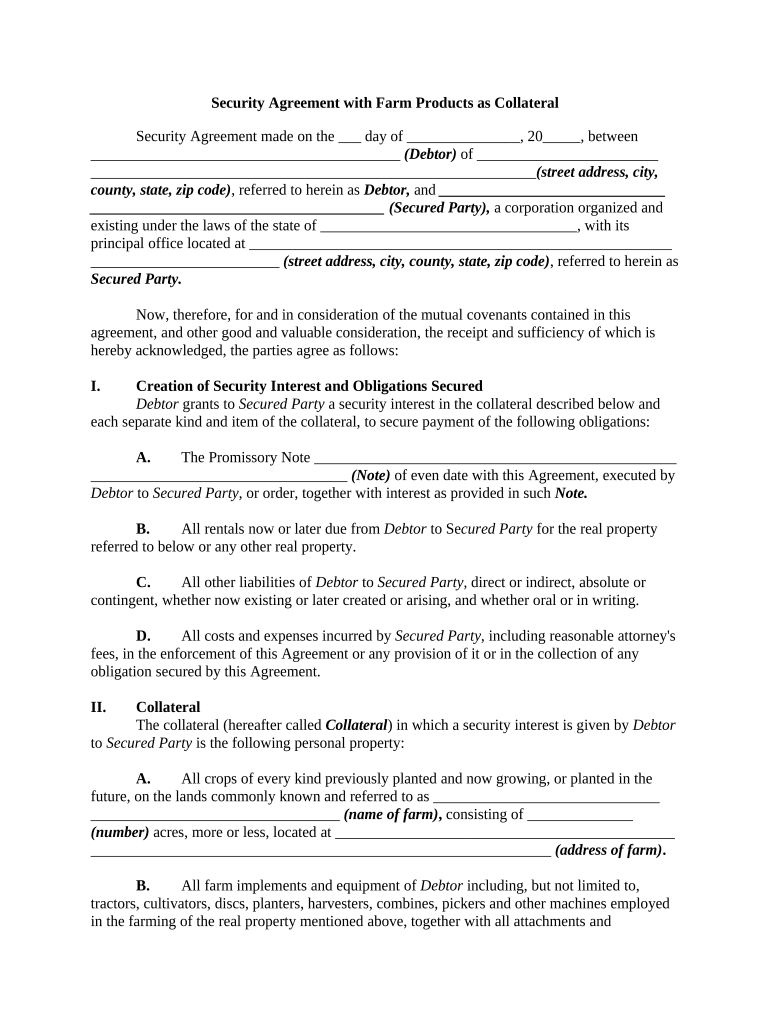

Security Agreement with Farm Products as Collateral

Security Agreement made on the ___ day of _______________, 20_____, between

_________________________________________ (Debtor) of ________________________

___________________________________________________________ (street address, city,

county, state, zip code) , referred to herein as Debtor, and ______________________________

_______________________________________ (Secured Party), a corporation organized and

existing under the laws of the state of __________________________________, with its

principal office located at ________________________________________________________

_________________________ (street address, city, county, state, zip code) , referred to herein as

Secured Party.

Now, therefore, for and in consideration of the mutual covenants contained in this

agreement, and other good and valuable consideration, the receipt and sufficiency of which is

hereby acknowledged, the parties agree as follows:

I. Creation of Security Interest and Obligations Secured

Debtor grants to Secured Party a security interest in the collateral described below and

each separate kind and item of the collateral, to secure payment of the following obligations:

A. The Promissory Note ________________________________________________

__________________________________ (Note) of even date with this Agreement, executed by

Debtor to Secured Party, or order, together with interest as provided in such Note.

B. All rentals now or later due from Debtor to Se cured Party for the real property

referred to below or any other real property.

C. All other liabilities of Debtor to Secured Party, direct or indirect, absolute or

contingent, whether now existing or later created or arising, and whether oral or in writing.

D. All costs and expenses incurred by Secured Party, including reasonable attorney's

fees, in the enforcement of this Agreement or any provision of it or in the collection of any

obligation secured by this Agreement.

II. Collateral

The collateral (hereafter called Collateral ) in which a security interest is given by Debtor

to Secured Party is the following personal property:

A. All crops of every kind previously planted and now growing, or planted in the

future, on the lands commonly known and referred to as ______________________________

_________________________________ (name of farm) , consisting of ______________

(number) acres, more or less, located at _____________________________________________

_____________________________________________________________ (address of farm) .

B. All farm implements and equipment of Debtor including, but not limited to,

tractors, cultivators, discs, planters, harvesters, combines, pickers and other machines employed

in the farming of the real property mentioned above, together with all attachments and

replacements of the same, including the equity of Debtor in any such item that is subject to a

purchase money or other prior security interest.

