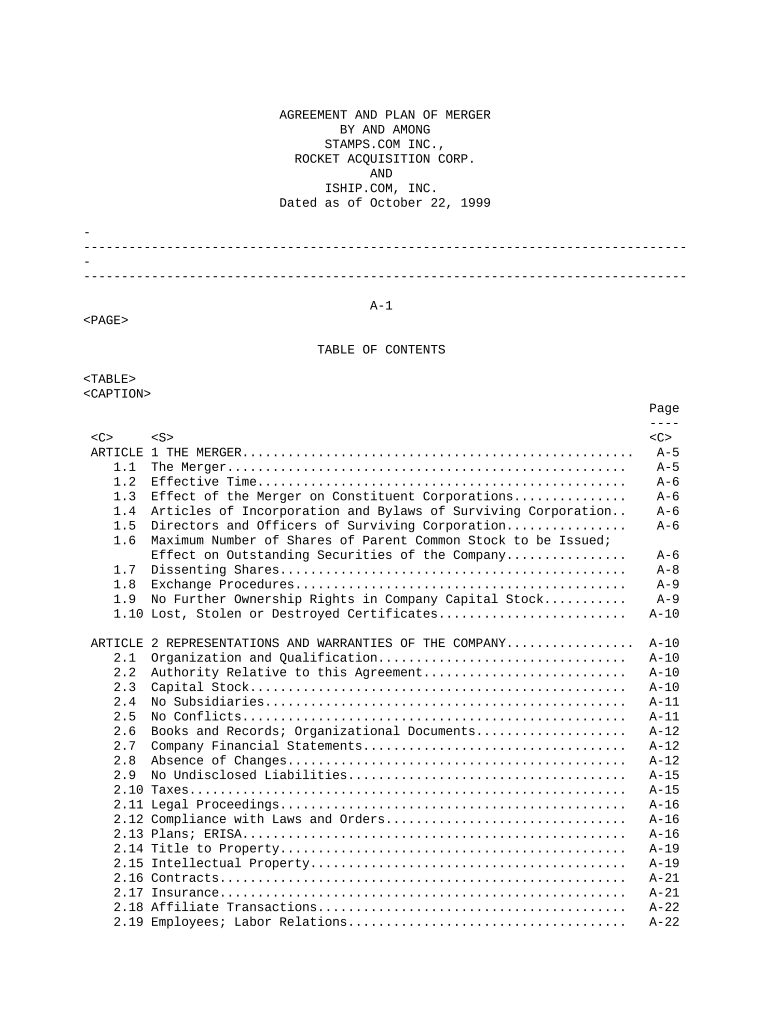

AGREEMENT AND PLAN OF MERGER

BY AND AMONG

STAMPS.COM INC.,

ROCKET ACQUISITION CORP.

AND

ISHIP.COM, INC.

Dated as of October 22, 1999

-

--------------------------------------------------------------------------------

-

--------------------------------------------------------------------------------

A-1

TABLE OF CONTENTS

Page

----

ARTICLE 1 THE MERGER.................................................... A-5

1.1 The Merger..................................................... A-5

1.2 Effective Time................................................. A-6

1.3 Effect of the Merger on Constituent Corporations............... A-6

1.4 Articles of Incorporation and Bylaws of Surviving Corporation.. A-6

1.5 Directors and Officers of Surviving Corporation................ A-6

1.6 Maximum Number of Shares of Parent Common Stock to be Issued;

Effect on Outstanding Securities of the Company................ A-6

1.7 Dissenting Shares.............................................. A-8

1.8 Exchange Procedures............................................ A-9

1.9 No Further Ownership Rights in Company Capital Stock........... A-9

1.10 Lost, Stolen or Destroyed Certificates......................... A-10

ARTICLE 2 REPRESENTATIONS AND WARRANTIES OF THE COMPANY................. A-10

2.1 Organization and Qualification................................. A-10

2.2 Authority Relative to this Agreement........................... A-10

2.3 Capital Stock.................................................. A-10

2.4 No Subsidiaries................................................ A-11

2.5 No Conflicts................................................... A-11

2.6 Books and Records; Organizational Documents.................... A-12

2.7 Company Financial Statements................................... A-12

2.8 Absence of Changes............................................. A-12

2.9 No Undisclosed Liabilities..................................... A-15

2.10 Taxes.......................................................... A-15

2.11 Legal Proceedings.............................................. A-16

2.12 Compliance with Laws and Orders................................ A-16

2.13 Plans; ERISA................................................... A-16

2.14 Title to Property.............................................. A-19

2.15 Intellectual Property.......................................... A-19

2.16 Contracts...................................................... A-21

2.17 Insurance...................................................... A-21

2.18 Affiliate Transactions......................................... A-22

2.19 Employees; Labor Relations..................................... A-22

2.20 Environmental Matters.......................................... A-23

2.21 Substantial Partnerships....................................... A-24

2.22 Accounts Receivable............................................ A-24

2.23 Other Negotiations; Brokers; Third Party Expenses.............. A-24

2.24 Foreign Corrupt Practices Act.................................. A-24

2.25 Financial Projections.......................................... A-24

2.26 Approvals...................................................... A-24

2.27 Takeover Statutes.............................................. A-25

2.28 Registration Statement; Information Sheet/Prospectus........... A-25

2.29 Disclosure..................................................... A-25

ARTICLE 3 REPRESENTATIONS AND WARRANTIES OF PARENT AND MERGER SUB....... A-26

3.1 Organization and Qualification................................. A-26

3.2 Authority Relative to this Agreement........................... A-26

3.3 SEC Documents; the Parent Financial Statements................. A-26

3.4 No Conflicts................................................... A-27

3.5 Ownership of Merger Sub; No Prior Activities................... A-27

A-2

Page

----

3.6 Investment Advisors............................................ A-27

3.7 Absence of Certain Changes or Events........................... A-27

3.8 Compliance with Laws........................................... A-27

3.9 Tax Matters.................................................... A-28

3.10 Intellectual Property Rights................................... A-28

3.11 Year 2000 Preparedness......................................... A-28

ARTICLE 4 CONDUCT PRIOR TO THE EFFECTIVE TIME........................... A-29

4.1 Conduct of Business of the Company............................. A-29

4.2 No Solicitation................................................ A-29

ARTICLE 5 ADDITIONAL AGREEMENTS......................................... A-29

5.1 Proxy Statement/Prospectus; Registration Statement............. A-29

5.2 Shareholder Approval........................................... A-30

5.3 Access to Information.......................................... A-30

5.4 Confidentiality................................................ A-30

5.5 Expenses; Termination Fee...................................... A-31

5.6 Public Disclosure.............................................. A-31

5.7 Approvals...................................................... A-31

5.8 Notification of Certain Matters................................ A-31

5.9 Company Affiliate Agreements................................... A-31

5.10 Additional Documents and Further Assurances.................... A-31

5.11 Form S-8....................................................... A-32

5.12 NNM Listing of Additional Shares Application................... A-32

5.13 Company's Auditors............................................. A-32

5.14 Takeover Statutes.............................................. A-32

5.15 Supplemental Disclosure Letter................................. A-32

5.16 Tax Treatment.................................................. A-32

5.17 Parent Board Representation.................................... A-32

ARTICLE 6 CONDITIONS TO THE MERGER...................................... A-32

6.1 Conditions to Obligations of Each Party to Effect the Merger... A-32

6.2 Additional Conditions to Obligations of the Company............ A-33

Additional Conditions to the Obligations of Parent and Merger

6.3 Sub............................................................ A-33

ARTICLE 7 SURVIVAL OF REPRESENTATIONS, WARRANTIES, COVENANTS AND

AGREEMENTS; ESCROW PROVISIONS................................. A-35

Survival of Representations, Warranties, Covenants and

7.1 Agreements..................................................... A-35

7.2 Escrow Provisions.............................................. A-35

ARTICLE 8 TERMINATION, AMENDMENT AND WAIVER............................. A-40

8.1 Termination.................................................... A-40

8.2 Effect of Termination.......................................... A-40

ARTICLE 9 MISCELLANEOUS PROVISIONS...................................... A-41

9.1 Notices........................................................ A-41

9.2 Entire Agreement............................................... A-41

9.3 Further Assurances; Post-Closing Cooperation................... A-41

9.4 Amendment; Waiver.............................................. A-42

9.5 Third Party Beneficiaries...................................... A-42

9.6 No Assignment; Binding Effect.................................. A-42

9.7 Headings....................................................... A-42

9.8 Invalid Provisions............................................. A-42

9.9 Governing Law.................................................. A-42

A-3

Page

----

9.10 Construction..................................................... A-42

9.11 Counterparts..................................................... A-42

9.12 Specific Performance............................................. A-42

ARTICLE 10 DEFINITIONS.................................................... A-43

10.1 Definitions...................................................... A-43

Exhibit A--Form of Support Agreements

Exhibit B--Form of Articles of Merger

Exhibit C--Form of Company Affiliate Agreement

A-4

AGREEMENT AND PLAN OF MERGER

AGREEMENT AND PLAN OF MERGER, dated as of October 22, 1999, by and among

Stamps.com Inc., a Delaware corporation (the "Parent"), Rocket Acquisition

Corp., a Washington corporation and a wholly owned subsidiary of the Parent

("Merger Sub"), and iShip.com, Inc., a Washington corporation (the "Company"),

and with respect to Section 7.2 only, U.S. Stock Transfer Corporation, as

Depositary. Capitalized terms used and not otherwise defined herein have the

meanings ascribed to them in Article 10.

RECITALS

A. The Boards of Directors of each of the Parent, Merger Sub and the Company

believe it is in the best interests of the Parent, Merger Sub and the Company

(as applicable) and their respective shareholders that the Parent acquire the

Company through the merger of Merger Sub with and into the Company (the

"Merger").

B. The Boards of Directors of each of the Parent, Merger Sub and the Company

have approved this Agreement, the Merger and the other transactions

contemplated hereby.

C. Pursuant to the Merger, among other things, and subject to the terms and

conditions of this Agreement, (i) all of the issued and outstanding shares of

capital stock of the Company shall be converted into the right to receive

shares of common stock, par value $0.001 per share, of the Parent ("Parent

Common Stock"), and (ii) all outstanding Company Options and Company Warrants

will become exercisable for Parent Common Stock, subject to the terms and

conditions set forth herein.

D. As an inducement to the Parent and Merger Sub to enter into this

Agreement, certain shareholders of the Company have, concurrently herewith,

entered into Support Agreements with the Parent in substantially the form

attached hereto as Exhibit A (the "Support Agreements") pursuant to which,

among other things, such shareholders have agreed to vote the shares of Company

Capital Stock owned by them in favor of the Merger.

E. The Parent, Merger Sub and the Company intend that the Merger shall

constitute a reorganization within the meaning of Section 368(a) of the Code,

and in furtherance thereof, intend that this Agreement shall be a "Plan of

Reorganization" within the meaning of Sections 354(a) and 361(a) of the Code.

F. The Company, the Parent and Merger Sub desire to make certain

representations, warranties, covenants and agreements in connection with the

Merger.

G. A portion of the shares of Parent Common Stock otherwise issuable or

reserved for issuance by the Parent in connection with the Merger shall be

placed in escrow as set forth in Article 7 herein.

H. As an inducement to the Parent and Merger Sub to enter into this

Agreement, certain officers and employees of the Company have entered into

employment agreements with the Parent (the "Employment Agreements") whose term

will commence on the Closing Date.

NOW, THEREFORE, in consideration of the covenants, agreements,

representations and warranties set forth herein, the parties, intending to be

legally bound hereby, agree as follows:

ARTICLE 1

THE MERGER

1.1 The Merger. At the Effective Time and subject to and upon the terms and

conditions of this Agreement and the applicable provisions of the Washington

Code, Merger Sub shall be merged with and into the Company, the separate

corporate existence of Merger Sub shall cease, and the Company shall continue

as the surviving corporation (sometimes referred to herein as the "Surviving

Corporation").

A-5

1.2 Effective Time. Unless this Agreement is earlier terminated pursuant to

Section 8.1, the closing of the Merger (the "Closing") will take place as

promptly as practicable, but no later than five Business Days following

satisfaction or waiver of the conditions set forth in Article 6, at the offices

of Brobeck, Phleger & Harrison LLP, 38 Technology Drive, Irvine, California,

unless another place or time is agreed to by the Parent and the Company. The

date upon which the Closing actually occurs is herein referred to as the

"Closing Date." On the Closing Date, the parties hereto shall cause the Merger

to be consummated by filing Articles of Merger (or like instrument), in

substantially the form attached hereto as Exhibit B (the "Articles of Merger"),

with the Secretary of State of the State of Washington, in accordance with

applicable Laws (the date and time of acceptance by the Secretary of State of

the State of Washington of such filing, or such later time agreed to by the

parties and set forth in the Articles of Merger, being referred to herein as

the "Effective Time").

1.3 Effect of the Merger on Constituent Corporations. At the Effective Time,

the Merger shall have the effects provided for in the applicable provisions of

the Washington Code. Without limiting the generality of the foregoing, and

subject thereto, at the Effective Time, all the property, rights, privileges,

powers and franchises of Merger Sub and the Company shall vest in the Surviving

Corporation, and all debts, liabilities, obligations, restrictions,

disabilities and duties of Merger Sub and the Company shall become the debts,

liabilities, obligations, restrictions, disabilities and duties of the

Surviving Corporation.

1.4 Articles of Incorporation and Bylaws of Surviving Corporation.

(a) At the Effective Time, the articles of incorporation of Merger Sub, as

in effect immediately prior to the Effective Time, shall be the articles of

incorporation of the Surviving Corporation until thereafter amended as provided

by law and such articles of incorporation and bylaws of the Surviving

Corporation, except that Article I thereof shall be amended to read in its

entirety as follows: "The name of the Corporation is iShip.com, Inc."

(b) The bylaws of Merger Sub, as in effect immediately prior to the

Effective Time, shall be the bylaws of the Surviving Corporation until

thereafter amended as provided by such bylaws, the articles of incorporation

and applicable law.

1.5 Directors and Officers of Surviving Corporation. The directors of Merger

Sub immediately prior to the Effective Time shall be the directors of the

Surviving Corporation, each to hold office in accordance with the articles of

incorporation and bylaws of the Surviving Corporation. The officers of Merger

Sub immediately prior to the Effective Time shall be the officers of the

Surviving Corporation, each to hold office in accordance with the bylaws of the

Surviving Corporation.

1.6 Maximum Number of Shares of Parent Common Stock to be Issued; Effect on

Outstanding Securities of the Company.

(a) The maximum number of shares of Parent Common Stock to be issued

(including Parent Common Stock to be reserved for issuance upon exercise of any

of the Company Options or Company Warrants to be assumed by the Parent as

provided herein) in the Merger and in exchange for all vested and unvested

Company Options and Company Warrants shall be the Aggregate Merger Share

Number. No increase shall be made in the number of shares of Parent Common

Stock issuable as a result of the transactions contemplated by this Agreement

arising from any consideration (except for deemed share consideration arising

from the net exercise provisions of any Company Options or Company Warrants,

which share consideration shall continue to be outstanding shares of Company

Capital Stock at the Closing and through the Escrow Period) received by the

Company from the date hereof to the Effective Time as a result of any exercise,

conversion or exchange of Company Options, or Company Warrants.

A-6

(b) Subject to the terms and conditions of this Agreement, as of the

Effective Time, by virtue of the Merger and without any action on the part of

the Parent or Merger Sub, the Company or the holder of any shares of the

Company Capital Stock and Company Options or Company Warrants, the following

shall occur:

(i) Conversion of Company Common Stock. At the Effective Time, each

share of Company Common Stock issued and outstanding immediately prior to

the Effective Time (other than any shares of Company Common Stock to be

canceled pursuant to Section 1.6(b)(iv) and any Dissenting Shares (as

provided in Section 1.7)) will be converted automatically into the right to

receive that number of shares of Parent Common Stock equal to the Common

Stock Exchange Ratio, rounded down to the nearest whole share of Parent

Common Stock.

(ii) Conversion of Series A Preferred Stock. At the Effective Time, each

share of Company Series A Preferred Stock issued and outstanding

immediately prior to the Effective Time (other than any shares of Company

Series A Preferred Stock to be cancelled pursuant to Section 1.6(b)(iv) and

any Dissenting Shares (as provided in Section 1.7)) will be automatically

converted into the right to receive that number of shares of Parent Common

Stock equal to the Series A Exchange Ratio, rounded down to the nearest

whole share of Parent Common Stock.

(iii) Conversion of Series B Preferred Stock. At the Effective Time,

each share of Company Series B Preferred Stock issued and outstanding

immediately prior to the Effective Time (other than any shares of Company

Series B Preferred Stock to be cancelled pursuant to Section 1.6(b)(iv) and

any Dissenting Shares (as provided in Section 1.7)) will be automatically

converted into the right to receive that number of shares of Parent Common

Stock equal to the Series B Exchange Ratio, rounded down to the nearest

whole share of Parent Common Stock.

(iv) Cancellation of Parent-Owned and Company-Owned Stock. Each share of

Company Capital Stock owned by the Parent or the Company or any Subsidiary

of the Parent or the Company immediately prior to the Effective Time shall

be automatically canceled and extinguished without any consideration in

respect thereof and without any further action on the part of the Parent,

Merger Sub or the Company.

(v) Company Options and Stock Plan. At the Effective Time all unexpired

and unexercised Company Options and Company Warrants then outstanding,

whether vested or unvested, together with the Company's Amended and

Restated 1997 Stock Plan (the "Stock Plan"), shall be assumed by the Parent

in accordance with provisions described below.

(A) At the Effective Time, each unexpired and unexercised Company

Option and Company Warrant then outstanding, whether vested or

unvested, together with the Stock Plan, shall be, in connection with

the Merger, assumed by the Parent. Each Company Option and Company

Warrant so assumed by the Parent under this Agreement shall continue to

have, and be subject to, the same terms and conditions as were

applicable to such Company Option or Company Warrant immediately prior

to the Effective Time; provided that (1) such Company Option or Company

Warrant, as the case may be, shall be exercisable for that number of

whole shares of Parent Common Stock equal to the product of the number

of shares of Company Capital Stock that were issuable upon exercise of

such Company Option or Company Warrant immediately prior to the

Effective Time multiplied by the Exchange Ratio applicable to the

series or class of Company Capital Stock subject to the Company Option

or Company Warrant (rounded down to the nearest whole number of shares

of Parent Common Stock) and (2) the per share exercise price for the

shares of Parent Common Stock issuable upon exercise of such assumed

Company Option or Company Warrant, as the case may be, shall be equal

to the quotient determined by dividing the exercise price per share of

Company Capital Stock at which such Company Option or Company Warrant

was exercisable immediately prior to the Effective Time by the Exchange

Ratio applicable to the series or class of Company Capital Stock

subject to the Company Option or Company Warrant (rounded up to the

nearest whole cent).

(B) It is the intention of the parties that the Company Options

assumed by the Parent shall qualify following the Effective Time as

incentive stock options as defined in Section 422 of the Code

A-7

to the same extent the Company Options qualified as incentive stock

options immediately prior to the Effective Time and the provisions of

this Section 1.6(b)(v) shall be applied consistent with this intent.

(C) At the Effective Time, the Parent shall succeed to the Company's

rights and assume the Company's obligations under any Restricted Stock

Purchase Agreements. Any and all restrictions on the Company Restricted

Stock issued pursuant to the Stock Plan or such other agreements which

do not lapse in accordance with their terms as in effect on the date of

this Agreement shall continue in full force and effect until such

restrictions lapse pursuant to the terms of such agreements.

(D) Notwithstanding the foregoing, the Series B Preferred Stock

Purchase Warrant, dated April 27, 1999 (the "MBE Warrant"), by and

between the Company and Mail Boxes Etc. USA, Inc. ("MBE"), shall,

subject to the consent of MBE, be modified, at the Effective Time, to

be a warrant of the Parent on terms and subject to conditions identical

to the MBE Warrant, except that such warrant shall be exercisable for

the number of whole shares of Parent Common Stock equal to the product

of the number of shares of Series B Preferred Stock that were issuable

upon exercise of the MBE Warrant immediately prior to the Effective

Time multiplied by the Series B Exchange Ratio (rounded down to the

nearest whole number of shares of Parent Common Stock) and the per

share exercise price for the shares of Parent Common Stock issuable

upon exercise of such warrant shall be equal to the quotient determined

by dividing the exercise price per share of Series B Preferred Stock

under the MBE Warrant by the Series B Exchange Ratio (rounded up to the

nearest whole cent).

(vi) Adjustments to Exchange Ratios. The Exchange Ratios shall be

equitably adjusted to reflect fully the effect of any stock split, reverse

split, stock combination, stock dividend (including any dividend or

distribution of securities convertible into Parent Common Stock or Company

Capital Stock), reorganization, reclassification, recapitalization or other

like change with respect to Parent Common Stock or Company Capital Stock

occurring on or after the date hereof and prior to the Effective Time.

(vii) Capital Stock of Merger Sub. Each share of common stock, no par

value per share, of Merger Sub, issued and outstanding immediately prior to

the Effective Time shall be converted into and exchanged for one validly

issued, fully paid and nonassessable share of common stock, no par value

per share, of the Surviving Corporation. Each share certificate of Merger

Sub evidencing ownership of any such shares shall continue to evidence

ownership of such shares of capital stock of the Surviving Corporation.

1.7 Dissenting Shares.

(a) Notwithstanding any provision of this Agreement to the contrary, any

shares of Company Capital Stock held by a holder who has demanded and perfected

dissenters' rights for such shares in accordance with Washington Code and who,

as of the Effective Time, has not effectively withdrawn or lost such

dissenters' rights ("Dissenting Shares") shall not be converted into or

represent a right to receive shares of Parent Common Stock pursuant to Section

1.6, but the holder thereof shall only be entitled to such rights as are

granted by the Washington Code.

(b) Notwithstanding the provisions of subsection (a) above, if any holder of

shares of Company Capital Stock who demands purchase of such shares under the

Washington Code shall effectively withdraw or lose (through failure to perfect

or otherwise) such holder's dissenters' rights, then, as of the later of (i)

the Effective Time or (ii) the occurrence of such withdrawal or loss, such

holder's shares shall automatically be converted into and represent only the

right to receive shares of Parent Common Stock as provided in Section 1.6,

without interest thereon, upon surrender of the certificate representing such

shares.

(c) The Company shall give the Parent (i) prompt notice of its receipt of

any written demands for appraisal of any shares of Company Capital Stock,

withdrawals of such demands, and any other instruments relating to the Merger

served pursuant to the Washington Code and received by the Company and (ii) the

opportunity to participate in all negotiations and proceedings with respect to

demands for appraisal of any shares of Company Capital Stock under the

Washington Code. The Company shall not, except with the prior written consent

of the Parent or as may be required under applicable law, voluntarily make any

payment with respect to any demands for appraisal of Company Capital Stock or

offer to settle or settle any such demands.

A-8

1.8 Exchange Procedures.

(a) Parent Common Stock. On the Closing Date, the Parent shall issue in

accordance with this Article 1, the aggregate number of shares of Parent Common

Stock issuable in exchange for outstanding shares of Company Capital Stock;

provided, however, that, on behalf of the holders of Company Capital Stock, the

Parent shall deposit into an escrow account a number of shares of Parent Common

Stock equal to the Escrow Amount. The portion of the Escrow Amount contributed

on behalf of each holder of Company Capital Stock shall be in proportion to the

aggregate number of shares of Parent Common Stock which such holder would

otherwise be entitled to receive by virtue of ownership of outstanding shares

of Company Capital Stock.

(b) Exchange Procedures. At the Closing, each holder of record of a

certificate or certificates (the "Certificates") which immediately prior to the

Effective Time represented outstanding shares of Company Capital Stock and

which shares were converted into the right to receive shares of Parent Common

Stock pursuant to Section 1.6, shall deliver the Certificates to the Parent.

Upon surrender of a Certificate for cancellation and a stock power indorsed in

blank with respect to the shares held pursuant to Article 7, the Parent shall

deliver to the holder of such Certificate in exchange therefor a certificate

representing the number of whole shares of Parent Common Stock (less the number

of shares of Parent Common Stock to be deposited in the Escrow Fund on such

holder's behalf pursuant to Article 7 hereof), to which such holder is entitled

pursuant to Section 1.6, and the Certificate so surrendered shall be canceled.

As soon as practicable after the Effective Time, and subject to and in

accordance with the provisions of Article 7 hereof, the Parent shall cause to

be distributed to the Depositary a certificate or certificates (in such

denominations as may be requested by the Depositary), registered in the name of

each former shareholder of the Company, representing that number of shares of

Parent Common Stock equal to the Escrow Amount. Such shares shall be

beneficially owned by the holders on whose behalf such shares were deposited in

the Escrow Fund and shall be available to compensate the Parent as provided in

Article 7. Until surrendered, each outstanding Certificate will be deemed, from

and after the Effective Time, for all corporate purposes, other than the

payment of dividends, to evidence the ownership of the number of full shares of

Parent Common Stock into which such shares of Company Capital Stock shall have

been so converted.

(c) Distributions With Respect to Unexchanged Shares of Company Capital

Stock. No dividends or other distributions with respect to Parent Common Stock

declared or made after the Effective Time and with a record date after the

Effective Time will be paid to the holder of any unsurrendered Certificate with

respect to the shares of Parent Common Stock represented thereby until the

holder of record of such Certificate shall surrender such Certificate. Subject

to applicable law, following surrender of any such Certificate, there shall be

paid to the record holder of the certificates representing whole shares of

Parent Common Stock issued in exchange for any such unsurrendered Certificates,

without interest, at the time of such surrender, the amount of dividends or

other distributions with a record date after the Effective Time theretofore

payable with respect to such shares of Parent Common Stock.

(d) Transfers of Ownership. If any certificate for shares of Parent Common

Stock is to be issued pursuant to the Merger in a name other than that in which

the Certificate surrendered in exchange therefor is registered, it will be a

condition of the issuance thereof that the Certificate so surrendered will be

properly endorsed and otherwise in proper form for transfer and that the person

requesting such exchange will have paid to the Parent, or any agent designated

by it, any transfer or other taxes required by reason of the issuance of a

certificate for shares of Parent Common Stock in any name other than that of

the registered holder of the Certificate surrendered, or established to the

satisfaction of the Parent or any agent designated by it that such tax has been

paid or is not payable.

1.9 No Further Ownership Rights in Company Capital Stock. All shares of

Parent Common Stock issued upon the surrender for exchange of shares of Company

Capital Stock in accordance with the terms hereof shall be deemed to have been

issued in full satisfaction of all rights pertaining to such shares of Company

Capital Stock, and there shall be no further registration of transfers on the

records of the Company of shares of Company Capital Stock which were

outstanding immediately prior to the Effective Time. If, after the Effective

Time, Certificates are presented to the Surviving Corporation for any reason,

they shall be canceled and exchanged as provided in this Article 1.

A-9

1.10 Lost, Stolen or Destroyed Certificates. In the event any certificates

evidencing shares of Company Capital Stock shall have been lost, stolen or

destroyed, the Parent shall issue certificates representing such shares of

Parent Common Stock in exchange for such lost, stolen or destroyed

Certificates, upon the making of an affidavit of that fact by the holder

thereof; provided, however, that the Parent may, in its discretion and as a

condition precedent to the issuance thereof, require the owner of such lost,

stolen or destroyed Certificates to provide an indemnity or deliver a bond in

such sum as it may reasonably direct as indemnity against any claim that may be

made against the Parent with respect to the Certificates alleged to have been

lost, stolen or destroyed.

ARTICLE 2

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

The Company hereby represents and warrants to each of Parent and Merger Sub,

subject to such exceptions as are specifically disclosed with respect to

specific sections of this Article 2 in the Disclosure Letter as follows:

2.1 Organization and Qualification. The Company is a corporation duly

organized, validly existing under the laws of the State of Washington, and has

full corporate power and authority to conduct its business as now conducted and

as currently proposed to be conducted and to own, use, license and lease its

Assets and Properties. The Company is duly qualified, licensed or admitted to

do business and is in good standing in each jurisdiction in which the

ownership, use, licensing or leasing of its Assets and Properties, or the

conduct or nature of its business, makes such qualification, licensing or

admission necessary, except for such failures to be so duly qualified, licensed

or admitted and in good standing that could not reasonably be expected to have

a material adverse effect on the Business or Condition of the Company. Section

2.1 of the Disclosure Letter sets forth each jurisdiction where the Company is

so qualified, licensed or admitted to do business and separately lists each

other jurisdiction in which the Company owns, uses, licenses or leases its

Assets and Properties, or conducts business or has employees or engages

independent contractors.

2.2 Authority Relative to this Agreement. Subject only to the requisite

approval of the Merger and this Agreement by the shareholders of the Company,

the Company has full corporate power and authority to execute and deliver this

Agreement, to perform its obligations hereunder and to consummate the

transactions contemplated hereby. The execution and delivery by the Company of

this Agreement and the consummation by the Company of the transactions

contemplated hereby, and the performance by the Company of its obligations

hereunder, have been duly and validly authorized by all necessary action by the

Board of Directors of the Company, and no other action on the part of the Board

of Directors of the Company is required to authorize the execution, delivery

and performance of this Agreement and the consummation by the Company of the

transactions contemplated hereby. This Agreement has been duly and validly

executed and delivered by the Company and, assuming the due authorization,

execution and delivery hereof by Parent and Merger Sub, constitutes a legal,

valid and binding obligation of the Company enforceable against the Company in

accordance with its respective terms, except as the enforceability thereof may

be limited by bankruptcy, insolvency, fraudulent conveyance, reorganization,

moratorium or other similar Laws relating to the enforcement of creditors'

rights generally and by general principles of equity.

2.3 Capital Stock.

(a) The authorized capital stock of the Company consists only of 60,000,000

shares of Common Stock, $0.0005 par value per share (the "Company Common

Stock"), of which 7,492,720 shares of Company Common Stock are issued and

outstanding as of the date hereof, and 21,786,668 shares of Preferred Stock,

$0.0005 par value per share (the "Company Preferred Stock"). The designation

and status of the Company Preferred Stock is as follows: (i) 8,986,668 shares

are designated as Series A Preferred Stock, all of which are issued and

outstanding as of the date hereof, and (ii) 12,800,000 shares are designated as

Series B Preferred Stock, 10,133,334 of which are issued and outstanding as of

the date hereof. All of the issued and outstanding shares of Company Common

Stock and Company Preferred Stock are validly issued, fully paid and

nonassessable, and have not been issued in violation of any applicable federal,

state and foreign securities Laws or preemptive rights. Except for shares

issuable upon conversion of the Series A Preferred Stock or the

A-10

Series B Preferred Stock or upon exercise of Company Options or Company

Warrants, no shares of Company Common Stock or Company Preferred Stock are

reserved for issuance. Section 2.3(a) of the Disclosure Letter lists the name

and state of residence of each holder of Company Common Stock and Company

Preferred Stock provided to the Company by such holder. With respect to any

Company Common Stock or Company Preferred Stock that has been issued subject to

a repurchase option on the part of the Company, Section 2.3(a) of the

Disclosure Letter sets forth the holder thereof, the number and type of

securities covered thereby, and the vesting schedule thereof (including a

description of the circumstances under which such vesting schedule can or will

be accelerated).

(b) As of the date hereof, there are no outstanding Company Options or

Company Warrants or agreements, arrangements or understandings to which the

Company is a party (written or oral) to issue Options with respect to the

Company and there are no preemptive rights or agreements, arrangements or

understandings to issue preemptive rights with respect to the issuance or sale

of Company Capital Stock created by statute, the articles of incorporation or

bylaws of the Company, or any agreement or other arrangement to which the

Company is a party or to which it is bound and there are no agreements,

arrangements or understandings to which the Company is a party (written or

oral) pursuant to which the Company has the right to elect to satisfy any

Liability by issuing Company Common Stock or Equity Equivalents. With respect

to each Company Option and Company Warrant, Section 2.3(b) of the Disclosure

Letter sets forth the holder thereof, the number and type of securities

issuable thereunder, and, if applicable, the exercise price therefor, the

exercise period and vesting schedule thereof (including a description of the

circumstances under which such vesting schedule can or will be accelerated).

All of the Company Options and Company Warrants were issued in compliance with

all applicable federal, state and foreign securities Laws. The Company is not a

party or subject to any agreement or understanding, and, to the Company's

knowledge, there is no agreement, arrangement or understanding between or among

any Persons which affects, restricts or relates to voting, giving of written

consents, dividend rights or transferability of shares with respect to the

Company Capital Stock, including without limitation any voting trust agreement

or proxy.

2.4 No Subsidiaries. The Company has no Subsidiaries and does not otherwise

hold any equity, membership, partnership, joint venture or other ownership

interest in any Person.

2.5 No Conflicts. The execution and delivery by the Company of this

Agreement does not, the performance by the Company of its obligations under

this Agreement and the consummation of the transactions contemplated hereby do

not and will not:

(a) conflict with or result in a violation or breach of any of the terms,

conditions or provisions of the articles of incorporation or bylaws of the

Company;

(b) except as could not reasonably be expected to have a material adverse

effect on the Business or Condition of the Company or be expected to prevent or

materially delay the consummation of the transactions contemplated by this

Agreement and subject to obtaining the consents, approvals and actions, making

the filings and giving the notices disclosed in Section 2.5 of the Disclosure

Letter, if any, conflict with or result in a violation or breach of any Law or

Order applicable to the Company or any of its Assets and Properties; or

(c) except as could not reasonably be expected to have a material adverse

effect on the Business or Condition of the Company or be expected to prevent or

materially delay the consummation of the transactions contemplated by this

Agreement, (i) conflict with or result in a violation or breach of, (ii)

constitute a default (or an event that, with or without notice or lapse of time

or both, would constitute a default) under, (iii) require the Company to obtain

any consent, approval or action of, make any filing with or give any notice to

any Person as a result or under the terms of, (iv) result in or give to any

Person any right of termination, cancellation, acceleration or modification in

or with respect to, (v) result in or give to any Person any additional rights

or entitlement to increased, additional, accelerated or guaranteed payments or

performance under, (vi) result in the creation or imposition of (or the

obligation to create or impose) any Lien upon the Company or any of its Assets

and Properties under or (vii) result in the loss of a material benefit under,

any of the terms, conditions or provisions of any Contract or License to which

the Company is a party or by which any of the Company's Assets and Properties

is bound.

A-11

2.6 Books and Records; Organizational Documents. The minute books and stock

record books and other similar records of the Company that have been provided

or made available to the Parent or its counsel prior to the execution of this

Agreement are complete and correct in all respects and have been maintained in

accordance with sound business practices. Such minute books contain a true and

complete record of all actions taken at all meetings and by all written

consents in lieu of meetings of the directors, shareholders and committees of

the board of directors of the Company through the date hereof. The Company has

prior to the execution of this Agreement delivered to the Parent true and

complete copies of its articles of incorporation and bylaws, both as amended

through the date hereof. The Company is not in violation of any provision of

its articles of incorporation or bylaws.

2.7 Company Financial Statements.

(a) Section 2.7 of the Disclosure Letter sets forth the Company Financials.

The Company Financials are correct and complete in all material respects and

have been prepared in accordance with GAAP applied on a basis consistent

throughout the periods indicated and consistent with each other (except as may

be indicated in the notes thereto, and, in the case of the Interim Financial

Statements, subject to normal year-end adjustments, which adjustments will not

be material in amount or significance). The Company Financials present fairly

and accurately the financial condition and operating results of the Company as

of the dates and during the periods indicated therein, subject, in the case of

the Interim Financial Statements, to normal year-end adjustments, which

adjustments will not be material in amount or significance and except that the

Interim Financial Statements may not contain footnotes. Since the Company's

inception, there has been no change in any accounting policies, principles,

methods or practices, including any change with respect to reserves (whether

for bad debts, contingent liabilities or otherwise), of the Company.

(b) The Company does not have as of the date hereof nor as of the Audited

Financial Statement Date assets with a book value greater than or equal to $10

million, and, with respect to the fiscal year ended on the Audited Financial

Statement Date, the Company, did not have revenues greater than or equal to $10

million.

2.8 Absence of Changes. Since the date of the Interim Financial Statements,

there has not been any material adverse change in the Business or Condition of

the Company or any occurrence or event which, individually or in the aggregate,

could be reasonably expected to have any material adverse change in the

Business or Condition of the Company. In addition, without limiting the

foregoing, except as expressly contemplated hereby, there has not occurred

since the date of the Interim Financial Statements:

(a) the entering into of any Contract, commitment or transaction or the

incurrence of any Liabilities outside of the ordinary course of business

consistent with past practice;

(b) the entering into of any Contract in connection with any transaction

involving a Business Combination;

(c) the entering into of any Contract or other commitment relating to any

interest of the Company in any corporation, association, joint venture,

partnership or business entity;

(d) the entering into of any strategic alliance, joint development or joint

marketing Contract (other than joint marketing efforts in the ordinary course

of business consistent with past practice with its customers with whom the

Company had such a relationship at the date of the Interim Financial

Statements);

(e) any material amendment or other modification (or agreement to do so),

except in the ordinary course of business consistent with past practice, or

violation of the terms of, any of the Contracts disclosed in the Disclosure

Letter;

(f) the entering into of any transaction with any officer, director,

shareholder, Affiliate or Associate of the Company, other than pursuant to any

Contract in effect on the date of the Interim Financial Statements and

disclosed to the Parent pursuant to Section 2.18 of the Disclosure Letter or

other than pursuant to any contract of employment and listed in Section 2.16(a)

of the Disclosure Letter;

(g) the entering into or amendment of any Contract pursuant to which any

other Person is granted manufacturing, marketing, distribution, licensing or

similar rights of any type or scope with respect to any products of the Company

or Company Intellectual Property other than as contemplated by the Company's

A-12

Contracts or Licenses disclosed in the Disclosure Letter or otherwise in the

ordinary course of business consistent with past practice with a Person with

whom the Company had such a relationship at the date of the Interim Financial

Statements;

(h) the commencement of any Action or Proceeding involving or which could

reasonably be expected to involve the Company, or insofar as it relates to

their capacity as such, any officer, director, Affiliate or Associate of the

Company;

(i) the declaration, setting aside or payment of any dividends on or making

of any other distributions (whether in cash, stock or property) in respect of

any Company Capital Stock or Equity Equivalents, or any split, combination or

reclassification of any Company Capital Stock or Equity Equivalents or issuance

or authorization of the issuance of any other securities in respect of, in lieu

of or in substitution for shares of Company Capital Stock or Equity

Equivalents, or the repurchase, redemption or other acquisition, directly or

indirectly, of any shares of Company Capital Stock or Equity Equivalents;

(j) except for (i) the issuance of shares of Company Capital Stock upon

exercise or conversion of then-outstanding Company Options, Company Warrants or

Company Preferred Stock listed in Section 2.3 of the Disclosure Letter, or (ii)

the issuance of options available for grant under the Stock Plan in the

ordinary course of business to employees who are not officers of the Company

consistent with past practice, the issuance, grant, delivery, sale or

authorization of or proposal to issue, grant, deliver or sell, or purchase or

proposal to purchase, any shares of Company Capital Stock, Equity Equivalents

or modification or amendment of the rights of any holder of any outstanding

shares of Company Capital Stock of Equity Equivalents (including to reduce or

alter the consideration to be paid to the Company upon the exercise of any

outstanding Company Options, Company Warrants or other Equity Equivalents), nor

have there been any agreements, arrangements, plans or understandings with

respect to any such modification or amendment;

