Fill and Sign the Printable Utah State Functional Ability Evaluation Medical Report Form 2010

Useful Advice on Finalizing Your ‘Printable Utah State Functional Ability Evaluation Medical Report Form 2010’ Online

Are you exhausted from the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and small to medium-sized businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can conveniently fill out and sign documents online. Utilize the powerful features integrated into this user-friendly and budget-friendly platform and transform your approach to document management. Whether you need to approve forms or collect signatures, airSlate SignNow takes care of everything effortlessly, requiring only a few clicks.

Follow this step-by-step guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Access your ‘Printable Utah State Functional Ability Evaluation Medical Report Form 2010’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and assign fillable fields for other participants (if necessary).

- Proceed with the Send Invite options to request electronic signatures from others.

- Save, print your copy, or convert it into a reusable template.

Don't worry if you need to collaborate with others on your Printable Utah State Functional Ability Evaluation Medical Report Form 2010 or send it for notarization—our solution provides everything you need to complete such tasks. Create an account with airSlate SignNow today and enhance your document management to a higher level!

FAQs

-

What is the Printable Utah State Functional Ability Evaluation Medical Report Form?

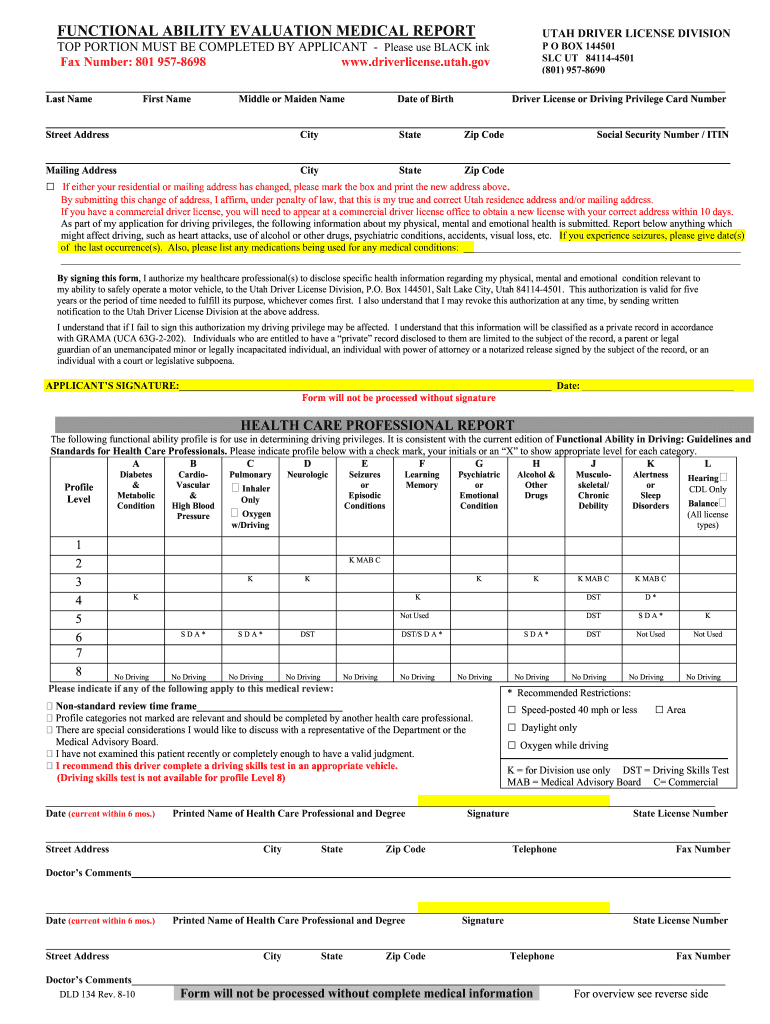

The Printable Utah State Functional Ability Evaluation Medical Report Form is a standardized document designed to assess an individual's functional abilities in a medical context. This form is essential for healthcare providers in Utah to evaluate patients’ capabilities accurately. By utilizing this form, you can ensure a comprehensive assessment that meets state guidelines.

-

How can I obtain the Printable Utah State Functional Ability Evaluation Medical Report Form?

You can easily obtain the Printable Utah State Functional Ability Evaluation Medical Report Form through airSlate SignNow. Our platform allows you to download and print the form directly, ensuring you have access to the most up-to-date version. Simply visit our website to get started!

-

Are there any costs associated with using the Printable Utah State Functional Ability Evaluation Medical Report Form?

Using airSlate SignNow to access the Printable Utah State Functional Ability Evaluation Medical Report Form is cost-effective. We offer various pricing plans tailored to meet the needs of businesses and healthcare professionals. You can choose a plan that best fits your usage needs while enjoying the benefits of our easy-to-use platform.

-

What features does the Printable Utah State Functional Ability Evaluation Medical Report Form include?

The Printable Utah State Functional Ability Evaluation Medical Report Form includes comprehensive sections for patient information, medical history, and evaluation results. airSlate SignNow enhances this experience by allowing users to eSign the document, ensuring a secure and efficient workflow. Our form is fully customizable to fit your specific requirements.

-

How does the Printable Utah State Functional Ability Evaluation Medical Report Form benefit healthcare providers?

Healthcare providers benefit signNowly from using the Printable Utah State Functional Ability Evaluation Medical Report Form by streamlining patient assessments. This form helps in maintaining compliance with Utah's medical standards while reducing paperwork errors. Additionally, eSigning capabilities expedite the approval process, saving valuable time.

-

Can I integrate the Printable Utah State Functional Ability Evaluation Medical Report Form with other tools?

Yes, airSlate SignNow allows for seamless integration of the Printable Utah State Functional Ability Evaluation Medical Report Form with various third-party applications. This capability enhances your existing workflows, making it easier to share and manage documents across different platforms. Explore our integration options to find the best fit for your needs.

-

Is the Printable Utah State Functional Ability Evaluation Medical Report Form compliant with state regulations?

Absolutely! The Printable Utah State Functional Ability Evaluation Medical Report Form is designed to comply with Utah's healthcare regulations. Using this form helps ensure that your assessments are legally valid and meet the necessary state standards, providing peace of mind for healthcare providers.

Find out other printable utah state functional ability evaluation medical report form 2010

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles