Fill and Sign the Rental Application PDF Fillable Form

Useful tips for preparing your ‘Rental Application Pdf Fillable Form’ online

Are you fed up with the inconvenience of dealing with paperwork? Your search ends here with airSlate SignNow, the premier eSignature solution for both individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can easily complete and sign documents online. Take advantage of the extensive features offered by this user-friendly and cost-effective platform and transform your document management strategy. Whether you need to approve forms or gather eSignatures, airSlate SignNow manages everything seamlessly, requiring just a few clicks.

Follow this comprehensive guide:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud, or our template library.

- Open your ‘Rental Application Pdf Fillable Form’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for others (if needed).

- Continue with the Send Invite options to ask for eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you have to collaborate with others on your Rental Application Pdf Fillable Form or send it for notarization—our platform provides you with all the necessary tools to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

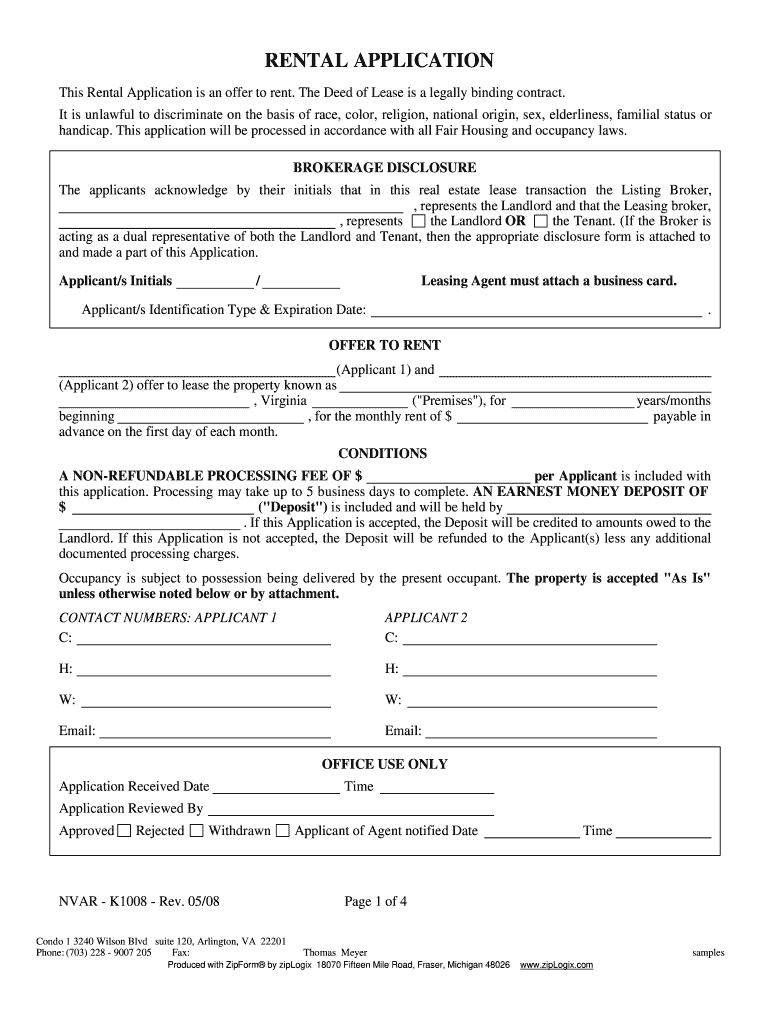

What is a Fillable PDF Rental Application?

A Fillable PDF Rental Application is a digital form that allows potential tenants to provide their information in a structured format. With airSlate SignNow, you can create, send, and eSign these applications easily, streamlining the rental process for both landlords and applicants.

-

How can I create a Fillable PDF Rental Application using airSlate SignNow?

Creating a Fillable PDF Rental Application with airSlate SignNow is simple. You can upload your existing PDF application and use our intuitive editor to make it fillable, adding fields for signatures, text, and checkboxes as needed.

-

What are the benefits of using a Fillable PDF Rental Application?

Using a Fillable PDF Rental Application enhances efficiency by reducing paperwork and eliminates the need for manual data entry. This solution also improves organization, as all applications are stored digitally and can be accessed anytime, ensuring a smoother rental process.

-

Is there a cost associated with using the Fillable PDF Rental Application feature?

Yes, airSlate SignNow offers various pricing plans that include access to the Fillable PDF Rental Application feature. You can choose a plan that fits your business needs, ensuring you get the best value while managing your rental applications effectively.

-

Can I integrate my Fillable PDF Rental Application with other tools?

Absolutely! airSlate SignNow allows seamless integrations with popular platforms like Google Drive, Dropbox, and various CRM systems. This ensures that your Fillable PDF Rental Application can work in conjunction with your existing tools, enhancing your workflow.

-

How secure is my data when using a Fillable PDF Rental Application?

Security is a top priority at airSlate SignNow. All Fillable PDF Rental Applications are encrypted and comply with industry standards to protect your sensitive information, ensuring that both landlords and applicants can trust the process.

-

Can applicants sign the Fillable PDF Rental Application electronically?

Yes, applicants can easily eSign the Fillable PDF Rental Application using airSlate SignNow. Our platform provides a secure and legally binding way for signatures, making it convenient and fast for both parties.

Find out other rental application pdf fillable form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles