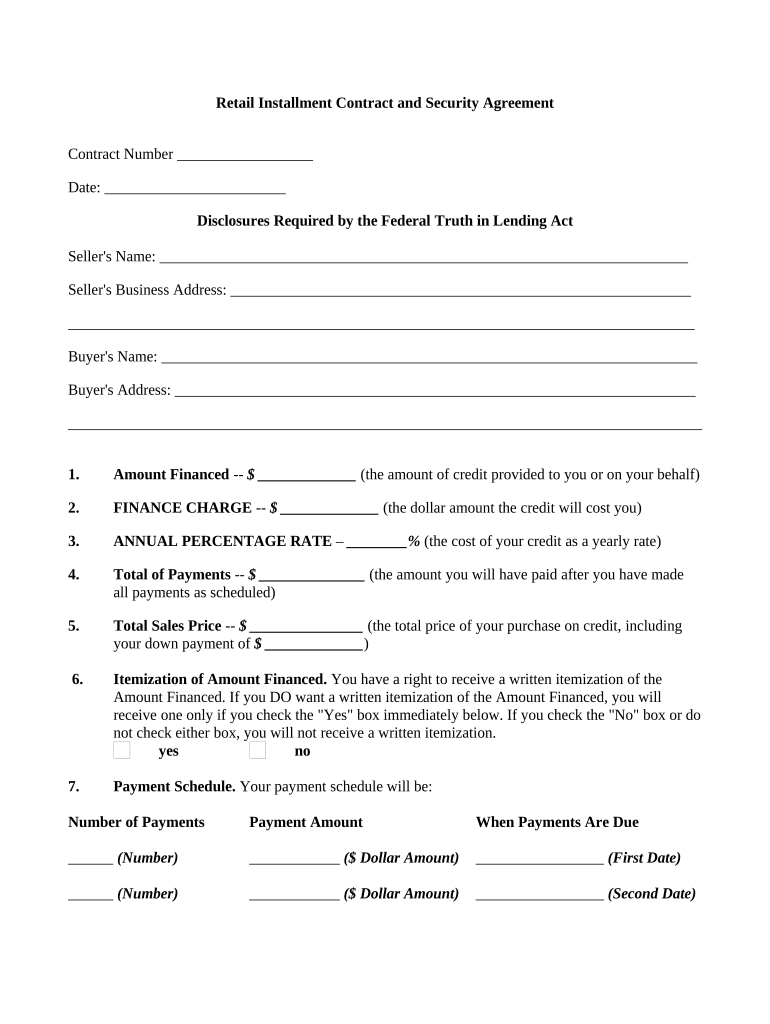

Retail Installment Contract and Security Agreement

Contract Number __________________

Date: ________________________

Disclosures Required by the Federal Truth in Lending Act

Seller's Name: ______________________________________________________________________

Seller's Business Address: _____________________________________________________________

___________________________________________________________________________________

Buyer's Name: _______________________________________________________________________

Buyer's Address: _____________________________________________________________________

____________________________________________________________________________________

1. Amount Financed -- $ _____________ (the amount of credit provided to you or on your behalf)

2. FINANCE CHARGE -- $ _____________ (the dollar amount the credit will cost you)

3. ANNUAL PERCENTAGE RATE – ________% (the cost of your credit as a yearly rate)

4. Total of Payments -- $ ______________ (the amount you will have paid after you have made

all payments as scheduled)

5. Total Sales Price -- $ _______________ (the total price of your purchase on credit, including

your down payment of $ _____________ )

6. Itemization of Amount Financed. You have a right to receive a written itemization of the

Amount Financed. If you DO want a written itemization of the Amount Financed, you will

receive one only if you check the "Yes" box immediately below. If you check the "No" box or do

not check either box, you will not receive a written itemization.

yes no

7. Payment Schedule. Your payment schedule will be:

Number of Payments Payment Amount When Payments Are Due

______ (Number) ____________ ($ Dollar Amount) _________________ (First Date)

______ (Number) ____________ ($ Dollar Amount) _________________ (Second Date)

_____ (Number) ____________ ($ Dollar Amount) _________________ (Third Date)

8. Insurance. Credit life insurance and credit disability insurance are not required to obtain

credit, and will not be provided unless you sign in the space(s) immediately below and agree to pay the

additional cost indicated.

Type of Insurance Premium Signature

I want credit life insurance.

Credit Life ____________ ($ Dollar Amount)

________________________

Your Signature

Credit Disability ____________ ($ Dollar Amount) I want credit disability

insurance.

________________________

Your Signature

Credit Life & Disability ____________ ($ Dollar Amount) I want credit Life & disability

insurance.

________________________

Your Signature

You may obtain property insurance from anyone you want that is acceptable to seller/creditor or its

assignee. If you get the insurance from seller/creditor, you will pay $ _______________ ( dollar amount)

for ______ (number) months' coverage.

9. Security Interest. You are giving a security interest in

the goods or property being purchased

other (give brief description of other property) ________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

10. (a) Filing Fees: $____________ (b) Non-filing Insurance $_____________

11. Late Charge. If a payment is late, you will pay (check one):

_____________ ($ Dollar Amount) ________ % of the payment amount.

_____________ ($ Dollar Amount) or ________ % of the payment amount of the payment

amount, whichever is _________________ (larger or smaller) .

12. Prepayment. If you pay off early, you may be entitled to a refund of part of the Finance

Charge, and (check one)

may have to pay a penalty.

will not have to pay a penalty.

See your contract documents for any additional information about nonpayment, default, any required

repayment in full before the maturity date, and prepayment refunds and penalties.

"e" means estimate (i.e., if estimates are used)

I. Subject of Transaction

Subject to the terms and conditions of this agreement, ___________________________________

(name of seller) , seller, sells and ______________________________________ (name of buyer) ,

buyer, purchases, the following:

A. Property, Goods, or Service:

Quantity Description Amount

(e.g., make, model, serial

number, or service)

_____ ____________________________________________ ($____________)

(number) (describe or specify)

_____ ____________________________________________ ($____________)

(number) (describe or specify)

_____ ____________________________________________ ($____________)

(number) (describe or specify)

_____ _____________________________________________ ($____________)

(number) (describe or specify)

Total ($____________)

B. Accessories:

Quantity Description Amount

(e.g., make, model, serial

number, or service)

_____ ____________________________________________ ($____________)

(number) (describe or specify)

_____ ____________________________________________ ($____________)

(number) (describe or specify)

_____ ____________________________________________ ($____________)

(number) (describe or specify)

_____ _____________________________________________ ($____________)

(number) (describe or specify)

Total ($____________)

C. Related Charges:

Description (e.g., delivery, installation, alteration, Amount

modification, or improvement charges)

_______________________________________________________ ($___________)

_______________________________________________________

(describe or specify)

________________________________________________________ ($___________)

________________________________________________________

(describe or specify)

Total ($____________)

D. Taxes:

Description (e.g., sales or other tax imposed Amount

on cash sale)

_______________________________________________________ ($___________)

_______________________________________________________

(describe or specify)

________________________________________________________ ($___________)

________________________________________________________

(describe or specify)

Total ($____________)

TOTAL of Items A, B, C, and D ($____________)

Description of Trade-in: (describe) __________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

II. Cost and Credit Terms

A. CASH PRICE ($___________)

B. Less: CASH DOWN PAYMENT ($___________)

C. TRADE-IN ($___________)

D. TOTAL DOWN PAYMENT (Items B + C) ($___________)

E. UNPAID BALANCE OF CASH PRICE (Item A – Item D) ($___________)

F. OTHER CHARGES

1. Official Fees ($____________)

2. Insurance ($____________)

3. Other (explain) ___________________________ ($____________)

G. TOTAL OTHER CHARGES ($____________)

H. UNPAID BALANCE (Item E + Item G) ($____________)

I. PREPAYMENTS or DEPOSITS

1. PREPAID FINANCE CHARGE ($____________)

2. REQUIRED DEPOSIT BALANCE ($____________)

J. TOTAL PREPAID FINANCE CHARGE

AND REQUIRED DEPOSIT BALANCE ($____________)

K. AMOUNT FINANCED (Item H – Item J) ($____________)

L. FINANCE CHARGE ($____________)

(Includes):

1. (specify or describe) ________________________________________________

__________________________________________________________________

2. (specify or describe) ________________________________________________

__________________________________________________________________

M. ANNUAL PERCENTAGE RATE _________ %

N. TOTAL OF PAYMENTS ($___________)

O. DEFERRED PAYMENT PRICE (Sum of Items A, G, & L) ($___________)

Buyer agrees to pay to ____________________________________ (name of seller) , seller, at of

____________________________________________________________________________________

_______________________________________________ (street address, city, county, state, zip code) ,

the TOTAL OF PAYMENTS shown above in ________ (number) monthly installments of

______________ ($ Dollar Amount) each; the first installment is due and payable under this agreement

on __________________________________ (date) , and all subsequent equal installments are due and

payable on the same day of each succeeding month until paid in full.

III. Security Interest.

Buyer grants to seller, subject to the terms and conditions of this agreement, a security interest in

the following-described property, hereafter called collateral : (describe collateral) _________________

____________________________________________________________________________________

___________________________________________________________________________________.

IV. Delinquency Charges.

If any installment, or portion of an installment, continues unpaid for more than ______ (number)

days following the date the payment is due, buyer shall pay to seller additional interest in an amount not

to exceed _______ % of each installment or _________________ ($ Dollar Amount) , whichever is less,

or, in lieu of such amount, interest after maturity on each such installment not to exceed the highest

lawful contract rate.

V. Acceleration on Default.

On nonpayment of any installment when due under the terms of this agreement, seller at seller's

option may declare all remaining installments immediately due and payable. If this agreement is placed

in the hands of an attorney, not a salaried employee of the holder of this agreement, for collection

through legal proceedings or otherwise, buyer will pay reasonable attorney's fees, court costs, and

disbursements to seller.

VI. General Provisions.

Buyer acknowledges receipt of a copy of this agreement containing the disclosures of

information applicable to this transaction. The information, disclosures, terms, and conditions following

the signatures of the parties are incorporated in, and made a part of, this agreement for all purposes.

NOTICE TO BUYER: Do not sign this agreement before you read it or if it contains blank spaces. You

are entitled to a copy of the contract you sign. You have the right to pay in advance the unpaid balance

of this agreement and obtain a partial refund of the FINANCE CHARGE based (cite state and/or

federal regulation) ___________________________________________________________________

___________________________________________ . Keep this agreement to protect your legal rights.

_______________________________________

(Signature of Buyer)

____________________________________________________________________________________

( Address of Buyer)

_______________________________________

(Signature of Seller)

____________________________________________________________________________________

( Address of Seller)

NOTICE 1

ANY HOLDER OF THIS CONSUMER CREDIT CONTRACT IS SUBJECT TO ALL CLAIMS AND

DEFENSES WHICH THE DEBTOR COULD ASSERT AGAINST THE SELLER OF GOODS OR

SERVICES OBTAINED PURSUANT HERETO OR WITH THE PROCEEDS HEREOF. RECOVERY

HEREUNDER BY THE DEBTOR SHALL NOT EXCEED AMOUNTS PAID BY THE DEBTOR

HEREUNDER.

ADDITIONAL TERMS AND CONDITIONS OF AGREEMENT

A. Protection of Collateral.

1. The collateral will be kept at buyer's address as stated above. Buyer will notify seller

promptly of any change in the location of the collateral , and will not remove the collateral from

__________________________________ (name of applicable state) without seller's prior

written consent.

2. Buyer will keep the collateral in good order and repair and will not use it in violation of

any statute or ordinance. Seller will have the right to examine and inspect the collateral at all

reasonable times.

B. Perfection of Security Interest.

No financing statement covering the collateral or any part of it, or any proceeds, is on

file in any public office. At seller's request, buyer will join in executing all necessary financing

statements in form satisfactory to seller and will pay all costs of filing, financing, continuation, or

termination statements with regard to seller's security interest.

C. Protection of Security Interest.

1. Buyer will not, without seller's written consent, sell, contract to sell, lease, encumber, or

dispose of the collateral, or any interest in it, until this contract and all obligations secured by

this contract have been fully performed.

2. Buyer will pay when due all taxes and assessments imposed on the collateral or for its

use and operation.

D. Default.

Buyer will be in default under this contract on the happening of any of the following events or

conditions (an event of default ):

1. Failure to make punctual payment when due of any of the obligations or failure to

perform any of the agreements or provisions contained or referred to in this agreement or in any

other agreement executed with reference to this agreement; or

2. If the seller shall deem the obligations secured by this agreement insecure, believing in

good faith that the prospect of payment or performance is impaired.

1

May be preferable to put this part on back of first page rather than having a separate page.

E. Seller's Rights and Remedies on Default.

1. Time is of the essence of this contract. Seller's acceptance of a partial or delinquent

payment or the failure of seller to exercise any right or remedy shall not be a waiver of any of the

buyer's obligations or seller's rights or constitute a waiver of any other similar default occurring

at a later date.

2. On the occurrence of an event of default, and at any subsequent time, seller may declare

all obligations secured by this contract immediately due and payable and may proceed to enforce

payment of the same and exercise any and all rights and remedies provided by

____________________________________ (name of applicable state) .

3. Seller may require buyer to assemble the collateral and make it available to seller at any

place to be designated by seller which is reasonably convenient to both parties. Seller may sell,

lease, or otherwise dispose of any or all of the collateral in its then condition or following any

commercially reasonable preparation or processing.

F. Notice of Sale.

Unless the collateral is perishable or threatens to decline speedily in value or is of a type

customarily sold on a recognized market, seller will give buyer reasonable notice of the time and place

of any public sale or of the time at which any private sale or other intended disposition is to be had. The

requirements of reasonable notice shall be met if the notice is mailed, postage prepaid, to the address of

buyer as shown above at least __________ (number) days before the time of the sale or disposition,

which provisions for notice buyer agrees are reasonable.

G. Disposition of Proceeds from Collateral.

After deducting all costs and expenses of every kind incurred or incidental to the retaking,

holding, advertising, or preparing for sale, or of selling, leasing, or otherwise disposing of the collateral

or in any way relating to seller's rights, including without limitation attorney fees, legal expenses, and

costs of any repair considered necessary by seller, all of which costs and expenses buyer agrees to pay,

seller may apply the net proceeds of any sale, lease, or other disposition of the collateral to the payment

of one or more of buyer's obligations to seller, whether due or not, in such order as seller may elect. In

applying net proceeds to the payment of obligations, proper rebate for any other interest or discount will

be made. Only after full payment of all obligations, and any other payment seller may be required by

law to make, need seller account to buyer for the surplus. Buyer shall remain liable to seller for the

payment of any deficiency with interest at the rate of _________ % per annum.

H. Seller's Right of Assignment.

Seller may assign this contract and all rights and privileges will inure to seller's successors and

assigns.

This agreement was executed by the parties on ______________________________________

(date) .

_______________________________________

(Signature of Buyer)

_______________________________________

(Signature of Seller)