(k) any amendments to the Company's articles of incorporation or bylaws;

(l) any transfer (by way of a License or otherwise) to any Person of rights

to any Company Intellectual Property other than non-exclusive transfers to the

Company's customers, distributors or other licensees at the date of the Interim

Financial Statements in the ordinary course of business consistent with past

practice;

(m) any disposition or sale of, waiver of rights to, license or lease of, or

incurrence of any Lien on, any Assets and Properties of the Company, other than

dispositions of inventory, or licenses of products to Persons to whom the

Company had granted licenses of its products at the date of the Interim

Financial Statements, in the ordinary course of business of the Company

consistent with past practice;

(n) any purchase of any Assets and Properties of any Person other than

acquisitions of inventory, or licenses of products, in the ordinary course of

business of the Company consistent with past practice;

(o) the making of any capital expenditures or commitments by the Company for

additions to property, plant or equipment of the Company constituting capital

assets individually or in the aggregate in an amount exceeding $50,000;

(p) the write-off or write-down or making of any determination to write off

or write-down, or revalue, any of the Assets and Properties of the Company, or

change in any reserves or liabilities associated therewith, individually or in

the aggregate in an amount exceeding $50,000;

(q) the payment, discharge or satisfaction, in an amount in excess of

$25,000, in any one case, or $50,000 in the aggregate, of any claim or

Liability, other than the payment, discharge or satisfaction in the ordinary

course of business of Liabilities reflected or reserved against in the Company

Financial Statements or incurred in the ordinary course of business since the

date of the Interim Financial Statements;

(r) the failure to pay or otherwise satisfy Liabilities of the Company

consistent with the Company's past practices, except such as are being

contested in good faith;

A-13

(s) the incurrence of any Indebtedness or guarantee of any Indebtedness in

an aggregate amount exceeding $50,000 or issuance or sale of any debt

securities of the Company or guarantee any debt securities of others;

(t) the grant of any severance or termination pay to any director, officer

employee or consultant, except payments made pursuant to written Contracts

outstanding on the date hereof, the terms of which are disclosed in the

Disclosure Letter;

(u) the increase of greater than five percent in salary, rate of

commissions, rate of consulting fees or any other compensation of any current

or former officer, director, shareholder, employee, independent contractor or

consultant of the Company;

(v) the payment of any consideration of any nature whatsoever (other than

salary, commissions or consulting fees and customary benefits paid to any

current or former officer, director, shareholder, employee or consultant of the

Company) to any current or former officer, director, shareholder, employee,

independent contractor or consultant of the Company;

(w) the establishment or modification of (i) targets, goals, pools or

similar provisions under any Plan, employment Contract or other employee

compensation arrangement or independent contractor Contract or other

compensation arrangement or (ii) salary ranges, increased guidelines or similar

provisions in respect of any Plan, employment Contract or other employee

compensation arrangement or independent contractor Contract or other

compensation arrangement;

(x) the adoption, entering into, amendment, modification or termination

(partial or complete) of any Plan (other than as required to comply with

applicable Laws or to maintain the qualified status of such plan under Section

401(a) of the Code);

(y) the payment of any discretionary or stay bonus;

(z) any action, including the acceleration of vesting of any Company Options

or Company Warrants, or other rights to acquire shares of capital stock of the

Company, which could jeopardize the tax-free reorganization hereunder, except

as expressly required by any Contract set forth in the Disclosure Letter;

(aa) the making or changing of any material election in respect of Taxes,

adoption or change of any accounting method in respect of Taxes, the entering

into of any tax allocation agreement, tax sharing agreement, tax indemnity

agreement or closing agreement, settlement or compromise of any claim or

assessment in respect of Taxes, or consent to any extension or waiver of the

limitation period applicable to any claim or assessment in respect of Taxes

with any Taxing Authority or otherwise;

(bb) other than in the ordinary course of business, the making of any

representation or proposal to, or engagement in substantive discussions with,

any of the holders (or their representatives) of any Indebtedness, or to or

with any party which has issued a letter of credit which benefits the Company;

(cc) the commencement or termination of, or change in, any line of business;

(dd) the cancellation, material amendment or failure to renew any insurance

policy other than in the ordinary course of business consistent with past

practice, or failure to use commercially reasonable efforts to give all notices

and present all claims under all such policies in a timely fashion;

(ee) any material amendment, failure to renew, or failure to use

commercially reasonable efforts to maintain, its existing Approvals or failure

to observe any Law or Order applicable to the conduct of the Company's business

or the Company's Assets and Properties;

(ff) any physical damage, destruction or other casualty loss (whether or not

covered by insurance) affecting any of the real or personal property or

equipment of the Company individually or in the aggregate in an amount

exceeding $50,000;

(gg) the repurchase, cancellation or modification of the terms of any

Company Capital Stock, Equity Equivalents, Company Options or Company Warrants

or other financial instrument that derives the majority of its value from its

convertibility into Company Capital Stock or Equity Equivalents, other than

transactions

A-14

entered into in the ordinary course of business and pursuant to either (i)

contractual provisions or (ii) the Stock Plan, in either case as in effect at

the date of this Agreement; or

(hh) any entering into of any Contract, or acquiescence by the Company in

respect of, an arrangement or understanding to do, engage in, cause or having

the effect of any of the foregoing, including with respect to any Business

Combination not otherwise restricted by the foregoing paragraphs.

2.9 No Undisclosed Liabilities. Except as reflected or reserved against in

the Company Financials, there are no Liabilities of, relating to or affecting

the Company or any of its Assets and Properties, other than Liabilities

incurred in the ordinary course of business consistent with past practice since

the date of the Interim Financial Statements and in accordance with the

provisions of this Agreement which, individually and in the aggregate, are not

material to the Business or Condition of the Company, and are not for tort or

for breach of contract.

2.10 Taxes.

(a) All Tax Returns required to have been filed by or with respect to the

Company or any affiliated, consolidated, combined, unitary or similar group of

which the Company is or was a member (a "Relevant Group") have been duly and

timely filed (including any extensions), and each such Tax Return correctly and

completely reflects Tax liability and all other material information required

to be reported thereon. All Taxes due and payable by the Company or any member

of a Relevant Group, whether or not shown on any Tax Return, or claimed to be

due by any Tax Authority, have been paid or accrued on the Company Financials

for all periods (or portions thereof) through and including the date thereof.

All such Tax Returns are true, complete and correct in all material respects.

(b) The Company has not incurred any material liability for Taxes other than

as reflected on the Interim Financial Statements for all periods (or portions

thereof) through and including the date thereof and will not incur additional

Liabilities for Taxes through and including the Closing Date, other than in the

ordinary course of business. The unpaid Taxes of the Company (i) did not, as of

the most recent fiscal month end, exceed by any material amount the reserve for

liability for Income Tax (other than the reserve for deferred taxes established

to reflect timing differences between book and tax income) set forth on the

face of the Company's most recent balance sheet and (ii) will not exceed by any

material amount that reserve as adjusted for operations and transactions

through the Closing Date.

(c) The Company is not a party to any agreement extending the time within

which to file any Tax Return. No claim has ever been made by a Taxing Authority

of any jurisdiction in which the Company does not file Tax Returns that it is

or may be subject to taxation by that jurisdiction.

(d) The Company has withheld and paid all Taxes required to have been

withheld and paid in connection with amounts paid or owing to any employee,

creditor or independent contractor.

(e) The Company does not have knowledge of any actions by any Taxing

Authority in connection with assessing additional Taxes against or in respect

of it for any past period. There is no dispute or claim concerning any Tax

liability of the Company either (i) threatened, claimed or raised by any Taxing

Authority or (ii) of which the Company is aware. There are no Liens for Taxes

upon the Assets and Properties of the Company other than Liens for Taxes not

yet due. Section 2.10 of the Disclosure Letter indicates those Tax Returns, if

any, of the Company that have been audited or examined by Taxing Authorities,

and indicates those Tax Returns of the Company that currently are the subject

of audit or examination. The Company has delivered to the Parent complete and

correct copies of all federal, state, local and foreign income Tax Returns

filed by, and all Tax examination reports and statements of deficiencies

assessed against or agreed to by, the Company since the fiscal year ended

December 31, 1997.

(f) There are no outstanding agreements or waivers extending the statutory

period of limitation applicable to any Tax Returns required to be filed by, or

which include or are treated as including, the Company or with respect to any

Tax assessment or deficiency affecting the Company or any Relevant Group.

A-15

(g) The Company has not received any written ruling related to Taxes or

entered into any agreement with a Taxing Authority relating to Taxes.

(h) The Company has no liability for the Taxes of any Person other than the

Company (i) under Section 1.1502-6 of the Treasury regulations (or any similar

provision of state, local or foreign Law), (ii) as a transferee or successor,

(iii) by Contract or (iv) otherwise.

(i) The Company (i) has neither agreed to make nor is required to make any

adjustment under Section 481 of the Code by reason of a change in accounting

method and (ii) is not a "consenting corporation" within the meaning of Section

341(f)(1) of the Code.

(j) The Company is not a party to or bound by any obligations under any tax

sharing, tax allocation, tax indemnity or similar agreement or arrangement.

(k) The Company is not involved in, subject to, or a party to any joint

venture, partnership, Contract or other arrangement that is treated as a

partnership for federal, state, local or foreign Income Tax purposes.

(l) The Company was not included and is not includible in the Tax Return of

any Relevant Group with any corporation other than such a return of which the

Company is the common parent corporation.

(m) The Company has not made any payments, is not obligated to make any

payments, nor is a party to any Contract that under certain circumstances could

require it to make any payments that are not deductible as a result of the

provisions set forth in Section 280G of the Code or the treasury regulations

thereunder or would result in an excise tax to the recipient of any such

payment under Section 4999 of the Code (other than payments for which

shareholder approval meeting the requirements of Section 280G(c)(5) of the Code

will be obtained prior to the Closing Date).

(n) The Company is not nor has it ever been a United States real property

holding corporation within the meaning of Section 897(c)(1)(A)(ii) of the Code.

2.11 Legal Proceedings.

(a) Except as set forth in Section 2.11 of the Disclosure Letter:

(i) there are no Actions or Proceedings pending or, to the knowledge of

the Company, threatened against, relating to or affecting the Company or

its Assets and Properties; and

(ii) the Company has not received notice, and does not otherwise have

knowledge, of any Orders outstanding against the Company.

(b) Prior to the execution of this Agreement, the Company has delivered to

the Parent all responses of counsel for the Company to auditor's requests for

information since the Company's inception (together with any updates provided

by such counsel) regarding Actions or Proceedings pending or threatened

against, relating to or affecting the Company. Section 2.11(b) of the

Disclosure Letter sets forth all Actions or Proceedings relating to or

affecting the Company or any of its Assets and Properties since the Company's

inception and prior to the date hereof.

2.12 Compliance with Laws and Orders. The Company has not violated, and is

not currently in default under, any Law or Order applicable to the Company or

any of its Assets and Properties, except for any such violations or defaults

that could not reasonably be expected to have a material adverse effect on the

Business or Condition of the Company.

2.13 Plans; ERISA.

(a) For purposes of this Agreement, the term "Plans" shall mean (i) all

"employee benefit plans" (as such term is defined in Section 3(3) of the

Employee Retirement Income Security Act of 1974, as amended ("ERISA"), of which

any of the Company or any member of the same controlled group of businesses as

the Company within the meaning of Section 4001(a)(14) of ERISA (an "ERISA

Affiliate") is or ever was a sponsor

A-16

or participating employer or as to which the Company or any of its ERISA

Affiliates makes contributions or is or has been required to make

contributions, and (ii) any similar employment, severance or other arrangement

or policy of any of the Company or any of its ERISA Affiliates (whether written

or oral) providing for health, life, vision or dental insurance coverage

(including self-insured arrangements), workers' compensation, disability

benefits, supplemental unemployment benefits, vacation benefits or retirement

benefits, fringe benefits, or for profit sharing, deferred compensation,

bonuses, stock options, stock appreciation or other forms of incentive

compensation or post-retirement insurance, compensation or benefits. Except as

disclosed on Section 2.13 of the Disclosure Letter, (i) neither the Company nor

any of its ERISA Affiliates maintains or sponsors (or ever maintained or

sponsored), or makes or is required to make contributions to, any Plans, (ii)

none of the Plans is or was a "multi-employer plan", as defined in Section

3(37) of ERISA, (iii) none of the Plans is or was a "defined benefit pension

plan" within the meaning of Section 3(35) of ERISA, (iv) none of the Plans

provides or provided post-retirement medical or health benefits, other than as

required under applicable Laws, (v) none of the Plans is or was a "welfare

benefit fund," as defined in Section 419(e) of the Code, or an organization

described in Sections 501(c)(9) or 501(c)(20) of the Code, (vi) neither the

Company nor any of its ERISA Affiliates is or was a party to any collective

bargaining agreement and (vii) neither the Company nor a