CONFORMED COPY

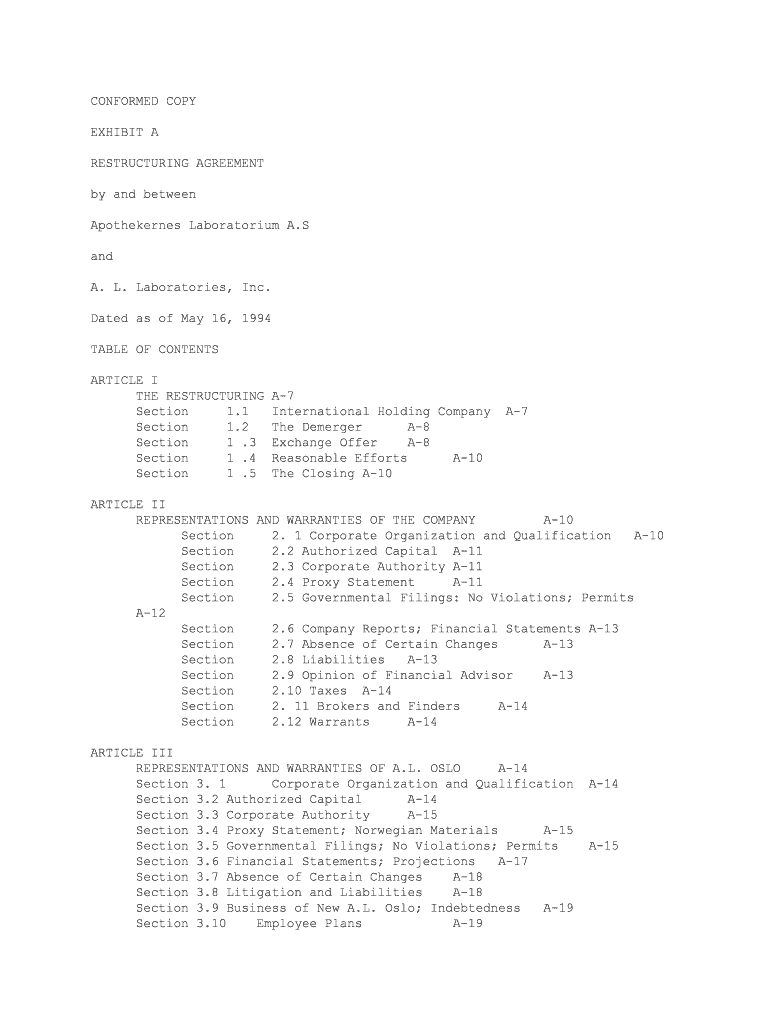

EXHIBIT A

RESTRUCTURING AGREEMENT

by and between

Apothekernes Laboratorium A.Sand

A. L. Laboratories, Inc.

Dated as of May 16, 1994

TABLE OF CONTENTS

ARTICLE ITHE RESTRUCTURING A-7

Section 1.1 International Holding Company A-7

Section 1.2 The Demerger A-8

Section 1 .3 Exchange Offer A-8

Section 1 .4 Reasonable Efforts A-10

Section 1 .5 The Closing A-10

ARTICLE II REPRESENTATIONS AND WARRANTIES OF THE COMPANY A-10

Section 2. 1 Corporate Organization and Qualification A-10

Section 2.2 Authorized Capital A-11

Section 2.3 Corporate Authority A-11

Section 2.4 Proxy Statement A-11

Section 2.5 Governmental Filings: No Violations; PermitsA-12

Section 2.6 Company Reports; Financial Statements A-13

Section 2.7 Absence of Certain Changes A-13

Section 2.8 Liabilities A-13

Section 2.9 Opinion of Financial Advisor A-13

Section 2.10 Taxes A-14

Section 2. 11 Brokers and Finders A-14

Section 2.12 Warrants A-14

ARTICLE III REPRESENTATIONS AND WARRANTIES OF A.L. OSLO A-14

Section 3. 1 Corporate Organization and Qualification A-14

Section 3.2 Authorized Capital A-14

Section 3.3 Corporate Authority A-15

Section 3.4 Proxy Statement; Norwegian Materials A-15

Section 3.5 Governmental Filings; No Violations; Permits A-15

Section 3.6 Financial Statements; Projections A-17

Section 3.7 Absence of Certain Changes A-18

Section 3.8 Litigation and Liabilities A-18

Section 3.9 Business of New A.L. Oslo; Indebtedness A-19

Section 3.10 Employee Plans A-19

Section 3. 11 Intellectual Property A-20

Section 3.12 Taxes A-20

Section 3.13 Brokers and Finders A-21

Section 3.14 Opinion of Financial Advisor A-21

Section 3.15 Insurance A-21

Section 3.16 Material Contracts A-21

ARTICLE IV COVENANTS A-21

Section 4.1 Interim Operations of the Company A-21

Section 4.2 Interim Operations of the Related Norwegian BusinessesA-22

Section 4.3 Additional Agreements A-23

Section 4.4 Meeting of Stockholders A-24

Section 4.5 Filings; Other Action A-24

Section 4.6 Access A-24

Section 4.7 Notification of Certain Matters A-25

Section 4.8 Publicity A-25

Section 4.9 Governance; Corporate Headquarters A-25

Section 4.10 Reasonable Efforts A-26

Section 4.11 Capital Expenditures A-26

Section 4. 12 A.L. Oslo Finances A-26

Section 4.13 Skøyen Lease A-27

Section 4.14 A.L. Pharma A-27

Section 4. 15 [Reserved] A-27

Section 4.16 Non-compete A-27

ARTICLE V CONDITIONS A-28

Section 5. 1 Conditions to Obligations of Each Party A-28

Section 5.2 Additional Conditions to Obligations of the Company A-28

Section 5.3 Additional Conditions to Obligations of A.L. Oslo A-29

ARTICLE VI TERMINATION A-30

Section 6. 1 Termination by Mutual Consent A-30

Section 6.2 Termination by the Company or A.L. Oslo A-30

Section 6.3 Termination by A.L. Oslo A-30

Section 6.4 Termination by the Company A-30

Section 6.5 Effect of Termination and Abandonment A-31

ARTICLE VII INDEMNIFICATION A-31

Section 7.1 General A-31

Section 7.2 Indemnification A-31

Section 7.3 Third Party Claims A-33

ARTICLE VIII MISCELLANEOUS AND GENERAL A-33

Section 8.1 Payment of Expenses A-33

Section 8.2 Survival A-33

Section 8.3 Other Definitional Provisions A-34

Section 8.4 Modification or Amendment A-34

Section 8.5 Waiver of Conditions A-35

Section 8.6 Counterparts A-35

Section 8.7 Governing Law A-35

Section 8.8 Notices A-35

Section 8.9 Entire Agreement, etc A-36

Section 8.10 Captions A-36

Section 8. 11 Dispute Resolution A-37

EXHIBITS

1. Form of Demerger Agreement

2. Form of Charter Amendments to the Company's Restated Certificate of Incorporation

3. Form of Warrant Agreement

4. Selected Combined Financial Data of A.L. Oslo

5. Form of Shareholder Affidavit

6. Form of Administrative Services Agreement

7. Form of Letter from Managing Director of A.L. Oslo

8. Form of Skøyen Lease

9. Form of Opinion of counsel to A.L. Oslo

10. Form of Opinion of counsel to the Company INDEX

OF DEFINED TERMS 483 Matters A-32

1983 Stock Option Plan A-11

1994 Budget for Related Norwegian Businesses A-22

A.L. Industrier A.S A-8

A.L. Laboratories, Inc A-7

A.L. Labs Transfer A-7

A.L. Oslo A-7

A.L. Oslo Benefit Plans A-19

A.L. Oslo Indemnified Parties A-31

A.L. Oslo information A-11

A.L. Oslo Regulatory Approvals A-15

AL. Oslo Shares A-7

A.L Pharma Transfer A-27

Affiliate A-34

Agreement A-7

Apothekernes Laboratorium A.S A-7

Average Closing NOK Rate A-9

Average Closing Price A-9

Business Day A-34

Cash Purchase Price A-8

Charter Amendments A-7

Class A Stock A-7

Class B Stock A-11

Closing A-10

Closing Date A-10

Code A-9

Company A-7

Company Indemnified Parties A-32

Company Permits A-12

Company Regulatory Approvals A-12

Company Reports A-13

Contracts A-12

Damages A-3 1

Demerger A-8

DGCL A-7

Employee Stock Purchase Plan A-11

Encumbrances A-15

Environmental Laws A-17

Exchange Act A-Il

Exchange Offer A-7

Exchange Offer Documents A-12

Exercise Price A-9

FDA A-17

ICC A-37

Indebtedness A-19

Intellectual Property Rights A-20

Investigatory New Animal Drug Application A-17

Investigatory New Drug Application A-17

Management Committee A-26

Material Adverse Effect A-b

Minimum Condition A-28

NCA A-S

New A.L. Labs A-7

New A.L. Oslo A-7

New A.L. Oslo Permits A-16

New A.L. Oslo Shares A-7

New Animal Drug Application A-17

New Drug Application A-17

NOK A-34

Norwegian Transactions A-10

Opening Related Norwegian Businesses Balance Sheet A-9

Order A-28

Person A-34

Proxy Statement A-12

Related Norwegian Businesses A-8

Related Norwegian Businesses Financial Statements A-17

Related Norwegian Businesses Insurance Policies A-21

Related Norwegian Businesses Intellectual Property Rights A-20

Representatives A-24

Restructuring A-10

RNB Material Adverse Effect A-16

SEC A-11

Securities Act A-12

Shareholder Affidavit A-9

Skøyen Amount A-33

Special Committee A-13

Stockholders Meeting A-11

Subsidiary A-34

Tax Return A-34

Taxes A-34

Transfer Expenses A-33

Warrant Agreement A-9

Warrants A-8

RESTRUCTURING AGREEMENT (hereinafter the "Agreement"), dated as of May

16, 1994, by and among Apothekernes Laboratorium A. 5, a corporation

organized and existing under the laws of the Kingdom of Norway ("A.L. Oslo")

and A. L. Laboratories, Inc., a Delaware

corporation (the "Company").WHEREAS, the Boards of Directors of A.L. Oslo and the Company have each

unanimously determined that it is in the best interests of their respective

stockholders to engage in the transactions contemplated hereby to restructure

and integrate their respective related businesses;

WHEREAS, the Company shall become a holding company by transferring

substantially all of its assets and liabilities (except for the capital stock

of its Subsidiaries or as otherwise agreed by the parties) to a newly

organized wholly owned subsidiary incorporated under Delaware law to be named

"A. L. Laboratories, Inc." and by changing its name to reflect the increased

international scope of the Company's business, upon the terms and subject to

the conditions of this Agreement;

WHEREAS, pursuant to the terms and conditions of the form of Demerger

Agreement attached hereto as Exhibit 1, (i) the assets and liabilities of

A.L. Oslo that comprise its related businesses including its Pharmaceutical

(including, bulk antibiotics), Animal Health and

Aquatic Animal Health divisions and its subsidiaries Apolab OY, Norgesplaster

A/S and A.L. Lakemedel AB shall be demerged into a new corporation to be

organized under the laws of the Kingdom of Norway ("New A.L. Oslo") and (ii)

each holder of the outstanding ordinary shares of A.L. Oslo (the "A.L. Oslo

Shares") shall receive one ordinary share of New A.L. Oslo for each A.L. Oslo

Share held by such holder;

WHEREAS, the Company shall commence an offer to the prospective

shareholders of New A.L. Oslo to exchange (the "Exchange Offer") for each of

the New A.L. Oslo ordinary shares to be issued upon consummation of the

demerger (the "New A.L. Oslo Shares") a pro

rats portion of certain cash consideration and warrants to purchase 3,600,000

shares of the Company's Class A Common Stock, par value $0.20 per share (the

"Class A Stock"), upon the terms and subject to the conditions of this

Agreement; and

WHEREAS, A.L. Oslo and the Company desire to make certain

representations, warranties and agreements in connection with the

transactions contemplated hereby.

NOW, THEREFORE, in consideration of the premises and the

representations, warranties and agreements herein contained, and intending to

be legally bound hereby, the parties hereto agree as follows:

ARTICLE I

THE RESTRUCTURING

Section 1.1 International Holding Company. Prior to the Closing (as

defined below), the Company shall form a new wholly owned subsidiary under

the Delaware General Corporation Law (the "DGCL") to be named "A.L.

Laboratories, Inc." ("New A.L. Labs"). Subject to the terms and conditions of

this Agreement, at the Closing the Company shall transfer its officers and

other employees to New A.L. Labs and as soon as reasonably practicable after

the Closing the Company shall contribute substantially all of its assets and

liabilities, including its animal health business (including related assets

and liabilities), to New A.L. Labs (together, the "A.L. Labs Transfer"),

except for the capital stock of its Subsidiaries or as may be agreed to by

A.L. Oslo and the Company. At the Stockholders Meeting of the Company at

which this Agreement (and the transactions contemplated hereby) shall be

submitted for approval, the Company shall also present to its shareholders a

resolution to amend the Company's Restated Certificate of Incorporation (the

"Charter Amendments") to (a) increase the representation of the holders of

Class A Stock on the Board of Directors from 25% to 33?% of the Board of

Directors (rounded

to the nearest whole number, but not less than 2 members of the Board of

Directors) and (b) change the name of the Company to reflect the increased

international scope of the Company's business. The form of Charter Amendments

to the Company's Restated Certificate of Incorporation is attached hereto as

Exhibit 2.Section 1.2 The Demerger. As soon as practicable after the execution of

this Agreement, A.L. Oslo and New A.L. Oslo shall execute and deliver the

form of Demerger Agreement attached hereto as Exhibit 1 (or a Norwegian

translation thereof) and shall submit to the stockholders of A.L. Oslo (in

the written materials provided to such stockholders in connection with the

Demerger) a resolution for the Demerger for adoption and approval by such

stockholders as required under the Norwegian Joint Stock Act of 1976, as

amended ("NCA"). A.L. Oslo and New A.L. Oslo shall not modify or amend the

Demerger Agreement without the express consent of the Company, which consent

shall not be unreasonably withheld. Pursuant to the terms and conditions of

the Demerger Agreement and the conditions set forth in Sections 5.1 and 5.3,

immediately prior to the consummation of the Exchange Offer the assets and

liabilities of A.L. Oslo that comprise its Pharmaceutical (including, bulk

antibiotics), Animal Health and Aquatic Animal Health Divisions, and its

subsidiaries Apolab OY, Norgesplaster A/S and A. L. Lakemedel AB and any

other businesses whose results of operations are included in the Related

Norwegian Businesses Financial Statements (as defined herein) (the "Related

Norwegian Businesses") shall be demerged into New A.L. Oslo (the "Demerger").

Upon the consummation of the Demerger, New A.L. Oslo shall issue to each

holder of A.L. Oslo Shares (other than ordinary shares of A.L. Oslo held by

A/S Wangs Fabrik) one New A.L. Oslo Share for each A.L. Oslo Share held by

such holder. A.L. Oslo will use its reasonable best efforts to obtain

approval to permit New A.L. Oslo to use the name "Apothekernes Laboratorium

A.S" and in the event that such approvals are obtained, New A.L. Oslo shall

be renamed "Apothekernes Laboratorium A.S" and A.L. Oslo shall be renamed

"A.L. Industrier A.S." Section 1.3 Exchange Offer.

(a) At or about the time of the mailing of the proxy materials

relating to the Demerger

to the holders of A.L. Oslo Shares and the mailing of the Proxy Statement (as

defined in Section 2.4) to the holders of Class A Stock and subject to the

receipt of all governmental and regulatory approvals necessary to its

commencement, the Company shall commence the Exchange Offer. The obligations

of the Company to accept for payment and exchange the New A.L. Oslo Shares

tendered pursuant to the Exchange Offer at the Closing shall be subject only

to the conditions set forth in Sections 5.1 and 5.2 (and other customary

procedural conditions), and without the written consent of A.L. Oslo, the

Company shall not decrease the number of New A.L. Oslo Shares being sought,

change the form of consideration payable in the Exchange Offer, add

additional material conditions to the Exchange Offer or waive the Minimum

Condition (as defined in Section 5.1(d)). The Company shall not consummate

the Exchange Offer unless and until the Demerger shall have been consummated.

The Exchange Offer shall be made by means of a written offer to exchange and

related letter of transmittal and shall be made in accordance with applicable

Norwegian law and regulations. The written Exchange Offer materials shall

contain a statement indicating that tendering shareholders shall be obligated

to reimburse A.L. Oslo for any amounts paid on their behalf by A.L. Oslo

pursuant to Section 7.2(b)(ii) of this Agreement.(b) Pursuant to the Exchange Offer, each holder of New A.L. Oslo

Shares whose shares are accepted for payment pursuant to the Exchange Offer

shall receive a pro rata portion (based upon the number of New A. L. Oslo

Shares validly tendered (and not withdrawn) by

such holder and the number of New A. L. Oslo Shares outstanding on the date

the Exchange Offer is consummated) of the Cash Purchase Price (as defined

below) and warrants to purchase 3,600,000 shares of Class A Stock (the

"Warrants"). The Managing Director of A.L. Oslo shall certify to A.L. Labs

the number of New A.L. Oslo Shares outstanding on the date of the

consummation of the Exchange Offer and eligible to be tendered in the

Exchange Offer.

(i) The "Cash Purchase Price," which shall be paid in Norwegian

Kroner, shall be NOK 170,000,000; provided, however, that if the arithmetic

average of the closing U.S. dollar exchange rate of the Norwegian Krone as

published by The Wall Street Journal in its "Exchange Rates" table for the 10

Business Days prior to the fifth Business Day prior to Closing (the "Average

Closing NOK Rate") (x) exceeds NOK 7.5 to U.S. $1.00 then the Cash Purchase

Price shall be an amount equal to NOK 170,000,000 divided by 7.5 and

multiplied by the Average

Closing NOK Rate and (y) is less than NOK 6.5 to U.S. $1.00 then the Cash

Purchase Price shall be an amount equal to NOK 170,000,000 divided by 6.5 and

multiplied by the Average Closing NOK Rate; provided, further, that the Cash

Purchase Price shall be reduced on a Krone for Krone basis to the extent that

A.L. Oslo shall pay a dividend on the A.L. Oslo Shares that would have the

effect of reducing the equity of New A.L. Oslo or the Related Norwegian

Businesses. The Managing Director of A.L. Oslo shall certify to A.L. Labs the

amount of any such reduction on the date of the consummation of the Exchange Offer.

(ii) The Warrants shall have the terms and conditions set forth in the

form of Warrant Agreement attached hereto as Exhibit 3 (the "Warrant

Agreement"), except that the exercise price for the Warrants (the "Exercise

Price") shall initially be determined pursuant to this Section 1 .3(b)(ii).

The initial Exercise Price for the Warrants shall be equal to the arithmetic average

of the daily closing price of the Class A Stock on the New York Stock

Exchange (the "Average Closing Price") for the period beginning on the date

the Proxy Statement (as defined in Section 2.4) is first mailed to

stockholders of the Company and ending on the last trading day that is at

least five trading days prior to the date of the Stockholders Meeting (as

defined in Section 2.4) multiplied by 1.4; provided, however, (w) if the

Average Closing Price is greater than or equal to $23.00 then the Exercise

Price shall equal the Average Closing Price plus $7.00, (x) if the Average

Closing Price is greater than $21 .4286 and less than $23.00 then the

Exercise Price shall equal $30.00, (y) if the Average Closing Price is less

than $14.2857 and greater than or equal to $13.00, then the Exercise Price

shall equal $20.00 and (z) if the Average Closing Price is less than $13.00

then the Exercise Price shall equal the Average Closing Price plus $7.00. The

Warrants shall expire on December 31, 1998; provided, however, if the Closing

Date shall occur after September 30, 1994 then the Warrants shall expire on

the date that is fifty-one (51) months

from the Closing Date.(c) The Company agrees to extend the Exchange Offer from time to time

until the conditions of the Exchange Offer are satisfied or this Agreement

shall have been terminated in accordance with its terms. The Company and, if

applicable, A.L. Oslo agree to make all filings and to obtain all consents

with respect to the Exchange Offer required by applicable Norwegian law. Upon

the terms and subject to the conditions of the Exchange Offer, on the Closing

Date the Company shall exchange, for the consideration set forth in Section

1.3(b) above, all the New A.L. Oslo Shares which are validly tendered and not

withdrawn on or prior to the expiration of the Exchange Offer.

(d) A.L. Oslo has delivered to the Company an audited combined

balance sheet for the Related Norwegian Businesses as of December 31, 1993

(the "Opening Related Norwegian Businesses Balance Sheet"), a copy of which

is included in Exhibit 4 hereto.

(e) The Exchange Offer materials shall require each accepting holder

of New A.L. Oslo Shares to certify to the information necessary to enable the

Company to determine the extent of any U.S. tax withholding obligations. The

payment of the Cash Purchase Price and Warrants to each holder of New A.L.

Oslo Shares by the Company shall be made free and clear of, and without

deduction for, any and all U.S. withholding Taxes (as defined in Section

8.3(g); unless (i) the Company shall not have received from such holder a

duly completed and executed affidavit in the form attached as Exhibit 5

hereto (the "Shareholder Affidavit") (which shall be provided to the holders

of A.L. Oslo Shares together with the materials referenced in Section 1.3),

or (ii) the Company shall have received the Shareholder Affidavit, but shall

have made a good faith determination that as a result of the Restructuring

(as defined in Section 1.4), such

holder may not have experienced a "substantially disproportionate redemption"

within the meaning of Section 302(b)(2) of the Internal Revenue Code of 1986,

as amended (the "Code"), as such section is applied pursuant to Section 304

of the Code; provided, that the Company may, in its sole discretion, waive

application of the preceding clause (ii) in the case of any holder who,

immediately before the Closing, owns directly, indirectly or constructively

(talcing into account the rules of Section 318 of the Code, applied without

regard to the 50% limitation contained in

Sections 3 18(a)(2)(C) and 3 18(a)(3)(C) of the Code) less than 100 New A.L.

Oslo Shares. If the Company does not intend to waive application of clause

(ii) in the preceding sentence with respect to any holder of New A.L. Oslo

Shares, it shall prior to making any final determinations thereof consult in

good faith with counsel to A.L. Oslo. In the event that the Company

determines that it is required by law to withhold any Taxes, the Company

shall, to the extent allowable by law, reduce the amount of any Taxes

otherwise imposed upon such payment pursuant to the terms of any applicable

income tax convention between the United States of America and the country in

which such holder is resident.Section 1.4 Reasonable Efforts. A.L. Oslo and the Company shall each

use all reasonable efforts to cause (i) the A.L. Labs Transfer and the

Charter Amendments to be consummated in accordance with this Agreement, (ii)

the Demerger to be consummated in accordance with the Demerger Agreement and

this Agreement and (iii) the Exchange Offer to be consummated in accordance

with this Agreement. The Demerger and the Exchange Offer are sometimes

referred to herein as the "Norwegian Transactions." The Norwegian

Transactions, the A.L. Labs Transfer and the Charter Amendments are sometimes

referred to herein as the "Restructuring." Contemporaneously herewith, the

Company has received a letter from A.L. Oslo's Managing Director, in the form

set forth in Exhibit 7 hereto, expressing his agreement (i) to vote, or cause

to be voted, all A.L. Oslo Shares owned of record by him or by A/S Swekk, in

favor of the transactions contemplated hereby and to tender, or cause to be

tendered, all New A.L. Oslo Shares to be issued to him or A/S Swekk pursuant

to the Exchange Offer and (ii) to use his reasonable efforts to obtain

similar assurances from his wife and children. In addition, A.L. Oslo shall

use its reasonable efforts to cause Nopal International AG to tender all New

A.L. Oslo Shares owned of record by it, pursuant to the Exchange Offer.Section 1.5 The Closing. The closing of the Restructuring (the

"Closing") shall take place (a) at the offices of A.L. Oslo, at 3:00 p.m.,

Oslo, Norway time, on the fifth business day after the date on which the last

to be fulfilled or waived of the conditions set forth in Article V hereof

shall be fulfilled or waived in accordance herewith, or (b)at such other time

and place and/or on such other date as A.L. Oslo and the Company may agree.

The date on which the Closing occurs is referred to herein as the "Closing Date."

ARTICLE II

REPRESENTATIONS AND WARRANTIES

OF THE COMPANYThe Company hereby represents and warrants to A.L. Oslo that:

Section 2.1 Corporate Organization and Qualification. Each of the

Company and its Subsidiaries (as defined in Section 8.3) is a corporation

duly organized, validly existing and in good standing under the laws of its

respective jurisdiction of incorporation and is in good standing as a foreign

corporation in each jurisdiction where the properties owned, leased or

operated, or the business conducted, by it require such qualification, except

for such failure to so qualify or be in such good standing, which, when taken

together with all other such failures, is not reasonably likely to have a

material adverse effect on the financial condition, properties, business or

results of operations of the Company and its Subsidiaries, taken as a whole

as currently conducted (a "Material Adverse Effect"). Each of the Company and

its Subsidiaries has the requisite corporate power and authority to carry on

its respective businesses as they are now being conducted. The Company has

provided to A. L. Oslo a complete and correct copy of the Company's

Certificate of Incorporation and By-Laws, each as amended to date. The

Company's Certificate of Incorporation and By-Laws so delivered are in full

force and effect.Section 2.2 Authorized Capital. The authorized capital stock of the

Company consists of: (i) 40,000,000 shares of Class A Stock of which, as of

December 31, 1993, 13,320,473 shares (not including treasury shares) were

issued and outstanding, (ii) 15,000,000 shares of Class B Common Stock, par

value $.20 per share (the "Class B Stock") of which, as of December 31, 1993,

8,226,562 shares were issued and outstanding and (iii) 500,000 shares of

Preferred Stock, par value $1.00 per share, of which, as of the date hereof,

none are outstanding. All of the outstanding shares of Class A Stock and

shares of Class B Stock have been duly authorized and are validly issued,

fully paid and non-assessable. The Company has no shares of its capital stock

reserved for issuance, except that, as of December 31, 1993, there were

972,648 shares of Class A Stock reserved for issuance under the Company's

benefit plans including options to purchase 489,900 shares of Class A Stock

outstanding pursuant to the 1983 Incentive Stock Option Plan, as amended (the

"1983 Stock Option Plan") and there are no shares of Class A Stock reserved

for issuance pursuant to the Company's Employee Stock Purchase Plan (the

"Employee Stock Purchase Plan"). Each of the outstanding shares of capital

stock of each of the Company's Subsidiaries is duly authorized, validly

issued, fully paid and non-assessable and all such shares owned, either

directly or indirectly, by the Company are owned free and clear of all liens,

pledges, security interests, claims or other encumbrances. Except as set

forth above, there are no, and on the Closing Date there will be no, shares

of capital stock of the Company authorized, issued or outstanding and, except

as set forth above or as contemplated by this Agreement, there are no, and on

the Closing Date there will be no, preemptive rights nor any outstanding

subscriptions, options, warrants, rights, convertible securities or other

agreements or commitments of any character relating to the issued or

unissued capital stock or other securities of the Company or any of its Subsidiaries.Section 2.3 Corporate Authority. The Company has the requisite

corporate power and authority to execute and deliver this Agreement. The

execution, delivery and performance of this Agreement and the consummation of

the transactions contemplated hereby have been duly authorized and approved

by its Board of Directors and no other action on the part of the Company is

necessary to authorize the execution, delivery and performance of this

Agreement by the Company (other than the approval of the stockholders of the

Company). This Agreement has been duly executed and delivered by the Company

and is a valid and binding agreement of the Company enforceable against the

Company in accordance with its terms.

Section 2.4 Proxy Statement.

(a) The Proxy Statement (as defined below) to be used by the Company

in soliciting proxies with respect to the meeting of the Company's

stockholders to be held in connection with the Agreement (the "Stockholders

Meeting") will not, on the date the Proxy Statement is mailed to stockholders

and on the date of such Stockholders Meeting, contain any statement which, at

the time and in light of the circumstances under which it is made, is false

or misleading with respect to any material fact or omit to state any material

fact necessary in order to make the statements therein (at the time and in

the light of the circumstances under which they were made) not false or

misleading or necessary to correct any statement in any earlier communication

with respect to the solicitation of proxies for such Stockholders Meeting

that has become false or misleading at that time; provided, however, the

Company makes no representations as to the information contained in or

omitted from the Proxy Statement in reliance upon and in conformance with

information furnished to the Company by A.L. Oslo, New A.L. Oslo or any

Subsidiaries or Affiliates thereof (excluding the Company and its

Subsidiaries, but including any principal stockholders of A. L. Oslo and New

A. L. Oslo while acting solely in such capacity) with respect to A. L. Oslo

and its Subsidiaries and Affiliates (excluding the Company and its

Subsidiaries, but including any principal stockholders of A.L. Oslo and New

A.L. Oslo while acting solely in such capacity) or the Related Norwegian

Businesses (the "A.L. Oslo Information"). The Proxy Statement will comply as

to form and otherwise in all material respects, with the applicable

requirements of the Securities Exchange Act of 1934, as amended (the

"Exchange Act") and the rules and regulations of the Securities and Exchange

Commission (the "SEC"). The letters and notices of meeting to the

stockholders of the Company, the proxy statement (and any amendments or

supplements thereto), the form of proxy to be distributed to the stockholders

of the Company in connection with the Restructuring and any schedules

required to be filed with the SEC in connection therewith, are collectively

referred to herein as the "Proxy Statement."

(b) The written materials furnished by the Company to the holders of

A.L. Oslo Shares (or New A.L. Oslo Shares, as the case may be) in connection

with the Exchange Offer (the "Exchange Offer Documents") and the information

relating to the Company and its Subsidiaries furnished by the Company for use

in the written materials provided to the holders of A.L. Oslo Shares in the

Demerger (i) shall be accurate and complete in all material respects, (ii)

shall be prepared in accordance with applicable law and (iii) shall not

contain any statement which, at the time and in light of the circumstances

under which it is made, is false or misleading with respect to any material

fact or omit to state any material fact necessary in order to make the

statements therein (at the time and in the light of the circumstances under

which they were made) not false or misleading; provided, that the Company

makes no representation or warranty as to the A.L. Oslo Information contained

in or omitted from such written materials.

Section 2.5 Governmental Filings: No Violations: Permits.

(a) Other than filings, notices, consents, registrations, approvals,

permits or authorizations set forth on Schedule 2.5 (the "Company Regulatory

Approvals") or those required under the DGCL, the Exchange Act, the

Securities Act of 1933, as amended (the "Securities Act"), or Norwegian law,

no notices, reports or other filings are required to be made by the Company

or any of its Subsidiaries, with, nor are any consents, registrations,

approvals, permits or authorizations required to be obtained by the Company

or any of its Subsidiaries, from, any governmental or regulatory authority of

the United States, the several states or any foreign jurisdiction in

connection with the execution and delivery of this Agreement by the Company

and the consummation by the Company of the transactions contemplated hereby,

the failure to make or obtain any or all of which is reasonably likely to

have a Material Adverse Effect or prevent, materially delay or materially

burden the transactions contemplated by this Agreement.(b) The execution and delivery of this Agreement by the Company does

not, and the consummation by the Company of the transactions contemplated by

this Agreement will not, constitute or result in (A) a breach or violation

of, or a default under, the Certificate of Incorporation or By-Laws of the

Company or the respective governing instruments of any of its Subsidiaries,

(B) a material breach or violation of, a default under or the triggering of

any material payment or other obligations pursuant to, any of the existing

Company employee benefit plans or any grant or award made under any of the

foregoing, (C) a breach or violation of, or a default under, the acceleration

of or the creation of a lien, pledge, security interest or other encumbrance

on assets (with or without the giving of notice or the lapse of time)

pursuant to, (x) except as set forth in Schedule 2.5(b), any provision of any

agreement, lease, contract, note, mortgage, indenture, arrangement, guarantee

or other obligation ("Contracts") of the Company or any of its Subsidiaries

or (y) any law, rule, ordinance or regulation or judgment, decree, order,

injunction, award or governmental or non-governmental permit or license to

which the Company or any of its Subsidiaries is subject or (D) any change in

the rights or obligations of any party under any of the Contracts; except, in

the case of clauses (B), (C) or (D) above, for such breaches, violations,

defaults, triggering, accelerations or changes that, alone or in the

aggregate, are not reasonably likely to have a Material Adverse Effect or to

prevent, materially delay or materially burden the transactions contemplated

by this Agreement.

(c) The Company and its Subsidiaries hold all permits, licenses,

variances, exemptions, orders and approvals from governmental authorities

which are material to the operation of the business of the Company and its

Subsidiaries taken as a whole (collectively, the "Company Permits") and the

Company Permits are in full force and effect.

(d) The Company and its Subsidiaries are being, and have been

operated, in compliance with all applicable laws, regulations, orders,

judgments and decrees except where the failure to do so would not have a

Material Adverse Effect.

Section 2.6 Company Reports: Financial Statements. The Company has

filed with the SEC all registration statements, quarterly and annual reports,

proxy statements, forms, schedules and other material documents required to

be filed by it since January 1, 1991 under the Exchange Act or the Securities

Act (including exhibits and any amendments thereto) (collectively, the

"Company Reports"). At the time filed, the Company Reports (A) did not

contain any untrue statement of a material fact or omit to state a material

fact required to be stated therein or necessary to make the statements made

therein, in light of the circumstances in which they were made, not

misleading, and (B) complied in all material respects with the applicable

requirements of the Exchange Act and the Securities Act and the applicable

rules and regulations of the SEC thereunder. Each of the consolidated balance

sheets included in or incorporated by reference into the Company Reports

(including the related notes and schedules) fairly presents in all material

respects the consolidated financial position of the Company and its

Subsidiaries as of its date and each of the consolidated statements of income

and cash flow included in or incorporated by reference into the Company

Reports (including any related notes and schedules) fairly presents in all

material respects the results of operations, retained earnings and cash

flows, as the case may be, of the Company and its Subsidiaries for the

periods set forth therein (subject, in the case of unaudited statements, to

normal year-end audit adjustments which were not or will not be material in

amount or effect), in each case in accordance with United States generally

accepted accounting principles consistently applied during the periods

involved, except as may be noted therein.Section 2.7 Absence of Certain Changes. Except as disclosed in the

Company Reports or in Schedule 2.7, since December 31, 1993, (i) the Company

and its Subsidiaries have conducted their respective businesses only in the

ordinary and usual course of such businesses and (ii) there has not been (A)

any change, or any development or combination of developments involving a

prospective change of which management of the Company has knowledge, which

has had or is reasonably likely to have a Material Adverse Effect (other than

changes or developments that generally affect the businesses in which the

Company competes); or (B) any material change by the Company in accounting

principles, practices or methods (except to the extent required by U.S.

generally accepted accounting. principles). Since December 31, 1993, and

prior to the date hereof, the Company has not taken any action which, if

taken after the date hereof, would be prohibited by Section 4.1 hereof. Section 2.8 Liabilities. Except as disclosed in the Company Reports or

as disclosed on Schedule 2.8, there are no obligations or liabilities (other

than those incurred in the ordinary course of business), whether or not

accrued, contingent or otherwise, including, without limitation, those

relating to environmental and occupational safety and health matters, that

may reasonably be expected to result in any claims against or obligations or

liabilities of the Company or any of its Subsidiaries that, alone or in the

aggregate, are reasonably likely to have a Material Adverse Effect.Section 2.9 Opinion of Financial Advisor. The Special Committee of the

Board of Directors of the Company established with respect to the

transactions contemplated hereunder (the "Special Committee") has determined

(at meetings duly called and held) that the transactions contemplated hereby

are fair to the Company and the holders of Class A Stock and the Board of

Directors of the Company has determined (at meetings duly called and held)

that the transactions contemplated hereby are fair to and in the best

interest of the Company and fair to the holders of Class A Stock. The Board

of Directors and the Special Committee of the Company has received the

opinion of Lehman Brothers dated as of the date hereof to the effect that the

consideration to be paid by the Company in the Exchange Offer is fair from a

financial point of view to the Company and the holders of Class A Stock, a

copy of which opinion has been delivered to A.L. Oslo. Section 2.10 Taxes.

(a) Each of the Company and its Subsidiaries has duly and timely

filed all U.S. federal, state, local and foreign Tax Returns required to be

filed by it and such Tax Returns were true, correct and complete in all

material respects, and has duly paid, caused to be paid or made adequate

provision for the payment of all Taxes required to be paid in respect of the

periods covered by such returns. There are no tax liens upon the assets of

the Company or any of the Subsidiaries other than liens for Taxes not yet due.

(b) The Company and the Subsidiaries have not filed any consent

pursuant to Section 34 1(f) of the Code or agreed to have Section 341(f)(2)

of the Code apply to any disposition of a subsection (f) asset owned by the

Company or any of its Subsidiaries.

Section 2.11 Brokers and Finders. Other than (i) Lehman Brothers, who

was retained by the Special Committee in connection with the transactions

contemplated by this Agreement, and (ii) a Norwegian stockbroker to be

retained in connection with the Exchange Offer, the Company has not engaged

any broker, finder, consultant or intermediary in connection with the

transactions contemplated by this Agreement who would be entitled to a

broker's, finder's or similar fee or commission in connection therewith or

upon the consummation thereof.Section 2.12 Warrants. The Company has the requisite corporate power

and authority to execute and deliver the Warrant Agreement. The execution,

delivery and performance of the Warrant Agreement has been duly authorized

and approved by the Board of Directors and no other action on the part of the

Company (except for approval of the stockholders of the Company) is necessary

to authorize the execution, delivery, or performance of the Warrant

Agreement. The Warrant Agreement, when properly executed and delivered by the

Company, will be a valid and binding agreement of the Company enforceable

against the Company in accordance with its terms. The Warrants, upon issuance

pursuant to the provisions of the Warrant Agreement, will be duly authorized

and validly issued. The underlying shares of Class A Stock to be issued upon

exercise of the Warrants shall be duly authorized and upon the exercise as

provided in the Warrant Agreement, will be validly issued, fully paid and non-assessable.

ARTICLE III

REPRESENTATIONS AND WARRANTIES

OF A.L. OSLOA. L. Oslo represents and warrants to the Company that:

Section 3.1 Corporate Organization and Qualification. Each of A. L.

Oslo, Norgesplaster A/S, Apolab OY and A. L. Lakemedel AB is a corporation

duly organized and validly existing under the laws of the jurisdiction of its

incorporation. Each of A.L. Oslo and its Subsidiaries has (and, on the

Closing Date, New A.L. Oslo and its Subsidiaries will have) the requisite

corporate power and authority to carry on the businesses of the Related

Norwegian Businesses as they are now being conducted. New A.L. Oslo will be

duly organized and validly existing under the laws of the Kingdom of Norway

on the Closing Date. Prior to the Closing, A.L. Oslo shall provide to the

Company a complete and correct copy of New A.L. Oslo's organizational

documents, as amended to date, and such organizational documents shall be in

full force and effect. Section 3.2 Authorized Capital. As of the date hereof, the authorized

share capital of A.L. Oslo is NOK 40,000,000 divided into 400,000 issued and

outstanding ordinary shares, NOK 100 per share (including 17,420 shares held

by A/S Wangs Fabrik and Nopal International AG) and A.L. Oslo has no shares

of capital stock reserved for issuance. The certificate referenced in Section

1.3(b) shall be true and correct as of its date. Except as set forth in such

certificate, at the Closing, there will be no shares of capital stock of New

A.L. Oslo authorized, issued or outstanding, and except as set forth under

the NCA, there will be no preemptive rights nor any outstanding

subscriptions, options, warrants, rights, convertible securities or other

agreements or commitments of any character relating to the issued or unissued

capital stock or other securities of New A.L. Oslo. Except as set forth on

Schedule 3.2, the outstanding shares that constitute all the share capital of

Norgesplaster A/S, Apolab OY and A.L. Lakemedel A.B have been fully paid;

and, all of such shares are owned, directly or indirectly, by A.L. Oslo (and

will be owned, directly or indirectly, immediately after the Closing by New

A.L. Oslo) free and clear of all liens, pledges, security interests, claims

or other encumbrances ("Encumbrances"), other than Encumbrances reflected on

the Related Norwegian Businesses Financial Statements or the Opening Related

Norwegian Businesses Balance Sheet or Encumbrances relating to indebtedness

that may be refinanced or modified as contemplated by Section 4.12(c) hereof.

Section 3.3 Corporate Authority. A.L. Oslo has the requisite corporate

power and authority to execute and deliver this Agreement. The execution,

delivery and performance of this Agreement and the consummation of the

transactions contemplated hereby have been duly authorized and approved by

the Board of Directors of A. L. Oslo, and no other action on the part of A.L.

Oslo is necessary to authorize the execution, delivery and performance of

this Agreement by A.L. Oslo (other than (i) the approval of the stockholders

of A.L. Oslo to the extent required by applicable law, and (ii) the

certifications of the Board of Directors of A.L. Oslo with respect to the

Demerger and the Exchange Offer required under the NCA). This Agreement has

been duly executed and delivered by A.L. Oslo and is a valid and binding

agreement of A.L. Oslo enforceable against A.L. Oslo in accordance with its

terms. The lease referenced in Section 4.13 hereof relating to the Skøyen

facility, will be a valid and binding agreement of A.L. Oslo enforceable

against A.L. Oslo in accordance with its terms.Section 3.4 Proxy Statement: Norwegian Materials.

(a) The A.L. Oslo Information contained in the Proxy Statement will

not on the date the Proxy Statement is first mailed to stockholders, nor on

the date of the Stockholders Meeting, contain any statement which, at the

time and in light of the circumstances under which it is made, is false or

misleading with respect to any material fact or omit to state any material

fact necessary in order to make the statements therein (at the time and in

the light of the circumstances under which they were made) not false or

misleading or necessary to correct any statement in any earlier communication

with respect to the solicitation of proxies for such Stockholders Meeting

that has become false or misleading at the time.(b) The A.L. Oslo Information contained in the Exchange Offer

Documents (i) shall be accurate and complete in all material respects, (ii)

shall be prepared in accordance with applicable law and (iii) shall not

contain any statement which, at the time and in light of the circumstances

under which it is made, is false or misleading with respect to any material

fact or omit to state any material fact necessary in order to make the

statements therein (at the time and in the light of the circumstances under

which they were made) not false or misleading. The written materials provided

to the holders of A.L. Oslo Shares in connection with the Demerger shall be

accurate and complete in all material respects and shall be prepared in

accordance with applicable law; provided, that A. L. Oslo makes no

representations as to information contained in or omitted from such materials

relating to the Company and its Subsidiaries.

Section 3.5 Governmental Filings: No Violations: Permits.

(a) Other than filings, notices, consents, registrations, approvals,

permits or authorizations set forth on Schedule 3.5 hereto (the "A.L. Oslo

Regulatory Approvals") or required under the NCA, the Exchange Act and the

Securities Act, no notices, reports or other filings are required to be made

by A.L. Oslo or New A.L. Oslo with, nor are any consents, registrations,

approvals, permits or authorizations required to be obtained by A.L. Oslo or

New A.L. Oslo from, any governmental or regulatory authority of the United

States, the several states or any foreign jurisdictions (including, without

limitation, Norway) in connection with the execution and delivery of this

Agreement by A.L. Oslo, and the consummation of the transactions contemplated

hereby by A.L. Oslo and New A.L. Oslo, the failure to make or obtain any or

all of which is reasonably likely to (A) have a material adverse effect on

the financial condition, properties, business, or results of operations of

the Related Norwegian Businesses, taken as a whole as currently conducted (a

"RNB Material Adverse Effect") or (B) prevent, materially delay or materially

burden the transactions contemplated by this Agreement.

(b) The execution and delivery of this Agreement by A.L. Oslo does

not, and the consummation of the transactions contemplated hereby by A.L.

Oslo and New A.L. Oslo will not, constitute or result in (A) a breach or

violation of, or a default under, the Articles of Association, of A.L. Oslo,

New A.L. Oslo or any of their respective Subsidiaries, (B) a material breach

or violation of, a default under or the triggering of any material payment or

other material obligations pursuant to, any of the existing A.L. Oslo Benefit

Plans (as defined in Section 3.10) or any grant or award made under any of

the foregoing, (C) except to the extent the transactions contemplated hereby

may require the consents set forth on Schedule 3.5, a breach or violation of,

a default under, the acceleration of or the creation of a lien, pledge,

security interest or other encumbrances on assets (with or without the giving

of notice or the lapse of time) pursuant to, any provision of any Contract of

A.L. Oslo, New A.L. Oslo or any of their respective Subsidiaries or any law,

ordinance, rule or regulation or judgment, injunctions, decree, order, award

or governmental or non-governmental permit or license to which A.L. Oslo, New

A. L. Oslo or any of their respective Subsidiaries is subject or (D) any

change in any of the rights or obligations of any party under such Contracts,

except, in the case of clauses (B), (C) or (D) above, for such breaches,

violations, defaults, accelerations or changes that, alone or in the

aggregate, are not reasonably likely to (x) have an RN B Material Adverse

Effect or (y) prevent or materially delay or materially burden the

transactions contemplated by this Agreement.(c) Except as set forth in Schedule 3.5(c), upon the consummation of

the Demerger, New A.L. Oslo (A) will hold all permits, licenses, variances,

exemptions, orders and approvals from governmental authorities which are

necessary for the operation of the Related Norwegian Businesses as currently

conducted (collectively, the "New A.L. Oslo Permits"), (B) will be in

compliance with the terms of the New A.L. Oslo Permits and with all

representations (such as master file descriptions) that have been made to

governmental regulatory officials (foreign and domestic including, without

limitation, Norwegian) and upon which the compliance status of products made

from A.L. Oslo's materials are based, and (C) except for the Skøyen facility

(in which New A.L. Oslo will hold a valid leasehold interest in accordance

with the terms of the form of lease referenced in Section 4.13), will hold

good, valid and marketable title to all real properties reflected as owned on

the Opening Related Norwegian Businesses Balance Sheet, except where the

failure to so hold or so comply would not have a RNB Material Adverse Effect.

Except as set forth on Schedule 3.5, all such real property referred to in

clause (C) of the preceding sentence is in good operating condition and,

subject to normal maintenance, is available for continuing use by the Related

Norwegian Businesses in the manner in which it has previously been used.

(d) Except as set forth in Schedule 3.5(d), A.L. Oslo and its

Subsidiaries are being, and have been operated, in compliance with all

applicable A.L. Oslo Permits, judgments, laws, regulations, orders and

decrees that relate to the Related Norwegian Businesses except where the

failure to do so would not have an RNB Material Adverse Effect. To the

knowledge of A.L. Oslo and except as set forth in Schedule 3.5(d), the

Related Norwegian Businesses hold and are in substantial compliance with, all

material permits, licenses and governmental authorizations required for A.L.

Oslo to conduct the Related Norwegian Businesses under applicable

Environmental Laws (as defined below), and are otherwise in compliance with

such laws, except where the failure to be in compliance would not have an RNB

Material Adverse Effect. To the knowledge of A.L. Oslo and except as set

forth in Schedule 3.5(d), A.L. Oslo has not received any request for

information from a governmental entity or third person with respect to the

potential liability of the Related Norwegian Businesses for environmental

pollution, and has not received any written notification from a governmental

entity or a third person alleging that the Related Norwegian Businesses are

or may be liable for the cost of remediating environmental pollution, under

any applicable Environmental Laws. To the knowledge of A.L. Oslo, there are

no facts, events or circumstances that would reasonably be expected to cause

liability for remediating environmental pollution under existing

Environmental Laws. For purposes of this Section 3.5(d), the term

"Environmental Laws" means all legal requirements (including laws, codes,

rules, regulations, orders, decrees, permits, licenses and other governmental

authorizations) applicable to the Related Norwegian Businesses relating to

pollution, the preservation of the environment or the discharge, emission,

disposal or escape of materials into the environment.(e) Except as set forth in Schedule 3.5(e), A.L. Oslo is not aware of

any facts (i) which could furnish a basis for the recall, withdrawal or

suspension of any approved new drug application (a "New Drug Application" or

"New Animal Drug Application") or other pre-market product notification or

approval, or any investigatory new drug application (an "Investigatory New

Drug Application" or "Investigatory New Animal Drug Application") or other

application for exemption from pre-market approval for the purpose of

conducting investigations on the product by the U.S. Food and Drug

Administration (the "FDA") or any other governmental regulatory agency

(foreign or domestic including, without limitation, Norwegian) insofar as the

status of the requested product is affected by any product being sold (as of

the date hereof) or proposed to be sold by any of the Related Norwegian

Businesses (including, any product proposed to be sold by the Biotechnical

division) being in compliance with representations or filings of any type

(including Master File or similar submissions which are not approved, per se)

made to any governmental regulatory agency) or (ii) which could otherwise

cause A.L. Oslo or its Subsidiaries (or New A.L. Oslo or any of its

Subsidiaries after the Closing Date) to withdraw any product sold by any of

them as of the date hereof (including any product sold by the Biotechnical

division) from the market or to change the marketing classification of any

such product or to terminate or suspend clinical testing of any such product

(including, without limitation, with respect to each of the foregoing clauses

(i) and (ii), any pending or threatened safety or efficacy hearing with

respect to a product not required to have obtained any such pre-market

approval); except for such recalls, withdrawals, suspensions, changes in

marketing, terminations, suspensions or pending or threatened efficacy

hearings which would not have a RNB Material Adverse Effect.

Section 3.6 Financial Statements: Projections.

(a) Set forth as Exhibit 4 hereto are (x) the audited Combined

Balance Sheets of the Related Norwegian Businesses for the years ended

December 31, 1992, and December 31, 1993, and the unaudited Interim Combined

Balance Sheet of the Related Norweigan Businesses for the three months ended

March 31,1994; (y) the audited Combined Statements of Income for the years

ended December 31, 1991, December 31, 1992, and December 31, 1993, the

unaudited Interim Combined Statement of Income for the three months ended

March 31, 1994, and the unaudited Interim Combined Statement of Cash Flows

for the three months ended March 31, 1994; and (z) the Combined Statements of

Cash Flows for the years ended December 31, 1991, December 31, 1992, and

December 31, 1993 (including any related notes and schedules) (together, the

"Related Norwegian Businesses Financial Statements"). Each such combined

balance sheet set forth in the Related Norwegian Businesses Financial

Statements has been prepared in accordance with the books and records of A.L.

Oslo kept in the normal course of business and fairly presents in all

material respects the combined financial position of the Related Norwegian

Businesses as of its date, in each case in accordance with U.S. generally

accepted accounting principles consistently applied during the periods

involved (except as may be noted therein and, in the case of the unaudited

Interim Combined Balance Sheet, for normal year-end audit adjustments and for

the absence of footnotes that may be required by U.S. generally accepted

accounting principles). Each of the combined statements of income and

combined statements of cash flow included in the Related Norwegian Businesses

Financial Statements (including any related notes and schedules) has been

prepared in accordance with the books and records of A.L. Oslo, which books

and records are accurate and complete and kept in the normal course of

business, and fairly presents in all material respects the results of

operations and changes in cash flow, respectively, of the Related Norwegian

Businesses for the periods set forth therein, in each case in accordance with

U.S. generally accepted accounting principles consistently applied

(including, without limitation, principles relating to the reflection of

assets (including accounts receivable, inventory and prepaid expenses) and

liabilities) during the periods involved (except as may be noted therein and,

in the case of the unaudited Interim Combined Statement of Income and the

unaudited Combined Statement of Cash Flows, for normal year-end audit

adjustments and for the absence of footnotes that may be required by U.S.

generally accepted accounting principles).(b) Except as set forth in the Related Norwegian Businesses Financial

Statements, Schedule 4.2(g), or as otherwise contemplated hereunder, as of

the date hereof none of A.L. Oslo, Apolab OY, Norgesplaster A/S nor A.L.

Lakemedel AB is a party to transactions with Affiliates.

(c) The financial projections for the Related Norwegian Businesses

attached as Schedule 3.6(c) hereto were prepared by A.L. Oslo in good faith

based upon certain estimates and assumptions that A.L. Oslo in good faith

believed to be reasonable both on the date such financial projections were

prepared and, except as modified by the 1994 Budget for the Related Norwegian

Businesses (as hereinafter defined), as of the date of this Agreement. The

Company acknowledges and agrees that such financial projections were not

prepared with a view toward compliance with published guidelines of the SEC

or the American Institute of Certified Public Accountants regarding forecasts

or Norwegian or U.S. generally accepted accounting principles, and that such

financial projections necessarily make numerous estimates and assumptions

with respect to industry performance, general business and economic

conditions, taxes and other matters, which are beyond the control of A. L.

Oslo. The Company also acknowledges and agrees that such financial

projections are not necessarily indicative of current values or the future

performance of the Related Norwegian Businesses, which may be significantly

different as compared to such financial projections, and that A.L. Oslo makes

no representation or warranty that the results set forth in such financial

projections will be achieved.

Section 3.7 Absence of Certain Changes. Except as set forth in Schedule

3.7(a) or as contemplated by this Agreement or the Demerger Agreement, since

December 31, 1993 (i) the Related Norwegian Businesses have been operated

only in the ordinary course of business, consistent with past practice; and

(ii) there has not been (A) any change, or any development or combination of

developments involving a prospective change which has had or is reasonably

likely to have an RNB Material Adverse Effect (other than changes or

developments that generally affect the businesses in which A.L. Oslo

competes); (B) any declaration, setting aside or payment of any dividend or

other distribution with respect to the capital stock of A.L. Oslo other than

regular annual cash dividends on its ordinary shares not in excess of NOK

10,000,000; (C) extraordinary increases in indebtedness; or (D) any material

change by A.L. Oslo in accounting principles, practices or methods (except as

required by U.S. or Norwegian generally accepted accounting principles).

Since December 31, 1993, other than in the ordinary course of business, there

has not been any material increase in the compensation payable or which could

become payable by A.L. Oslo and its Subsidiaries to their key employees, or

any material amendment of any A.L. Oslo Benefit Plan (as defined in Section

3.10(a)). Except as set forth on Schedule 3.7(b) since December 31, 1993, and

prior to the date hereof, A.L. Oslo has not taken any action which, if taken

after the date hereof, would have been prohibited by Section 4.2 hereof.Section 3.8 Litigation and Liabilities. Except as disclosed in the

Related Norwegian Businesses Financial Statements, in the Opening Related

Norwegian Businesses Balance Sheet or in Schedule 3.8, there are no (i)

actions, suits or proceedings or investigations pending or, to the knowledge

of the management of A.L. Oslo, threatened against or affecting New A.L. Oslo

or its Subsidiaries (at the time of the Closing) or the Related Norwegian

Businesses or (ii) obligations or liabilities (other than those incurred in

the ordinary course of business consistent with past practice), whether or

not accrued, contingent or otherwise, relating to the Related Norwegian

Businesses, or for which New A.L. Oslo or its Subsidiaries shall be liable

following the Demerger including, without limitation, those relating to

environmental and occupational safety and health matters, that may reasonably

be expected to result in any claims against or obligations or liabilities of

New A.L. Oslo or any of its Subsidiaries or the Related Norwegian Businesses

that, alone or in the aggregate, are reasonably likely to have an RNB

Material Adverse Effect.Section 3.9 Business of New A.L. Oslo: Indebtedness. Upon consummation

of the Demerger, New A. L. Oslo shall hold or have appropriate rights to use

all the assets (including contracts), property, real and personal, tangible

and intangible (including, without limitation, technology), used or held for

use by the Related Norwegian Businesses immediately prior to the Demerger or

otherwise necessary for the conduct of the Related Norwegian Businesses as

they are being conducted by A.L. Oslo on the date hereof (except as otherwise

contemplated under Section 4.13), including the assets which are reflected on

the Opening Related Norwegian Businesses Balance Sheet (except for assets

thereafter disposed of in the ordinary course of business consistent with

past practice). As of the Closing Date, the total indebtedness associated

with the Related Norwegian Businesses shall not be in excess of NOK

490,000,000. Upon consummation of the Demerger, all of the assets of New A.L.

Oslo will be owned free and clear of all Encumbrances except for Encumbrances

evidenced by indebtedness reflected on the Opening Related Norwegian

Businesses Balance Sheet (or the refinancing or modification of such

indebtedness) or Encumbrances which do not materially interfere with the use

and enjoyment of such assets. Except as contemplated hereunder or under the

Demerger Agreement, prior to the Closing Date New A.L. Oslo shall not have

engaged in any businesses. Upon the consummation of the Demerger, New A.L.

Oslo shall not have assumed or otherwise be liable for any liabilities other

than contemplated herein or under the Demerger Agreement. Except as set forth

in Schedule 3.9 and Schedule 4.16, upon the consummation of the Demerger A.L.

Oslo shall not have retained any pharmaceutical-related (including, bulk

antibiotics), animal health, aquatic animal health businesses or any other

business similar to those whose results of operations are included in the

Related Norwegian Businesses Financial Statements. For purposes of this

Section 3.9, the term "indebtedness" shall include indebtedness for money

borrowed (including, current portion of long term debt, long term debt and

short term debt), capitalized leases, guarantees of the indebtedness of third

parties and amounts not drawn on open letters of credit for the benefit of

A.L. Oslo; and shall not include accounts payable, accrued expenses, accrued

and deferred income taxes, other current liabilities or other non-current liabilities.Section 3.10 Employee Plans.

(a) A. L. Oslo has made available to the Company a true and complete

copy of each material deferred compensation, incentive compensation, stock

purchase, stock option, employment, severance, health, life or other

insurance, supplemental unemployment benefits, profit-sharing, or retirement

plan, program, agreement or arrangement, and each other employee benefit

plan, program, agreement or arrangement, sponsored, maintained or contributed

to or required to be contributed to by A.L. Oslo or any of its Subsidiaries

for the benefit of any employee or former employee of A.L. Oslo or any of its

Subsidiaries (the "A.L. Oslo Benefit Plans").

(b) Except as set forth on Schedule 3.10, after the consummation of

the Demerger, neither New A.L. Oslo nor any of its Subsidiaries will have any

material unfunded liabilities (not otherwise set forth on the Opening Related

Norwegian Businesses Balance Sheet) with respect to any A.L. Oslo Benefit Plan.

(c) Neither A.L. Oslo nor any of its Subsidiaries has engaged in a

transaction with respect to any A.L. Oslo Benefit Plan in connection with

which A.L. Oslo or any of its Subsidiaries could be subject to either a civil

penalty assessed pursuant to or a tax imposed pursuant to applicable law.

(d) Each A.L. Oslo Benefit Plan has been operated and administered in

all material respects in accordance with its terms and applicable law. There

are no material pending or, to the best knowledge of the A. L. Oslo,

threatened claims involving any A. L. Oslo Benefit Plan.

(e) Except as provided pursuant to applicable law or in Schedule

3.10(e), no A.L. Oslo Benefit Plan provides benefits, including without

limitation death or medical benefits (whether or not insured), with respect

to current or former employees of A.L. Oslo or any of its Subsidiaries

beyond their retirement or other termination of service.

(f) Except as provided in Schedule 3.10(f), the consummation of the

transactions contemplated by this Agreement will not (i) entitle any current

or former employee or officer of A.L. Oslo or any of its Subsidiaries to

severance pay, unemployment compensation or any other payment or (ii)

accelerate the time of payment or vesting, or increase the amount of

compensation due any such employee or officer.

Sectio