- 1 -

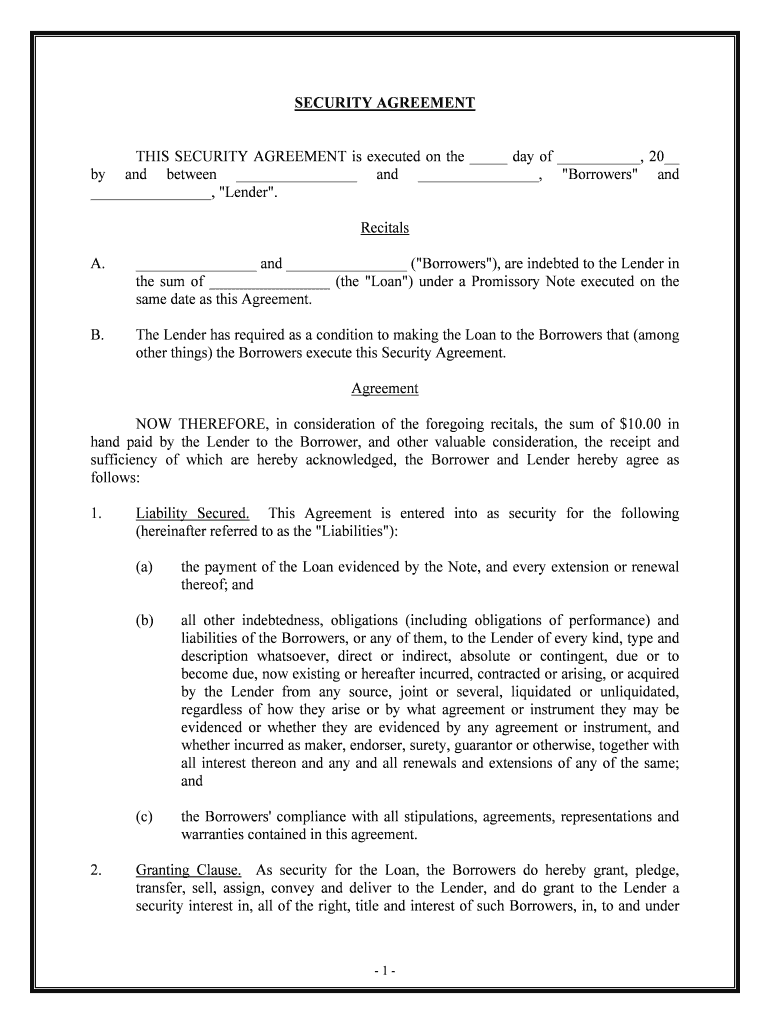

SECURITY AGREEMENT

THIS SECURITY AGREEMENT is executed on the _____ day of ___________, 20__

by and between ________________ and ________________, "Borrowers" and

________________, "Lender".

Recitals

A. ________________ and ________________ ("Borrowers"), are indebted to the Lender in the sum of ________________ (the "Loan") under a Promissory Note executed on the

same date as this Agreement.

B. The Lender has required as a condition to making the Loan to the Borrowers that (am ong

other things) the Borrowers execute this Security Agreement.

Agreement

NOW THEREFORE, in consideration of the foregoing recitals, the sum of $10.00 in

hand paid by the Lender to the Borrower, and other valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the Borrower and Lender hereby agree as

follows:

1. Liability Secured. This Agreement is entered into as security for the following

(hereinafter referred to as the "Liabilities"):

(a) the payment of the Loan evidenced by the Note, and every extension or renewal thereof; and

(b) all other indebtedness, obligations (including obligations of performance) and liabilities of the Borrowers, or any of them, to the Lender of every kind, type and

description whatsoever, direct or indirect, absolute or contingent, due or to

become due, now existing or hereafter incurred, contracted or arising, or acquired

by the Lender from any source, joint or several, liquidated or unliquidated,

regardless of how they arise or by what agreement or instrument they may be

evidenced or whether they are evidenced by any agreement or instrument, and

whether incurred as maker, endorser, surety, guarantor or otherwise, together with

all interest thereon and any and all renewals and extensions of any of the same;

and

(c) the Borrowers' compliance with all stipulations, agreements, representations and warranties contained in this agreement.

2. Granting Clause. As security for the Loan, the Borrowers do hereby grant, pledge,

transfer, sell, assign, convey and deliver to the Lender, and do grant to the Lender a

security interest in, all of the right, title and interest of such Borrowers, in, to a nd under

- 2 -

the following (hereinafter collectively referred to as the "Collateral"):

(a) {describe collateral}

(b) All proceeds of any of the foregoing, after acquired property and accounts receivable.

3. Security The security granted by this agreement shall at all time be m aintained at

________________.

4. Warranties of Title, etc. The Borrowers hereby: (a) covenant with the Lender, it s

successors and assigns, that the Borrowers are the lawful and absolute owner of the

Collateral and have a good right to sell, assign, convey and grant a security interest in the

same and that the Collateral is free and clear of all encumbrances and sec urity interests

(other than that of the Lender); (b) warrant and covenant to forever defend the title of the

Collateral unto the Lender, its successors and assigns, against the claims of all person

whomsoever, whether lawful or unlawful; (c) warrant that no financing statement

covering any of the Collateral or any proceeds therefrom is on file at any public office ;

(d) agree, promptly upon request for the Lender to join with the Lender in executing one

or more financing statements pursuant to the Uniform Commercial Code in form

satisfactory to the Lender and to pay the cost of filing the same in all public offices

wherever filing is deemed necessary or prudent by the Lender; (e) authorize the Lender to

correct any and all patent errors in the typewritten or handwritten portion of this

agreement or any documents executed in connection herewith; and (f) agree to pledge,

assign, and deliver to the Lender any additional certificates, instruments, securities and

documents hereafter constituting part of the Collateral immediately upon the acqui sition

thereof by the Borrowers.

5. Negative Pledge. The Borrowers and each of them warrant and represent that they wil l

not, without the prior consent of the Lender, pledge or grant any security interest in any

of the Collateral to anyone except the Lender, permit any lien or encumbrance to attach to

any of the Collateral or any levy to be made thereon or any financing statement or

security interest (except those to the Lender) to be on file with respect thereto.

6. Taxes and Assessments. The Borrowers agree to pay all taxes, rents, assessments and

charges levied against the Collateral and all other claims that are or may become liens

against the Collateral, or any part thereof, and should default be made in the paym ent of

the same, the Lender, as its option, may pay the same.

7. Collection of Collateral. At any time, upon notice to the Borrowers, the Lende r may

notify the Borrower to make all payments and distributions in connection with the

Collateral, whether in cash or other assets, directly to the Lender and to accept the receipt

of the Lender therefor. In the event that, after such notice has been given, either of the

Borrowers receive monies due under or in connection with the Collateral, such

Borrower(s) shall forthwith pay over and deliver the same to the Lender in the identical

form received and until so paid over and delivered shall hold the same in trust for the

- 3 -

Lender and shall not commingle the same with any funds or assets of such Borrower.

The Borrowers agree promptly upon demand by the Lender to take any and all further

actions and execute any and all further documents required by the Lender of the

Borrowers in order to effect immediate payment of such amounts, properties and assets to

the Lender. The Borrowers hereby constitute and appoint the Lender, and any other

person designated by the Lender as the agent and attorney-in-fact of such Borrowers, at

Borrowers' cost and expense, to exercise at any time all of the following powers, all of

which powers, being coupled with an interest, shall be irrevocable until the liabilities

secured hereby have been fully discharged: (a) to receive, take, endorse, assign, deliver

in the Lender's name or in the name of the Borrowers any and all checks, notes, drafts,

and other instruments relating to the Collateral; (b) to transmit to the Borrowers not ice of

the Lender’s interest in the Collateral and to demand and receive for the Borrowers at any

time, in the name of the Lender or of the Borrowers or of the designate of the Lender,

information concerning the Collateral and the amounts owing thereon; (c) to notify the

Borrowers to make payments on the Collateral directly to the Lender; and (d) to take or to

bring in the name of the Lender or in the name of the Borrowers all steps, action, suit s or

proceedings deemed by the Lender necessary or desirable to effect collection of the

Collateral. All acts of such attorney-in-fact or designee taken pursuant to this Secti on 7

or Section 13 are hereby ratified and approved by each of the Borrowers, and said

attorney or designee shall not be liable for any acts or omissions nor for any error of

judgment or mistake of fact or law.

8. Waiver of Exemption, etc. As against the Liabilities the Borrowers and each of them

waive all rights of exemption under the Constitution and laws of the State of

________________ or any other jurisdiction and agree to pay all cost of collection and

enforcement hereof, and reasonable attorneys' fees, if the Liabilities are not paid at

maturity or any other Event of Default occurs hereunder.

9. Non-Waiver. It is agreed that no delay in exercising any right or option given or granted

hereby to the Lender shall be construed as a waiver thereof; nor shall a single or pa rtial

exercise of any other right, power or privilege. The Lender may permit the Borrowers to

remedy any default without waiving the default so remedied, and the Lender may waive

any default without waiving any other subsequent or prior default by the Borrowers.

10. Events of Default. As used in this agreement, the terms "default" or "Event of Default"

shall mean the occurrence or happening of any one of the following events,

circumstances or conditions:

(a) Violation or default in the observance or performance of any term, agreement, covenant, condition or stipulation contained or referred to in this agreement or in

any document executed in connection with this agreement or in any note,

endorsement, guaranty or other document evidencing any of the Liabilities

secured by this agreement, including, without limitations, the Loan Note, and any

and all other documents executed in connection with the Loan; or

(b) The occurrence of an Event of Default under the Promissory Note.

- 4 -

11. Acceleration of Liabilities. Upon the occurrence of any Event of Default, the Lender

shall have the right without further notice to the Borrowers to declare the entire unpaid

balance of the Liabilities, with accrued interest thereon, immediately due and payable.

12. Secured Party's Right After Default. Upon the occurrence of an Event of Default under

this agreement, the Lender shall have, in addition to any other rights under this agreement

or under applicable law, the right without notice to the Borrowers to take any or all of the

following actions at the same or at different times: (a) to collect all C ollateral in the

Borrowers' name and take control of any cash or non-cash proceeds of Collateral; (b) to

enforce payment of any Collateral, to prosecute any action or proceeding with respect t o

the Collateral, to extend the time of payment of any and all Collateral, to make allowance

and adjustments with respect thereto and to issue credits in the name of the Borrower; (c)

to settle, compromise, extend, renew, release, terminate or discharge, in whole or i n part,

any Collateral or deal with the same as the Lender may deem advisable; (d) without

notice or advertisement, to sell, assign and deliver the Collateral or any other property

held by the Lender, at public or private sale, for cash, upon credit or otherwise at the sol e

option and discretion of Lender and to bid or become purchaser at any such sale; and (e)

to exercise, in addition to all other rights and remedies of a Lender upon default unde r the

________________ Uniform Commercial Code. The net cash proceeds resulting from

the exercise of any of the foregoing rights, after deducting all charges, expenses, cost and

attorneys' fees relating thereto, including any and all costs and expenses incurred in

securing the possession of Collateral and preparing the same for sale, shall be applied by

the Lender to the payment of the Liabilities, whether due or to become due, i n such order

and in such proportions as the Lender may elect, and Borrowers shall remain jointly and

severally liable to the Lender for any deficiency.

13. Attorney-in-Fact After Default. At any time after the occurrence of an Event of Defa ult,

the Lender or any other person serving as the attorney-in-fact for either of the under

Section 7 of this agreement, shall have all or any of the following powers: (a) to exercise

all of such Borrowers' rights and remedies with respect to the collection of the Col lateral;

(b) to settle, adjust, compromise, extend, renew, discharge, terminate or release the

Collateral in whole or in part; (c) to sell or assign the Collateral upon such t erms, for such

amounts and at such time or times as the Lender deems advisable; (d) to take control, in

any manner, of any item of payment on, or proceeds of the Collateral; (e) to use the

information recorded on or contained in any data processing equipment and computer

hardware and software relating to the Collateral to which such Borrowers have access;

and (f) to do all acts and things necessary , in the Lender's sole judgment, to carry out the

purpose of this Agreement.

14. Other Provisions Regarding Remedies on Default. With respect to the Lender's rights

and remedies on default under this agreement:

(a) Written notice, when required by law, given to the Borrowers as set forth in Section 20 below at least 5 calendar days (counting the day of sending) before the

date of a proposed disposition of the Collateral is reasonable notice to the

- 5 -

Borrowers.

(b) The Borrowers agree to reimburse the Lender for any expense incurred by the Lender in protecting or enforcing its rights under the agreement, including,

without limitation, all expenses of disposing of the Collateral, together with court

costs and reasonable attorneys' fees. After deductions of such expenses, the

Lender may apply the proceeds of the disposition of the Collateral to any one or

more of the Liabilities, as well as to any other indebtedness, obligation or lia bility

of the Borrowers to the Lender secured hereby, in such order and amounts as the

Lender elects.

(c) The Lender shall not be obligated to resort to any other collateral or security now

held or hereafter given to the Lender to secure the Liabilities or to seek recovery

from the Borrowers of said debts but may, upon default, at the Lender's sole

election, proceed to enforce its rights as to the Collateral hereunder.

15. Successor and Assigns. All covenants an agreements herein made by the Borrowers shall

bind them and their respective successors and assigns, and every option, right and

privilege herein reserved or granted to the Lender shall inure to the benefit of and ma y be

exercised by the Lender's successors or assigns.

16. Governing Law. This agreement shall be construed in accordance with and governed by

the laws of the State of ________________, except as required by mandatory provisions

of law.

17. Modification, etc. No modification, amendment or waiver of any provision of this

agreement, any note secured hereby, nor consent to any departure by the Borrowers

therefrom shall in any event be effective unless the same shall be in writing and signed by

the Lender and then such waiver or consent shall be effective only in the specific instance

and for the purpose for which given. No notice to or demand on the Borrowers shall

entitle either of them to any other or further notice or demand in the same, si milar or

other circumstances.

18. Further Assurances. The Borrowers will take such action as my be necessary to protec t

and maintain a continuously perfected security interest of the Lender in the Collateral,

including, without limitation, the filing of such financing statements and other

instruments in such detail as, in the opinion of the Lender and its counsel may be

necessary to create or maintain a perfected security interest therein.

19. Notices. Any request, demand or notices provided in this agreement to be given by either

party hereto to the other shall be conclusively deemed to have been given when the same

shall have been deposited in the United States mail, postage prepaid, addressed to t he

party to whom such request, demand or notice is directed, at the following address, or

delivered by hand to such party at such address:

(a) if to the Borrower, or either of them, at ________________

- 6 -

(b) if to the Lender, at ________________________________

IN WITNESS WHEREFORE, each of the undersigned has executed this agreement on the day

and year first above written. ___________________________________________

Borrower ________________________________ ___________________________________________

Borrower ________________________________

STATE OF ________________

COUNTY OF ________________ PERSONALLY appeared before me, the undersigned authority in and for the jurisdiction

aforesaid, the within named ________________ and ________________ who acknowledged to

me that they signed, executed and delivered the above and foregoing instrument of writi ng on the

day and year therein mentioned, having been first authorized so to do. GIVEN under my hand and official seal this the ______ day of _____________, 20__.

__________________________________

NOTARY PUBLIC

MY COMMISSION EXPIRES: _____________________