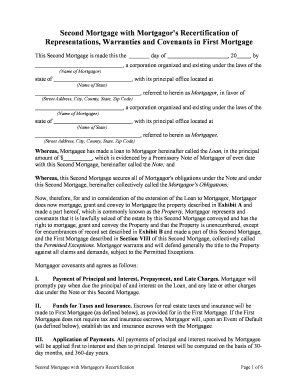

Second Mortgage with Mortgagor's Recertification Page 1 of 6 Second Mortgage with Mortgagor's Recertification of

Representations, Warranties and Covenants in First Mortgage This Second Mortgage is made this the day of , 20 , by , a corporation organized and existing under the laws of the (Name of Mortgagor) state of , with its principal office located at (Name of State) , referred to herein as Mortgagor, in favor of (Street Address, City, County, State, Zip Code) , a corporation organized and existing under the laws of the (Name of Mortgagee) state of , with its principal office located at (Name of State) , referred to herein as Mortgagee. (Street Address, City, County, State, Zip Code) Whereas, Mortgagee has made a loan to Mortgagor hereinafter called the Loan, in the principal

amount of $ , which is evidenced by a Promissory Note of Mortgagor of even date

with this Second Mortgage, hereinafter called the Note; and

Whereas, this Second Mortgage secures all of Mortgagor's obligations under the Note and under

this Second Mortgage, hereinafter collectively called the Mortgagor's Obligations; Now, therefore, for and in consideration of the extension of the Loan to Mortgagor, Mortgagor

does now mortgage, grant and convey to Mortgagee the property described in Exhibit A and

made a part hereof, which is commonly known as the Property, Mortgagor represents and

covenants that it is lawfully seized of the estate by this Second Mortgage conveyed and has the

right to mortgage, grant and convey the Property and that the Property is unencumbered, except

for encumbrances of record set described in Exhibit B and made a part of this Second Mortgage,

and the First Mortgage described in Section VIII of this Second Mortgage, collectively called

the Permitted Exceptions. Mortgagor warrants and will defend generally the title to the Property

against all claims and demands, subject to the Permitted Exceptions. Mortgagor covenants and agrees as follows:I.Payment of Principal and Interest, Prepayment, and Late Charges. Mortgagor will

promptly pay when due the principal of and interest on the Loan, and any late or other charges

due under the Note or this Second Mortgage.II.Funds for Taxes and Insurance. Escrows for real estate taxes and insurance will be

made to First Mortgagee (as defined below), as provided for in the First Mortgage. If the First

Mortgagee does not require tax and insurance escrows, Mortgagor will, upon an Event of Default

(as defined below), establish tax and insurance escrows with the Mortgagee.III.Application of Payments. All payments of principal and interest received by Mortgagee

will be applied first to interest and then to principal. Interest will be computed on the basis of 30-

day months, and 360-day years.

Second Mortgage with Mortgagor's Recertification Page 2 of 6

IV. Charges and Liens. Mortgagor will pay, before the dates they are due, all payments of

principal, interest and other amounts due on the First Loan (as defined in Section VIII below),

and all taxes, assessments, charges, fines and other impositions attributable to the Property that

may attain priority over this Second Mortgage. Upon written request, Mortgagor will promptly

furnish to Mortgagee receipts evidencing the payments. Mortgagor will promptly discharge any

lien (other than the First Mortgage) which has priority over this Second Mortgage.

V.Hazard or Property Insurance. Mortgagor will keep the Property insured against loss

by fire, hazards included within the term extended coverage and any other hazards, including

floods or flooding, as required by the First Mortgagee (as defined below). This insurance will be

maintained in the amounts and for the periods that the First Mortgagee requires. The insurance

carrier providing the insurance will be chosen by Mortgagor. If Mortgagor fails to maintain

coverage described above, Mortgagee may, at Mortgagee's option, obtain coverage to protect

Mortgagee's rights in the Property in accordance with Section VII below. All insurance policies

and renewals will include a standard mortgage clause, and name Mortgagee as an additional

insured and (after the First Mortgagee) loss payee. Mortgagor will provide Mortgagee with

certificates of such insurance. In the event of an accident, fire or other casualty, Mortgagor will

give prompt notice to the insurance carrier and Mortgagee. Insurance proceeds will be applied

first as required by the First Mortgage, and then to the unpaid balance of the Loan evidenced by

the Note in such order as determined by Mortgagee, whether or not such sums are then due, with

the balance, if any, paid to Mortgagor, or, at Mortgagee's sole option, to restoration or repair of

the Property damaged; provided, however, that if the First Mortgagee has consented to using the

insurance proceeds to restore or rebuild the portion of the Property that was damaged or

destroyed, Mortgagee will also agree to restoration or rebuilding upon the same terms and

conditions established in the First Mortgage. Mortgagee may use the proceeds to repair or restore

the Property or to pay sums secured by this Second Mortgage, whether or not then due. Unless

Mortgagee and Mortgagor otherwise agree in writing, any application of proceeds to principal

will not extend or postpone the due date of the monthly payments due under the Note, or change

the amount of the payments. If the Property is acquired by Mortgagee, Mortgagor's right to any

insurance policies and proceeds resulting from damage to the Property prior to the acquisition

will pass to Mortgagee to the extent of the sums secured by this Second Mortgage immediately

prior to the acquisition.VI.Preservation, Maintenance and Protection of Property. Mortgagor will preserve and

protect the Property in a manner required by the First Mortgage, this Second Mortgage, and the

standards of a reasonable property owner in , . (Name of City) (Name of State) Mortgagor will not commit or permit waste on the Property.VII.Protection of the Rights of the Mortgagee in the Property. If Mortgagor fails to

perform the covenants and agreements contained in this Second Mortgage, or there is a legal

proceeding that may significantly affect Mortgagee's rights in the Property (such as a proceeding

in bankruptcy, probate, for condemnation or forfeiture or to enforce laws or regulations), then

Mortgagee may, at its option, do and pay for whatever is necessary to protect the value of the

Property and Mortgagee's rights in the Property. Mortgagee's actions may include paying any sums secured by a lien that has priority over this Second Mortgage, appearing in court, paying

reasonable attorney's fees and entering on the Property to make repairs. Although Mortgagee

Second Mortgage with Mortgagor's Recertification Page 3 of 6may take action under this Section Seven, Mortgagee is not obligated to do so. Any amounts

disbursed by Mortgagee under this Section Seven will become additional debt of Mortgagor secured by this Second Mortgage. These amounts will bear interest from the date of

disbursement at the Default Rate and will be payable, with interest, to Mortgagee upon demand.VIII.First Mortgage. This Second Mortgage is subject and subordinate to the Note and that

certain Mortgage and Security Agreement (the First Mortgage) dated , (Date) and made by Mortgagor in favor of , hereinafter called the (Name of First Mortgagee) First Mortgagee, and recorded against the Property in the [e.g., County Recorder’s Office of in Book at Page ]. Mortgagor (Name of County and State) (Number)(Number) represents and warrants that it has timely paid and will continue to pay all amounts due, and has

performed and will continue to perform all obligations it is required to perform, under the First

Mortgage. In no event shall Mortgagee proceed with enforcing any of the rights or remedies

afforded it under Section XVII, or otherwise, without first providing the First Mortgagee with days' prior written notice of Mortgagor's default and Mortgagee's intention of (Number)enforcing any of the rights or remedies Mortgagee may have pursuant to the terms of this Second

Mortgage.IX.Inspection. Mortgagee or its agent may make reasonable entries upon and inspections of

the Property. Mortgagee will give Mortgagor reasonable notice prior to any such entry onto the

Property.X.Condemnation. In the event of a taking of the Property, the award or proceeds will be

applied first to the sums secured by the First Mortgage, and then to the Loan secured by this

Second Mortgage, whether or not then due. If the Property is abandoned by Mortgagor, or if,

after notice by Mortgagee to Mortgagor that the condemnor offers to make an award or settle a

claim for damages, Mortgagor fails to respond to Mortgagee within days after the (Number) date the notice is given, Mortgagee is authorized to collect and apply the proceeds, at its option,

either to restoration or repair of the Property or to the sums secured by this Second Mortgage,

whether or not then due. Unless Mortgagee and Mortgagor otherwise agree in writing, any

application of proceeds to principal will not extend or postpone the due date of the monthly

payments referred to in Section I above or change the amount of such payments.XI.Mortgagor not Released; Forbearance by Mortgagor not a Waiver. Extension of the

time for payment of the sums secured by this Second Mortgage granted by Mortgagee to any

successor in interest of Mortgagor will not operate to release the liability of the original Mortgagor or Mortgagor's successors in interest. Mortgagee will not be required to commence

proceedings against any successor in interest or refuse to extend time for payment of the sums

secured by this Second Mortgage by reason of any demand made by the original Mortgagor or

Mortgagor's successors in interest. Any forbearance by Mortgagee in exercising any right or

remedy will not be a waiver of or preclude the exercise of any right or remedy.

Second Mortgage with Mortgagor's Recertification Page 4 of 6XII. Successors and Assigns Bound. The covenants and agreements of this Second Mortgage

will bind and benefit the successors and assigns of Mortgagee and Mortgagor.XIII.Loan Charges. If any charges, fee or interest due under the Loan or the Loan Documents

is found to exceed the permitted legal limits, then: (i) any such charges, fee or interest will be

reduced by the amount necessary to reduce the charge to the permitted limit; and (ii) any sums

already collected from Mortgagor which exceeded permitted limits will, at the option of

Mortgagee, be applied to the unpaid principal amount evidenced by the Note, or refunded to

Mortgagor.XIV. Notices. All notices, communications and waivers under this Mortgage must be in

writing and must be: (i) delivered in person; or (ii) mailed, postage prepaid, either by registered

or certified mail, return receipt requested; or (iii) by overnight express carrier, addressed in each

case as set forth in the first paragraph of this Second Mortgage. All notices sent pursuant to the

terms of this Section XIV will be considered received: (i) if personally delivered, then on the

date of delivery; (ii) if sent by overnight, express carrier, then on the next federal banking day

immediately following the day sent; or (iii) if sent by registered or certified mail, then on the

earlier of the third federal banking day following the day sent or when actually received.XV.Governing Law; Severability. This Second Mortgage will be governed by federal law

and the law of . In the event that any provision or clause of this (Name of State) Second Mortgage or the Note conflicts with applicable law, such conflict will not affect other

provisions of this Second Mortgage or the Note which can be given effect without the conflicting

provision. To this end the provisions of this Second Mortgage and the Note are declared to be

severable.XVI. Default. The occurrence of any of the following will constitute an event of default under

this Second Mortgage and under the Note and other Loan Documents:A. If Mortgagor fails to pay all or any portion of Mortgagor's Obligations within days of the date when the same become due and payable. (Number) B. If Mortgagor fails to observe or perform any covenant or agreement made by

Mortgagor under this Second Mortgage, and such default is not cured within (Number) days following written notice of default from Mortgagee.C. If any representation or warranty made by Mortgagor to Mortgagee (including but

not limited to the representations set forth in Section VIII above) proves to be false or

misleading in any way.D. If Mortgagor: (i) is generally not paying its debts as they become due; (ii) files, or

consents, by answer or otherwise, to the filing of a petition for relief or reorganization or

arrangement or any other petition in bankruptcy or insolvency under the laws of any

jurisdiction; (iii) makes an assignment for the benefit of creditors; (iv) consents to the

appointment of a custodian, receiver, trustee or other officer with similar powers for

Second Mortgage with Mortgagor's Recertification Page 5 of 6Mortgagor or for any part of the Property; (v) is adjudicated insolvent; or (vi) takes action

for the purpose of any of the foregoing.E. If any court or governmental agency of competent jurisdiction enters an order

appointing a custodian, receiver, trustee or other officer with similar powers with respect

to Mortgagor.F. If: (i) all or any part of the Property or any interest in it is sold or otherwise

transferred; or (ii) any mortgage or other financing other than the First Mortgage and this

Second Mortgage is placed on or recorded against the Property.G. If there is an amendment to any material term of the First Mortgage or any of the

related First Mortgage loan documents (collectively, First Mortgage Loan Documents)

without the prior written consent of Mortgagee.H. If there is a default by Mortgagor under any of the First Mortgage Loan

Documents.XVII.Acceleration of Mortgagor’s Obligations; Remedies. Upon the occurrence of any

Event of Default under this Second Mortgage, Mortgagee, at any time at its option without notice

or demand, may declare all of Mortgagor's obligations due and payable, whereupon Mortgagor's

obligations will mature and become due and payable, all without presentment, demand, protest or

notice, all of which Mortgagor now waives. In such event, Mortgagee may: (i) enforce its rights

and remedies under the Loan Documents or loan documents evidencing or securing Mortgagor's

Obligations in accordance with their respective terms; or (ii) enforce any of the rights or

remedies accorded to Mortgagee at equity or law, by virtue of statute or otherwise. Mortgagor

agrees to pay all costs and expenses of collection and enforcement of the Note and this Second

Mortgage when incurred, including Mortgagee's reasonable attorney's fees and legal and court

costs, including any incurred on appeal or in connection with bankruptcy or insolvency, and

whether or not any lawsuit or proceeding is filed with respect to this Second Mortgage.XVIII.Recertification of Representations, Warranties and Covenants. Mortgagor represents,

warrants and covenants to Mortgagee all of those certain representations, warranties and

covenants set forth in Section III of the First Mortgage. Mortgagor has executed this Second

Mortgage as of the date and year first set forth above.

Witness our signature this the day of , 20 .

(Name of Mortgagor) By: (Signature of Officer) (Printed Name & Office in Corporation)

Second Mortgage with Mortgagor's Recertification Page 6 of 6 Acknowledgment before Notary PublicAttach Exhibits