Financial Affidavit/Page 1 of 15/January 2018

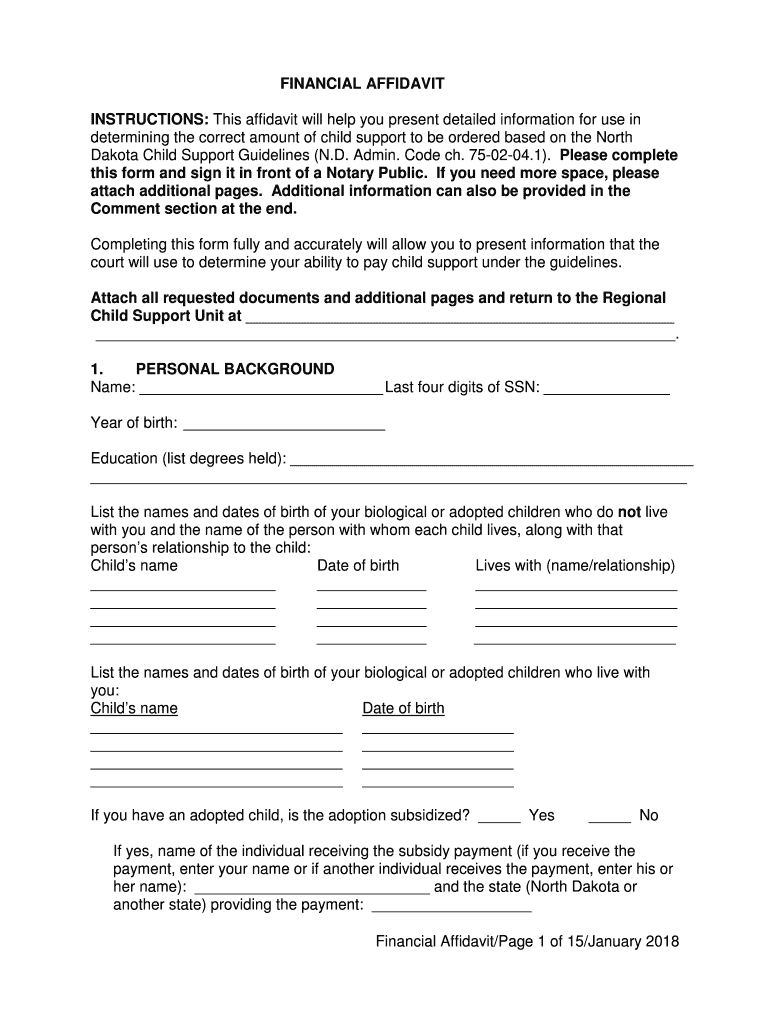

FINANCIAL AFFIDAVIT

INSTRUCTIONS: This affidavit will help you present detailed info rmation for use in

determining the correct amount of child support to be ordered based on the North

Dakota Child Support Guidelines (N.D. Admin. Code c h. 75-02-04.1). Please complete

this form and sign it in front of a Notary Public. If you need more space, please

attach additional pages. Additional information ca n also be provided in the

Comment section at the end.

Completing this form fully and accurately will allo w you to present information that the

court will use to determine your ability to pay chi ld support under the guidelines.

Attach all requested documents and additional pages and return to the Regional

Child Support Unit at ___________________________________________________

__________________________________________________ ___________________.

1. PERSONAL BACKGROUND

Name: _____________________________ Last four digit s of SSN: _______________

Year of birth: ________________________

Education (list degrees held): ____________________ ____________________________

___________________________________________________ ____________________

List the names and dates of birth of your biologica l or adopted children who do not live

with you and the name of the person with whom each child lives, along with that

person’s relationship to the child:

Child’s name Date of birth Lives with (name/relatio nship)

______________________ _____________ ______________ __________

______________________ _____________ ______________ __________

______________________ _____________ ______________ __________

______________________ _____________ _________ _______________

List the names and dates of birth of your biologica l or adopted children who live with

you:

Child’s name Date of birth

______________________________ __________________

______________________________ __________________

______________________________ __________________

______________________________ __________________

If you have an adopted child, is the adoption subsi dized? _____ Yes _____ No

If yes, name of the individual receiving the subsid y payment (if you receive the

payment, enter your name or if another individual r eceives the payment, enter his or

her name): ____________________________ and the st ate (North Dakota or

another state) providing the payment: ____________ _______

Financial Affidavit/Page 2 of 15/January 2018

Are you currently incarcerated (physically confined

to a prison, jail, or other correctional

facility)?

_____ Yes _____ No If yes, name and address of prison, jail, or correc tional facility where you are

confined: ________________________________________ _______________

________________________________________ ________________________

__________________________________________________ ______________

Prisoner Identification Number: ___________

Date that your current period of incarceration bega n (do not include any time that

you were confined while awaiting trial or sentencin g): _____________

Maximum release date: _________________

Are you on work release? _____ Yes _____ No

If yes, date that work release began: __________ _

(Provide the details of your work release employmen t in Section 6.

Do not skip Sections 2 through 5.)

Have you been released from incarceration within th e past six months?

_____ Yes _____ No

If yes, date of release: _____________________

Are you currently under any medical restrictions that limit your abi lity to work?

_____ Yes _____ No

If yes, describe the restrictions: ______________ ________________

__________________________________________________ _____

Note: You must attach copies of medical records th at confirm the work

restrictions if you want them to be considered.

2. TAX EXEMPTIONS FOR CHILDREN AND CHILD TAX CREDIT

List all the children you claim as exemptions on yo ur federal income tax return. If any of

these children are not your biological or adopted c hildren, please indicate the

relationship (for example, stepchild).

Child’s name Relationship

_________________________________ ________________

_________________________________ ________________

_________________________________ ________________

_________________________________ ________________

Financial Affidavit/Page 3 of 15/January 2018

Do you claim the exemption for any of your biologic

al or adopted children based on a

court order?

_____ Yes _____ No

If yes, please list the names of the children for w hom the exemption is claimed based on

the court order:

__________________________________________

__________________________________________

__________________________________________

__________________________________________

Do you alternate claiming the exemption for any of your biological or adopted children

with the other parent of those children based on a court order?

_____ Yes _____ No

If yes, please list the names of the children for w hom the exemption is alternated based

on the court order:

__________________________________________

__________________________________________

__________________________________________

__________________________________________

Are any of your biological or adopted children for whom you claim an exemption

qualifying children for purposes of the child tax c redit?

_____ Yes _____ No

If yes, please list the names of the children who a re qualifying children for purposes of

the child tax credit:

__________________________________________

__________________________________________

__________________________________________

__________________________________________

3. PRIMARY RESIDENTIAL RESPONSIBILITY (CUSTODY)

Do you and the other parent in this child support m atter have split primary residential

responsibility for your children? (Split primary r esidential responsibility means that you

and the other parent have more than one child in co mmon and you and the other parent

each have primary residential responsibility for at least one child.)

_____ Yes _____ No

Do you and the other parent in this child support m atter have equal residential

responsibility for your child or, if there are mult iple children, for any or all of those

children? (Equal residential responsibility means each parent, by court order, has

residential responsibility for the child or childre n for an equal amount of time.)

_____ Yes _____ No

Financial Affidavit/Page 4 of 15/January 2018

4. PARENTING TIME (VISITATION)

Does a court order specify when you have parenting time with your children?

_____ Yes _____ No

If yes, based on the court order, is the number of nights any of your children spend with

you: More than 60 of 90 consecutive nights? _____ Yes _____ No

More than an annual total of 164 nights? _____ Ye s _____ No

If you answered yes to either of the last two quest ions, please provide the total

number of court-ordered parenting time nights per c hild, per year:

Child’s name Total number of court-ordered parentin g time

nights per year

_____________________ __________

_____________________ __________

_____________________ __________

5. CHILDREN’S BENEFITS

Do the children in this child support matter receiv e any governmental or other benefits

on your account? (Examples include dependent’s ben efits from the Social Security

Administration based on your disability or retireme nt.)

_____ Yes _____ No

If yes, list the names of the children, the type of benefit they are receiving, and the

monthly amount of such benefit:

Child’s name Type of benefit Monthly amount

________________________ ______________________ ___ __________

________________________ ______________________ ___ __________

________________________ ______________________ ___ __________

6. EMPLOYMENT

If you are employed, you must attach: • A copy of your most recent federal income tax retur n, including copies of all

W-2s, 1099s, and schedules.

• A copy of a year-end or final pay stub from each em ployer who gave you a W-2

form to attach to your most recent federal income t ax return.

• For the current year, copies of your most recent pa y stubs from all employers

to show your year-to-date income from each employer (this includes your

leave and earnings statement, if you are in the mil itary).

Note: If you have more than one employer, please a nswer the questions in this

section based on your primary job. Then attach add itional pages to provide the

same kind of information for each of your other job s.

Employer name: ________________________________

Employer address: ______________________________

______________________________________________

Financial Affidavit/Page 5 of 15/January 2018

Employer telephone number: _______________________

____

Date you started working for this employer: _______ __________

Occupation: _______________________________________ ___

Brief job description: ___________________________ _______________________

Rate of pay (complete the option that best describe s your situation)

Hourly: $________ per hour; ________ hours per wee k

Monthly: $________ per month

Annually: $________ per year

Number of pay periods (check one) _____ weekly

_____ 24 per year (paid twice per month)

_____ 26 per year (paid every two weeks)

_____ monthly

_____ other ___________________________

Overtime Did you work any overtime hours during the past 24 months?

_____ Yes _____ No

If yes, provide the number of overtime (OT) hours w orked in each of the past 24

months: mo/yr ______ OT hours _____ mo/yr ________ OT hou rs _____

mo/yr ______ OT hours _____ mo/yr ________ OT hou rs _____

mo/yr ______ OT hours _____ mo/yr ________ OT hou rs _____

mo/yr ______ OT hours _____ mo/yr ________ OT hou rs _____

mo/yr ______ OT hours _____ mo/yr ________ OT hou rs _____

mo/yr ______ OT hours _____ mo/yr ________ OT hou rs _____

mo/yr ______ OT hours _____ mo/yr ________ OT hou rs _____

mo/yr ______ OT hours _____ mo/yr ________ OT hou rs _____

mo/yr ______ OT hours _____ mo/yr ________ OT hou rs _____

mo/yr ______ OT hours _____ mo/yr ________ OT hou rs _____

mo/yr ______ OT hours _____ mo/yr ________ OT hou rs _____

mo/yr ______ OT hours _____ mo/yr ________ OT hou rs _____

Rate of pay for overtime hours: $________

Do you expect to continue to have overtime hours du ring the next 12 months?

_____ Yes _____ No; because ____________________ _________

Commissions and tips Commissions: $________ per __________

Tips: $________ per __________

Financial Affidavit/Page 6 of 15/January 2018

Bonuses

Did you receive any bonuses during the past three ( 3) calendar years?

_____ Yes _____ No

If yes, provide the amount of bonuses received in e ach of the past three (3)

calendar years and the reason for the bonuses:

Year _______ Amount $_______ Reason: ______ ______________

Year _______ Amount $_______ Reason: _______ _____________

Year _______ Amount $_______ Reason: _______ _____________

Do you expect to receive a bonus during the current calendar year?

_____ Yes _____ No; because: ___________________ _________________

Employee benefits Describe the benefits provided to you by your emplo yer and the annual value of

each benefit (examples include accrued vacation and sick leave, health

insurance, employer retirement contributions, etc.) :

Benefit provided Annual value

__________________________________________ ______ ____

__________________________________________ ______ ____

__________________________________________ ______ ____

__________________________________________ _____ _____

In-kind income Describe any in-kind income provided to you by your employer and the annual

value of the in-kind income. (In-kind income means you are allowed to use your

employer’s property or you are being provided with services at no charge or less

than the usual charge. Examples include housing all owance or the use of living

quarters or being provided with transportation, gro ceries, or utilities.)

In-kind income received Annual value

_________________________________________ ______ ____

_________________________________________ ______ ____

_________________________________________ ______ ____

Union dues: $________ per month Name of union: ________________________

Are union dues required as a condition of employme nt? _____ Yes _____ No

(If yes, you must provide proof from your employer if you want this

expense to be considered.)

List each professional/occupational license you hol d:___________________________

Is the license required as a condition of employme nt? _____ Yes _____ No

Annual professional/occupational license fee: $__ _____

Is this fee paid or reimbursed by your employer? _____ Yes _____ No

Financial Affidavit/Page 7 of 15/January 2018

Are you required,

as a condition of employment , to contribute to a retirement plan?

_____ Yes _____ No

If yes, monthly amount of required contribution: $_ _________

Employee expenses

Do you have out-of-pocket expenses for special equi pment or clothing required

as a condition of your employment? _____ Yes _____ No

If yes, describe these items, your annual out-of-po cket expenses for them, and

the amount, if any, that you are reimbursed for the m:

Item Annual out-of-pocket expenses Amount reimbu rsed

___________________ _________________________ _______________

___________________ _________________________ _____ __________

___________________ _________________________ _____ __________

Do you have out-of-pocket expenses for lodging when you must travel as a

condition of your employment? _____ Yes _____ No

If yes, are you reimbursed for these lodging expens es? _____ Yes _____ No

If no, please provide the number of overnights in t he last calendar year:

________ and the current calendar year to date: ___ _____

Are you required, as a condition of employment, to use your personal vehicle to

drive between work locations (this does not include driving between your home

and your work)? _____ Yes _____ No

If yes, are you reimbursed for these mileage expen ses? _____ Yes _____ No

If no, please provide the number of these miles dr iven in the last calendar

year: ____________ and the current calendar year t o date: _________

Note: If you claim any employment-related expenses for special

equipment, clothing, lodging, or mileage, you must provide proof of those

expenses if you want them to be considered.

Military Service

Are you currently in the military? _____ Yes ___ __ No

If yes, branch of service: ______________________ ___________________

Rank: ___________________________________________ _____________

Years of service: _______________________________ _________________

Duty station (base and state or foreign country): ________________________

________________________

Financial Affidavit/Page 8 of 15/January 2018

List any monthly payments and allowances that have

not already been included

above:

Type of payment or allowance Monthly amount

________________________ _____________

________________________ _____________

________________________ _____________

________________________ _____________

7. HEALTH INSURANCE AND MEDICAL EXPENSES

Do you have access to health insurance coverage, in cluding dental or vision coverage,

for your children?

_____ Yes _____ No

If coverage is or would be available, please provid e the following information:

Are you currently enrolled in the health insurance plan?

_____ Yes _____ No

If yes, indicate what type of plan you are current ly enrolled in:

_____ Single

_____ Single + dependent

_____ Family

If you are currently enrolled in the plan, please p rovide the names of

persons, including yourself, covered under the plan and the effective date

of the coverage:

Name of insured Effective date

______________________________ ____________

______________________________ ____________

______________________________ ____________

______________________________ ____________

Name of insurance company: _______________________ ________

Address of insurance company: _____________________ _________

______________________________

Telephone number of insurance company (if multiple numbers, please

provide the “member services” number): ____________ ___________

Group number: ________________

Policy number: ________________

Name of policyholder: ______________

If you are not currently eligible for coverage, on what date will you become

eligible? _______________________

Financial Affidavit/Page 9 of 15/January 2018

Your cost for health insurance is/would be (complet

e all options that are/would be

available): Single plan: $_______ per ________

Single + dependent plan: $________ per ________

Family plan: $_______ per ________

Child-only plan: $_________ per _________

Do you currently have dental insurance for your children?

_____ Yes _____ No

If yes:

Name of insurance company: _______________________ _____

Group number: ___________________________________ ____

Policy number:____________________________________ ____

Cost of coverage: _______________________________ ______

Name of insured Effective date

______________________________ ____________

______________________________ ____________

______________________________ ____________

Your cost for dental insurance is/would be (complet e all options that are/would be

available): Single plan: $_______ per ________

Single + dependent plan: $________ per ________

Family plan: $_______ per ________

Child-only plan: $_________ per _________

Do you currently have vision insurance for your children?

_____ Yes _____ No

If yes:

Name of insurance company: _______________________ _____

Group number:_____________________________________ ___

Policy number:____________________________________ ____

Cost of coverage: _______________________________ ______

Name of insured Effective date

______________________________ ____________

______________________________ ____________

______________________________ ____________

Your cost for vision insurance is/would be (complet e all options that are/would be

available): Single plan: $_______ per ________

Single + dependent plan: $________ per ________

Family plan: $_______ per ________

Child-only plan: $_________ per _________

Financial Affidavit/Page 10 of 15/January 2018

Annual amount of out-of-pocket medical expenses you

pay for the children for whom

support is being determined in this child support m atter:

Child’s name Annual amount

____________________ $___________

____________________ $___________

____________________ $___________

____________________ $___________

Is it reasonably likely that these medical expenses will continue?

_____ Yes _____ No

If yes, please explain what these expenses are for: _______________________

__________________________________________________ ______________

Note: You must provide proof of these expenses if you want them to be

considered.

8. UNEMPLOYMENT INFORMATION

If you are currently unemployed, please provide the following information about

your last employment. Also, you must attach: • A copy of your most recent federal income tax retur n, including all W-2s,

1099s, and schedules.

• A copy of your final pay stub from your last employ er.

• If you are receiving or have received unemployment compensation, a copy of

your benefits award letter or other documentation s howing the amount

received.

Reason for unemployment: __________________________ ________________

Date you became unemployed: ______________________ ________________

Name and address of last employer:_________________ __________________

___________________________________

Occupation: _______________________________________ _______________

Brief job description for your last employment: ___ ________________________

___________________________________________________ _____________

Wages for last employment Hourly: $________ per hour; ________ hours per wee k

Monthly: $________ per month

Annually: $________ per year

Financial Affidavit/Page 11 of 15/January 2018

Number of pay periods for last employment (check on

e)

_____ weekly

_____ 24 per year (paid twice per month)

_____ 26 per year (paid every two weeks)

_____ monthly

_____ other _______________________________________ _________

Overtime Average number of overtime hours worked per month d uring the final 36 months

of your last employment: ________

Rate of pay for overtime hours: $________

Commissions and tips for last employment Commissions: $________ per __________

Tips: $________ per __________

Bonuses Please provide information regarding the amount of and reason for any bonuses

you received during the final 36 months of your las t employment: __________

___________________________________________________ ____________

___________________________________________________ ____________

Did you receive severance pay when you became unemp loyed? _____ Yes _____ No

If yes, amount received: $_________

Are you now receiving or, within the past 36 months , did you receive unemployment

compensation?

_____ Yes _____ No

If yes, weekly compensation amount: $__________

Date unemployment compensation began: __________ _

Date unemployment compensation ended/will end: _ ________

Work history

Describe other jobs you have had in the past, asid e from your last employer:

___________________________________________________ ____________

__________________________________________________ _____________

__________________________________________________ _____________

9. SELF-EMPLOYMENT INCOME

If you are self-employed, you must attach: • Copies of your personal and business federal income tax returns, including all

schedules, for the last five years. These include, as applicable, IRS forms

1040, 1065, 1120, and 1120S.

• If you do not have income tax returns, copies of pr ofit and loss statements for

the last five years.

Financial Affidavit/Page 12 of 15/January 2018

Note: If you have more than one self-employment ac

tivity, please answer the

questions in this section based on your primary sel f-employment activity. Then

attach additional pages to provide the same kind of information for each of your

other self-employment activities.

Structure of business entity:

_____ Sole proprietorship

_____ Partnership; percent ownership interest: ___ __

_____ Limited liability company; percent ownership interest: _____

_____ S Corporation; percent ownership interest: _ ____

_____ C Corporation; percent ownership interest: _ ____

Name of business entity: _______________________

Business address: ____________________________

____________________________

Business telephone number: ________________________ _____

Taxpayer identification number(s): ________________ _________

Type of business:

_____ Farming/ranching

_____ Service

_____ Retail sales

_____ Wholesale sales

_____ Manufacturing

_____ Other; please describe: ____________________ ________

Description of business activity (e.g., type of ser vice provided, type of item(s) sold, etc.):

___________________________________________________ __________________

___________________________________________________ __________________

How long has this business been in existence? ____ _ years _____ months

Names of household members who work in this busines s, the wage/salary paid to the

household member, and household member’s job duties :

Household member’s name Wage/salary Job duties

______________________ __________ _______________ _____

______________________ __________ _______________ _____

______________________ __________ _______________ _____

10. OTHER INCOME

If you are receiving worker’s compensation, social security payments, veterans’

benefits, military retirement payments, railroad retirement board payments, or

any other disability or retirement payments, please attach a copy of your benefits

award letter or other documentation showing the amo unt received.

Financial Affidavit/Page 13 of 15/January 2018

Are you now receiving or did you receive worker’s c

ompensation wage replacement

payments?

_____ Yes _____ No

If yes, weekly payment amount: $_____________

Date payments began: ________________

Date payments ended/will end: __________

Are you receiving social security disability paymen ts (this does not mean Supplemental

Security Income (SSI))?

_____ Yes _____ No

If yes, monthly payment amount: $________

Date payments began: ____________

Are you receiving social security retirement paymen ts?

_____ Yes _____ No

If yes, monthly payment amount: $__________

Date payments began: ______________

Are you receiving social security survivor’s paymen ts?

_____ Yes _____ No

If yes, monthly payment amount: $__________

Date payments began: ______________

Are you receiving SSI payments? (Note: SSI paymen ts are not treated as income

under the guidelines.)

_____ Yes _____ No

Are you receiving veterans’ pension or disability b enefits?

_____ Yes _____ No

If yes, monthly payment amount: $ _______

Date payments began: ___________

If disability benefits, percent disabled: _____ %

Are you receiving military retirement payments? _____ Yes _____ No

If yes, monthly payment amount: $____________

Date payments began: ________________

Are you receiving total and permanent disability pa yments from the railroad retirement

board?

_____ Yes _____ No

Financial Affidavit/Page 14 of 15/January 2018

If yes, monthly payment amount: $________

Date payments began: ____________

Are you receiving occupational disability payments

from the railroad retirement board?

_____ Yes _____ No

If yes, monthly payment amount: $________

Date payments began: ____________

Are you receiving retirement payments from the rail road retirement board?

_____ Yes _____ No

If yes, monthly payment amount: $______

Date payments began: __________

Are you receiving any other disability, retirement, or pension payments not included

above?

_____ Yes _____ No

If yes, source of payments: ____________________ ____

Monthly payment amount: $_________

Date payments began: _____________

Dividends and interest ............................ ...................... $_______ per __________

Annuities income .................................. ........................ $_______ per __________

Trust income ...................................... .......................... $_______ per __________

Currently deferred income ......................... ................... $_______ per __________

Receipt of previously deferred income ............. ............ $_______ per __________

Was this treated as income to you

at the time it was deferred?

___ Yes; amount previously counted: $_______

___ No

Gifts and prizes (exceeding $1,000/year) .......... ........... $_______ per __________

Refundable tax credits ............................ ...................... $_______

Gains ............................................. ............................... $_______

Describe transaction resulting in gains: _________ _______________________

__________________________________________________ ______________

Spousal support (alimony) payments received ....... ...... $_______ per __________

Rental income ..................................... ......................... $_______ per __________

Mineral lease income …………………………………… $ _______ per _ _________

Income from royalties…………………………….. .......... $____ ___ per __________

Other (specify)_________________________ .......... .. $_______ per __________

Financial Affidavit/Page 15 of 15/January 2018

11. COMMENTS

Please use this section to provide any other inform ation that you feel would help the

Regional Child Support Unit to understand your situ ation or to supplement answers

given above, including any factors that affect your ability to work:

___________________________________________________ _________________

___________________________________________________ __________________

___________________________________________________ __________________

___________________________________________________ __________________

___________________________________________________ __________________

___________________________________________________ __________________

___________________________________________________ __________________

___________________________________________________ __________________

12. CHECKLIST OF ATTACHED DOCUMENTS

Please put a check mark next to the documents that are attached to this form:

_____ Business and personal federal income tax ret urns for the last five years (if self-

employed).

_____ Business profit and loss statements for the last five years (if self-employed).

_____ Most recent federal income tax return, inclu ding W-2s,1099s, and schedules.

_____ Year-end or final paystub from each employer who gave you a W-2 form.

_____ Year-to-date paystub from each employer for the current year.

_____ Leave and earnings statement for the current year (if in the military).

_____ Unemployment compensation benefits award let ter.

_____ Worker’s compensation benefits award letter.

_____ Social security benefits award letter (for d isability, retirement, or survivor’s

payments).

_____ SSI benefits award letter.

_____ Veterans’ pension or disability benefits awa rd letter.

_____ Military retirement award letter.

_____ Railroad retirement board benefits award let ter.

_____ Proof of expenses for employment-related spe cial equipment, clothing, lodging,

or mileage for driving between work locations.

_____ Proof of out-of-pocket medical expenses paid for the children for whom support

is being determined in this child support matter.

_____ Current medical records confirming any work restrictions.

13. SIGNATURE

I state, under penalty of perjury, that the informa tion contained in, and attached to, this

Financial Affidavit, is true and correct to the bes t of my knowledge.

Date: _______________ Signature: ________________ ____________

Subscribed and sworn to before me this _____ day of ______________, ______.

________________________________ Notary Public

_____________ County, North Dakota