C. Feed, seed, fertilizer and other supplies now or later owned by Debtor and used or

intended for use in the farming of the real property mentioned above.

E. Livestock described and inventoried on Schedule A attached to this Agreement,

and the increase of such livestock .

F. All products and proceeds of any of the foregoing, including cash and accounts

receivable.

III. Ownership and Preservation of Collateral

A. Debtor warrants that he is the owner of all Collateral mentioned above and

currently in his possession or control, free from any adverse lien, security interest or

encumbrance, except for the security interest now granted, and purchase-money and other

security interests of other creditors listed in Schedule B, attached to this Agreement. Debtor

shall defend Collateral against all claims and demands of all persons at any time claiming the

Collateral or any interest in the same.

B. Debtor shall not remove any of the Collateral from the real property mentioned

above without the prior written consent of Secured Party, except for the disposition of Collateral

provided for below.

C. Debtor shall keep Collateral and the proceeds of the same free from adverse liens,

in good condition and in an unmanufactured state. Debtor shall not waste or destroy Collateral

or any part of the same, and shall plant, cultivate and harvest the crops mentioned above, in a

good and farmer-like manner in accordance with accepted methods of farming in the county in

which the farm is situated.

IV. Financing Statements

Debtor represents that no financing statement pertaining to any portion of the Collateral

is on file in any public office. Debtor will join with Secured Party, at the request of Secured

Party, in executing one or more financing statements pursuant to _________________________

___________________________ (citation state’s code sections dealing with Article 9 of the

Uniform Commercial Code) in form satisfactory to Secured Party, and will pay the cost of filing

such statements in all public offices where filing is deemed by Secured Party to be necessary;

provided, that Debtor shall pay the costs of filing at the appropriate public offices. If and to the

extent that continuation statements are necessary or advisable in the judgment of Secured Party,

such statements shall be prepared and filed with the full cooperation of Debtor, at such public

offices as Secured Party may deem advisable, and Debtor shall pay the filing costs for such

continuation statements to the same extent as in the case of financing statements .

V. Insurance and Taxes

A. Debtor shall maintain insurance at all times on all tangible Collateral against risks

of fire and risks included within extended-coverage provisions of standard policies, theft and

such other risks as Secured Party may require, written by such company or companies as may be

satisfactory to Secured Party , and payable in the event of loss to Secured Party and Debtor as

their interests may appear. Such insurance shall be written for the full insurable values of the

tangible collateral covered by the insurance. All policies of insurance shall provide for ________

(number) days' written minimum cancellation notice to Secured Party. All policies of insurance

may, at the option of Secured Party , be held by Secured Party . Secured Party shall have the right

to act as attorney for Debtor in connection with all claims of loss, and the negotiation and

settlement of all such claims. Secured Party may receive, endorse and deposit any insurance

drafts for losses in the name of Debtor and as Debtor's attorney-in-fact.

B. Debtor shall pay promptly when due all taxes and assessments levied against

Collateral or the proceeds of the same, or against this Agreement or any note secured by this

Agreement.

VI. Payment of Expenses by Secured Party and Right to Reimbursement

If any tax, insurance premium, lien or other expense or obligation relating to the

Collateral is not paid by Debtor promptly when due, Secured Party at Secured Party’s option

may pay any such indebtedness. Debtor shall promptly reimburse Secured Party on demand for

any such indebtedness paid by Secured Party . Such right and option of Secured Party is

cumulative, and in addition to any other right or remedy of Secured Party under this Agreement.

VII. Control, Use and Sale of Collateral by Debtor

So long as Debtor shall not be in default under this Agreement, Debtor may harvest,

process, store and use the Collateral for all appropriate purposes not inconsistent with this

Agreement, or with the terms or conditions of any policy of insurance covering the Collateral.

Debtor may also sell the Collateral at seasonable times in the ordinary course of business of

farming the real property referred to mentioned above. A sale in the ordinary course of business

does not include a transfer in partial or total satisfaction of a debt owing by Debtor to a third

person. The rights of Debtor under this section shall include the right to use and consume

appropriate kinds and portions of the Collateral in preserving and preparing for market any

livestock or poultry covered by this Agreement, and in planting, cultivating or harvesting crops

referred to in this Agreement. If Debtor shall fail so to use and employ the Collateral and

dispose of the Collateral by sale, Secured Party at Secured Party’s option may assume the

management, use and control of the Collateral and the conducting of farming operations on the

real property described above in order to protect the Collateral and preserve the rights of

Secured Party in the Collateral, and in the proceeds of the same.

VIII. Proceeds of Collateral

A. On request of Secured Party , Debtor shall promptly deliver to Secured Party after

the accounts are created lists of all accounts that constitute proceeds of the Collateral. Debtor

shall deliver to Secured Party promptly on receipt, and to the extent necessary to discharge all

obligations secured by this Agreement as they arise, all cash proceeds of the Collateral.

B. Secured Party shall have full right and power to collect, compromise, endorse,

sell, or otherwise deal with proceeds of the Collateral in Secured Party’s own name or the name

of Debtor, and, in the discretion of Secured Party , to apply cash proceeds to any obligation

secured by this Agreement or release such proceeds, or portions of the same, to Debtor for use in

the farming operations of Debtor.

C. Debtor agrees that there shall be no offsets or credits charged against any

proceeds adverse to the interest of Secured Party .

IX. Default

Debtor shall be in default under this Agreement on the happening of any one of the

following events or conditions, or any combination of the same:

A . Failure to make any payment or perform any obligation or covenant provided for

or required by any promissory note secured by this Agreement, or otherwise set forth in this

Agreement.

B. The falsity in any material respect of any warranty, representation or statement

made or furnished to Secured Party by Debtor, expressed in this Agreement or necessarily

implied by the provisions of this Agreement.

C. The occurrence of any event that causes the acceleration of the maturity of the

indebtedness of Debtor to others under any agreement which affects or may affect the position or

performance of Debtor under this Agreement.

D. The loss, theft, damage, destruction, sale or encumbrance of any of the

Collateral, or the making of any levy on, or seizure or attachment of, the Collateral.

E. Commencement of any voluntary or involuntary proceeding under the bankruptcy

or any state insolvency laws against Debtor, the death, insolvency or business failure of Debtor ,

or the appointment of a receiver for any part of the property of Debtor.

F. The failure of Debtor to plant, cultivate and harvest crops referred to in this

Agreement, in due season and in a good and farmer-like manner, or to properly care for or

protect any of the Collateral.

G. The failure to deliver to Secured Party the proceeds of any Collateral sold

pursuant to Section VIII.

X. Remedies of Secured Party

A. All obligations secured by this Agreement shall be immediately due and payable,

and the remedies of a secured party under ______________________________________

_______________ (citation state’s code sections dealing with Article 9 of the Uniform

Commercial Code) and any other remedies expressed or provided for in this Agreement, shall

accrue to and may be exercised by Secured Party on the default of Debtor. Secured Party may

require Debtor to assemble the Collateral and make it available at a place to be designated by

Secured Party that is reasonably convenient to Debtor.

B. Unless the Collateral is perishable, or threatens to decline speedily in value, or is

of a type customarily sold on a recognized market, Secured Party will give Debtor reasonable

notice of the time and place of any public sale of the Collateral, or of the time after which any

private sale or any other intended disposition of the Collateral is to be made by Secured Party .

The requirements of reasonable notice shall be met if such notice is mailed, postage prepaid, to

the address of Debtor shown in this Agreement, or such subsequent address as may be

designated by Debtor in writing, at least __________ (number) days before the time of the

intended sale or other disposition.

C. Expenses of retaking, holding, preparing for sale, selling and other expenses

reasonably incurred in enforcing any remedy available to Secured Party , including reasonable

attorney's fees and other legal expenses of Secured Party , shall be added to the obligation of

Debtor and be paid by Debtor to Secured Party .

D. No waiver by Secured Party , whether express or implied, of any default shall

operate as a waiver of any other default or of the same default on a future occasion.

XI. Governing Law

This Agreement shall be governed by, construed, and enforced in accordance with the

laws of the State of _______________________________________.

XII. Mandatory Arbitration

Notwithstanding the foregoing, and anything herein to the contrary, any dispute under

this Agreement shall be required to be resolved by binding arbitration of the parties hereto. If the

parties cannot agree on an arbitrator, each party shall select one arbitrator and both arbitrators

shall then select a third. The third arbitrator so selected shall arbitrate said dispute. The

arbitration shall be governed by the rules of the American Arbitration Association then in force

and effect.

XIII. Entire Agreement

This Agreement shall constitute the entire agreement between the parties and any prior

understanding or representation of any kind preceding the date of this Agreement shall not be

binding upon either party except to the extent incorporated in this Agreement.

XIV. Modification of Agreement

Any modification of this Agreement or additional obligation assumed by either party in

connection with this Agreement shall be binding only if placed in writing and signed by each

party or an authorized representative of each party.

WITNESS our signatures as of the day and date first above stated.

__________________________________________

SECURED PARTY

___________________________________ By_______________________________________

DEBTOR (Name and Office in Corporation)

Acknowledgment (may vary by state)

STATE OF ______________________________________

COUNTY OF ___________________________

Personally appeared before me, the undersigned authority in and for the said County and

State, on this _____ day of ___________________________, 20___, within my jurisdiction, the

within - named _______________________________________________ (Debtor) who

acknowledged that he executed the above and foregoing instrument.

__________________________________________

NOTARY PUBLIC

My Commission Expires:

_______________________________