Fill and Sign the Schedule B Number Form

Valuable advice on finalizing your ‘Schedule B Number’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and businesses. Bid farewell to the monotonous procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the robust features packed into this user-friendly and cost-effective platform and transform your document management approach. Whether you need to sign forms or gather signatures, airSlate SignNow takes care of everything with just a few clicks.

Follow this detailed guide:

- Sign into your account or initiate a complimentary trial of our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Schedule B Number’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Add and assign fillable fields for other participants (if needed).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to collaborate with your teammates on your Schedule B Number or send it for notarization—our platform offers everything required to complete these tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

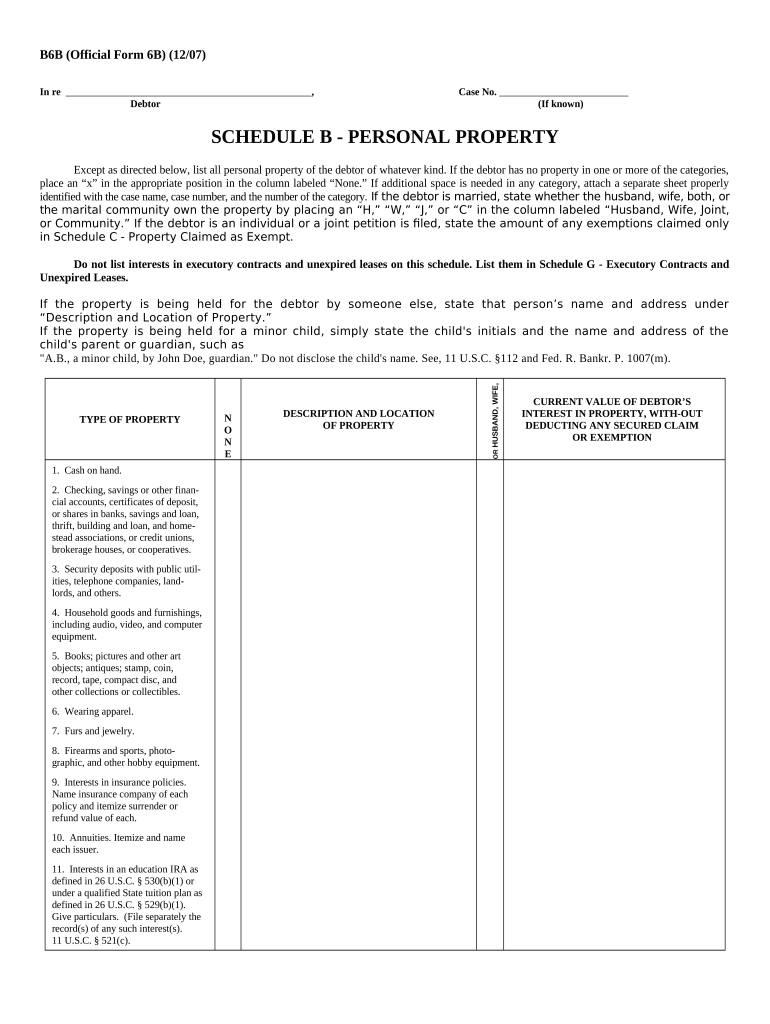

What is a Schedule B form and why do I need it?

The Schedule B form is a crucial document used by taxpayers to report interest and ordinary dividends. If you're looking to accurately file your taxes, understanding how to fill out the Schedule B form is essential. Using airSlate SignNow, you can easily eSign and send your Schedule B form, streamlining the process.

-

How can airSlate SignNow help me with my Schedule B form?

airSlate SignNow simplifies the process of managing your Schedule B form by allowing you to eSign, send, and store your documents securely. With our user-friendly platform, you can ensure that your Schedule B form is completed accurately and submitted on time. Plus, our solution is designed for efficiency, saving you valuable time.

-

Is airSlate SignNow affordable for small businesses needing a Schedule B form?

Yes, airSlate SignNow offers competitive pricing that is ideal for small businesses needing to manage documents like the Schedule B form. Our cost-effective solution allows you to access essential features without breaking the bank, making it easier for any business to stay compliant with tax reporting.

-

What features does airSlate SignNow provide for managing the Schedule B form?

With airSlate SignNow, you have access to features such as customizable templates, secure eSigning, and document tracking. These tools make it easier to manage your Schedule B form efficiently, ensuring that you can focus on your business while we handle your document needs.

-

Can I integrate airSlate SignNow with other software for my Schedule B form?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Dropbox, and Microsoft Office. This allows for easy access to your Schedule B form and other documents, streamlining your workflow and enhancing productivity.

-

What is the process for eSigning a Schedule B form with airSlate SignNow?

To eSign your Schedule B form with airSlate SignNow, upload the document, add the necessary signers, and send it for signature. Our intuitive interface guides you through the steps, ensuring that your Schedule B form is signed quickly and securely.

-

How secure is my Schedule B form when using airSlate SignNow?

Security is a top priority for airSlate SignNow. We employ advanced encryption and compliance measures to protect your Schedule B form and any sensitive information within it, ensuring that your documents remain confidential and secure.

The best way to complete and sign your schedule b number form

Find out other schedule b number form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles