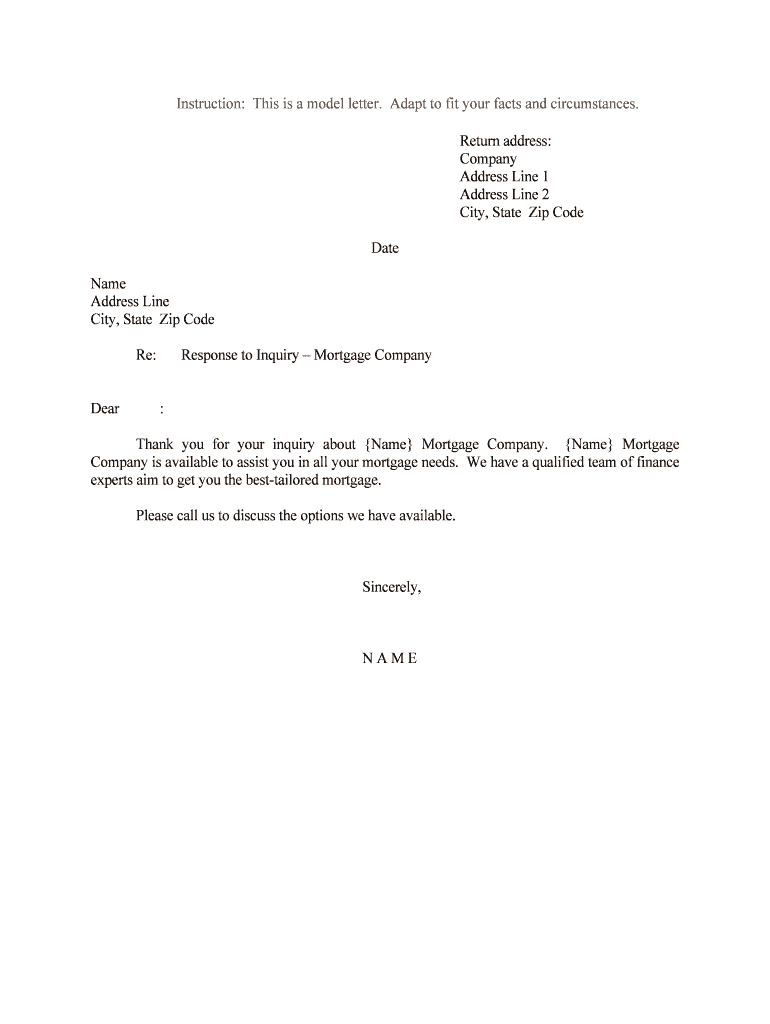

Fill and Sign the Response to Inquiry Mortgage Company Form

Helpful tips on finishing your ‘Response To Inquiry Mortgage Company’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the ultimate eSignature platform for individuals and organizations. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and sign documents online. Take advantage of the extensive features bundled in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve forms or collect signatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Adhere to this comprehensive guide:

- Access your account or register for a free trial with our platform.

- Click +Create to upload a document from your device, cloud storage, or our form library.

- Open your ‘Response To Inquiry Mortgage Company’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Insert and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Response To Inquiry Mortgage Company or send it for notarization—our solution provides you with everything you need to achieve those tasks. Register with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

What is the response time for inquiries to a mortgage company using airSlate SignNow?

The response time to inquiries for a mortgage company using airSlate SignNow is typically very quick. With our streamlined document management solution, mortgage companies can send and receive documents almost instantly, ensuring that client inquiries are addressed promptly. This efficiency enhances customer satisfaction and improves the overall client experience.

-

How does airSlate SignNow improve the response to inquiry processes for mortgage companies?

airSlate SignNow improves the response to inquiry processes for mortgage companies by providing an intuitive platform for eSigning and document sharing. This allows mortgage professionals to respond to inquiries with the necessary documentation quickly, reducing delays and enhancing communication with clients. The ease of use also ensures that all parties can access and complete forms without hassle.

-

What are the pricing options for airSlate SignNow tailored for mortgage companies?

AirSlate SignNow offers flexible pricing plans suitable for mortgage companies of all sizes. Our subscription options are designed to accommodate varying usage levels, ensuring that companies only pay for what they need. Each plan includes features that enhance the response to inquiry processes, making it a cost-effective solution.

-

What features does airSlate SignNow offer for mortgage companies?

airSlate SignNow provides a host of features specifically designed for mortgage companies, including customizable templates, automated workflows, and secure eSignatures. These features streamline the response to inquiry processes, allowing teams to efficiently manage and respond to client requests. Additionally, the platform ensures compliance with all relevant regulations.

-

Can airSlate SignNow integrate with existing tools used by mortgage companies?

Yes, airSlate SignNow seamlessly integrates with a variety of existing tools commonly used by mortgage companies, including CRM systems and project management software. This integration enhances the overall efficiency of response to inquiry processes by allowing teams to manage documents and communications from a single platform. It simplifies workflows and reduces the time spent switching between applications.

-

What are the benefits of using airSlate SignNow for mortgage companies?

The benefits of using airSlate SignNow for mortgage companies include improved response times to inquiries, enhanced document security, and increased operational efficiency. By digitizing the eSigning and document management processes, mortgage companies can respond to inquiries faster and provide a better customer experience. Furthermore, our solution is cost-effective, making it a smart choice for businesses.

-

How secure is the response to inquiry process with airSlate SignNow?

The security of the response to inquiry process with airSlate SignNow is top-notch, featuring bank-level encryption and secure access controls. We prioritize the protection of sensitive client data, especially in the mortgage industry where confidentiality is crucial. Our compliance with industry standards ensures that all documents exchanged are safe and secure.

The best way to complete and sign your response to inquiry mortgage company form

Find out other response to inquiry mortgage company form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles