

to be distributed under Paragraph A of this Article shall be the amount which must be

distributed at least yearly multiplied by a fraction, the numerator of which is the number

of days in the period beginning on the first day of the taxable year and ending on the

date on which the termination occurs, and the denominator of which is 365 (366 if

February 29 is a day included in the numerator).

F. In the event any payment is not paid when due, any late payment shall bear

interest at the applicable federal rate.

G. In the event the net fair market value of the Trust assets is incorrectly determined

by the Trustees , the Trustees shall pay to the Donor (in the case of an undervaluation)

or be repaid by the Donor (in the case of an overvaluation) an amount equal to the

difference between the amount which the Trustees should have paid the recipient if the

correct value were used and the amount which the Trustees actually paid the recipient.

Such payments or repayments shall be made within a reasonable period after the final

determination of such value. The Trustees may in their absolute discretion require that

distributions to the Donor be made subject to written acknowledgment and acceptance

of these conditions.

H. Prior to the end of the Donor's qualified interest in this Trust, no distributions of

principal may be made from the Trust other than to the Donor with respect to the

qualified annuity interest of the Donor.

I. No additions may be made to the Trust during the period it is governed by this

Article.

J. No commutation may be made of the distributions to the Donor provided for

under this Article.

K. It is the express intent of the Donor that the interest of the Donor created under

this Article shall qualify as a qualified interest as described in Section 2702(b) of the Code , and that any gift from the Donor to any Trust created under this agreement shall

qualify to the maximum extent possible for the deduction from the value of the gift as

provided in Section 2702(a)(2)(B) of the Code and this agreement. All powers, Trusts,

directions, authorizations, instructions, and obligations granted to or imposed on the

Trustees by this Agreement and by law shall be construed in such a way that the Trusts

created under this Article shall so qualify. To the same end and purpose, the Trustees

are authorized and empowered, by an instrument in writing, to amend this instrument in

whatever manner the Trustees in their absolute and uncontrolled discretion shall deem

necessary or desirable to qualify the interest retained by the Donor created under this

Article as described in Section 2702(b) of the Code; provided, however, that this

instrument may not be amended in such a way that the Trusts created under this Article

shall not so qualify.

L. If at any time there shall be no beneficiary eligible to receive the principal of any

Trust created under Article 1 or Article 3, then the entire principal of any such Trust shall

be paid and distributed to the persons then living who would have inherited the estate of

the Donor if the Donor had then died intestate under the laws of __________________

(name of state) existing on the date of the execution of this Trust Agreement in the

proportions prescribed by such laws.

4. Division into Trusts for Issue A. Any property designated under Paragraph D of Article 1 or Paragraph B of Article

3 with the name of a child or more remote issue of the Donor (each such child or more

remote issue of the Donor referred to in this Paragraph A as the Beneficiary) shall be

held as a separate and distinct Trust and Trust fund (which respective Trust shall be

identified by the name of the Beneficiary) for the following uses and purposes:

1. Until the Beneficiary with whose name a Trust is designated shall attain

the age of (e.g. 25) ______ years, the Trustees may, from time to time, in the

Trustees ' absolute discretion, pay or distribute such part or all of the net income

of the Trust as may be deemed appropriate to any one or more then living of the

group consisting of the Beneficiary with whose name the Trust is designated and

the issue of the Beneficiary, in such amounts and proportions as the Trustees

shall determine.

2. When any Beneficiary with whose name such a Trust is designated shall

have attained the age of (e.g. 25) ______ years, the entire remaining principal of

the Trust designated with the name of the Beneficiary shall be paid and

distributed to the Beneficiary; provided, however, that the Trustees may, in the

Trustees ' absolute discretion, postpone the date on which the right to the

distribution vests for a period not exceeding (e.g. two years) ______________.

3. If any Beneficiary with whose name such a Trust is designated shall die

prior to the termination of the Trust, the entire principal of the Trust designated

with the name of the Beneficiary shall be paid and distributed to such appointee

or appointees, including the Beneficiary's estate, in such amounts and

proportions, for such estates and interests, and free of Trust or on such terms,

Trusts, conditions, and limitations as the Beneficiary may designate in the

Beneficiary's last will and testament by making specific reference to and exercise

of this power given to the Beneficiary. If the Beneficiary shall die intestate or shall

fail in part or entirely to exercise this power, the entire principal of the Trust

designated with the name of the Beneficiary, or the part not disposed of by the

Beneficiary, shall be paid and distributed as follows: a. If the Beneficiary leaves issue then surviving, to the Beneficiary's

then surviving issue, per stirpes; provided, however, that if any such issue

shall not then have attained the age of (e.g. 25) _____ years, the share or

partial share of the issue shall be designated with the name of the issue

and shall continue to be held as a separate and distinct Trust and Trust

fund pursuant to the terms of this Paragraph A.

b. If the Beneficiary leaves no issue then surviving, the property shall

be divided into equal shares, and one such share shall be paid and

distributed to each then surviving brother or sister of the Beneficiary, and

one such share, per stirpes, to the then surviving issue of any then

deceased brother or sister of the Beneficiary; or if there shall not then be

any such surviving brother or sister or issue, then to the then surviving

issue, per stirpes, of the Beneficiary's nearest ascendant who is a

descendant of the Donor and of whom there are issue then surviving; or if

there shall not then be any such surviving issue, then to the then

surviving issue of the Donor, per stirpes; provided, however, that if any

such person shall not then have attained the age of (e.g. 25) ______

years, the share or partial share which would otherwise be paid and

distributed to that person shall be added to the Trust fund created under

this Paragraph A designated with the name of that person, or if such a

Trust fund is not then in existence, the share or partial share shall be held

as a separate and distinct Trust and Trust fund designated with the name

of the person for the same uses and purposes specified in this Paragraph

A.

B. Net income not paid or distributed from any Trust created by this Article may be

added to any subsequent income payment from the Trust. Until distributed, accrued and

accumulated income shall be regarded for all purposes under this Trust agreement as

principal of the respective Trusts created by this Article. First consideration for any

distribution of income or principal from any such Trust shall be given to the person with

whose name the Trust is designated.

C. The Trustees may, from time to time, in the Trustees' absolute discretion, pay or

distribute to any Beneficiary then eligible to receive income from any Trust created by

this Article such part of the principal of the Trust from which the Beneficiary is eligible to

receive income as the Trustees may deem appropriate. No such payment or distribution

shall constitute an advance against any amount receivable by any person from any Trust

created by this Article unless the Trustees shall otherwise provide in writing at the time

of making the payment, and then only to the extent so provided.

D. Any of the Trusts created under this Article may be terminated, in whole or in

part, at any time after the termination of the Trusts created under Article 1 or Article 3, if

such action is deemed advisable and for the best interests of the Trust or Trusts, or the

Beneficiaries, in the sole discretion of the Trustees whose judgment shall be conclusive

and free from question by anyone or in any court. In the event of such termination, the

principal of each Trust so terminated, together with the accrued, accumulated, and

undistributed income, shall be paid over and distributed to that person with whose name

the Trust is designated. In giving the Trustees such discretion to terminate any such

Trust, the Donor recognizes that the interests of present and future Beneficiaries may be

terminated on the exercise of that discretion.

E. If at any time after the termination of the Trusts created by this Article there shall

be no Beneficiary eligible to receive the income or principal of any Trust created by this

Article, the entire principal of the Trust created by this Article shall be paid and

distributed to the persons then living who would have been the next of kin of the Donor if

the Donor had died at that time.

F. All interests, both in income and in principal, in all Trusts created by this Article

are intended for the personal protection and welfare of the Beneficiaries; no such

interest shall be transferable, voluntarily or involuntarily, by the Beneficiary nor subject to

the claims of creditors or of a spouse or former spouse of the Beneficiary. In the event

that the Trustees shall have notice or believe that the rights or interests of any

Beneficiary in or to any part of the income or principal of any Trust created by this Article

have been or may be diverted from the purpose of providing for the personal protection

and welfare of the Beneficiary, whether by voluntary act or legal process, the Trustees

shall not pay the income or principal to the Beneficiary, but may use so much of it as the

Trustees , in the Trustees ' sole discretion, deem appropriate for the care, support,

maintenance, education, or other necessities of the Beneficiary, such use, if any, to be

made as the Trustees deem appropriate under the circumstances.

G. Any person may irrevocably disclaim and renounce any part or all of any gift

made to the person by this Article. Any such disclaimer and renunciation shall be

effected in the manner required by applicable law. If any person disclaims and

renounces all interest in all or any part of any gift made to the person by this Article, all

of the gift or all of the part shall be disposed of as if the person had not survived the Donor . If any person disclaims and renounces less than all interest in all or any part of

any gift made to the person by this Article, all of the gift or all of such part shall be held in

Trust.

H. If, in the absence of this provision, any Trust created under this Article would at

any time fail in whole or in part because of the violation of any applicable rule against

perpetuities, accumulation of profits, restraints on alienation, or remoteness of vesting,

then the Trust fund shall terminate as of the date preceding the termination of the

permissible period prescribed by such rule, and the Trustees shall immediately distribute

the principal of the Trust fund to the person with whose name the Trust is designated.

5. Additions to Trust The Donor or any other person or organization may, at any time other than when the

Trust is governed by Article 4, give, transfer, or bequeath to this Trust or to any separate Trust

fund created under this Agreement, either by inter vivos transfer or testamentary disposition,

additional money or property of any kind acceptable to the Trustees. In that event, the additional

property shall become a part of the principal of the Trust or Trust fund to which it is given and

shall be divided, allocated, administered, and distributed as if it originally had been a part of the

same. The Trustees may assume any obligation associated with any such property.

6. Payments to Minor or Incompetent A. If any person to whom any payment or distribution from any Trust created by

Article 4 of this instrument is required or permitted by any provision of this instrument to

be made is then a minor, incompetent, or for any other reason incapable of receiving the

payment or distribution, or if there is a substantial risk that the payment or distribution

will be involuntarily diverted from benefiting such person, the Trustees may, but need

not, from time to time, exercise any one or more of the following powers:

1. Transfer property to the name of the person (as by depositing cash or

registering securities in the person's name), whether or not the person is then

able to exercise control over the property.

2. Transfer property to any creditor of the person in discharge of any debts

of the person.

3. Use such payment or distribution to obtain goods or services for the

person if any obligation of any other person is not consequently discharged.

B. No such payment or distribution shall be made which would have the effect of

satisfying any legal obligation of anyone other than such person nor shall any such

payment or distribution be made to any Donor or Donor 's spouse or to any spouse of a

child of the Donor either individually or as a fiduciary.

C. The receipt of any person to whom property is transferred pursuant to this Article

or other evidence of application made under this agreement for the benefit of any

Beneficiary shall fully discharge the Trustees from any further liability in connection with

the payment or distribution.

D. The determinations of the Trustees with respect to all matters referred to in this

Article shall be final.

E. Nothing contained in this Article shall authorize any Trustee to transfer any

property to himself or herself in a nonfiduciary capacity or to use any such payment or

distribution to support or maintain any person whom the Trustee is obligated to support

or maintain.

7. Discretion of Trustees In allotting or making any division of or payment or distribution from any Trust fund or

any portion of it for any purpose under this agreement, the Trustees shall not be required to

convert any property, real or personal, tangible or intangible, into money or to divide or

apportion each or any item of property, but may, in the sole and absolute discretion of the

Trustees , allot all or any part (including an undivided interest) of any item of property, real or

personal, tangible or intangible, to any fund or to any beneficiary provided for by this instrument;

or the Trustees may convert any property into any other form, it being the Donor's intent and

purpose to leave all such divisions and apportionments entirely to the discretion of the Trustees

with the direction merely that each fund, share, portion, or part at any time created or provided

for shall be constituted so that the same shall have the value, relative or absolute, designated

by this instrument.

8. Powers of Trustees Subject to the provisions and limitations set forth in this instrument, the Trustees shall

have the powers granted below, in addition to all powers which are granted by applicable law.

While it is the Donor's intention that the Trustees have broad and effective powers to carry out

the provisions of this Trust agreement, no power conferred on any Trustee by this Article shall

be exercised in such a manner as, in the aggregate, to deprive the Donor or any Trust created

under this agreement of any otherwise available tax exemption, deduction, or credit, or to qualify

for special treatment. The powers granted below shall not be exhausted by any use of them, but

each shall be continuing; and each shall continue and be exercisable until all of the provisions of

this Trust agreement are fully executed. Any of the powers granted in this agreement may be

exercised without the license or authorization of any court or other legal authority. The

determination of the Trustees with respect to whether to exercise or not to exercise any power

shall be final. These powers are the powers:

A. To retain any and all stocks, bonds, notes, securities, and other property, real or

personal (but not wasting assets), comprising a part of this Trust without liability for any

decrease in the value of the same.

B. For fair and adequate consideration, to sell, at public or private sale, exchange

for like or unlike property, convey, lease for longer or shorter terms than the Trust

provided in this agreement, and otherwise dispose of, any and all property, real or

personal, held under this agreement on such terms and credits as the Trustees may

deem proper, including specifically the power to sell or otherwise dispose of any such

property for less than its acquisition or appraised value, without liability for any loss

resulting from the disposition.

C. For fair and adequate consideration, to invest any money held under this

agreement and available for investment in any and all kinds of securities or property

except wasting assets, whether or not of the kind authorized by the common law or by

the laws of any state or country to which they would, in the absence of this provision, be

subject, and to form or join in forming any corporation and subscribe for and acquire

stock in any corporation in exchange for money or other property.

D. To invest and reinvest and retain the investment of the whole or any part of the

Trust fund or any and all of the proceeds from the disposition of any assets of any Trust

fund in any single security or other asset, or any limited number of securities or other

assets, or any exchanged or merged or substitute or successor security or securities, or

any single type or limited number of types of securities or other assets, without liability

for any loss resulting from any lack of diversification; it being intended that this provision

free and absolve the Trustees from any and all obligation or liability for any lack of

diversification of investments and assets held in the Trust fund, or any loss resulting

from the same, regardless of whether the investments or assets were held or owned by

the Donor at any time or whether they are exchanged or merged for successor or

substitute investments for assets owned by the Donor or whether they are investments

or assets acquired during the Donor's life or after the Donor's death by the Trustees.

E. Subject to the express limitations of Article 2 of this Agreement, to retain cash

included in the Trust fund without investment of the same for such period of time as the

Trustees shall deem advisable, whenever the Trustees shall determine that it is

inadvisable to invest such cash because of market conditions or for any other reason.

F. To vote directly or by proxy at any election or stockholders' meeting any shares

of stock held under this Agreement.

G. To exercise or dispose of or reject any purchase rights arising from or issued in

connection with any stock, securities, or other property held under this Agreement.

H. To repair, alter, or demolish any existing building or structure and to erect any

buildings and structures on any real estate held under this Agreement.

I. To effect fire, rent, title, liability, casualty, or other insurance of such nature and in

such form and amount as may be desirable on any property held under this Agreement.

J. To participate in any plan or proceeding for protecting or enforcing any right,

obligation, or interest arising from any property held under this agreement, or for

reorganizing, consolidating, merging, or adjusting the finances of any corporation issuing

the same; to accept in lieu of the same any new property; to pay any assessment or

expense incident to such property; to join in any voting Trust agreement and to do any

other act or thing which the Trustees may deem necessary or advisable in connection

with the same.

K. To employ, on such terms and with such discretionary powers as the Trustees

may approve, servants, agents, custodians of securities, or other property, accountants,

or other professional persons, and attorneys-at-law or in-fact, and to obtain the advice of

any bank, Trust company, investment counsel, or any other institution or individual, and

permit books of account to be kept by any of the foregoing and pay for such services out

of the Trust fund profiting by such services, making such division as between principal

and income as the Trustees may deem just within the scope of generally accepted

accounting principles.

L. To collect, pay, abandon, contest, compromise, or submit to arbitration any claim

in favor of or against the Trust fund, or any part of it, or the Trustees.

M. To borrow money for such periods of time and on such terms and conditions as

the Trustees may deem advisable for any purpose whatsoever, and the Trustees may

mortgage or pledge such part or the whole of the Trust fund as may be required to

secure the loan or loans.

N. To delegate from time to time the exercise of the Trustees' powers and duties, in

whole or in part, to one or more other Trustees if any additional Trustee or Trustees are

acting under this agreement or to attorneys or agents, including in either case delegation

of discretionary as well as ministerial powers and the delegation of the performance and

execution of all acts and the exercise of all judgment and discretion in connection with

the administration or performance of the Trust.

O. To manage and conduct or participate in the management or conduct of the

affairs of any corporation, the stock of which may be held under this agreement; to act

as officer, director, attorney, or employee of any such corporation or for the Trust or

Trustees and to receive reasonable compensation for acting as such; to vote the stock in

favor of the increase or decrease of the capital of any such corporation and to take such

action with regard to the stock in the interest of the Trust as the Trustees in the Trustees '

discretion may determine; and personally to own stock or be interested in any

corporation or business in which the Trust shall own stock or be interested.

P. To hold stocks and other assets and to open bank accounts for deposits of

money comprising a part of the Trust fund in the individual name of a Trustee or the

Trustees ' nominee with or without disclosing any fiduciary relationship, and to employ

custodians of securities or other property, and to permit the custodians to hold such

securities or other property in their own name or in the name of a nominee, with or

without disclosing any fiduciary relationship.

Q. To change the situs of the Trust and of any property which is a part of the Trust

to any place in the United States of America.

R. Until _______________ (date), the Donor in a nonfiduciary capacity may

reacquire the Trust corpus by substituting other property of an equivalent value.

9. Governing Law The construction, validity, and effect of this agreement and the rights and duties of the

Beneficiaries and the Trustees shall at all times be governed exclusively by the laws of

_____________________ (name of state).

10. Counterparts This Agreement may be executed in any number of counterparts, any one of which shall

constitute the Agreement between the parties.

11. Construction A. Unless the context requires otherwise, all words used in this instrument in the

singular number shall extend to and include the plural; all words used in the plural

number shall extend to and include the singular; and all words used in any gender shall

extend to and include all genders.

B. For all purposes under this instrument, adoption of a minor who is not an issue of

the Donor by a person or persons shall have the same effect except for determining his

or her age as if the minor were born to such person or persons on the date of his or her

adoption.

C. As used in this instrument, the terms "brother" and "sister" shall include persons

who have acquired the designated relationship by the half as well as the whole blood,

but shall be limited to persons related to the Donor by blood or adoption.

D. As used in this instrument, the term " Trustees" shall include all those holding that

office under this Agreement from time to time without regard to whether they were

initially appointed, successor, or additional Trustees.

E. As used in this instrument, the term "children" means first generation offspring of

the designated ancestor; the term "issue" means both children of the designated

ancestor and lineal descendants indefinitely.

12. Trustees A. _____________________ (Name of one Trustee) and ____________________

(Name of other Trustee) are appointed initial Trustees under this agreement. Any of the

Trustees , or any successor Trustee, shall have the power, exercisable by the execution

of a written instrument so specifying, to nominate and appoint the Trustee's immediate

successor as Trustee under this Agreement. The nomination may be changed by the

nominating Trustee at any time while the Trustee is acting as Trustee under this

Agreement. Any such nominated successor Trustee shall become a Trustee whenever

the nominating Trustee shall cease to serve as Trustee. In the event any Trustee acting

under this Agreement shall cease to serve as Trustee and (1) has not effectively

nominated the Trustee's immediate successor as Trustee, or (2) if the so nominated

successor Trustee shall, for any reason, not become a Trustee under this agreement,

then the remaining Trustee or Trustees then serving shall nominate and appoint such

successor Trustee.

B. Any individual or corporation at any time serving as Trustee under this

Agreement may resign as Trustee of any Trust or Trusts by delivering a written

instrument to that effect signed by or on behalf of the Trustee to the Donor, if the Donor

is then living, otherwise to the other Trustees then serving. Any such resignation shall be

effective as of the date of completion of delivery of the instrument to such person or

persons or as of such later date as shall be specified in the instrument.

C. No bond or other security shall ever be required to be given or be filed by any

Trustee for the faithful execution of the Trustee's duty under this Agreement. If,

notwithstanding the foregoing provision, a bond shall nevertheless be required, no

sureties shall be required.

D. No Trustee shall be liable except for willful malfeasance or bad faith.

E. The vote of a majority of the Trustees entitled to act on any matter shall be

sufficient to govern any action.

WITNESS our signatures as of the day and date first above stated.

________________________ _________________________

(Printed name) (Printed name)

________________________ _________________________

(Signature of Donor) (Signature of Trustee)

_______________________

(Printed name) _______________________

(Signature of Trustee)

( Acknowledgements)

(Attached Schedule)